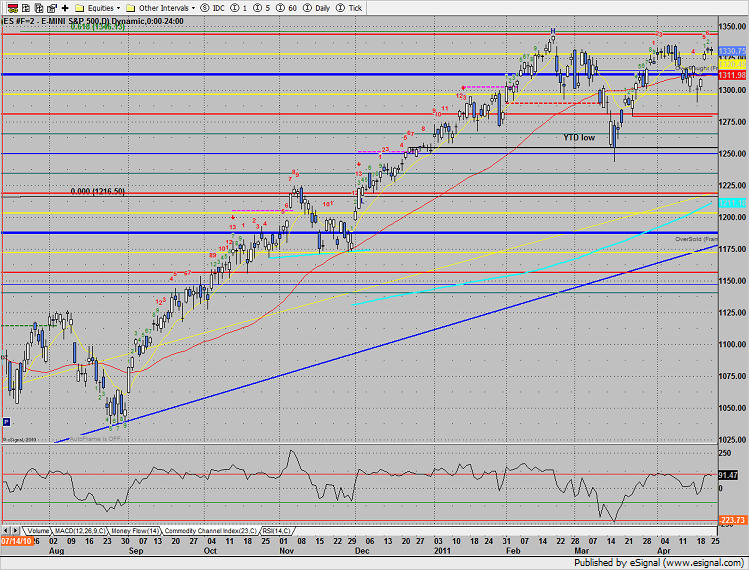

The SP posted a very narrow range measuring day with very little change on the day. Volume was down ahead of the 2 day FOMC meeting.

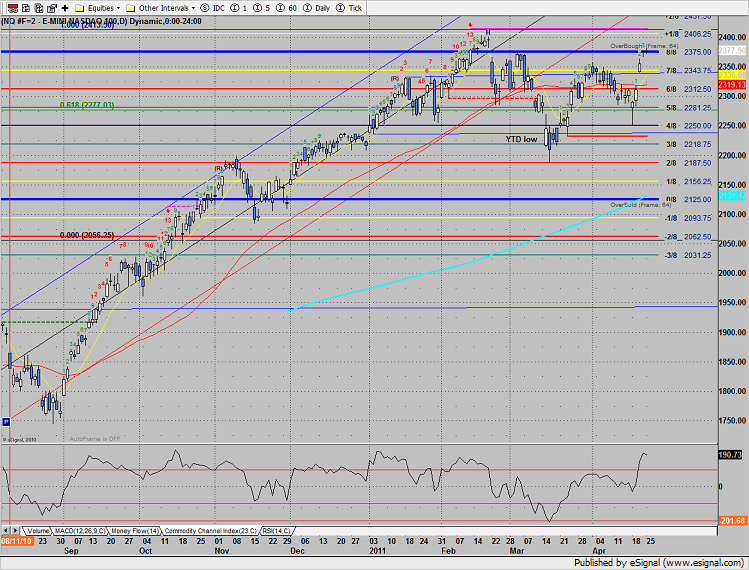

The price action in the Naz was very similar to the SP. Price closed very near the 8/8 Gann level with little net change on the day. Note that narrow range days build up energy for a range expansion move when a catalyst is introduced.

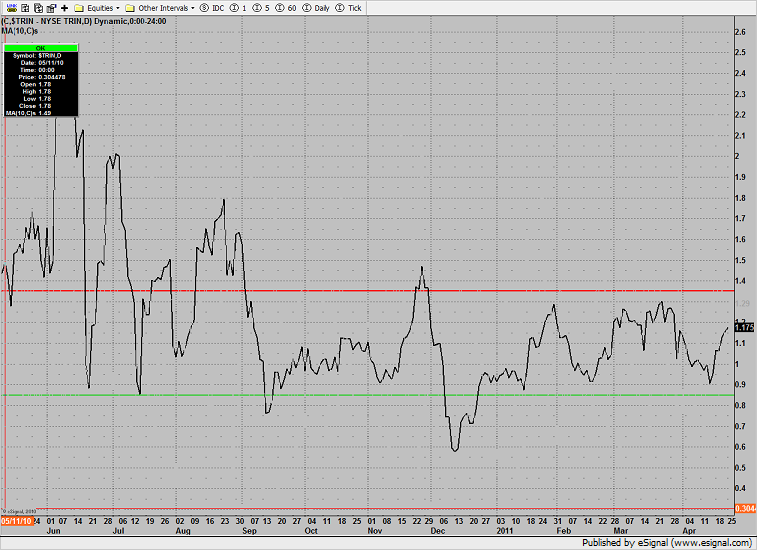

The 10-day Trin is actually closer to oversold than overbought at 1.17.

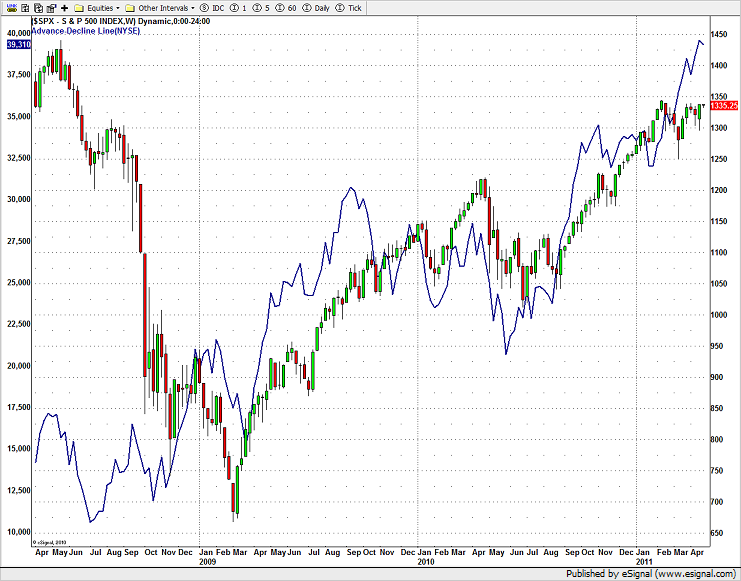

The weekly cumulative A/D line is technically sound after recording a new high close on the move. This is exactly what intermarket analysts would expect to see before the broad market breaks out to the upside.

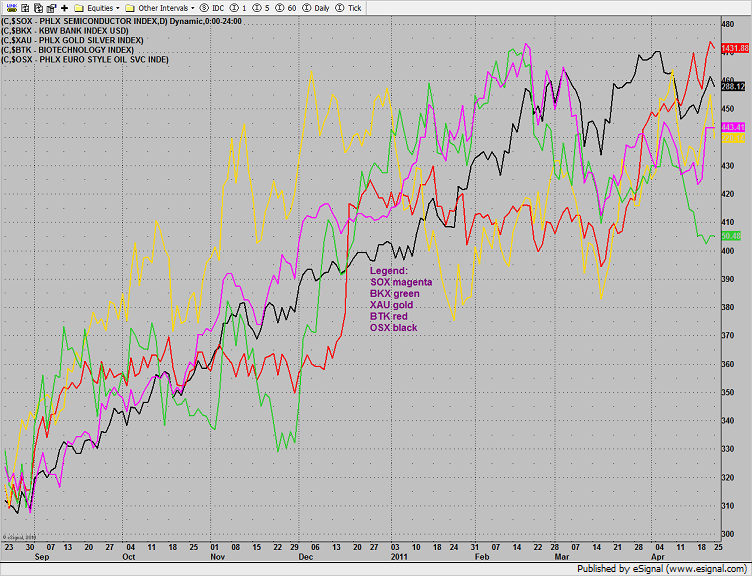

Multi sector daily chart:

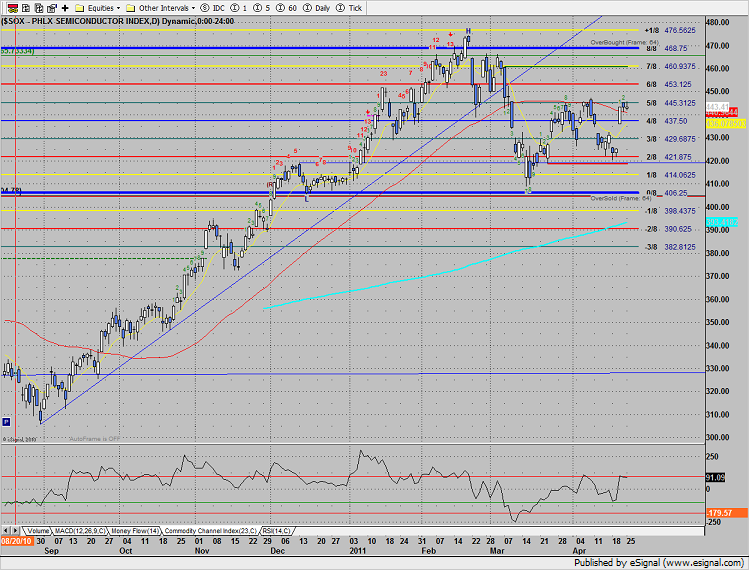

The SOX posted a narrow range day but was the top Naz sector. A close over the April highs opens the door to the static trend line at 460.

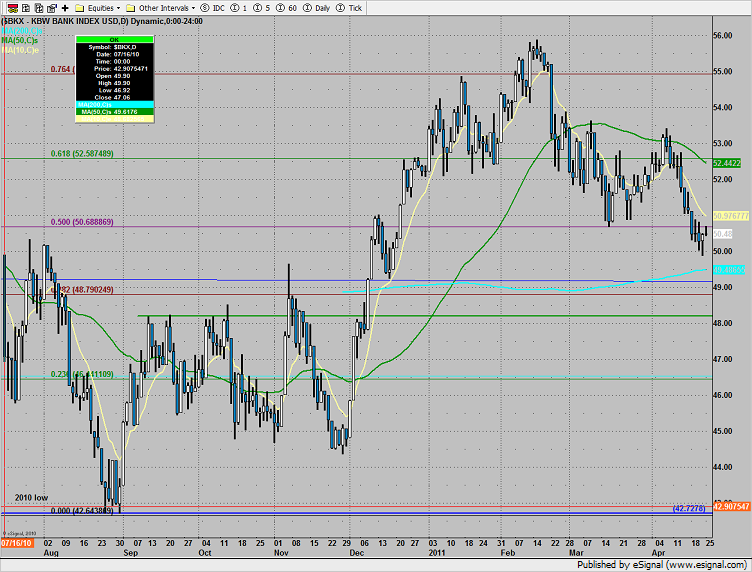

The BKX traded inline with the broad market so nothing new technically.

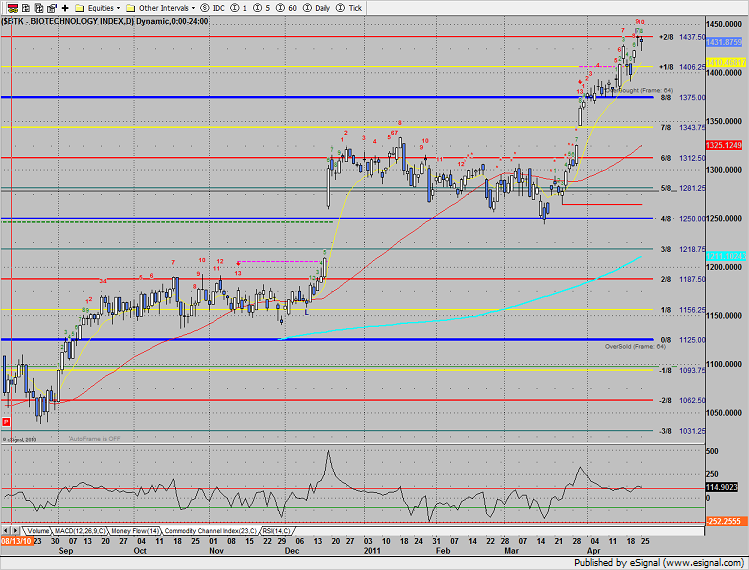

The BTK lost 5 handles on the day, still below the +2/8 level that would frame shift the daily.

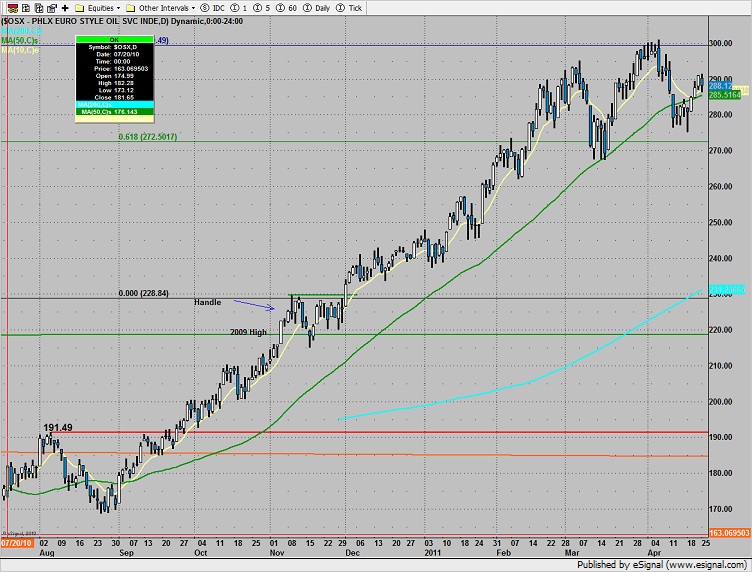

The OSX lost 1% on the day and was much weaker than the market. The 10 and 50dmas have converged just below the recent lows which make for key support.

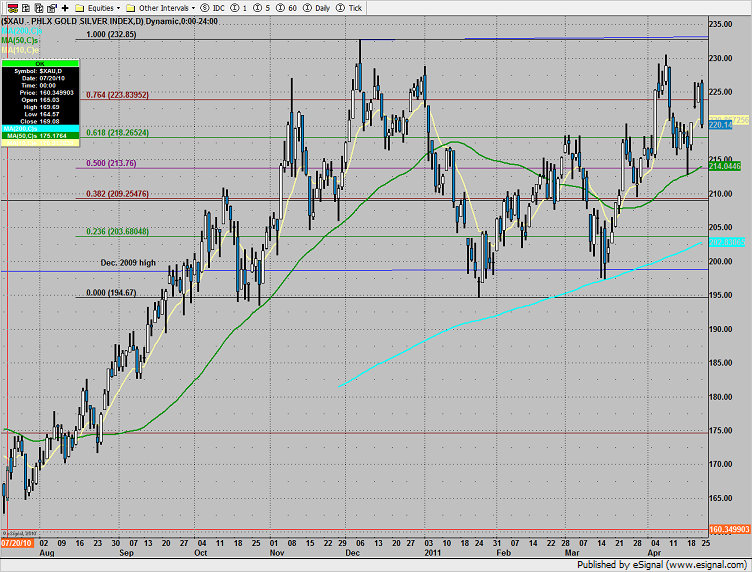

The XAU was the last laggard losing 2.5% on the day. The XAUs refusal to produce a new high bodes poorly for gold futures holding above 1500. For gold futures to continue higher the XAU needs to make a new high.

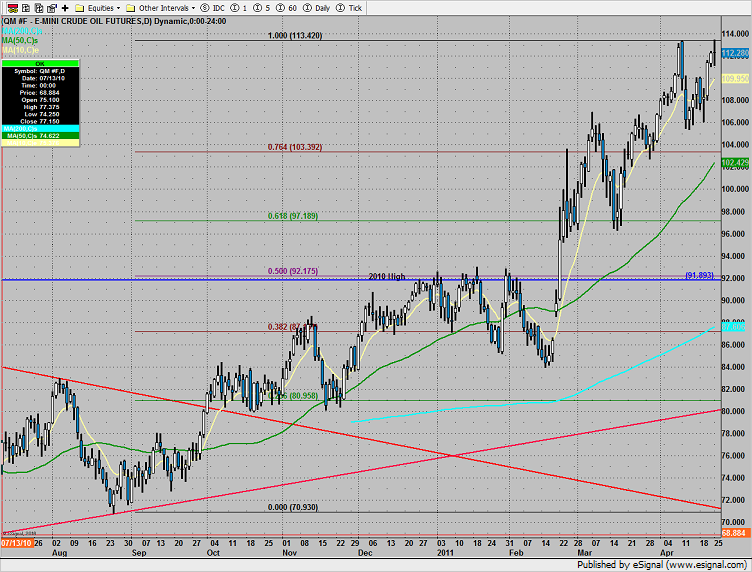

Oil retested the 100% fib extension but has yet to exceed it. This is a very key area of resistance and also new beak point.

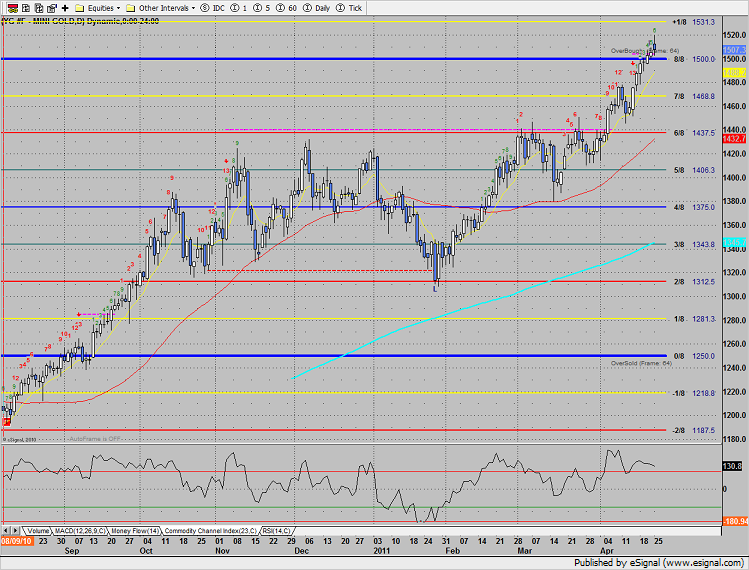

Gold posted a range high distribution day, settling below the open.