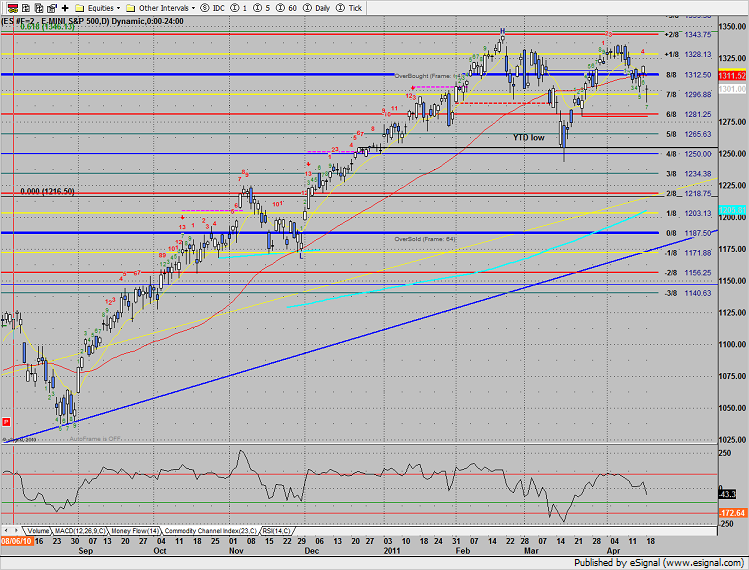

The SP gapped sharply lower, closing near the opening level and losing 17 on the day. Note that price now quite a bit below the 50dma and the CCI continues lower but has not broken below the zero line.

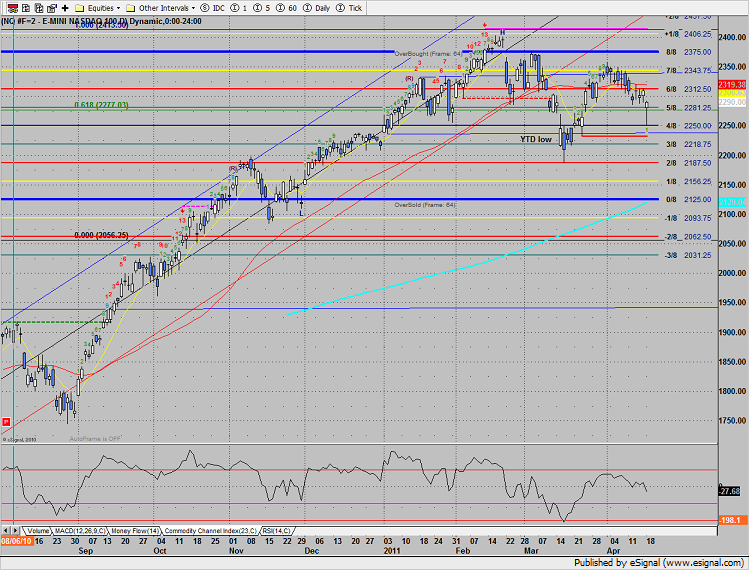

Naz lost 19 on the day but settled near the HOD, intraday using the 4/8 level for support.

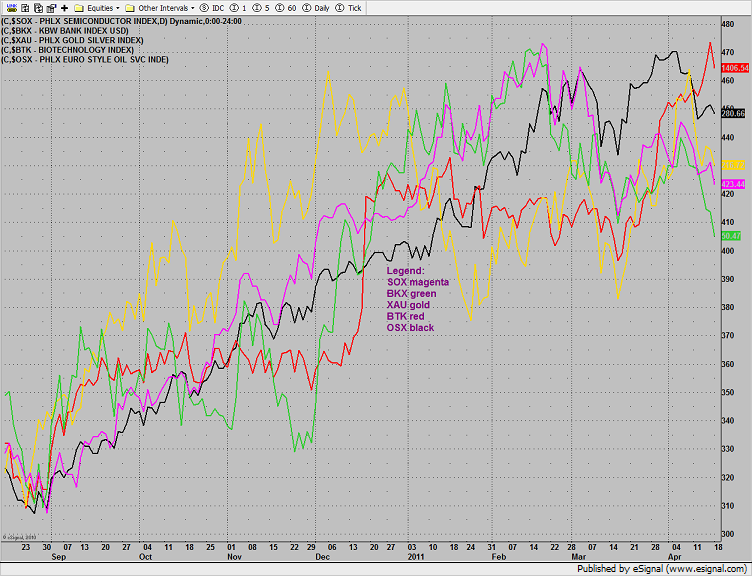

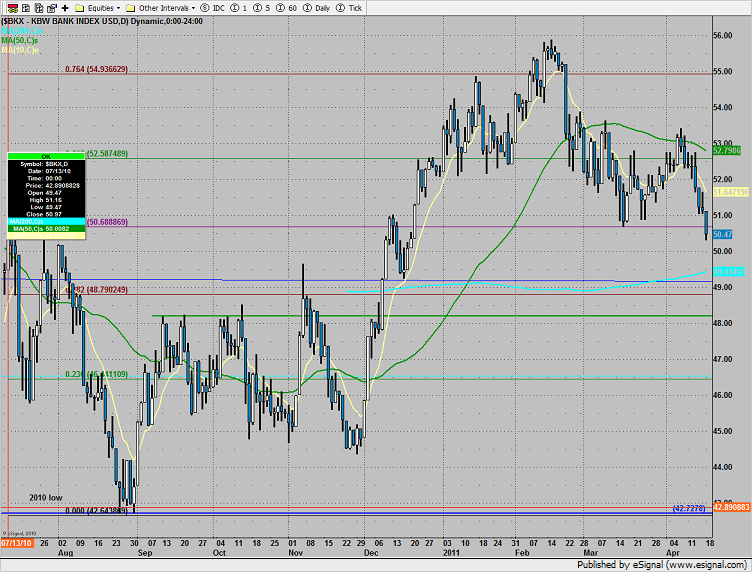

The multi sector daily chart shows the relative weakness in the BKX:

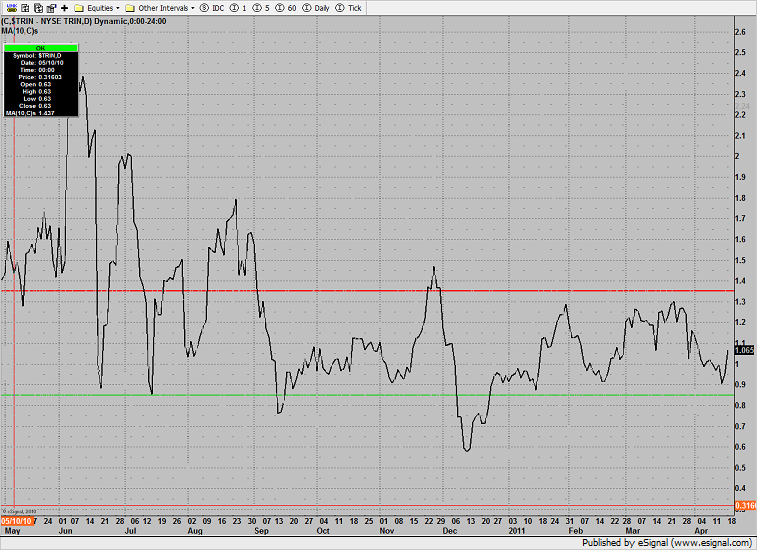

The 10-day Trin has turned up from just above the over bought threshold but is nowhere near the 1.35 oversold threshold.

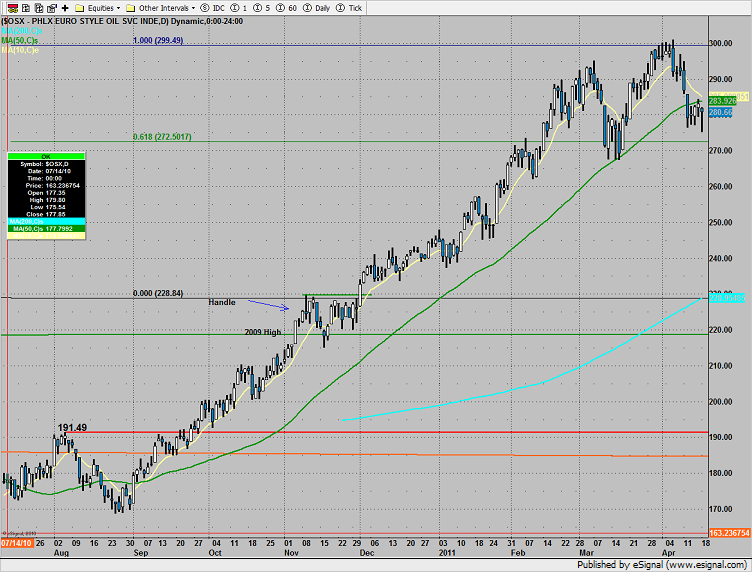

The OSX was top gun, losing less then the broad market and also above the active static trend line. Price remains short-term bearish below both the 10 and 50dmas.

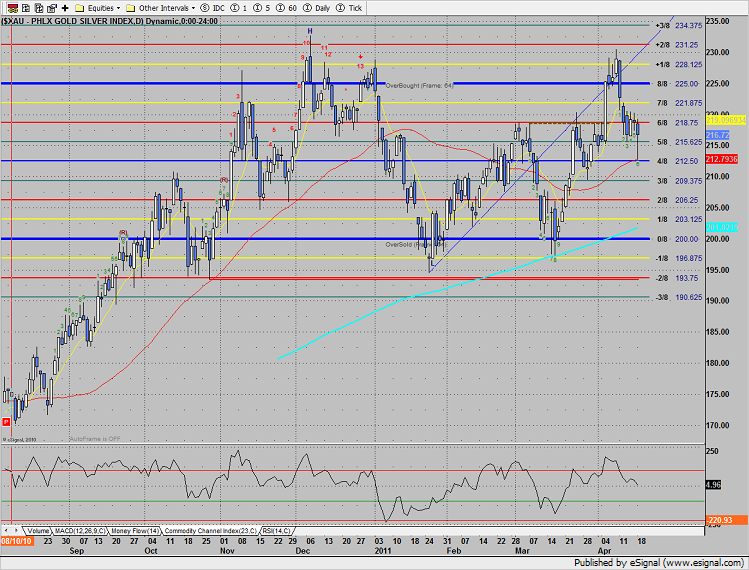

The XAU tested but did not break below the 4/8 level or the 50dma. Monday’s low is a very key short term support level. Set an alarm for a break below 212.50.

The BKX banking index broke to new lows on the move and also year-to-date. Price undercut the 50% fib which opens the door for a test of the 200dma.

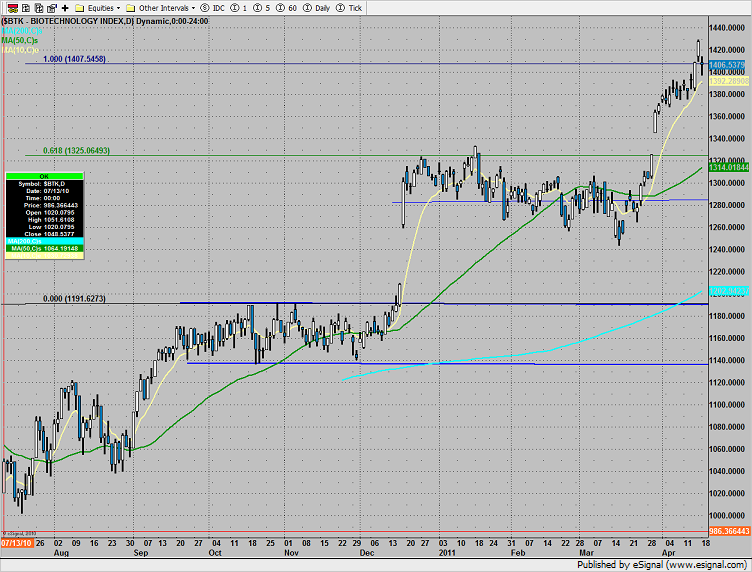

The BTK was weaker than the Naz, settling right at the 100% fib extension.

The SOX was the last laggard, losing 2% on the day. Note that 420 was the breakout pivot on the daily chart.

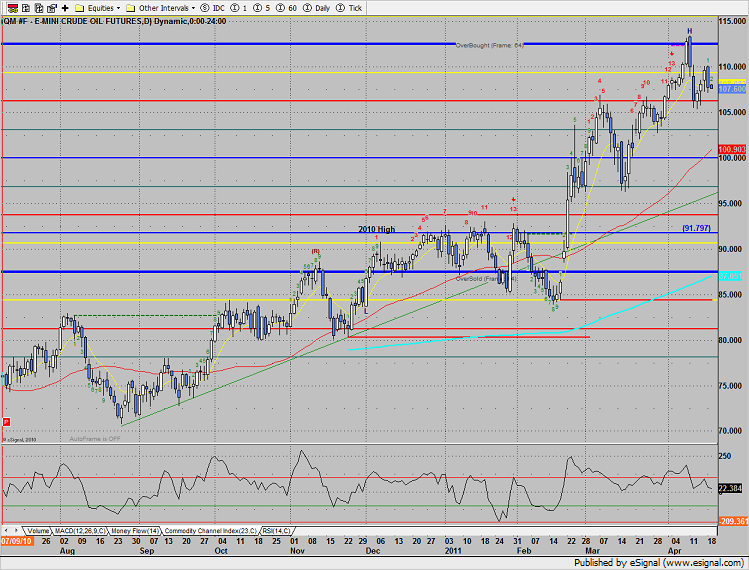

Oil was lower on the day, possibly making a lower high in the process.

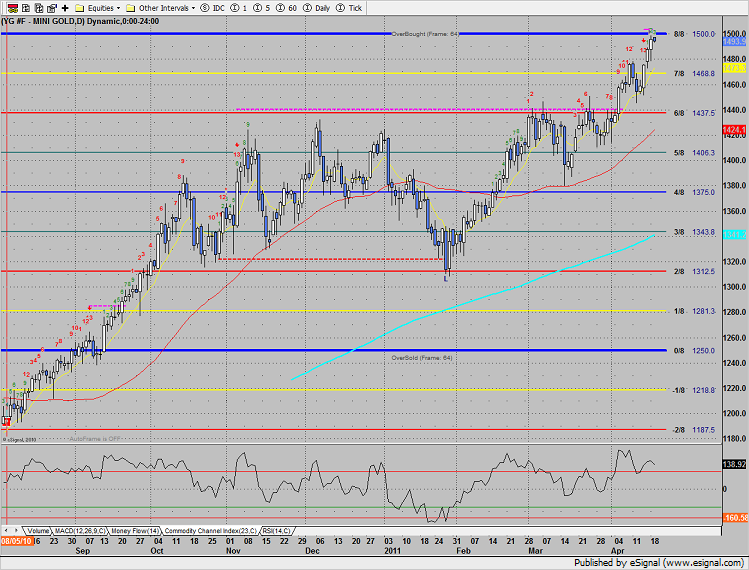

Gold was high on the day after some volatile intraday trading. 1500 is the 8/8 level and for now a key price target.