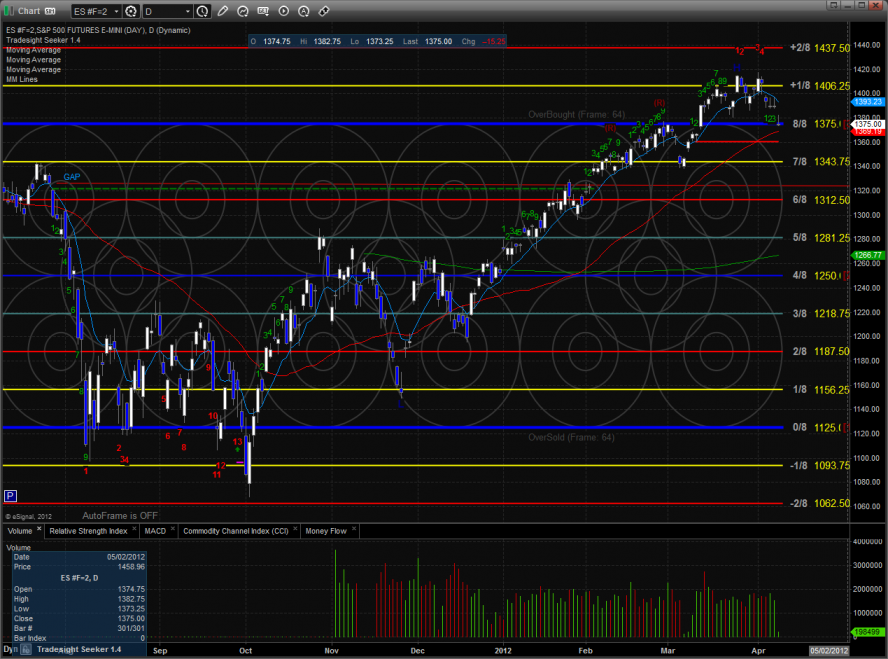

The ES broke down after the awkwardly reported NFP number and settled lower by 15 on the day. This is the low close of the month and is breaking down below the trend defining 10ema. Price gravitated to the 8/8 Murrey math level but most likely will tag the static trend line.

The NQ futures have a similar setup but continue to bullishly hold their relative strength. Seasond traders know that when one stock like AAPL is driving the relative strength, the market is asking too much from one stock. The next level of support will be the static trend line and rising 50dma.

10-day NYSE Trin:

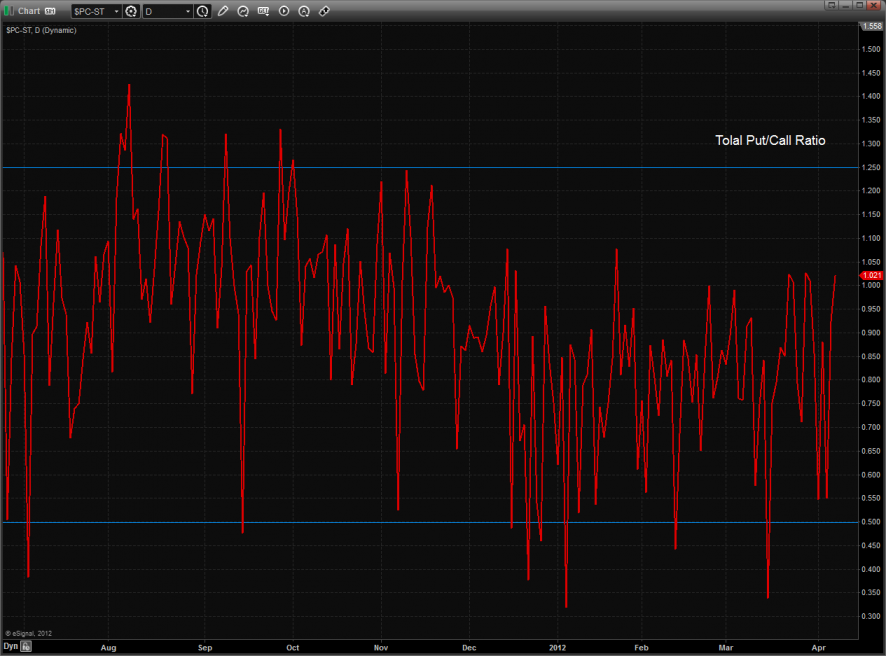

Total put/call ratio is still neutral:

Multi sector daily chart:

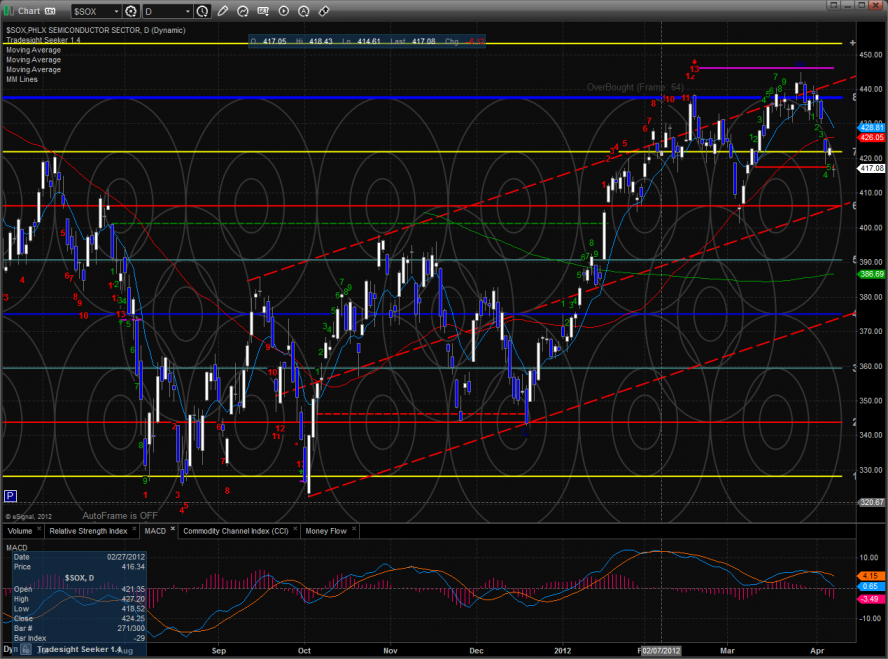

SOX/NDX cross remains weak and bearishly made a lower low.

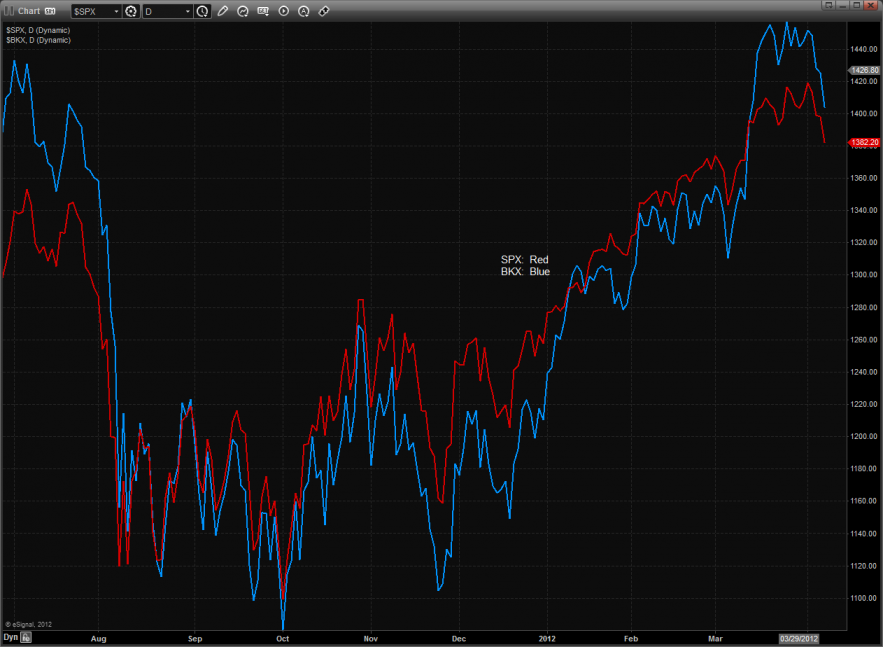

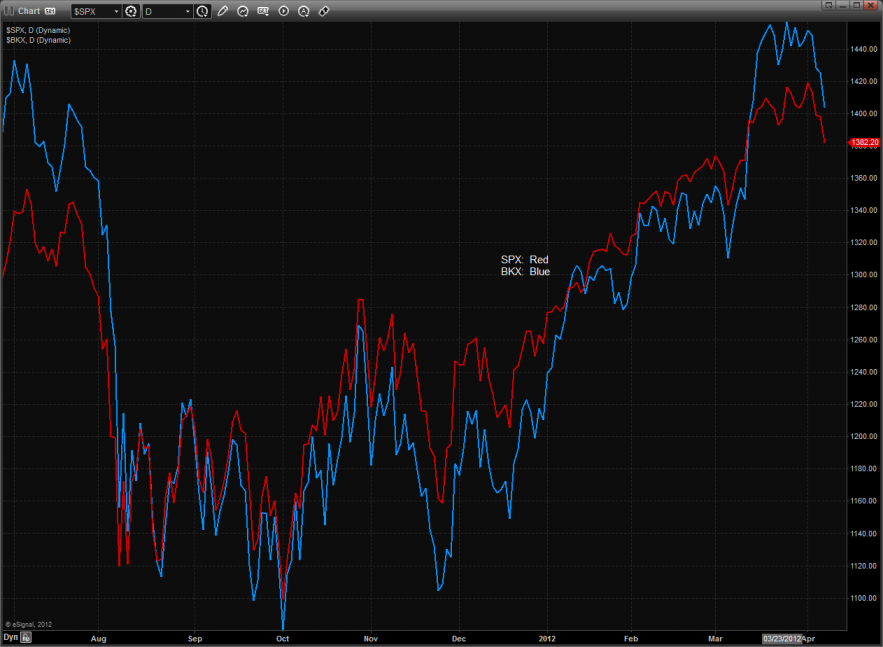

The BKX is giving back a good deal of its relative strength.

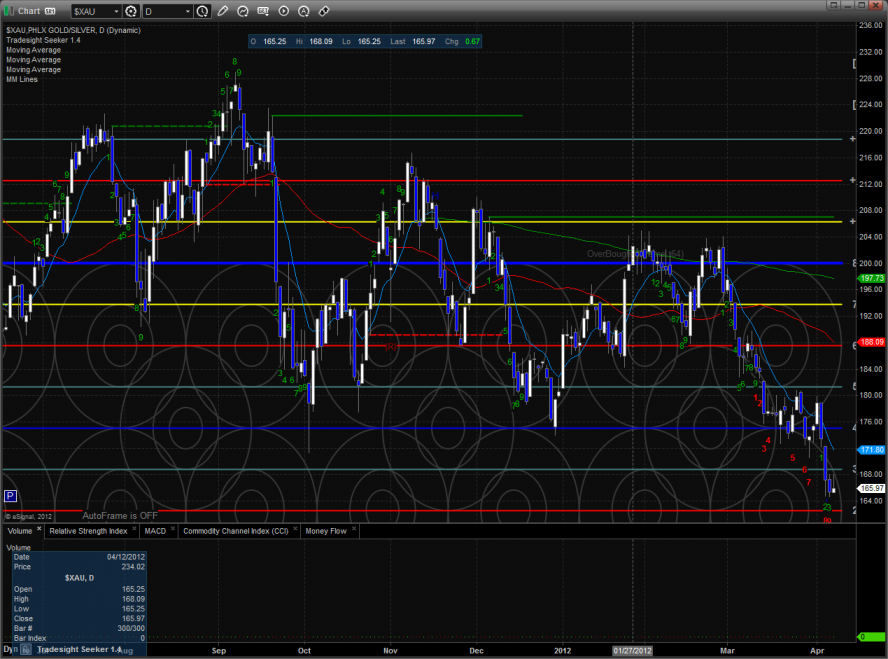

The defensive XAU was the strongest sector on the day. The real body of the candle was inside the prior day’s range so a breakout should have extra punch.

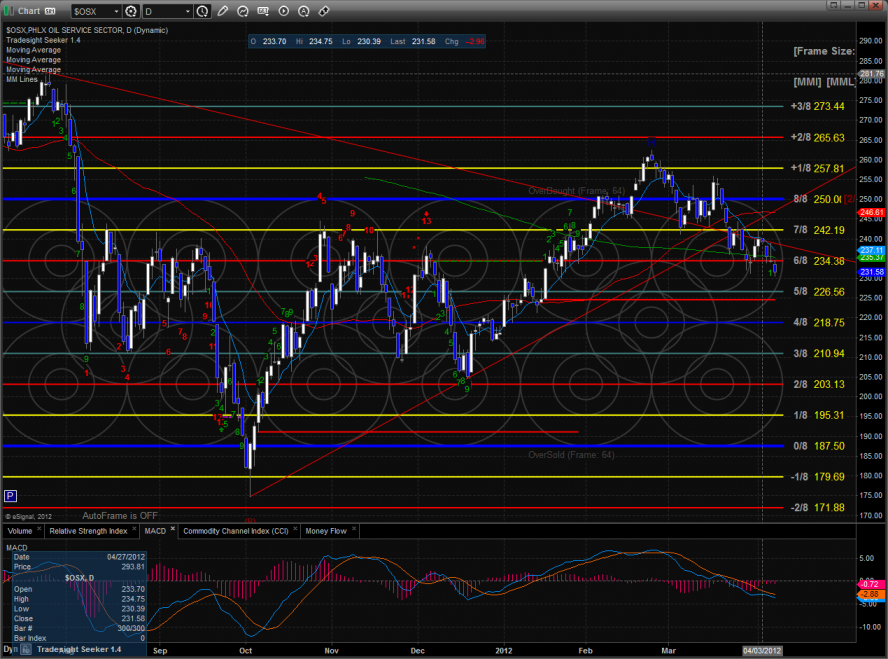

The OSX made a new multi month low close and the MACD is gaining downside momentum.

The SOX is using the static trend line for support, if this breaks then the February lows are the next trade to target.

The BKX has decisively broken the 10ema and will find critical support were the February highs converge with the 50dma.

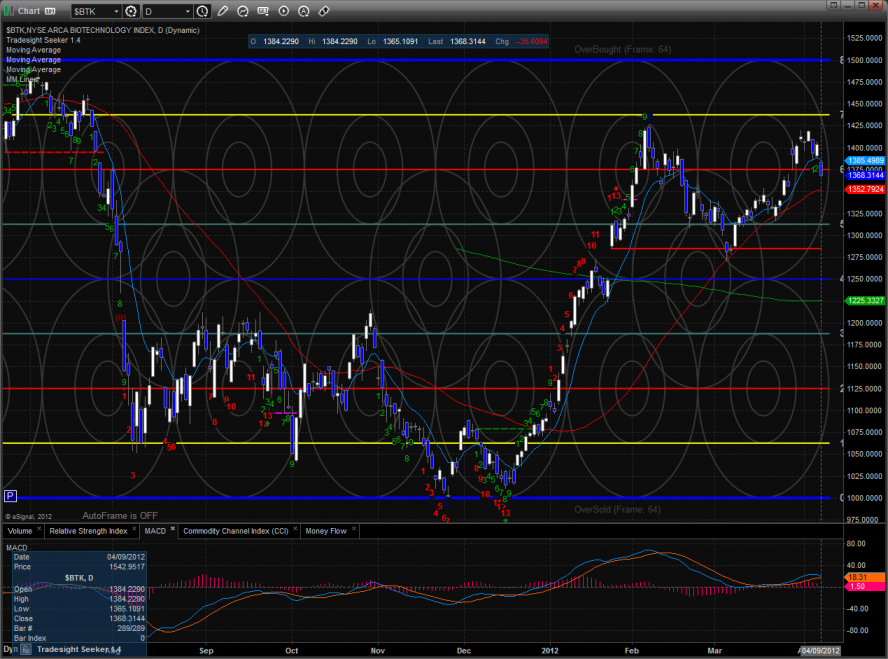

The BTK was the last laggard on the day. If the current lower high becomes qualified by a lower low then a very deep pullback is in the cards.

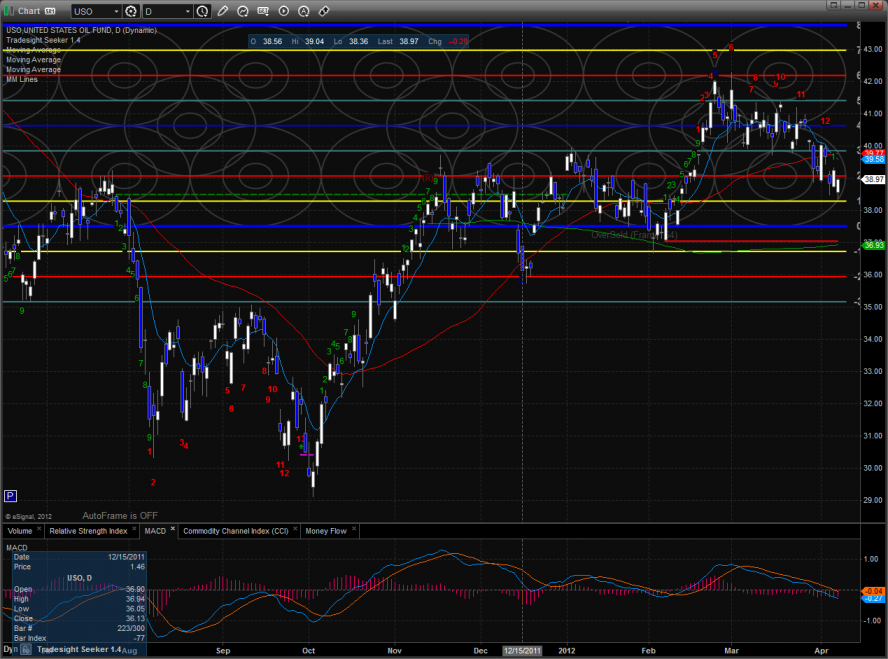

Oil (USO):

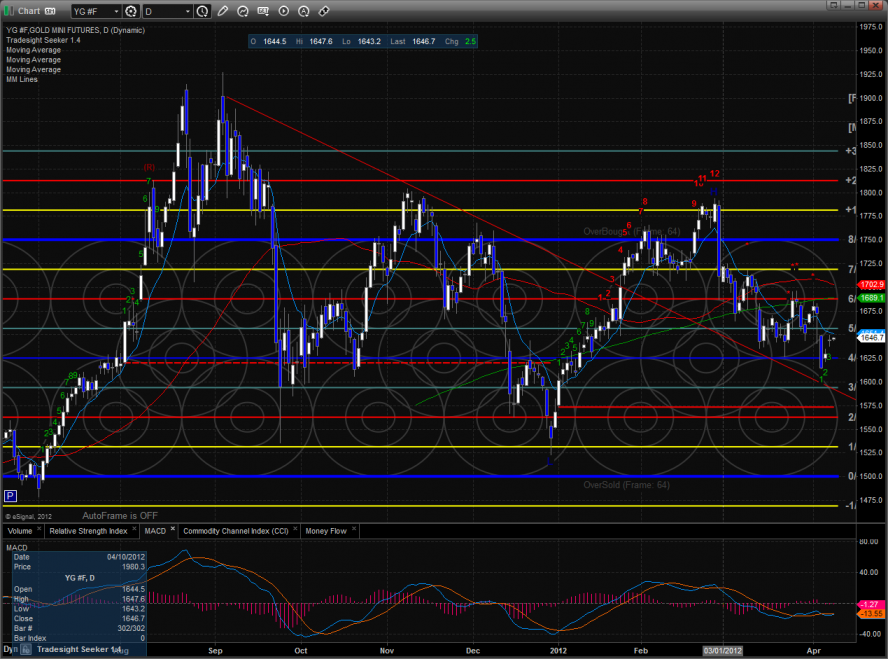

Gold:

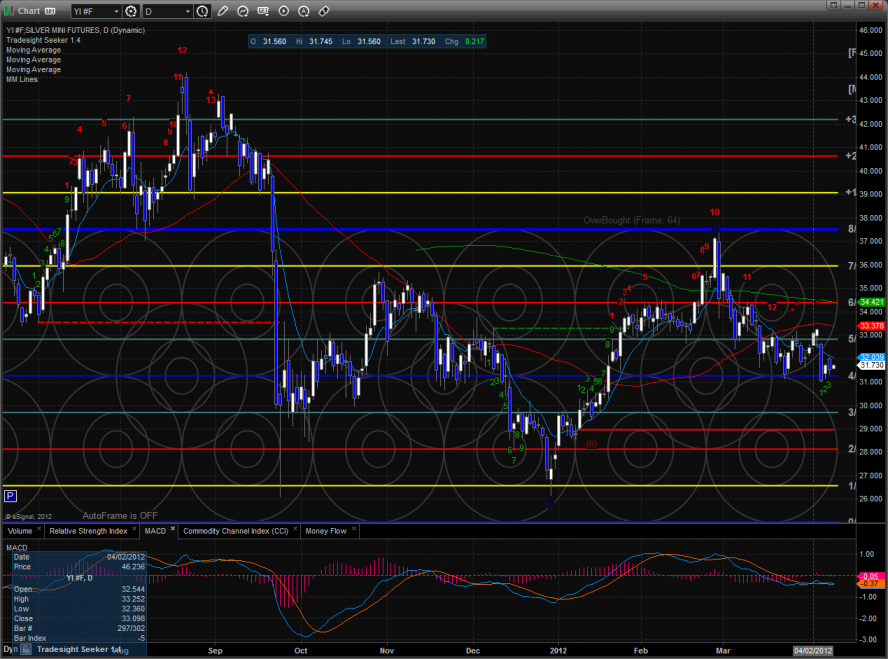

Silver: