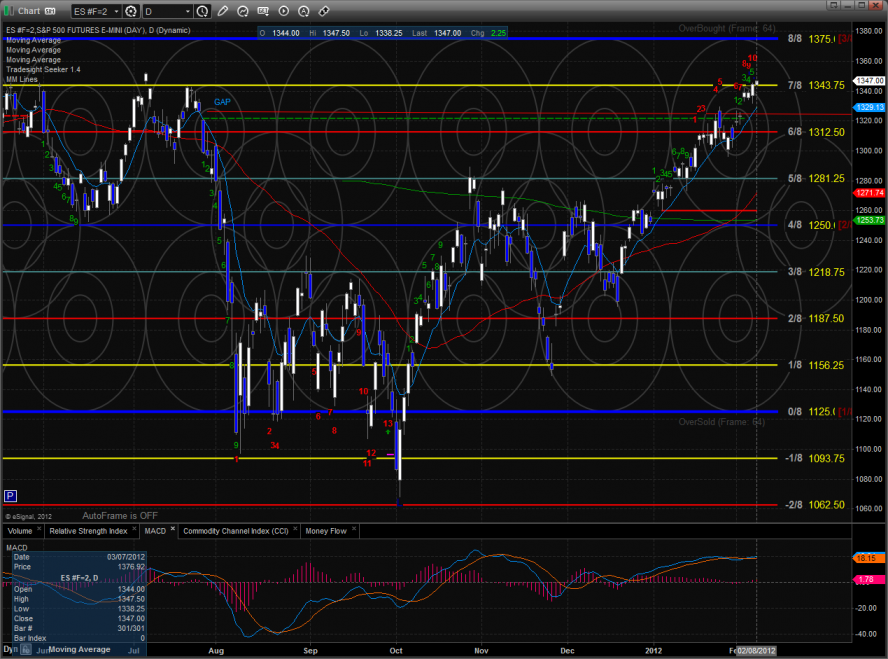

The ES recouped a steep midday loss to close up on the day by 2 handles. The pattern is now 11 days up and has major overhead at the 1375 level.

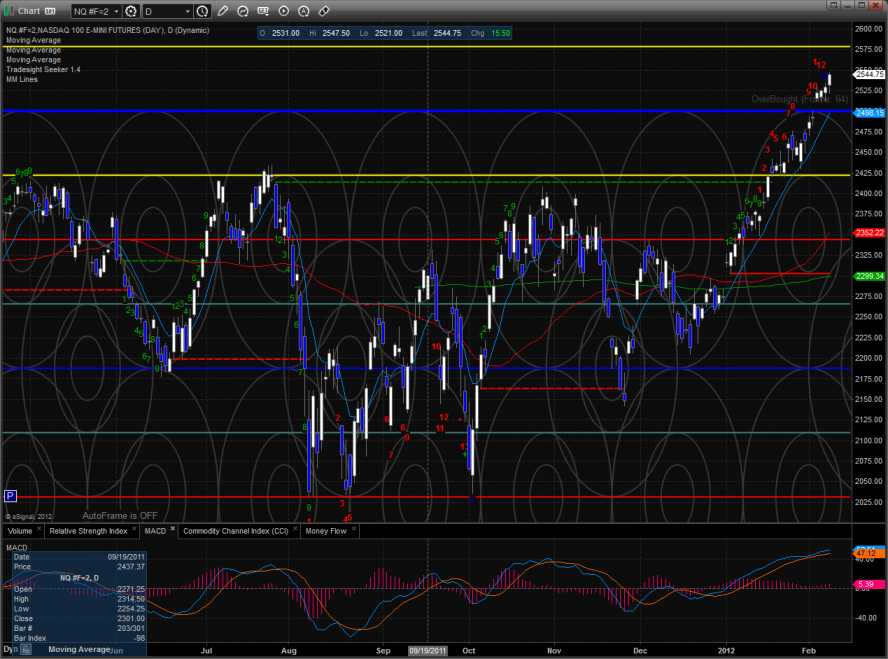

The NQ futures were higher by 15 handles and are now have an active Seeker 13 exhaustion signal in place. Watch the MACD closely for a crossover.

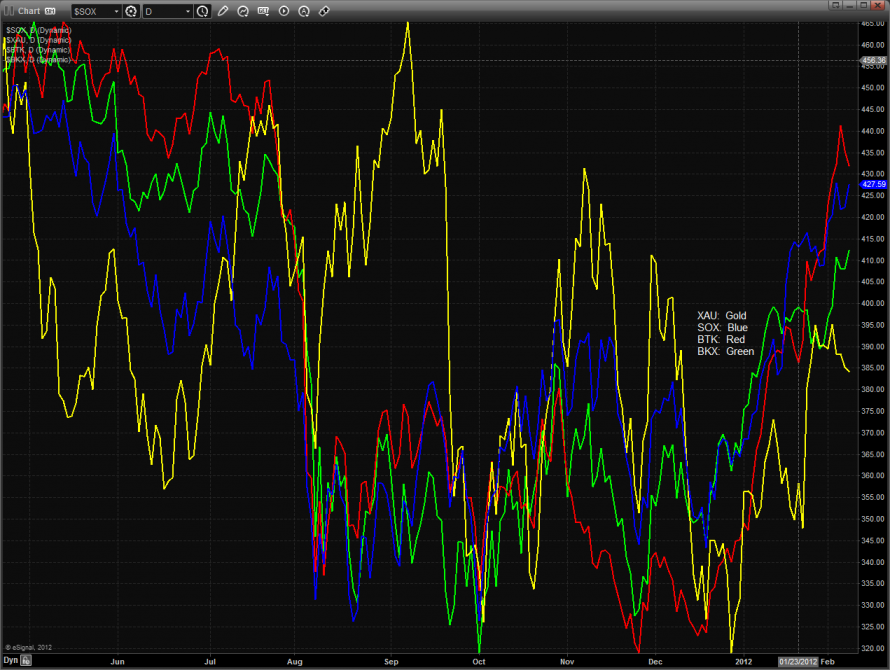

Multi sector daily chart:

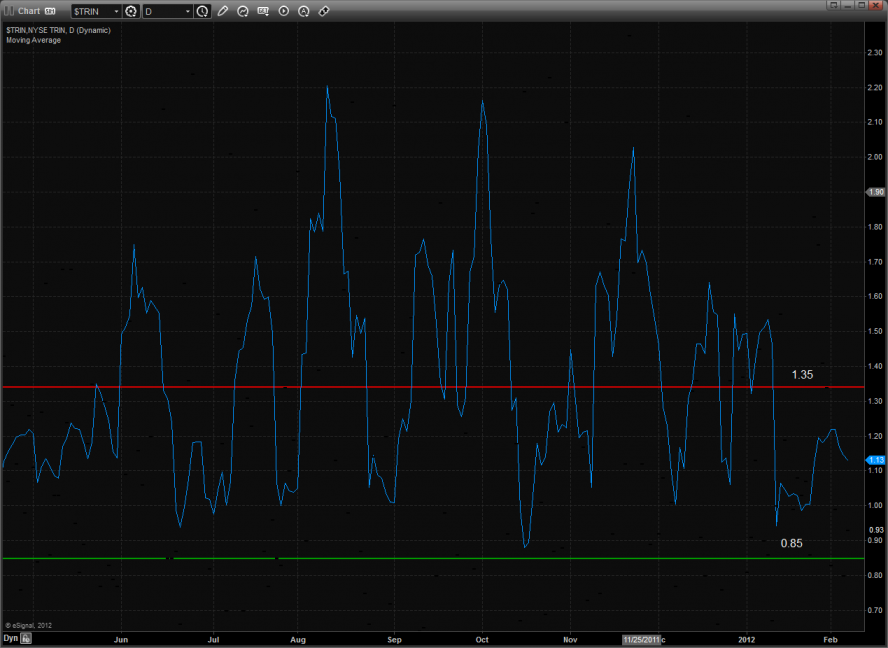

The 10-day Trin is still in the neutral zone.

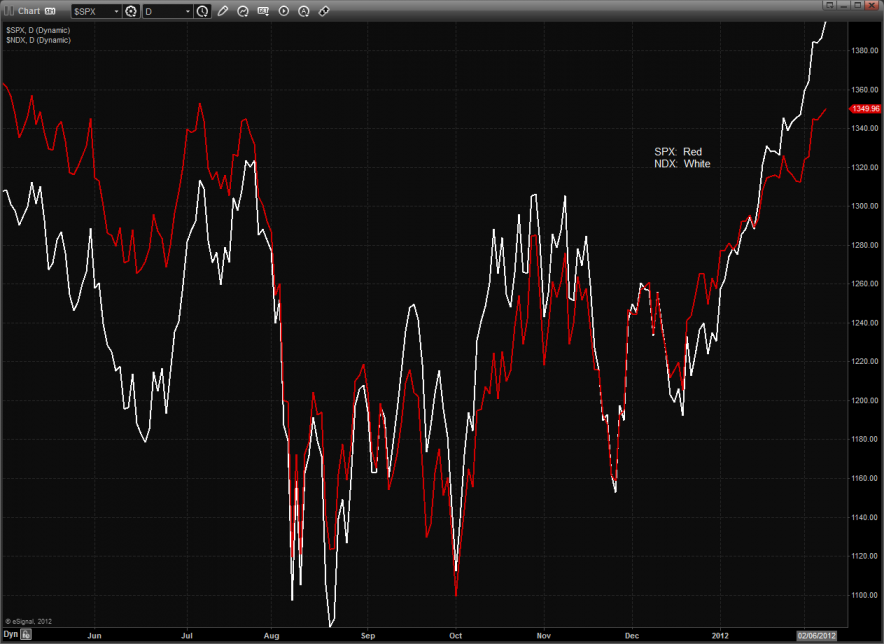

The NDX was relatively strong vs. the SPX which is a healthy sign and has yet to produce that leading divergence that always kills an advance.

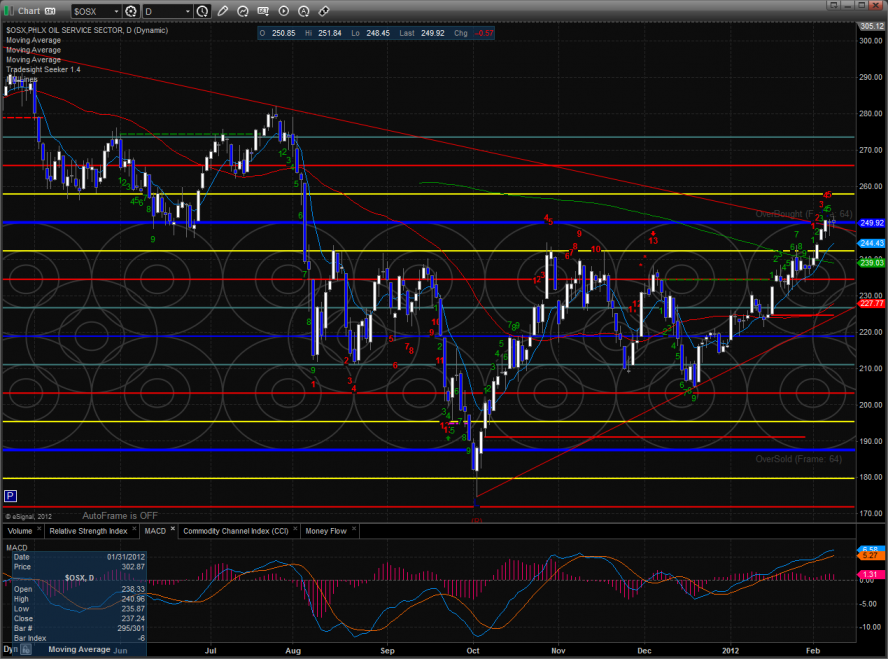

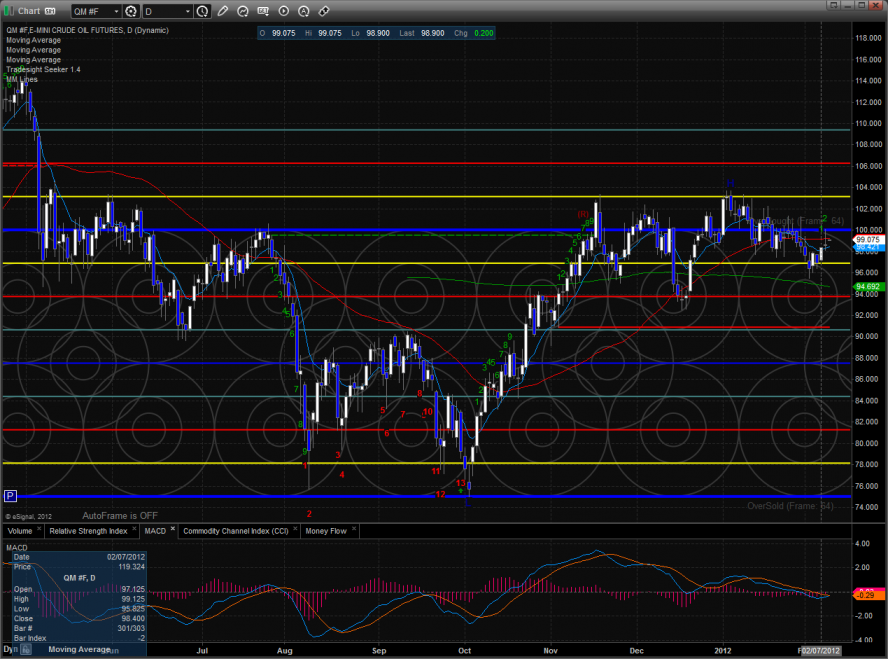

The OSX is working on a positive cross of the crude futures which will pull crude futures higher if it follows through.

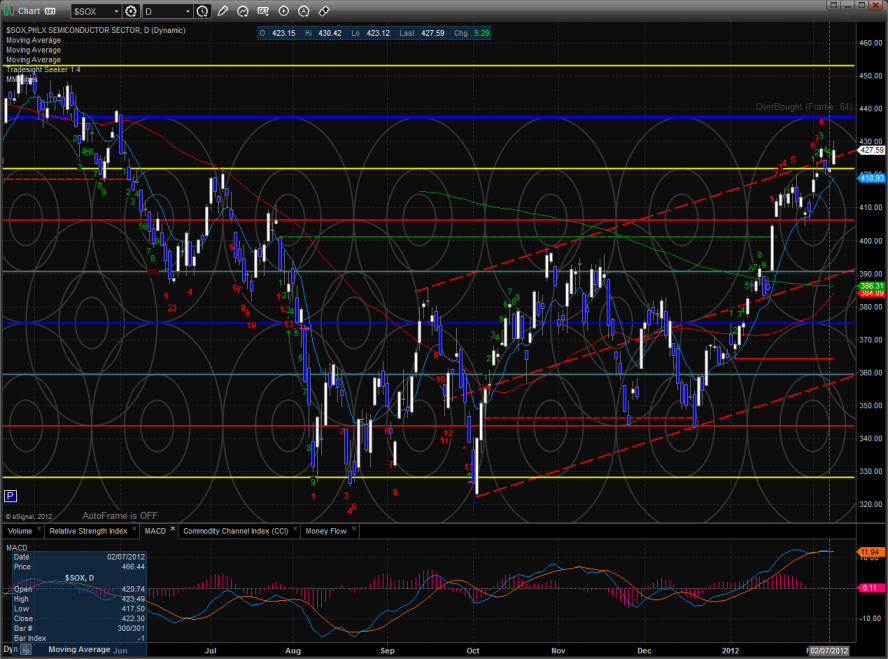

The SOX was the top gun on the day and recorded a new high on the move.

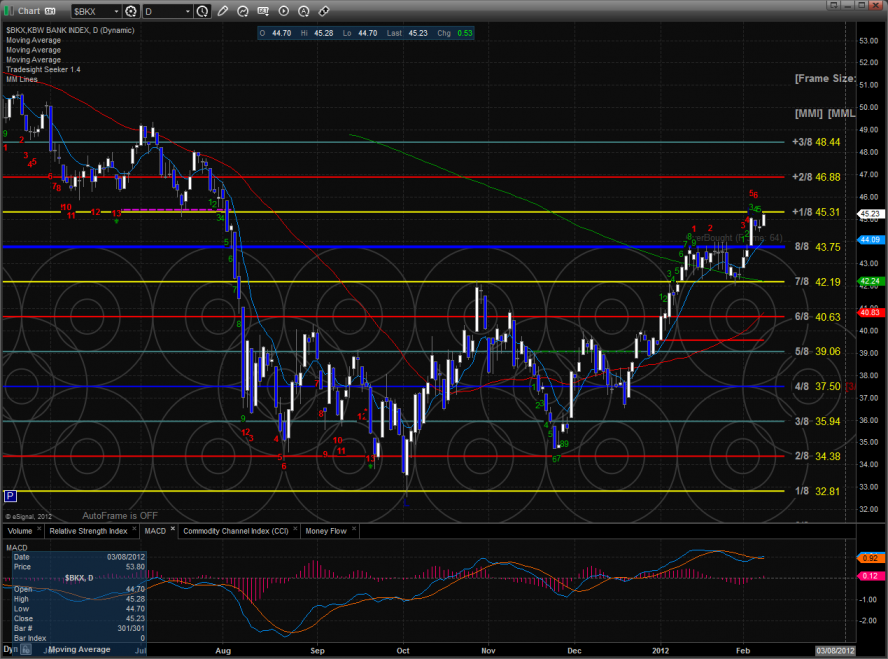

The BKX was stronger than the market and made a new high on the move. Keep in mind that price is in the overbought Gann area.

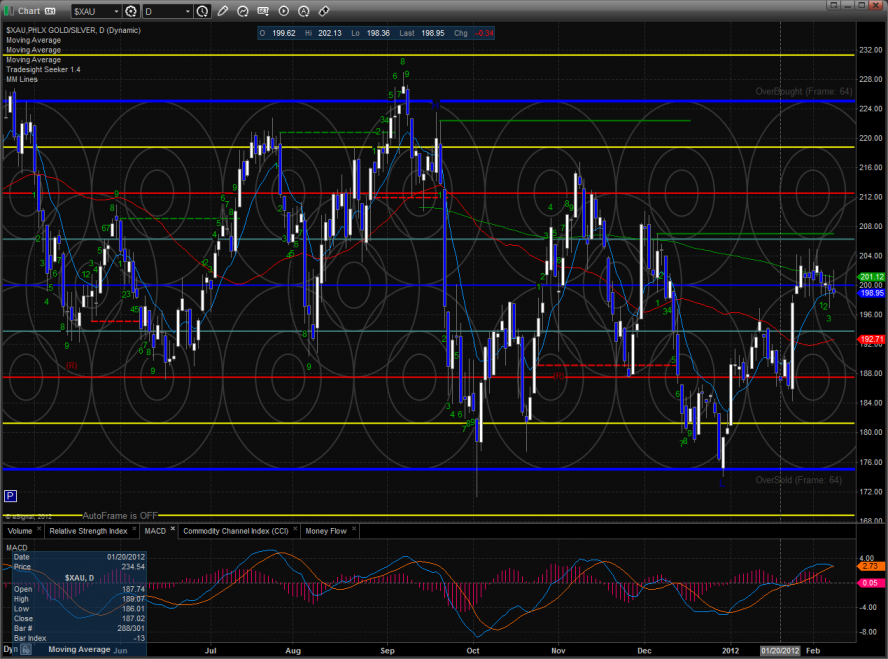

The XAU remains trapped between the major moving averages and has been a source of funds.

The OSX remains on the verge of a major breakout or failure. A few more bars are required for confirmation.

Oil:

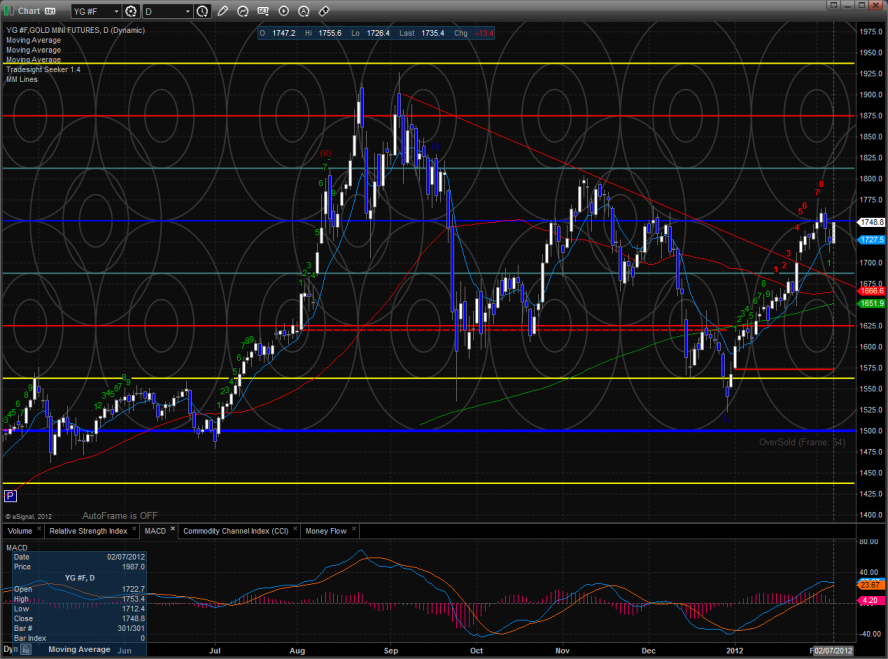

Gold: