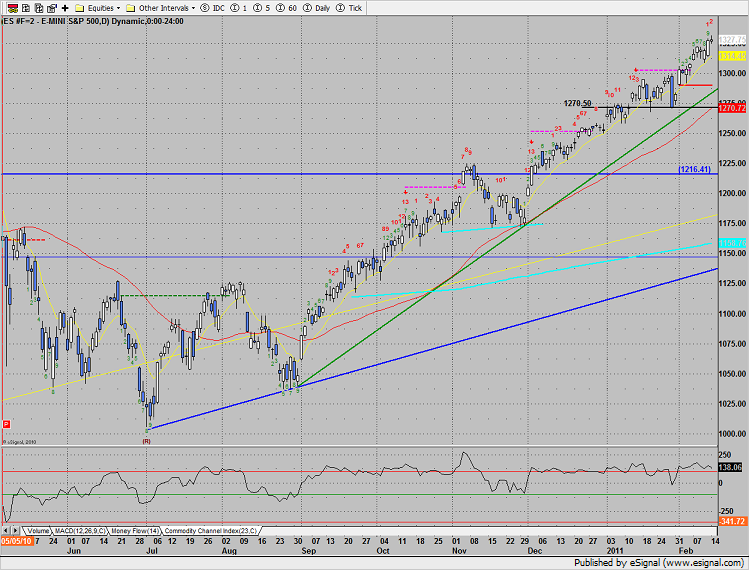

The SP was fractionally higher on the day. The most notable feature of the day was the lack of volume, the DIA which we like to track the true market volume on the day was only 49% of the typical run rate. Yup, less than half of the typical volume which need to be taken into account when evaluating all of Monday’s technical action.

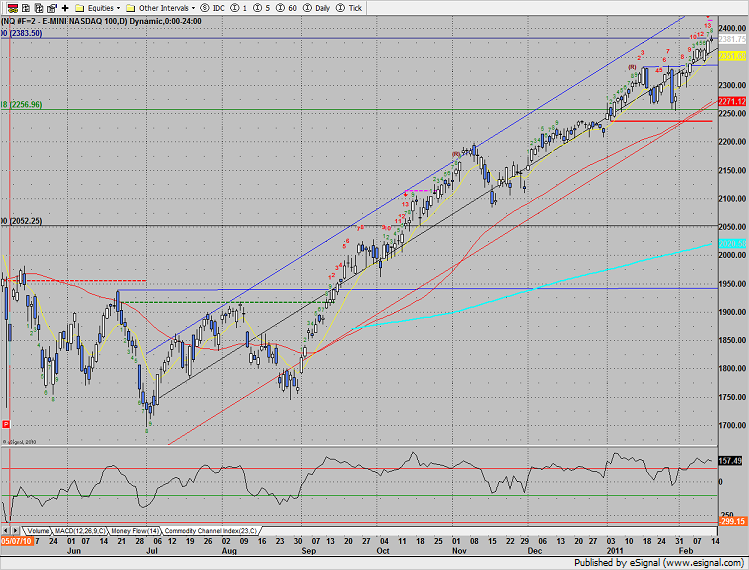

Naz was higher by 3 handles and still has an active Seeker exhaustion signal in place.

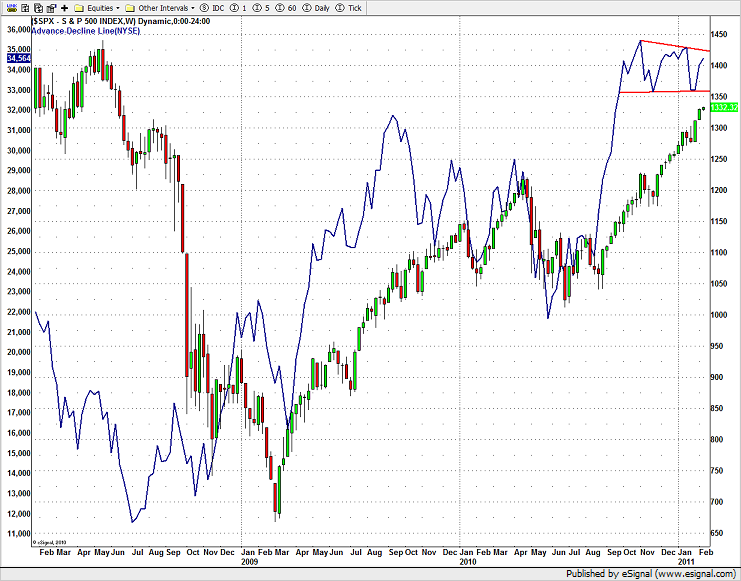

The weekly cumulative A/D line still needs to record a new higher high; this could be a problem if a divergence develops.

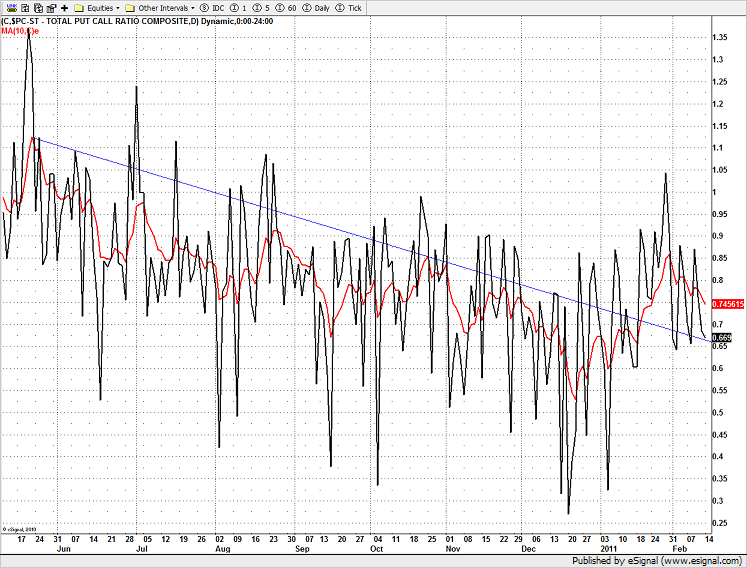

The Put/Call ratio is back to the trend line:

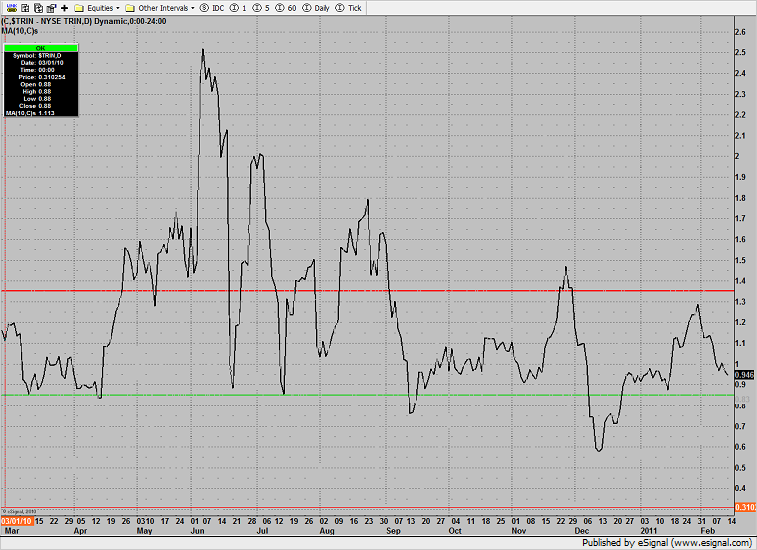

The 10-day Trin is below the baseline but still above the 0.85 overbought threshold:

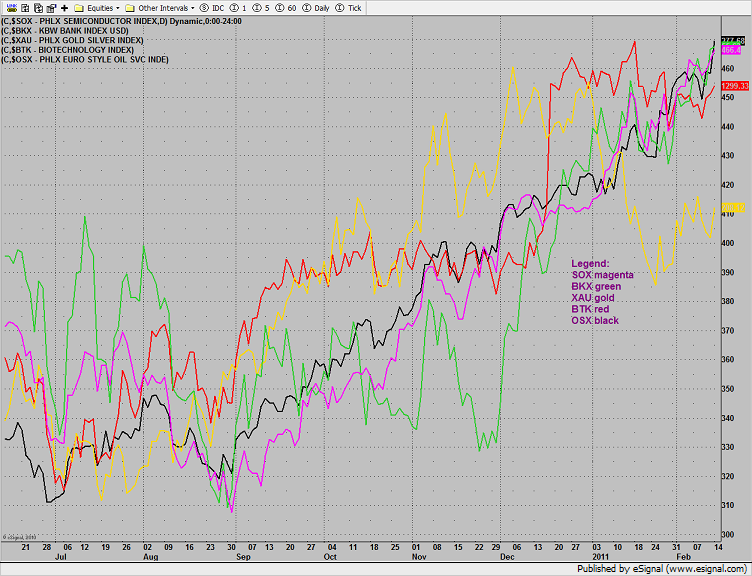

Multi sector daily chart:

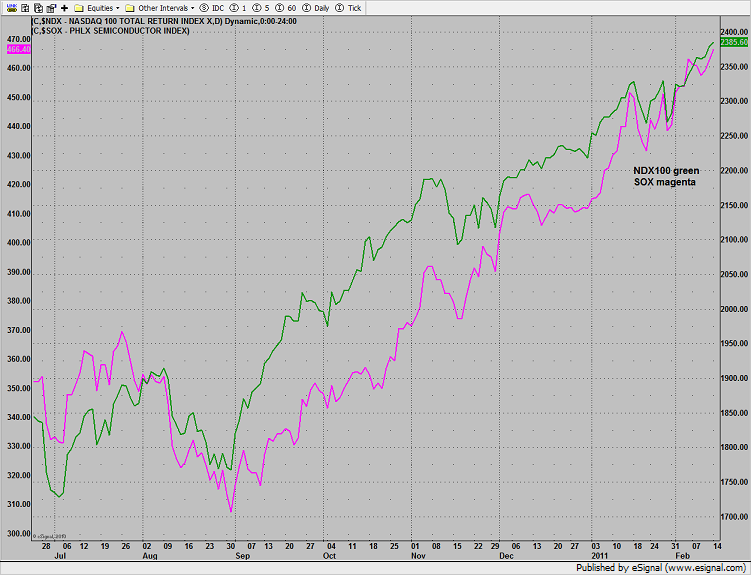

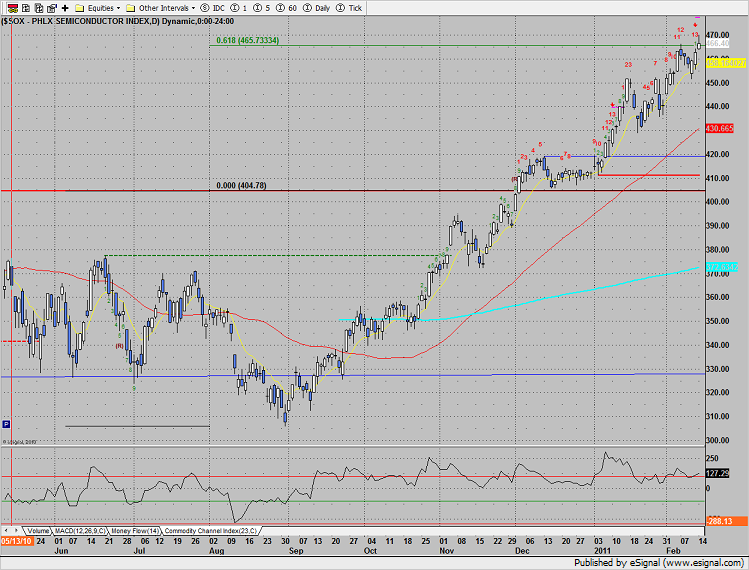

The SOX continues to lag the NDX100—negative divergence:

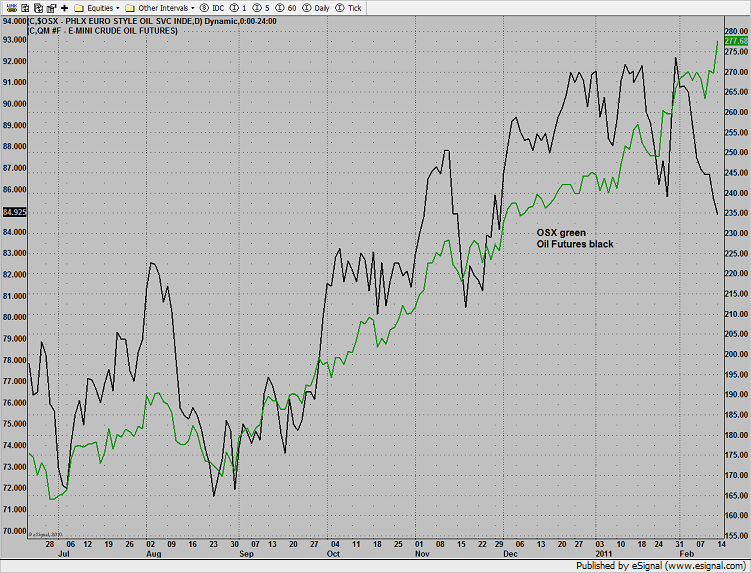

The OSX/Oil future cross has developed into a screaming divergence. This is typically bullish for crude futures but cannot continue if crude futures continue to tank.

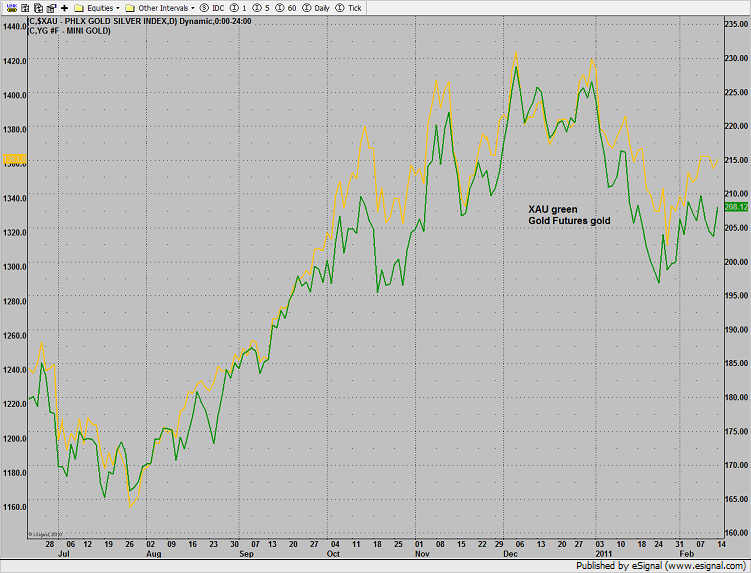

The XAU/Gold cross still has a very bearish divergence;

The SOX closed right at the measured move target and as of Friday has an active Seeker exhaustion signal.

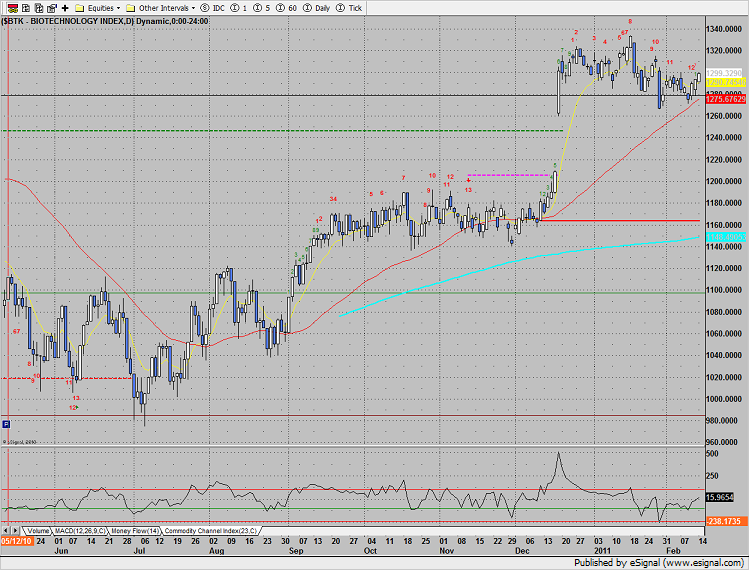

The BTK is finding support at the key 50dma. The chart is still bullish for now, with a Seeker 13 exhaustion on deck.

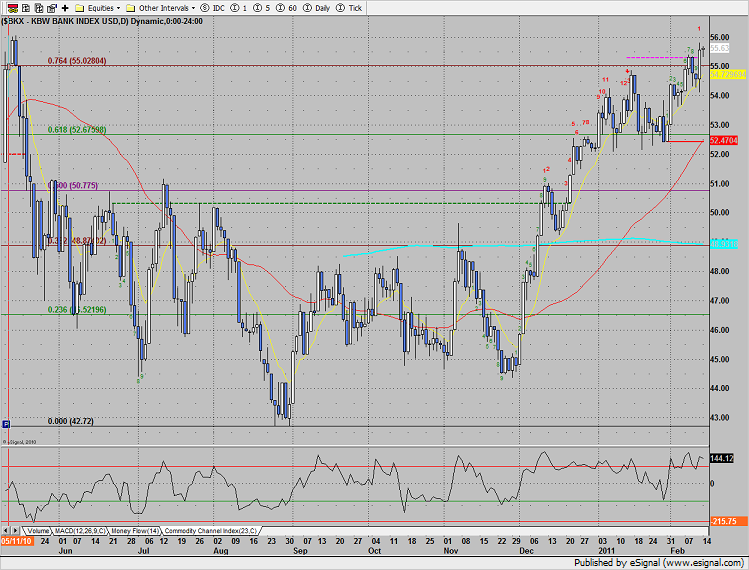

The BKX posted a narrow range inside day: