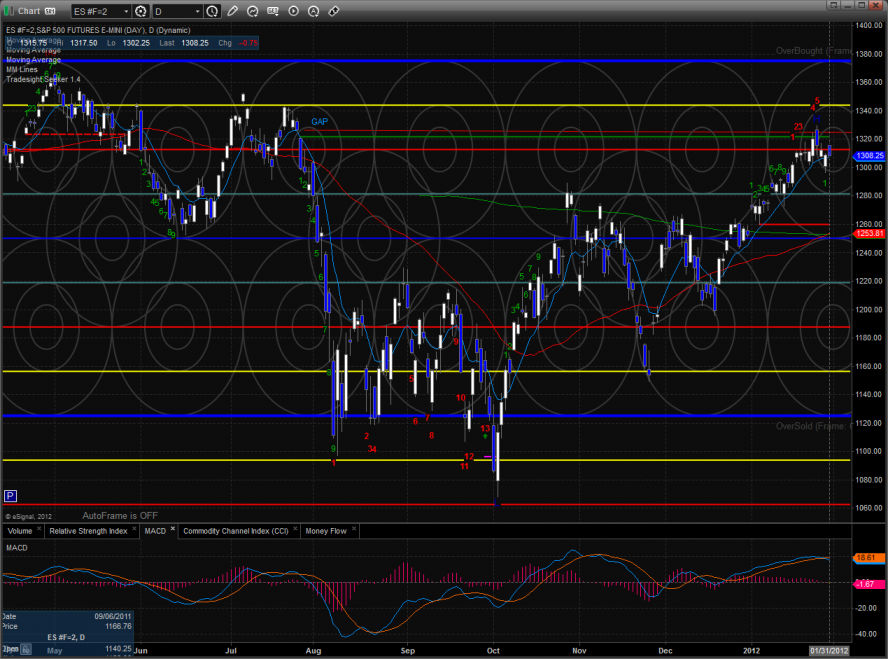

The ES closes marginally lower on the day to finish the month just above the 10ema. Today’s candle was a CPS downside alert where price should take out Tuesday’s low before high. Note that the MACD has gone negative.

The NQ futures finished the month higher on the day by 2 handles which is positive but the close was well below the open leaving a camouflage sell signal on the chart. Keep a close eye on the MACD for a bearish cross.

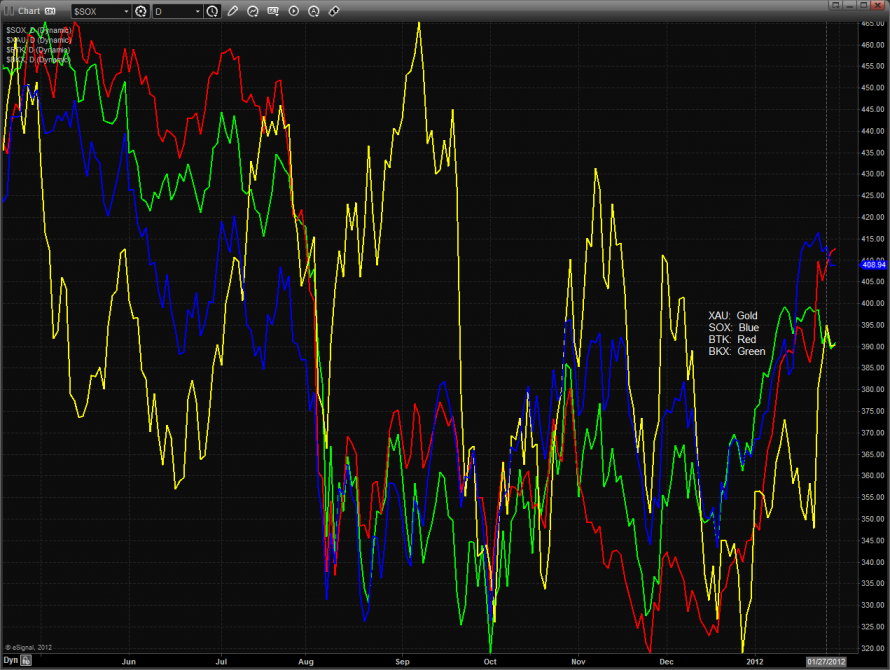

Multi sector daily chart:

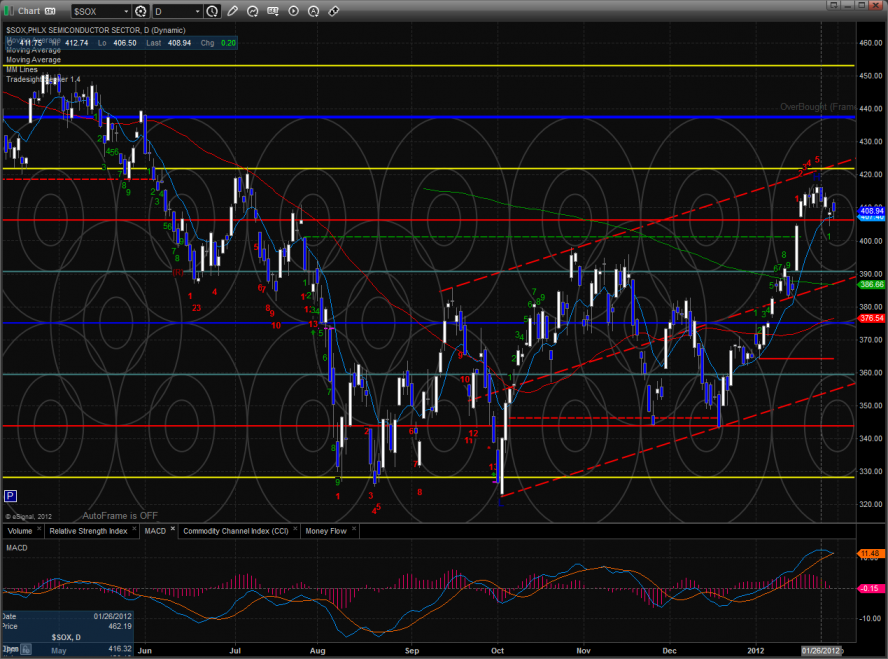

The SOX continues to lag the overall NDX which is historically a bearish condition. In addition to this generalization is that the chart of the cross pair has a bearish expanding pattern in the works.

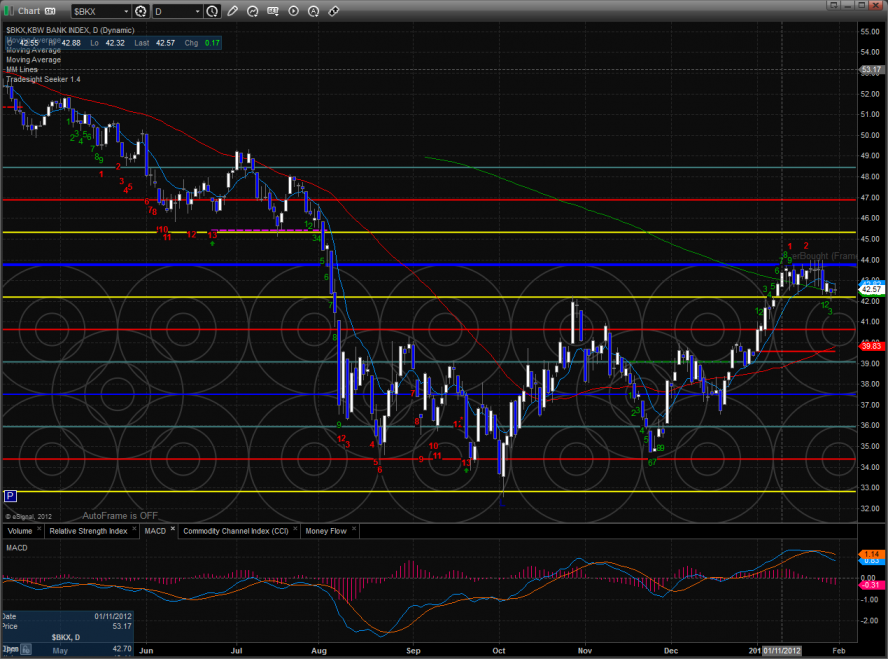

The BKX was the top gun on the day, posting tiny range candle on the chart. Price remains trapped and awaiting a definitive resolution.

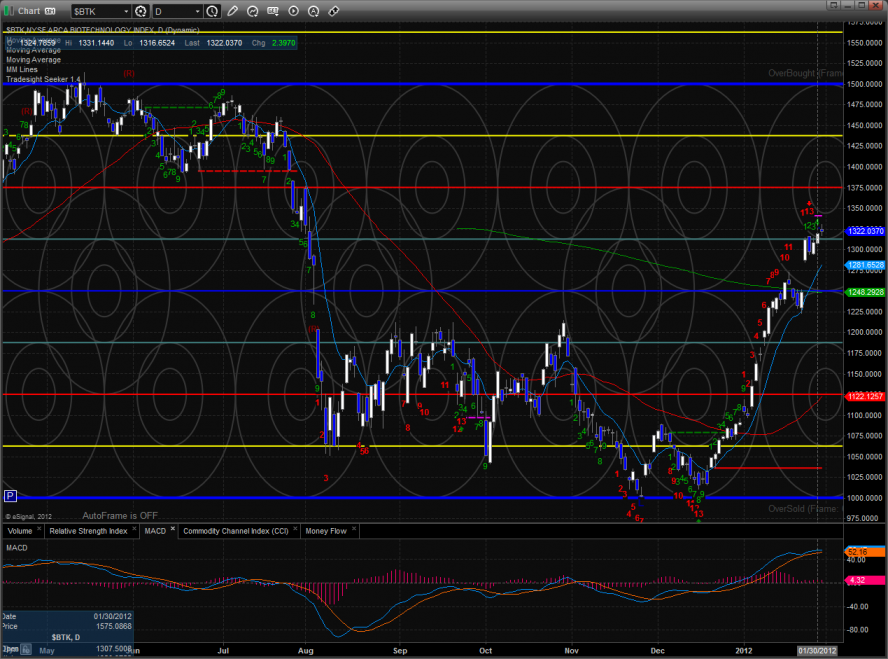

The BTK did nothing on the day and is still sporting a 13 exhaustion signal.

The SOX closed almost unchanged and looks poised for more downside.

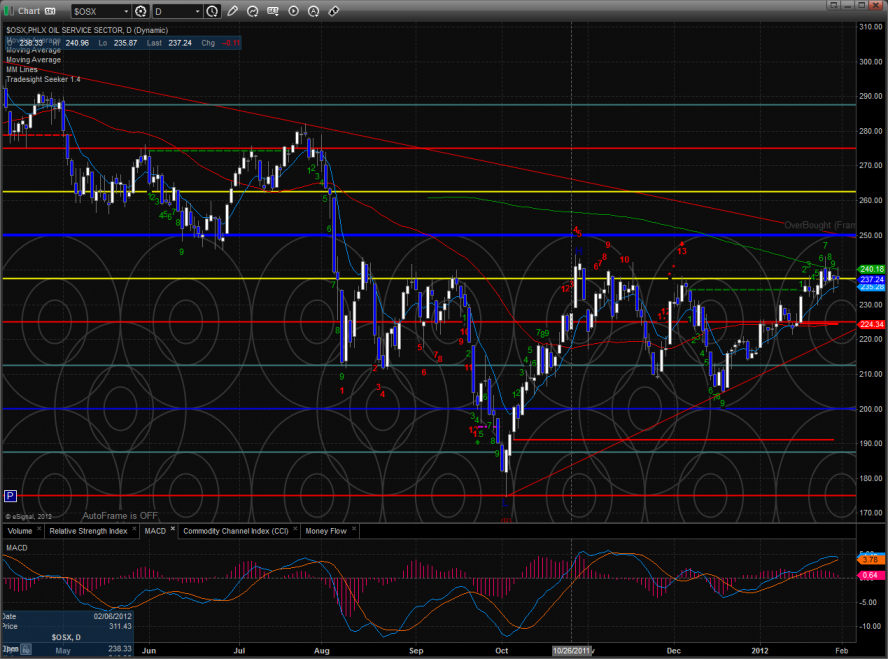

The OSX is 9 bars up in the seeker count and the pattern is totally wound up with power. Be ready.

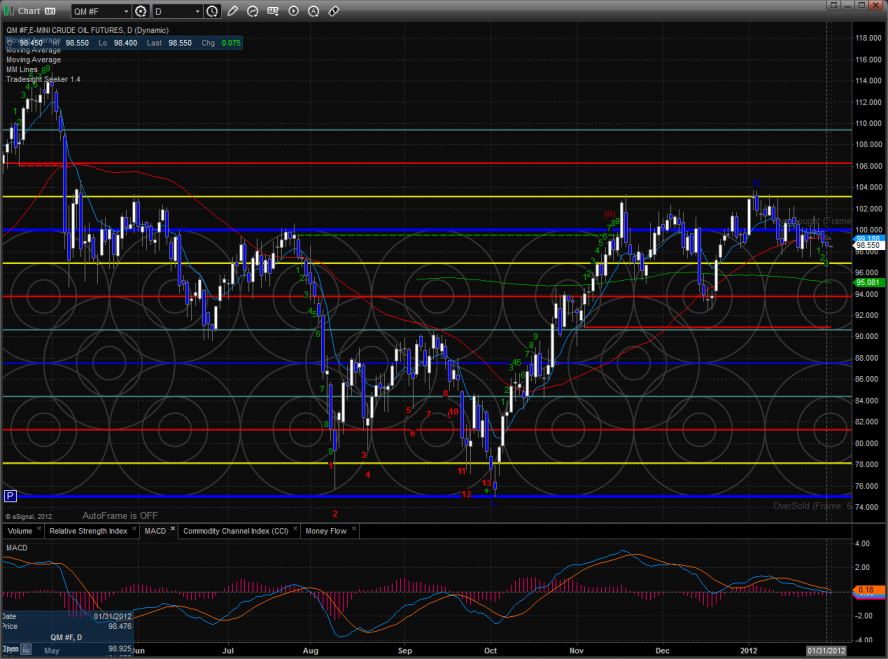

Oil was the notable commodity Tuesday. Early in the session, price was higher by as much as $2 before reversing and breaking a full $4 to the downside.

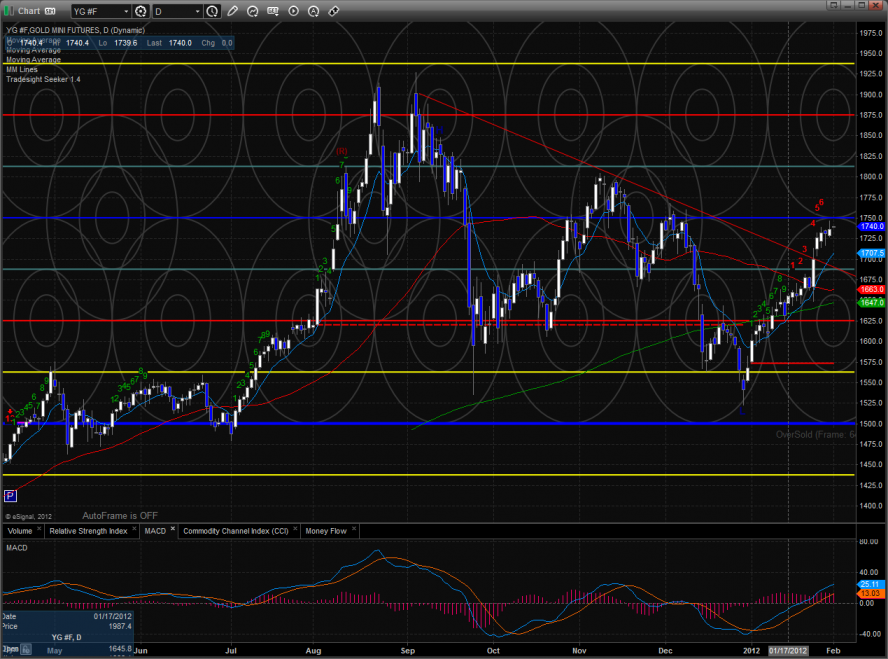

Gold: