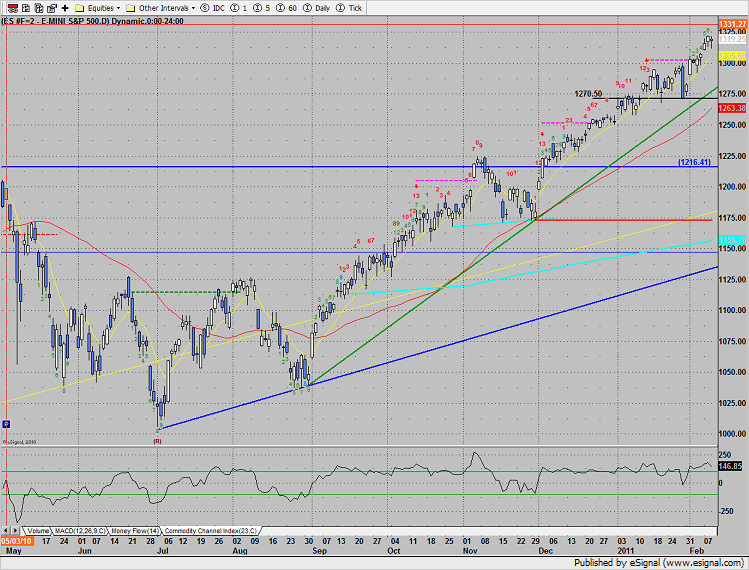

The SP was lower on the day by 3 managing to settle above the open. This is a small win for the bulls that they need to build on.

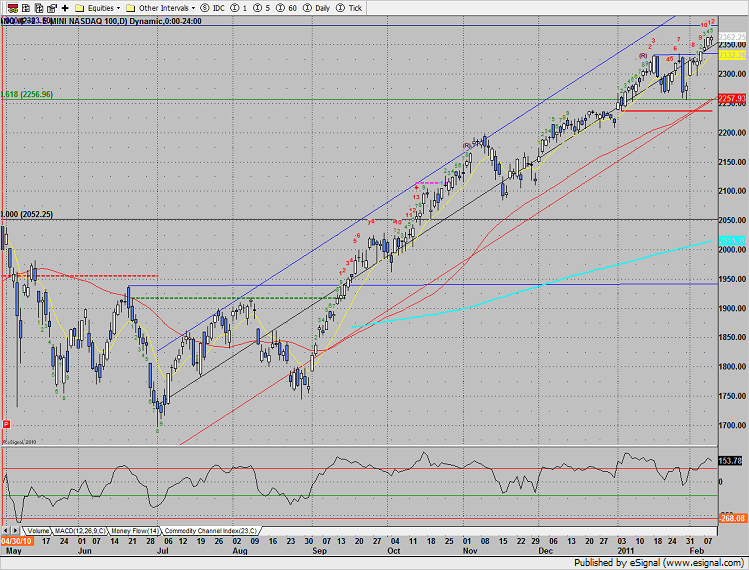

Naz hit a new intraday high but settled about even on the day. The Seeker exhaustion countdown is now 12 days up.

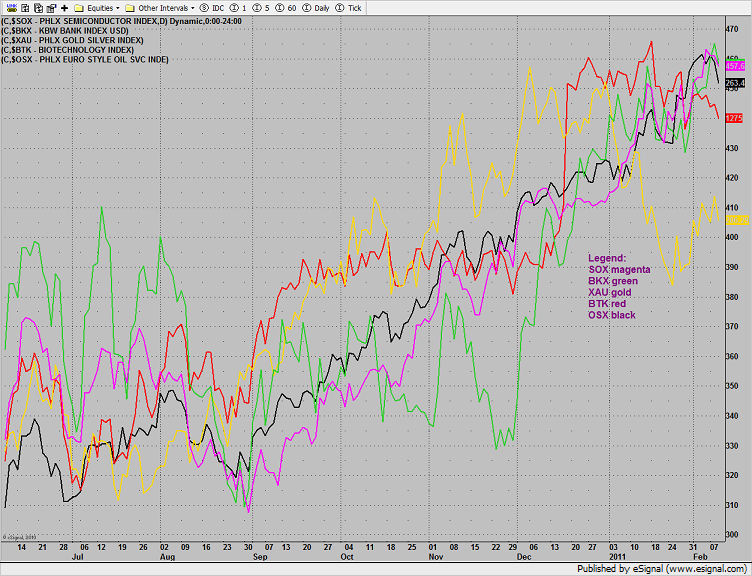

Multi sector daily chart:

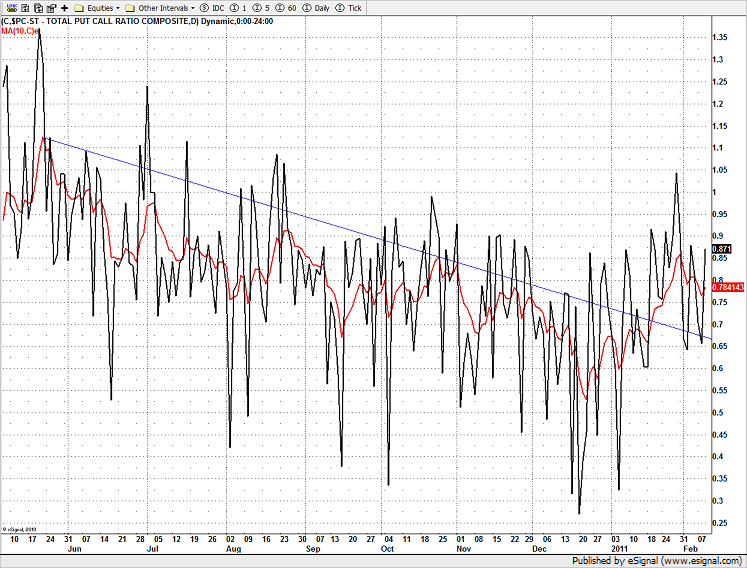

Checking in on the put/call ratio shows that there is nothing extreme happening but note that the downward bias of the chart has reversed to an upward bias.

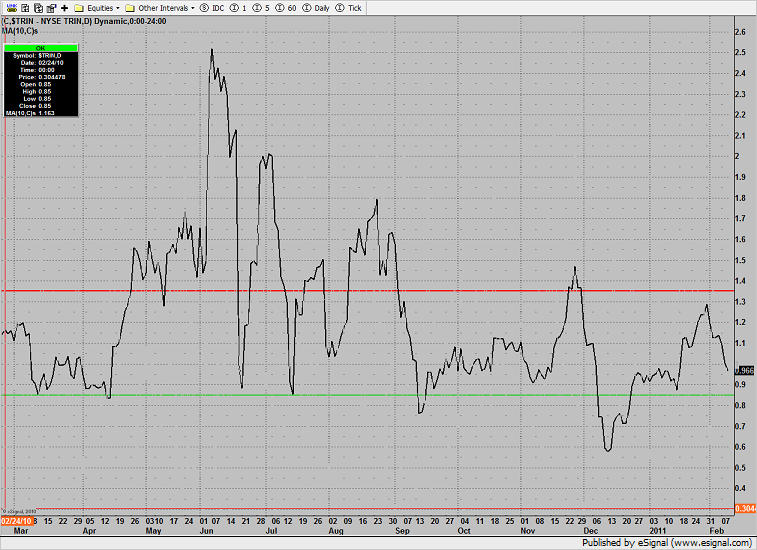

The 10-day NYSE Trin is below the 1.0 base line but above the 0.85 overbought threshold.

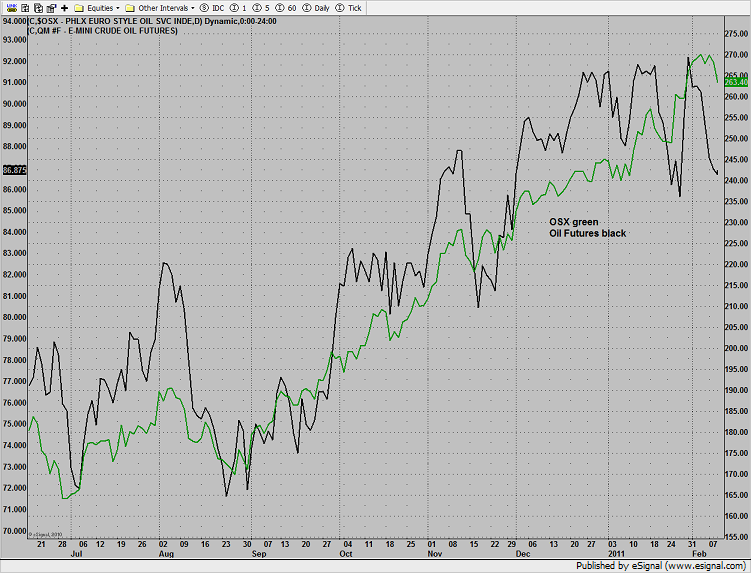

The OSX continues to handily outperform the underlying crude futures which is generally bullish for the oil futures.

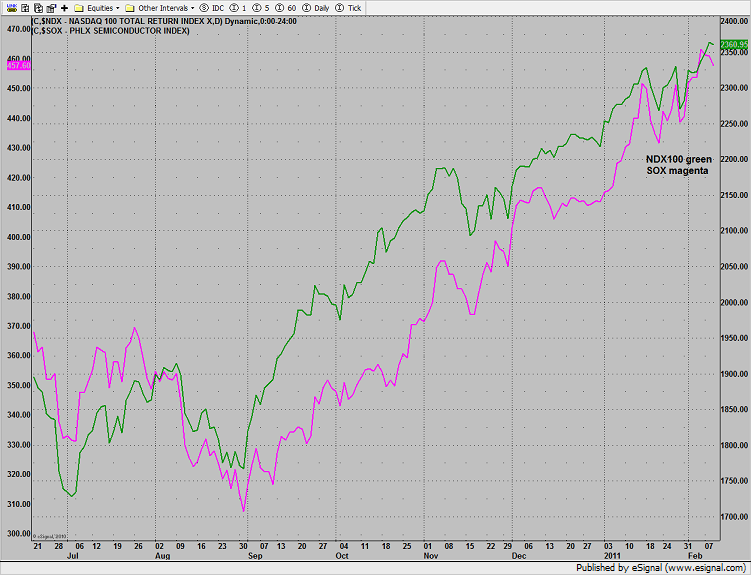

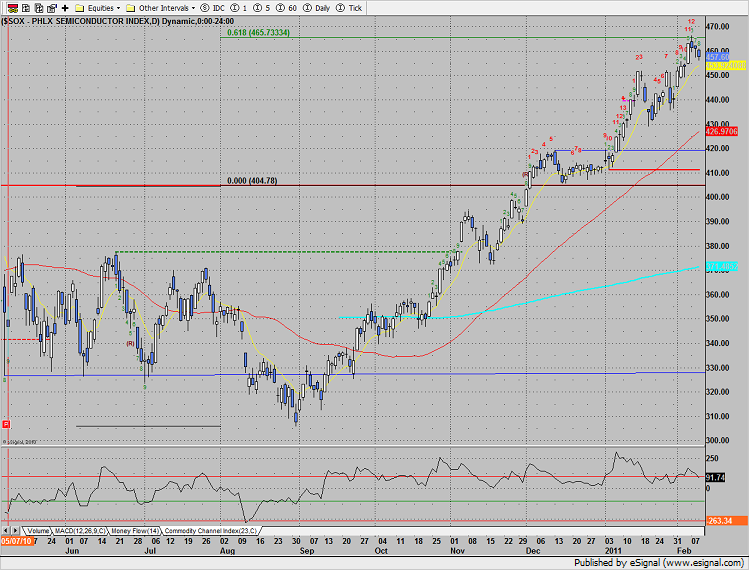

The SOX has begun to underperform the broader NDX100. If this condition persists it will be bearish for the NDX.

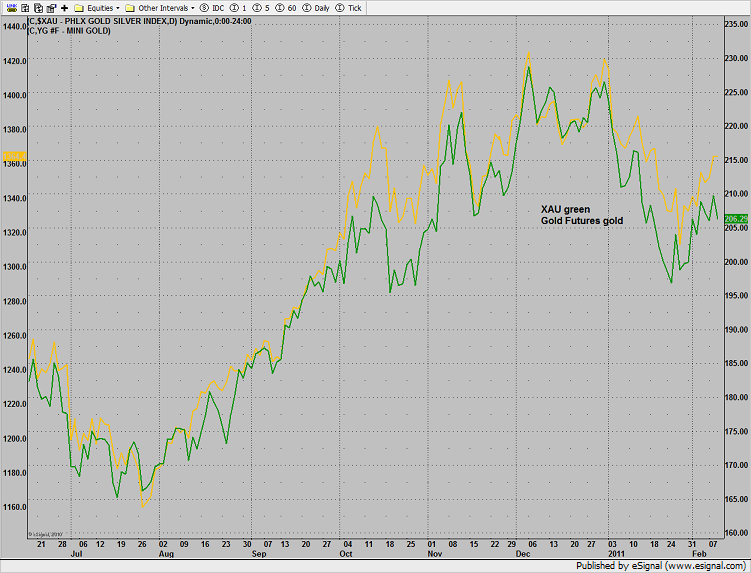

The XAU continues to underperform the gold futures which is bearish for gold.

The Seeker exhaustion signal is still on deck in the SOX index. Keep a close eye on the setup phase that is in progress. If the setup completes the minimum 9 bar run before the 13th countdown candle prints it will recycle the current exhaustion countdown.

S

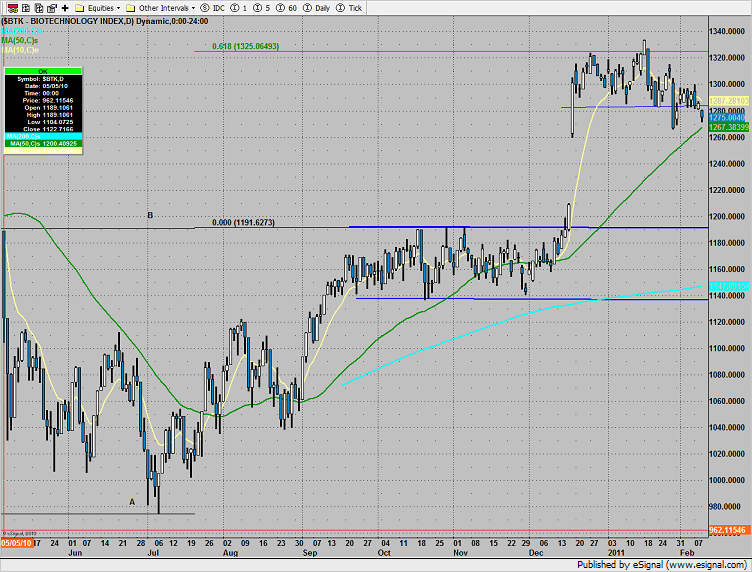

The BTK underperformed both Naz and the broad market. Key support is just below at the range low and 50dma (green).

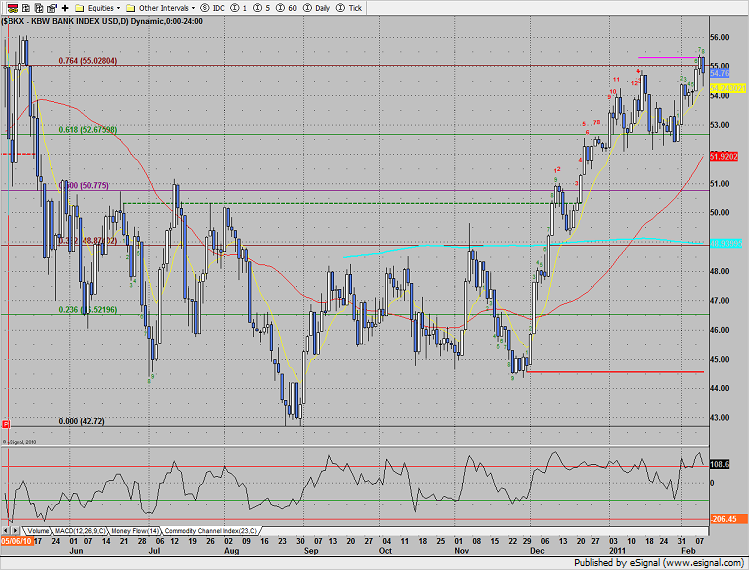

The BKX posted a wide ranging day, keeping the Seeker sell signal alive.

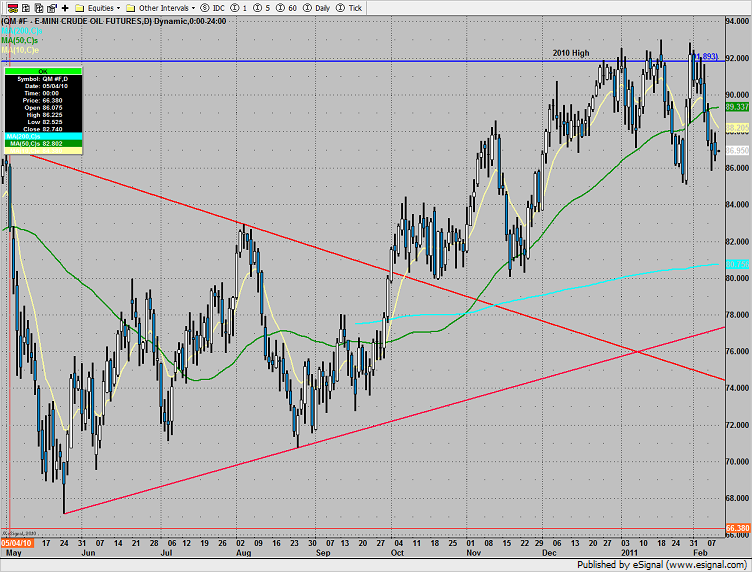

Oil:

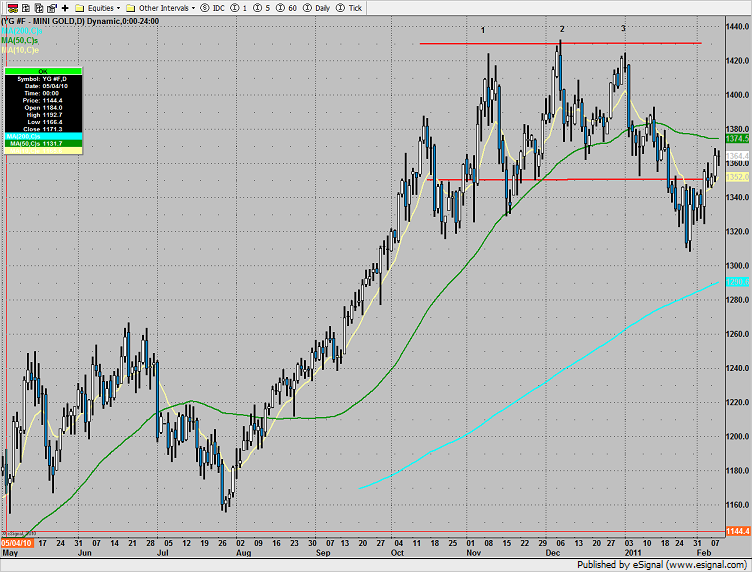

Gold: