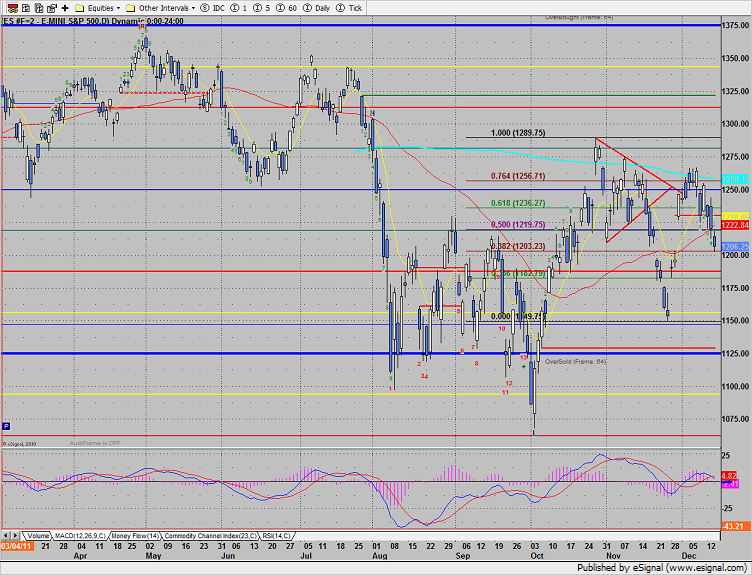

The ES broke very hard and violated the key support at 1250 and ran all the way down to the next fib at 1203. Price is now below the 50dma and using the gap window as support. If the decline continues, the gap all the way down at 1150 may come into play.

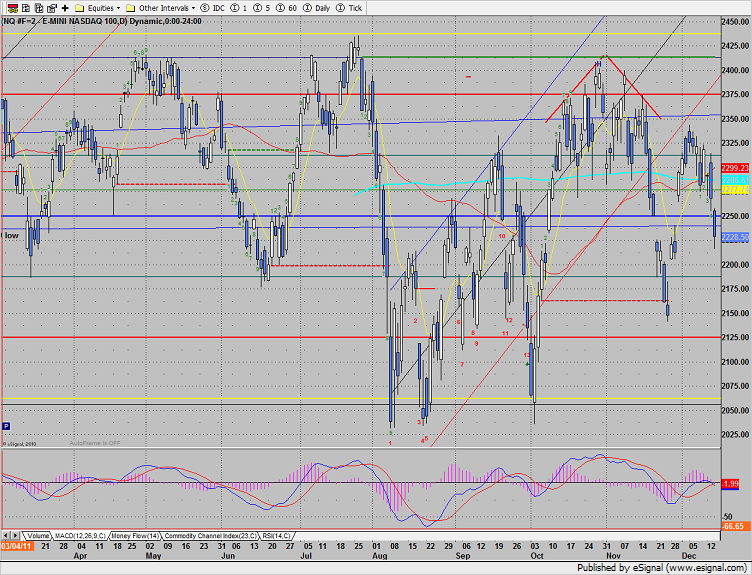

The NQ futures filled the open gap at 2225 and lost the support of the 4/8 Gann level in the process. Like the ES futures there is a large all the way down at the recent low of 2150.

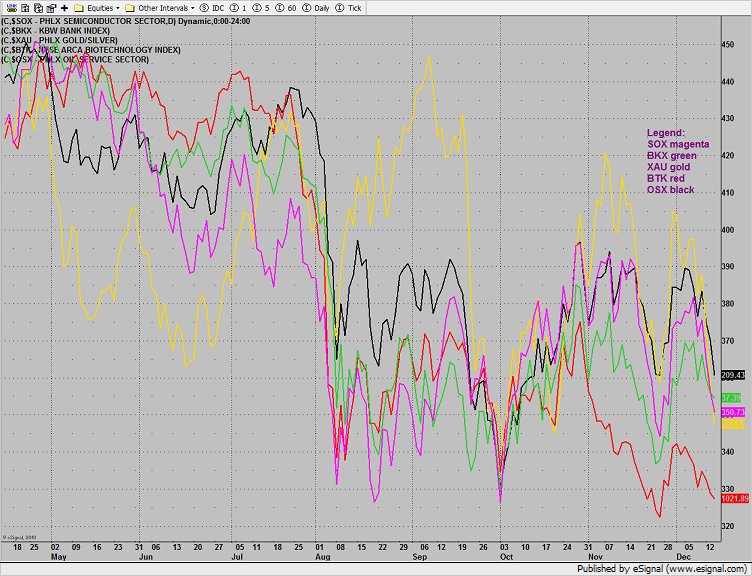

Multi sector daily chart:

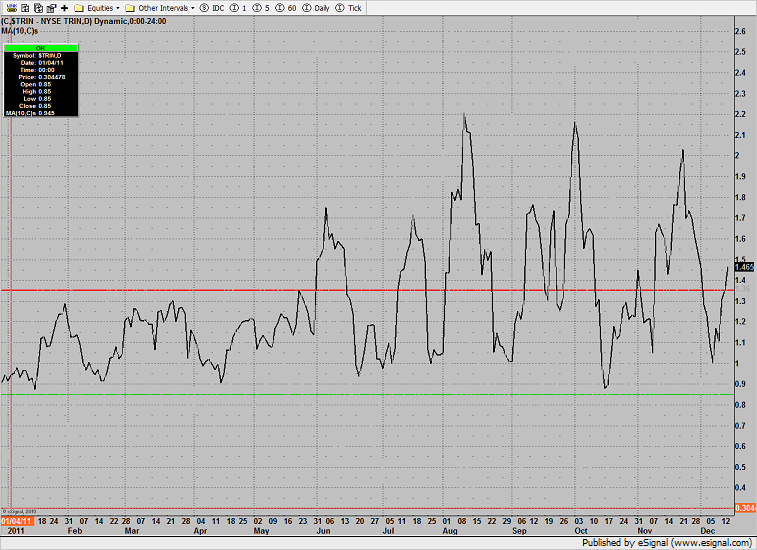

The NYSE 10-day Trin is getting more oversold recording 1.46 on Wednesday’s close.

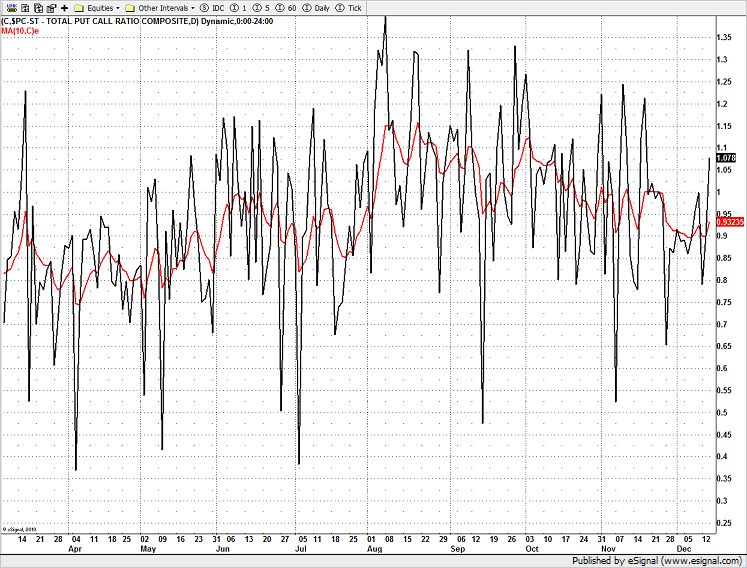

The put/call ratio advanced but did not record a climatic reading;

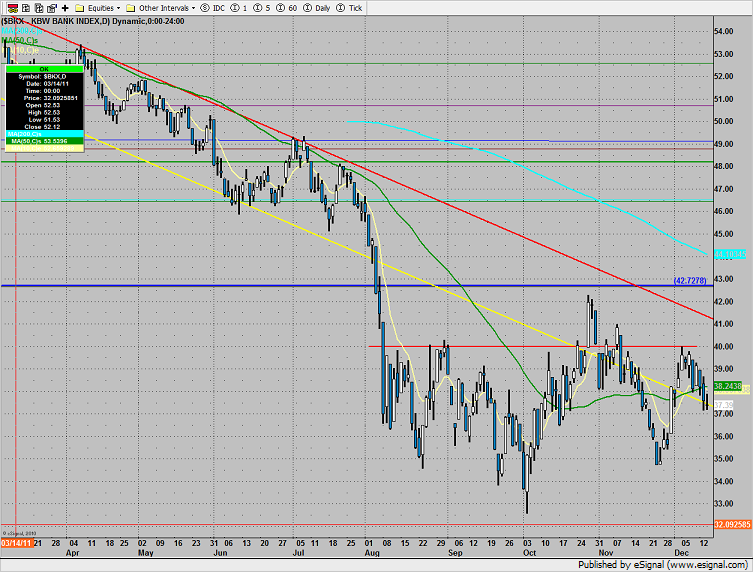

The previously lagging BKX was relatively strong on the day and managed to record an inside day. Since today’s candle was inside the previous day’s range, there is extra energy wound up in the pattern.

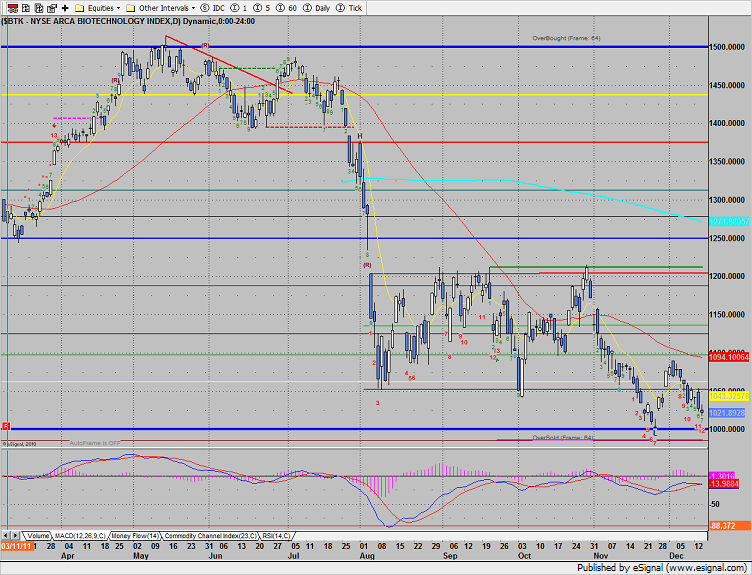

The BTK is now 12 days down in the Seeker count and could form a nice candle if the November gap is filled.

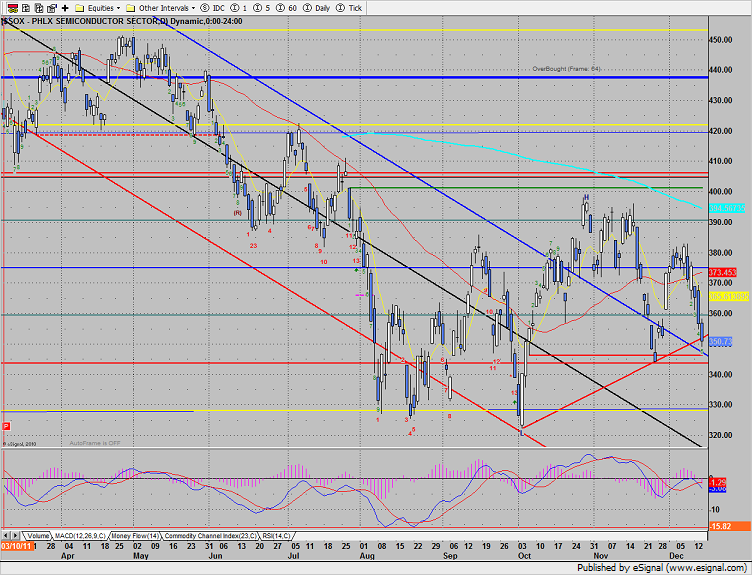

The SOX settled slightly below DTL and is only 5 days down in the Seeker setup.

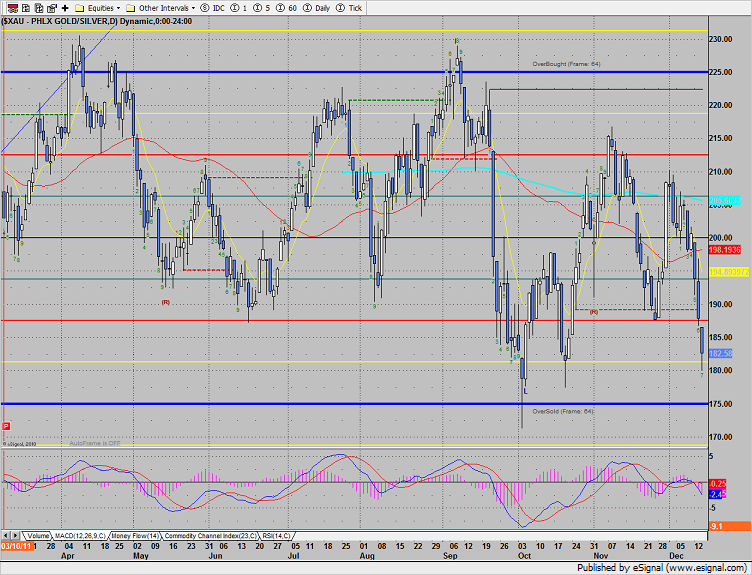

The XAU is very close to a new low on the move. Major support lies at the 175 0/8 Gann level.

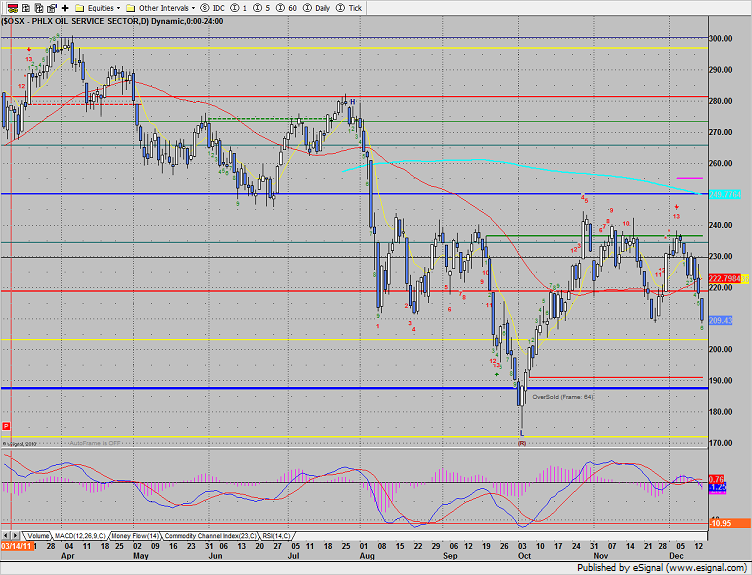

The OSX was the last laggard on the day. The Seeker 13 exhaustion signal is pressing price lower and the current setup count is still immature. The pattern is now aggressively 3 day down from the most recent up candle so expect some kind of relief bounce before more downside.

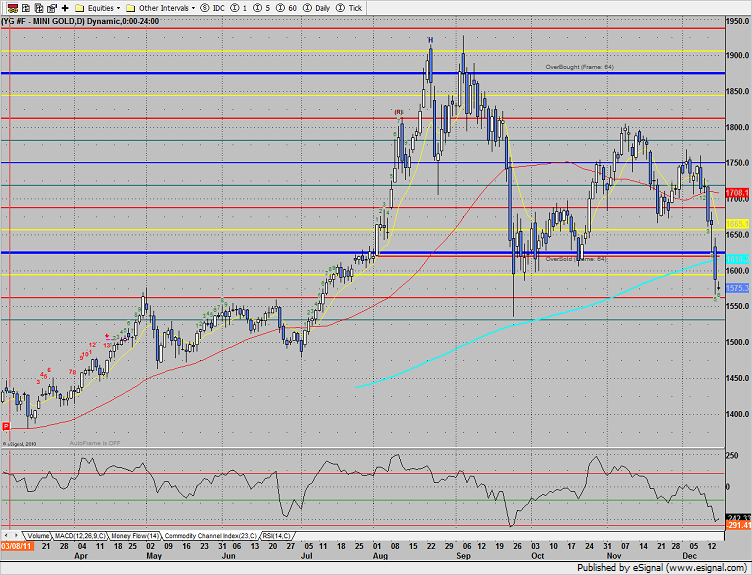

Gold was sharply lower, losing the 200dma in the process. Key support is in the 1535 are where price bottomed out in September.

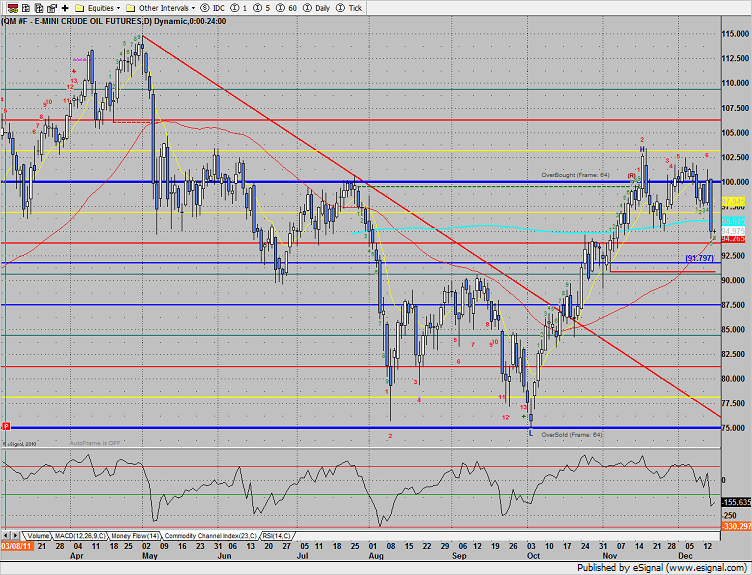

Oil was down big settling below the recent range support. Next support is 91.97.