The ES expanded the rally’s range gaining 11 on the day. The MACD is above the zero line and carrying positive momentum. The next challenge for the bulls will be the 8/8 level at 1437.

The NQ futures were higher by 35 on the day and finally may be losing their relative weakness. Pride is now back above all the major moving averages and the MACD is just above the zero line which opens the door for momentum. Expect that the 5/8 level will be very key since it terminated the bounce in November and was the origin of the exhaustion gap on 12/3.

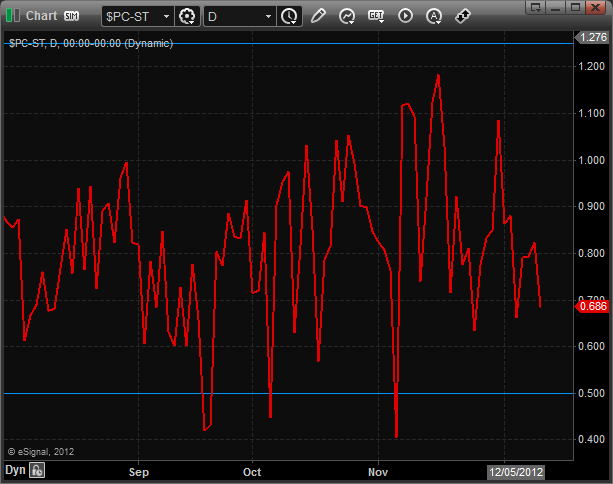

The total put/call ratio is still neutral:

The cause for concern to the bulls is the 10-day Trin which is very close to recording the first overbought reading since mid September.

Multi sector daily chart:

The SOX/NDX cross continues to make progress and is a very good indication that the relative weakness in the NDX may be taking a turn for the better. The NDX tends to lead the SPX and within the NDX the SOX tends to lead. So continued relative strength in the SOX is bullish for the NDX and then by extension relative strength in the NDX is bullish for the broad market.

The SOX was the top gun on the day and have solidly broken out above the active static trend line. Keep in mind that as this key index has pushed higher, the 200dma will be a formidable level.

The BTK was almost as strong as the SOX and could drive up to the swing high in October.

The BKX has yet to get the key boost from the MACD crossing above the zero line…stay tuned.

The OSX was flat on the day and is still being pulled by the DTL.

The XAU was lower on the day serving as a source of funds. Price bearishly remains below all of the important moving averages.

Oil:

Gold:

Silver: