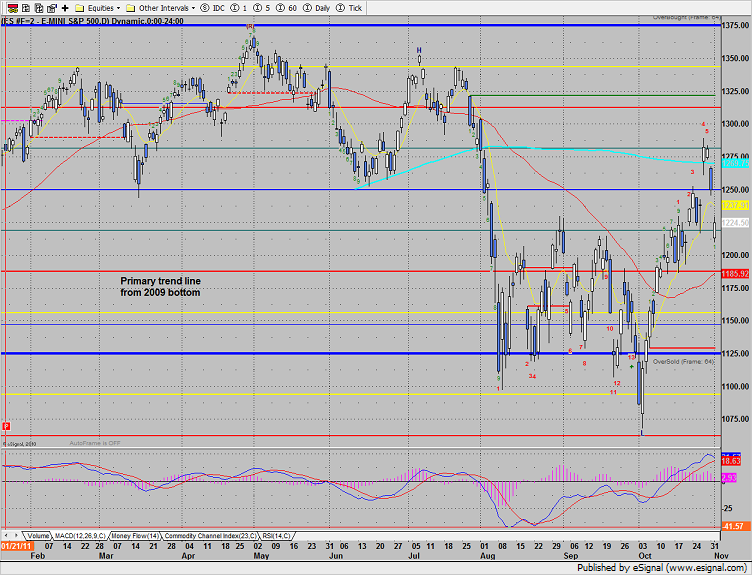

The ES gapped down back into the trading range that it just exited and settled right at the high close of the range. This was a very interesting day and posted a camouflage buy signal. This implies that price will exceed Tuesday’s range before undercutting it.

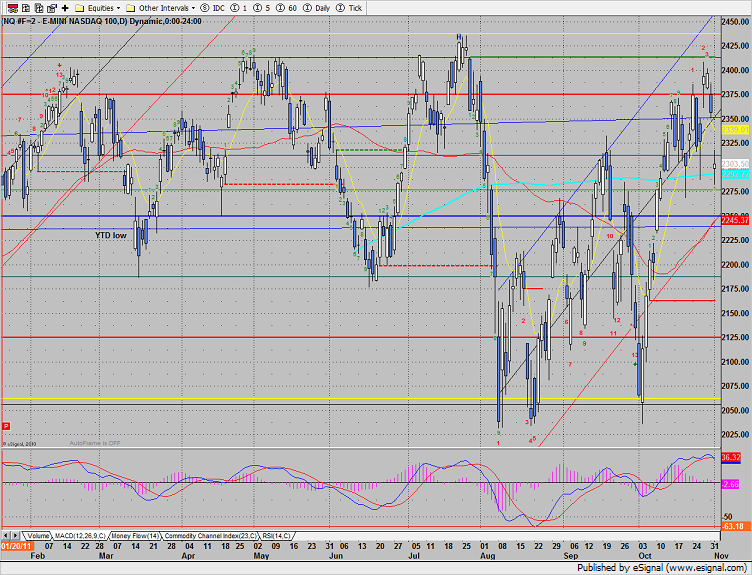

The NQ futures tested but held the 200dma losing 52 on the day. The next important area of support is the 4/8 Gann level that is also the 50dma and lower trend channel boundary. This is THE area for the bulls to hold.

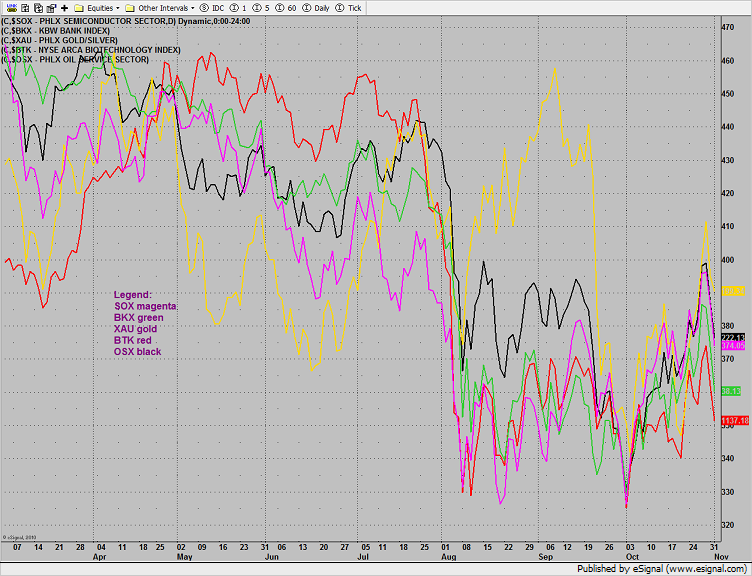

Multi sector daily chart:

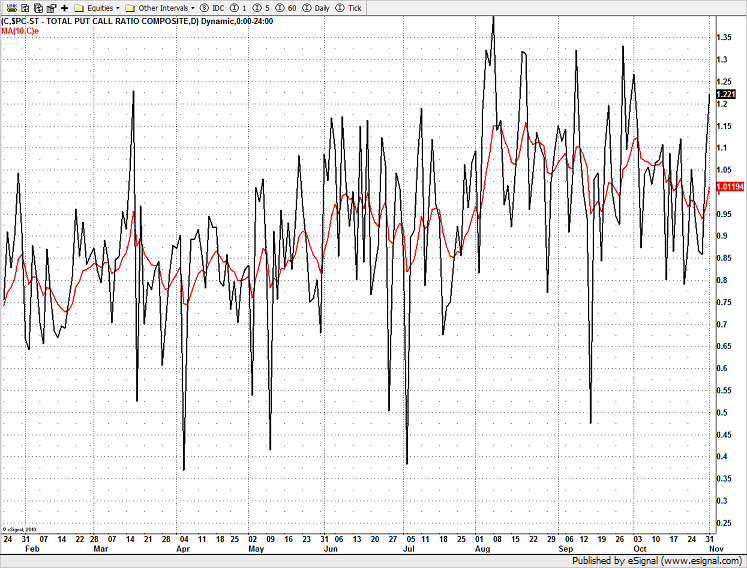

The put/call ratio recorded a spike:

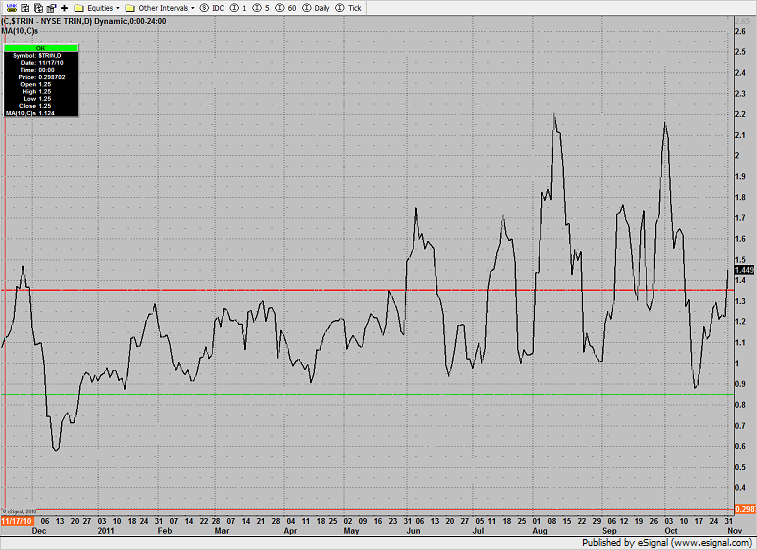

The 10-day Trin is back above the 1.35 oversold threshold.

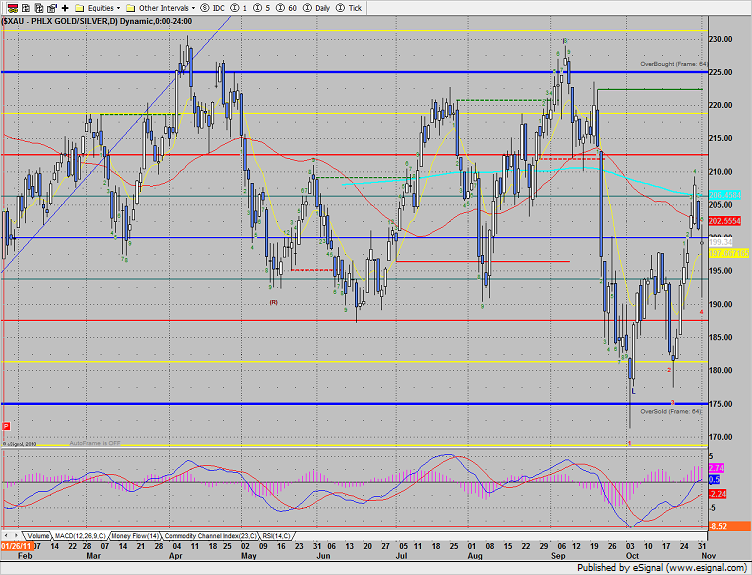

The defensive XAU was the top gun on the day.

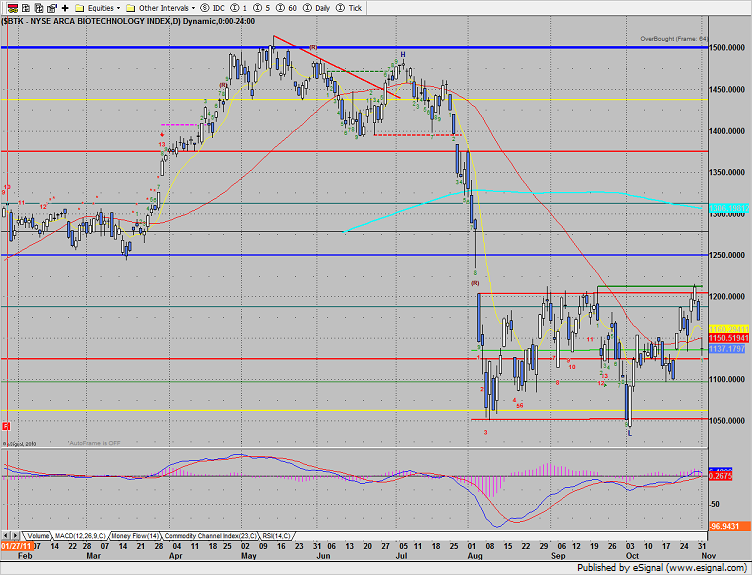

The BTK held above the midpoint of the recent range but lost the 50dma. Keep a close eye on the MACD.

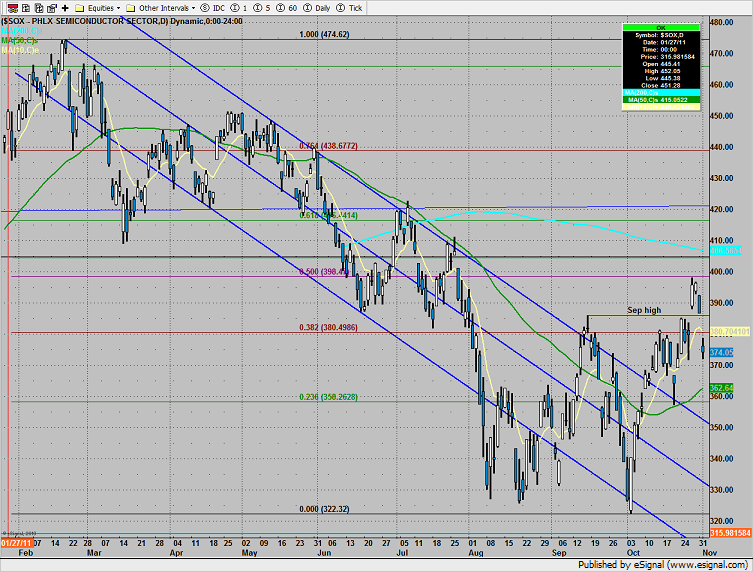

The SOX left a floating island above the September high. This is potentially very bearish but could be reconciled. This will be a very key sector in the next few days since it’s non-financial and should offer traders a pure appraisal of market risk appetite.

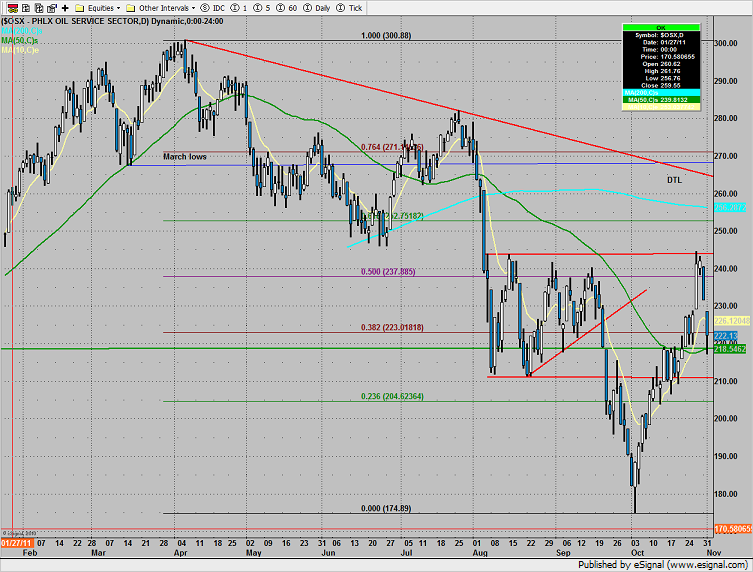

The OSX was weaker than the broad market and has key support at 210. This could be forming a reverse head and shoulders pattern which implies that the 210 area is buyable.

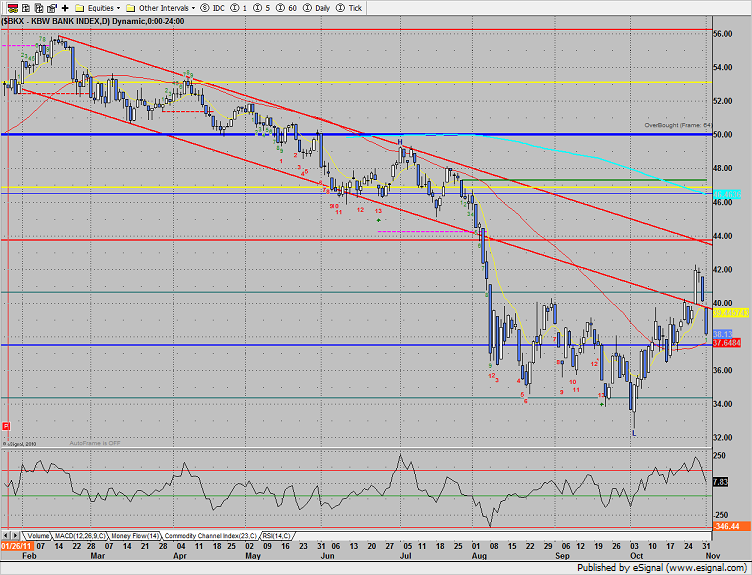

The BKX got hammered and was much weaker than the SPX. Price is bearishly back below the trend channel. Keep a close eye on the 50dma which is key near-term support.

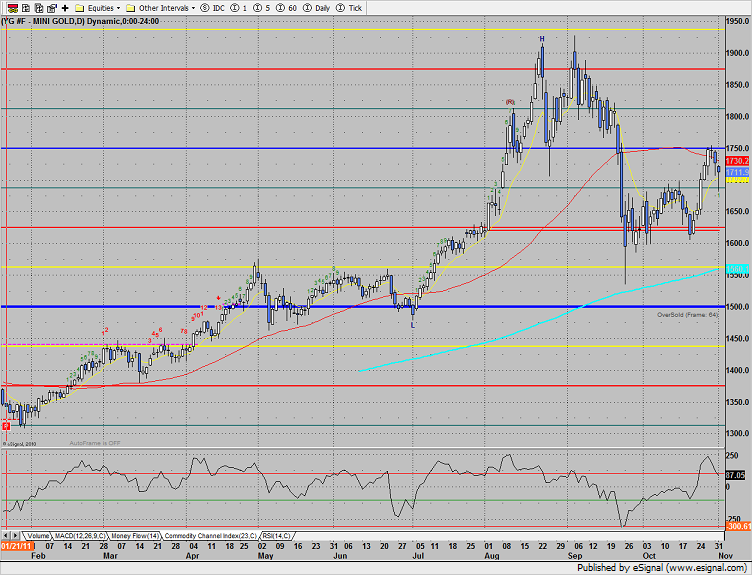

Gold was weaker on the day but recouped much steeper losses.

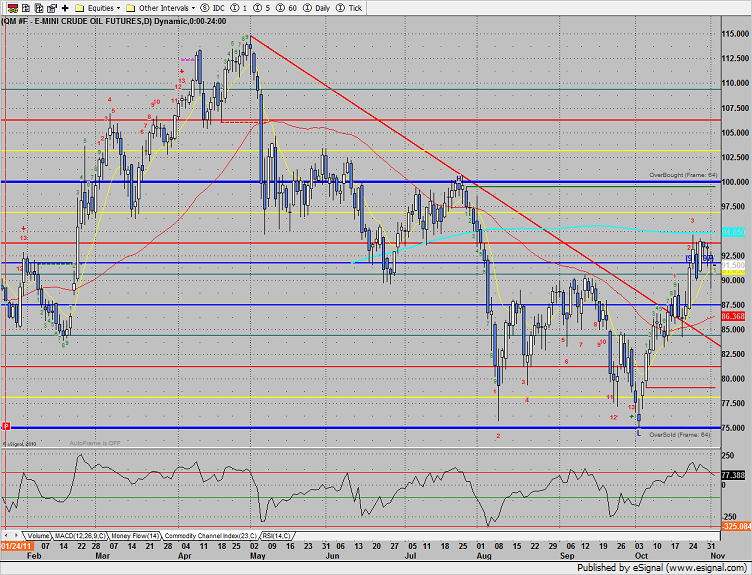

Oil is still trapped in the recent range.