The ES lost 18 handles on the day and recorded a new low on the move. Price has broken below the 4/8 Murrey math level but is close to recording an oversold reading of -200 on the CCI. Next support is 1343.75.

The NQ futures also made a new low on the move, losing 31 on the day. The chart has broken below the 1/8 level and should find support at the 0/8 level in the 2500 area. Like the SP side, the CCI is very close to an oversold reading.

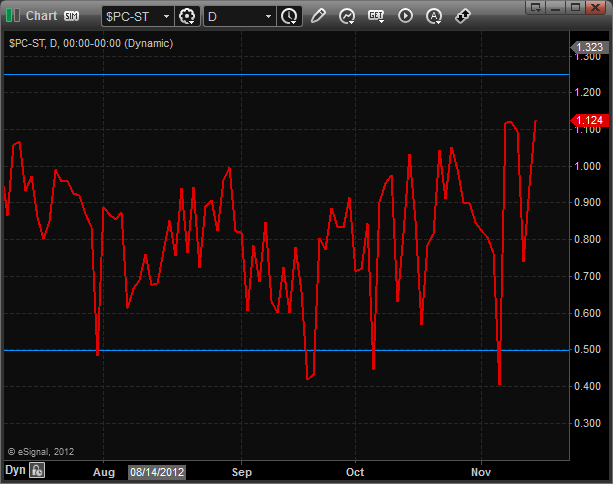

The total put/call ratio is close to an oversold reading but not quite yet…stay tuned.

The 10-day Trin is still in the neutral range.

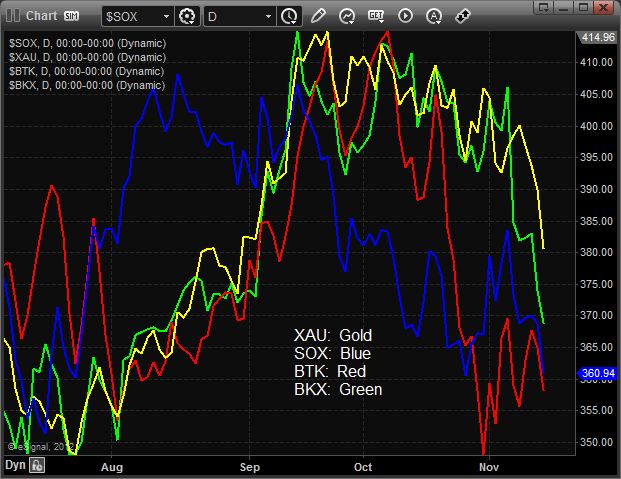

Multi sector daily chart:

The SOX/NDX cross chart is still in the trading range:

The Dow/gold ratio remains in a bearish trend with the hard asset favored over equities—weekly chart below.

The SOX was the top sector on the day. Note the key Murrey math level that is again being used for support.

The OSX traded in-line with the broad market but did make a new low on the move.

The BTK continues to game the 200dma so nothing new technically. Keep in mind that it still has relative strength.

The banking index broke below the key 200dma but expect it to at least find short term support here. The 200dma tends to be gammed when first tested.

The XAU was the last laggard on the day. Next important support will be the active static trend line.

Oil:

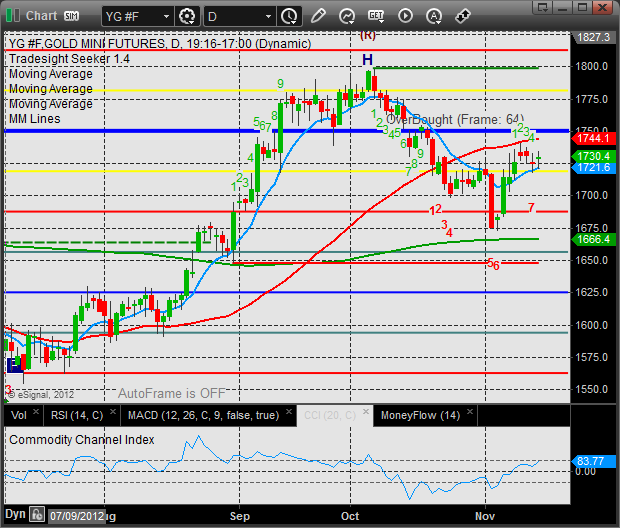

Gold:

Silver: