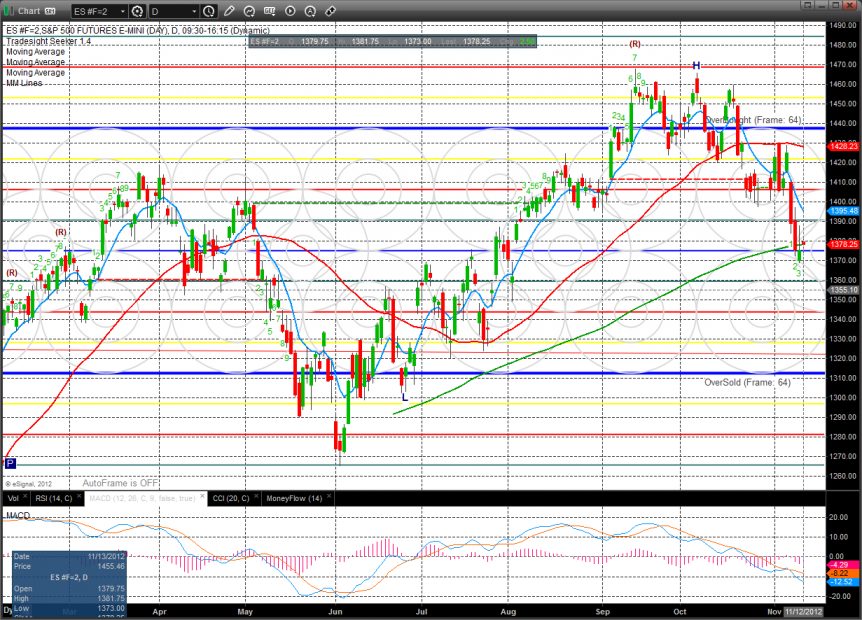

The ES was higher by 2 on the day after trading in a wide range. Price is feeling the pull of the 200dma, setting right at it. Expect more 200dma gaming until the expiration will force decisions.

The NQ futures were flat on the day after gapping up and attempting higher prices. Price was contained within the prior day’s range so the resolution of the pattern will have some punch.

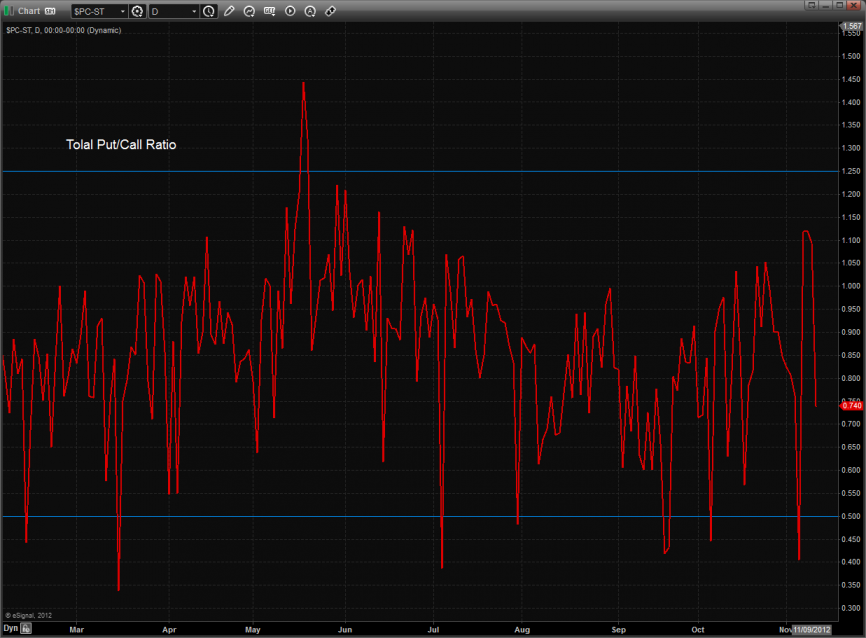

The total put/call ratio has retreated to neutral after recording climatic over sold reading.

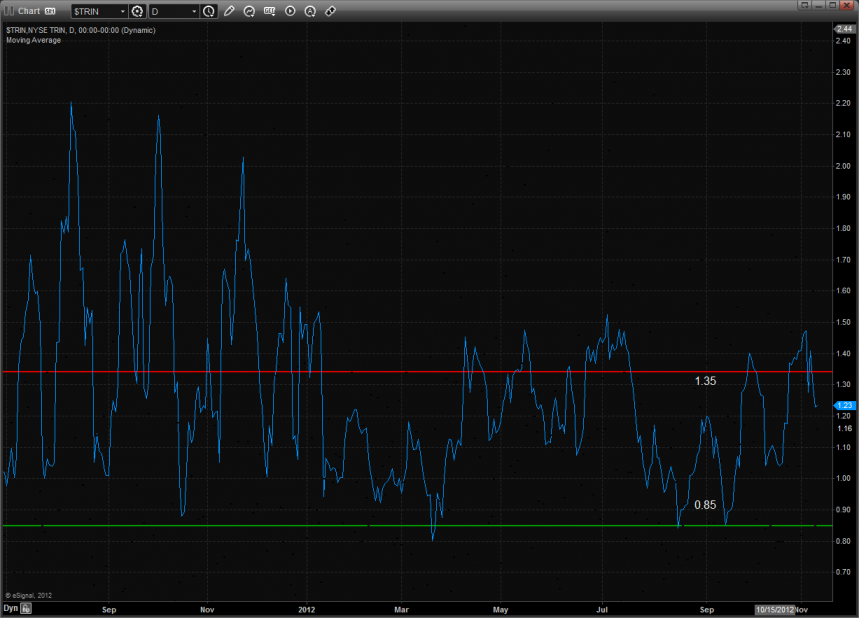

The 10-day Trin has pulled back to the neutral area.

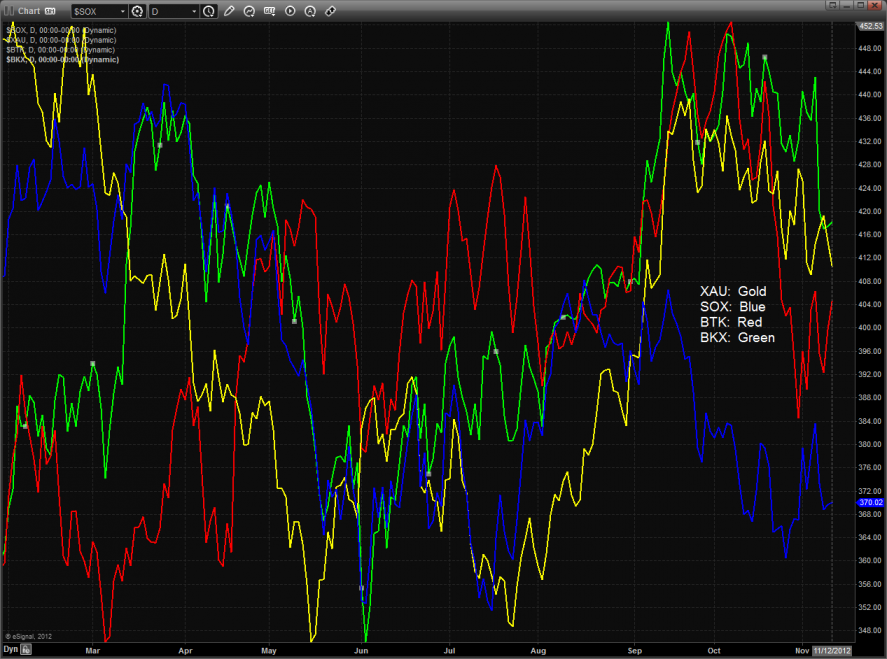

Multi sector daily chart:

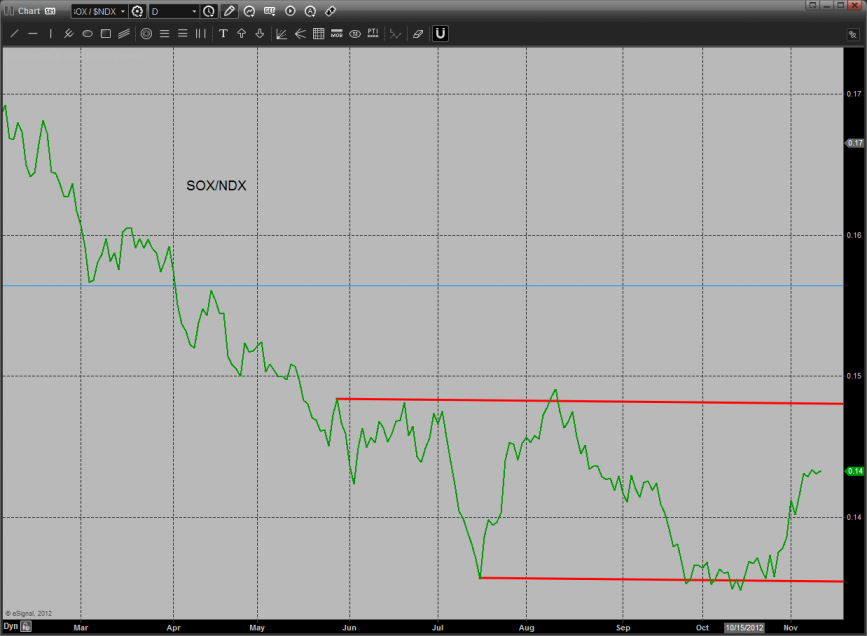

The bright point within the Naz universe is that the SOX is showing relative strength but until the range is broken it’s just a reflex move.

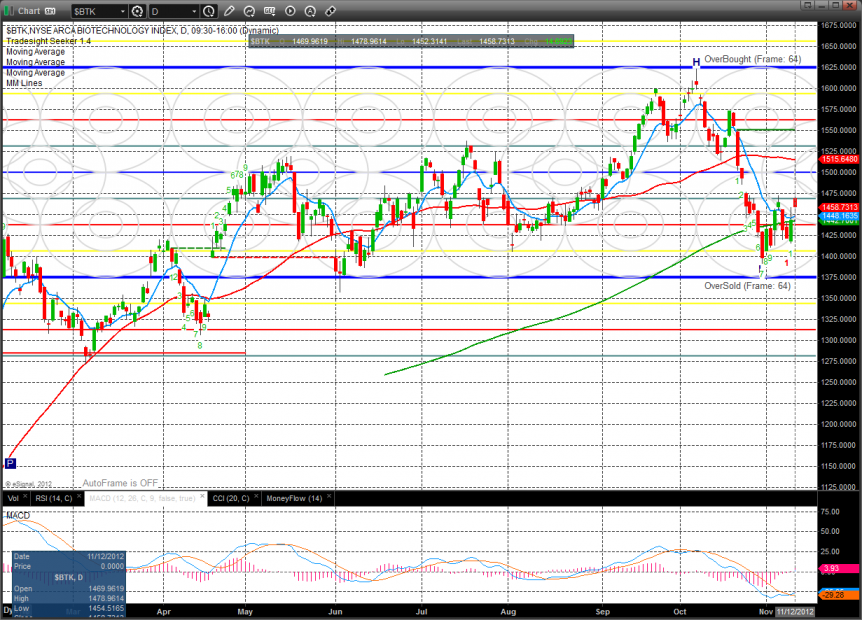

BTK was the top gun on the day:

OSX was stronger than the broad market.

The BKX was flat:

The SOX was also flat:

The HGX housing index was the last laggard on the day. Monday it bearishly settled below the 50dma and could be ready to turn lower. Keep a close eye on the MACD for the cross of the zero line which will accelerate the downside momentum.

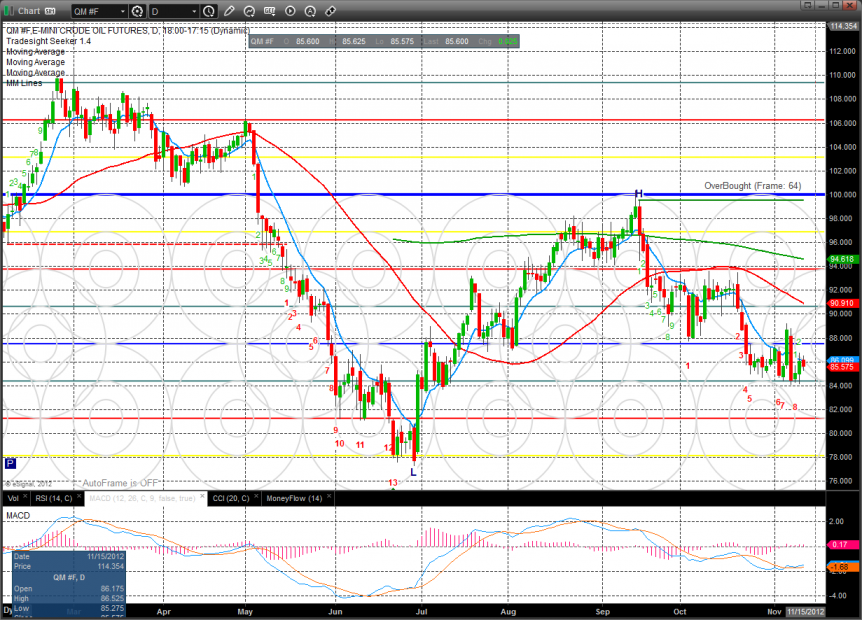

Oil:

Gold:

Silver: