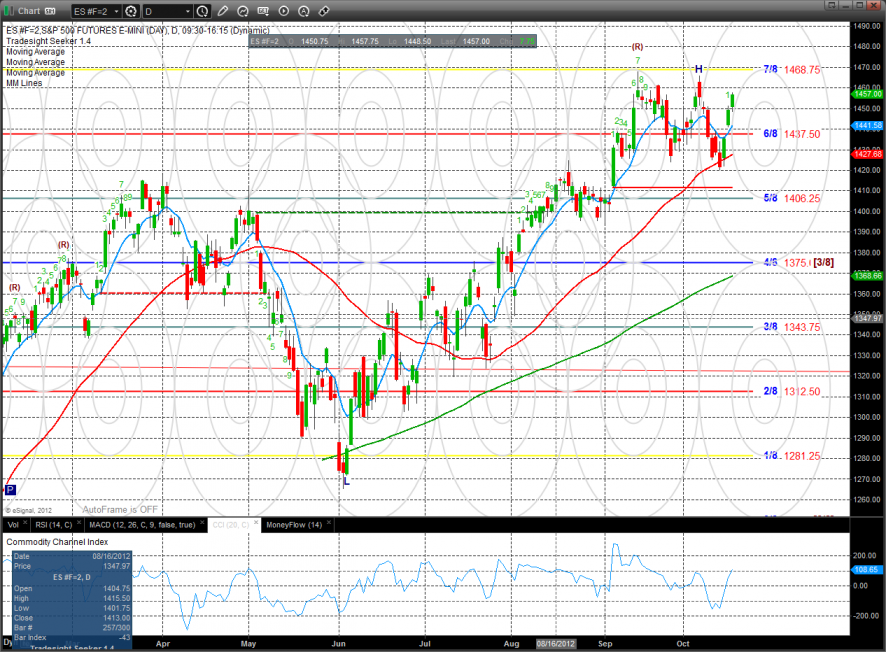

The ES was higher by 8 on the day and is just under the best close of the YTD. 1468 is the next key overhead if it can continue to build on the recent pivot off the 50dma.

The NQ futures were higher on the day but only by 5 handles. The NQ’s remain relatively weak vs. the SP futures and are still below the recent breakdown level of 2775. Also note that price is still below the 50dma and the key 8/8 Murrey math level.

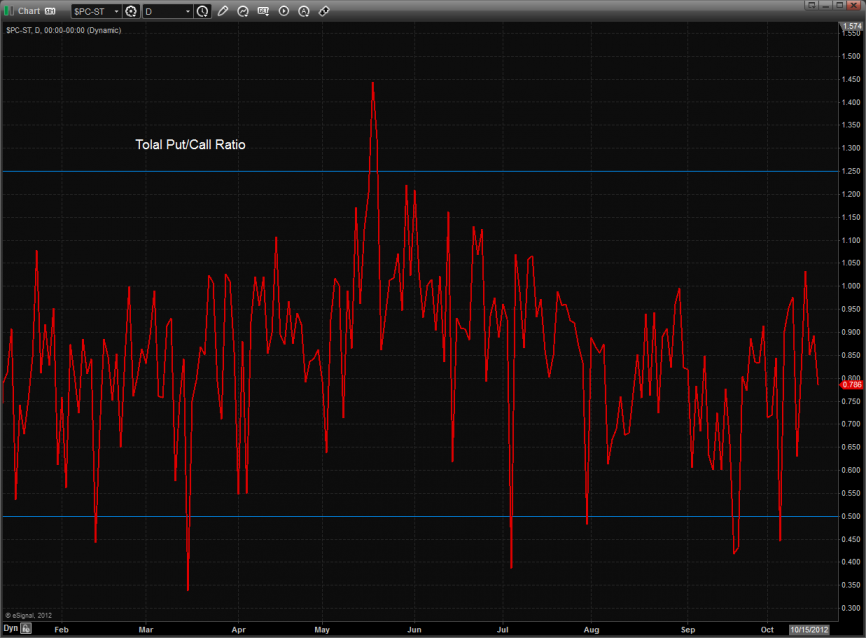

The total put/call ratio is neutral:

The 10-day Trin is still in the neutral area:

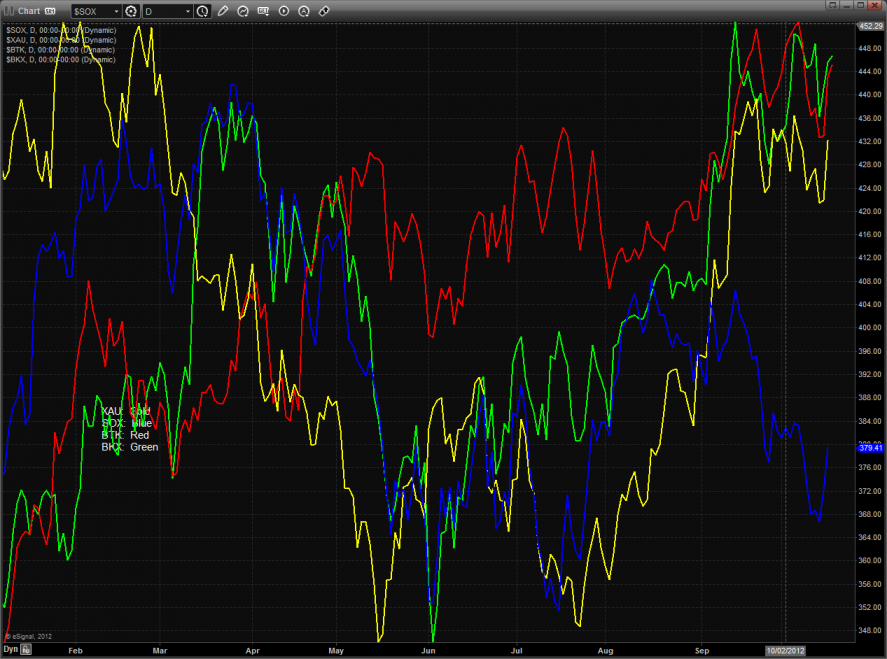

Multi sector daily chart:

The NDX lost more ground vs. the SPX but did not yet make a fatal decisive break.

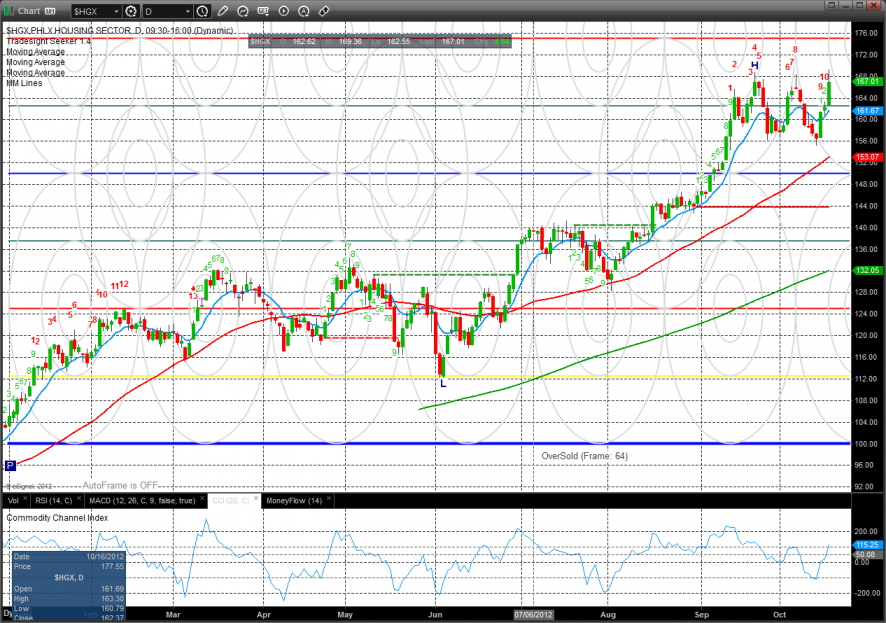

The HGX housing index was the top gun on the day and is close to breaking out but is 11 days up in the Seeker count.

The BTK was stronger than the broad market and could take a run at the 8/8 level.

The OSX has broken out of the recent range and is now above all of the major moving averages. The static trend line is the near-term target.

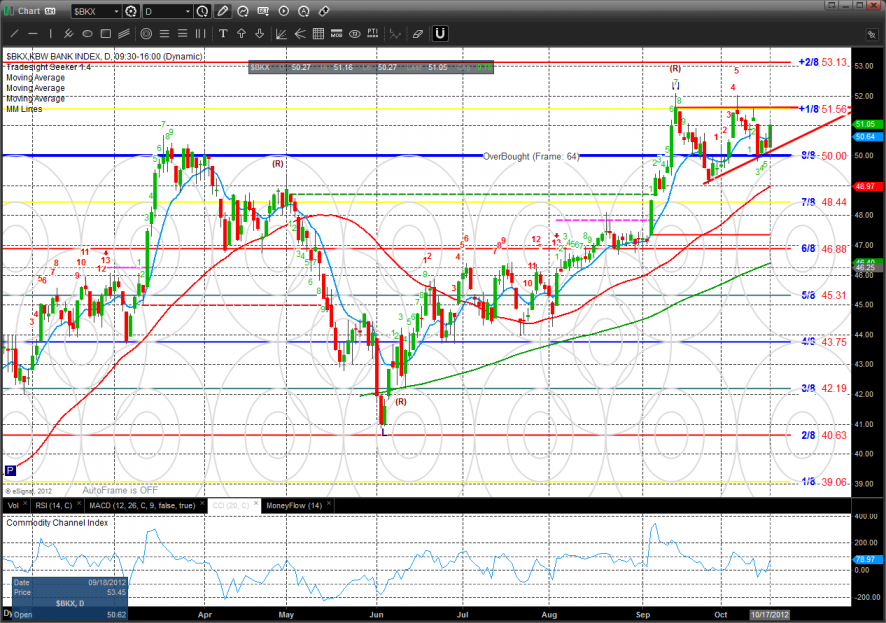

The BKX was positive on the day but is tracing out a bearish rising wedge. Key support is at the 8/8 Murrey math level.

The SOX did not build on yesterday’s gains and posted an inside real body candle.

Oil:

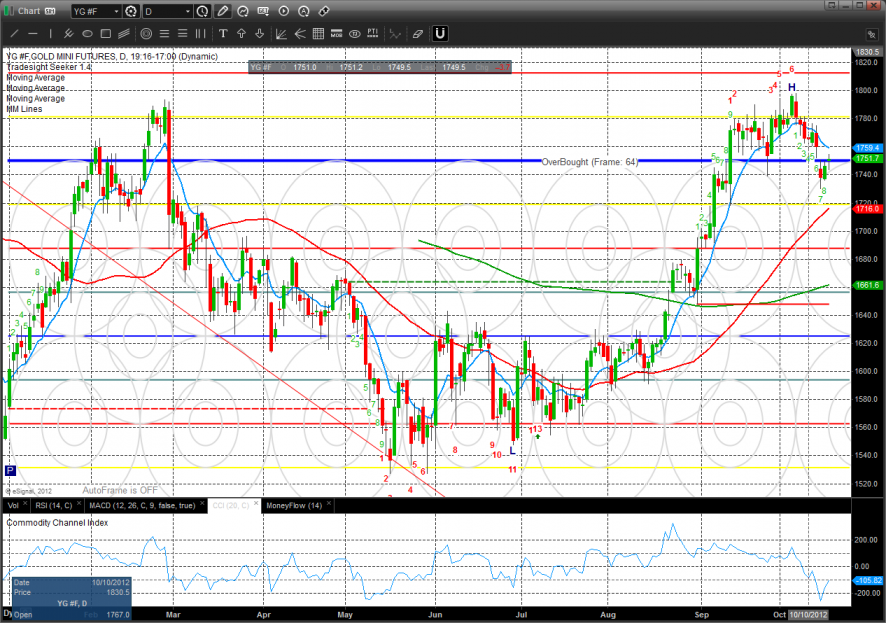

Gold:

Silver: