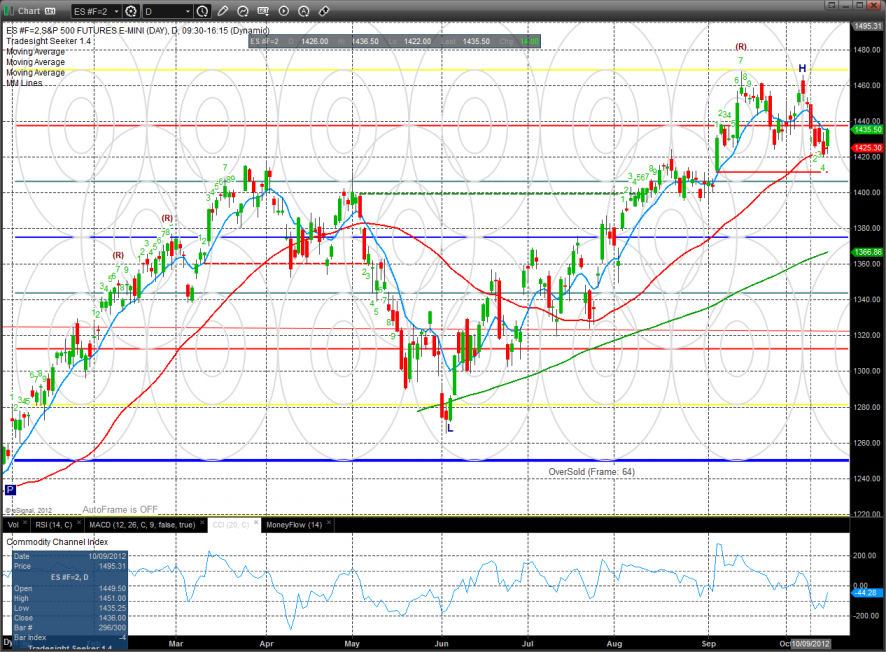

The ES was higher on the day by 14 handles. This was the best close in 4 sessions but did not change the trend back to short-term positive because price remains below the 10ema. If the pattern turns back lower then look to the static trend line for support.

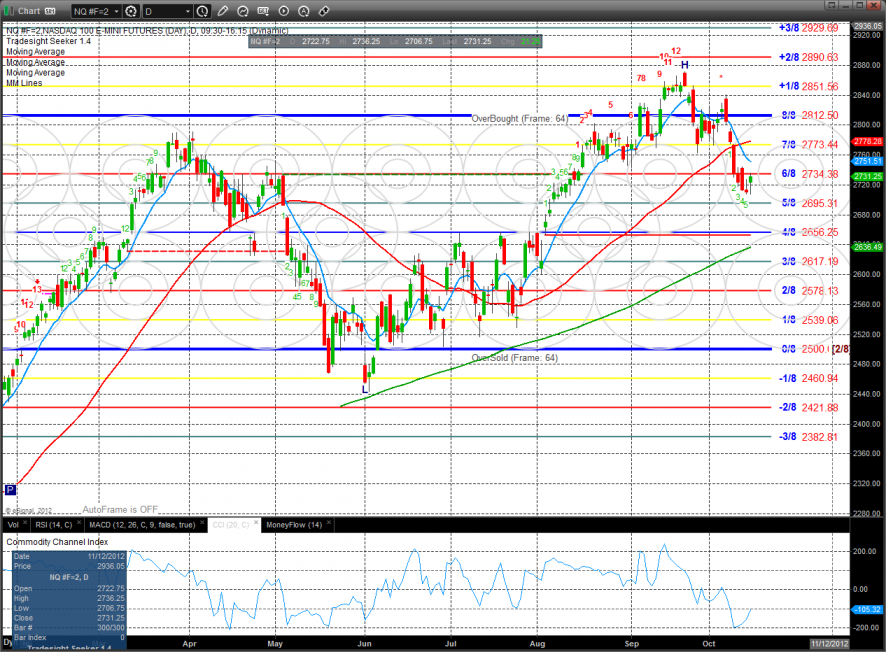

The NQ was higher by 21 on the day but still has relative weakness vs. the SP side. The pattern is still below the 10 and 50 period moving averages. Keep in mind that on a bounce and a retest of the YTD highs the Seeker could still record a sell signal.

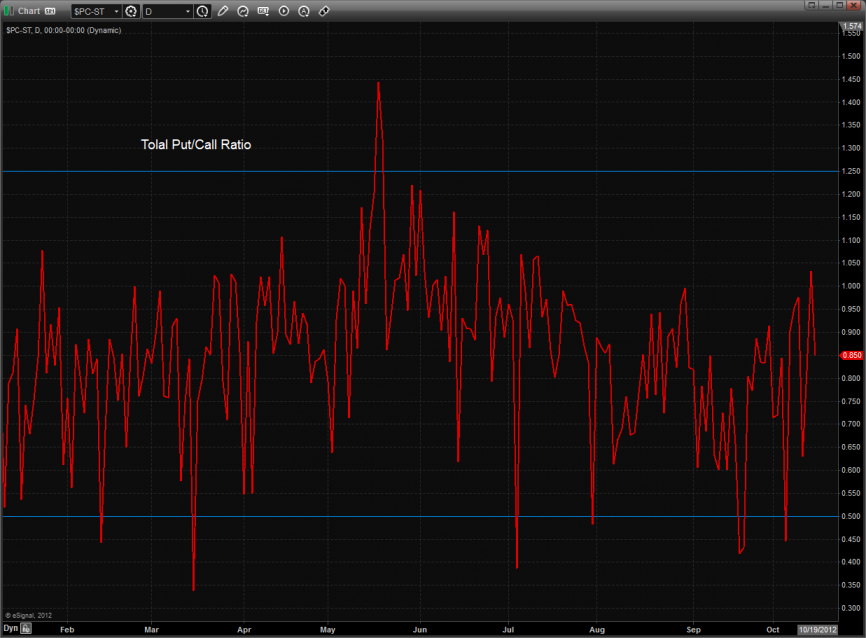

The total put/call ratio is still in the normal trading range.

The 10-day Trin is still neutral:

Multi sector daily chart:

The relative weakness in the NDX vs. SPX is painfully clear in the cross ratio chart. Keep a close eye on a break below the recent support level which will be a key inflection point.

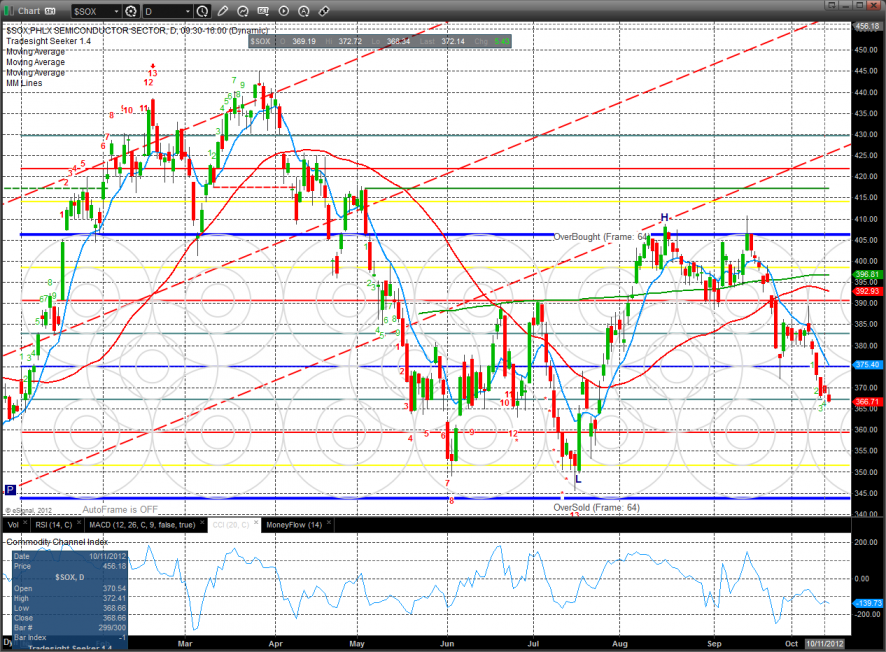

The SOX closed at a new low on the move and does not yet have any support from the Seeker for a reversal.

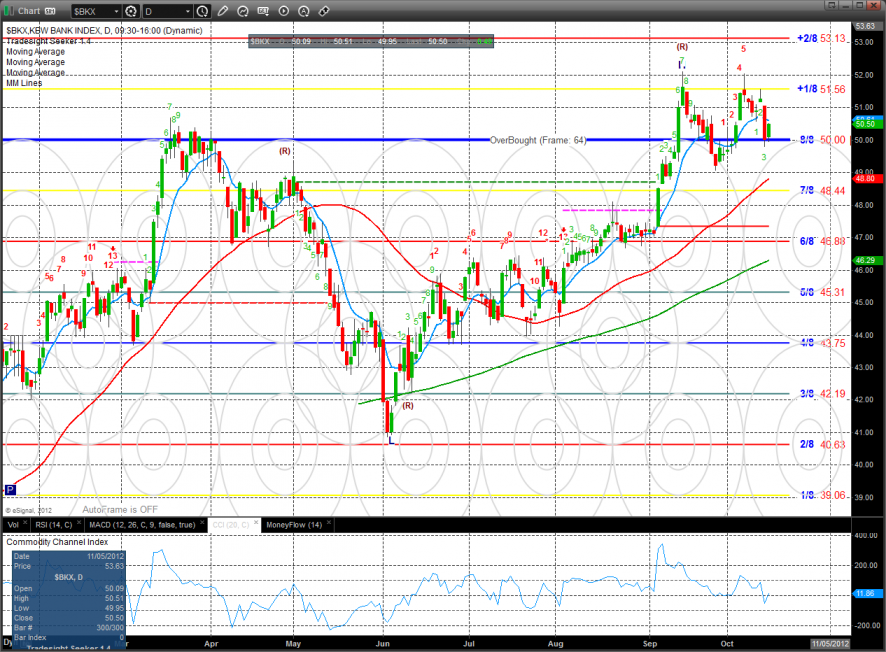

The BKX posted an indecisive inside day. It will take until the range is resolved to have a technical development. Keep in mind that the 8/8 level is very strong.

The OSX is still range bound and below all of the major moving averages.

BTK was the weakest sector on the day. It was flat and is still above the key 50 and 200 period moving averages.

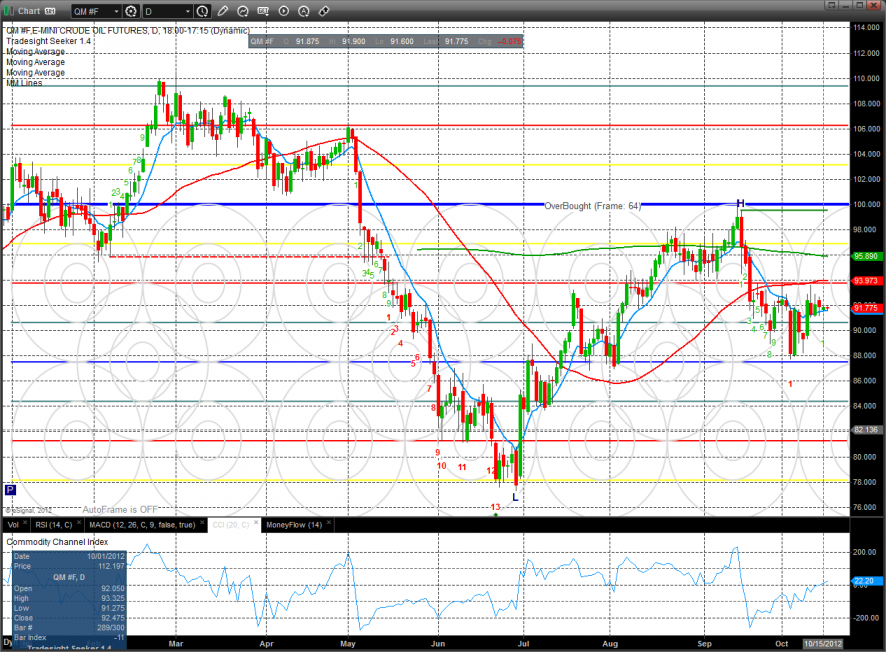

Oil:

Gold:

Silver: