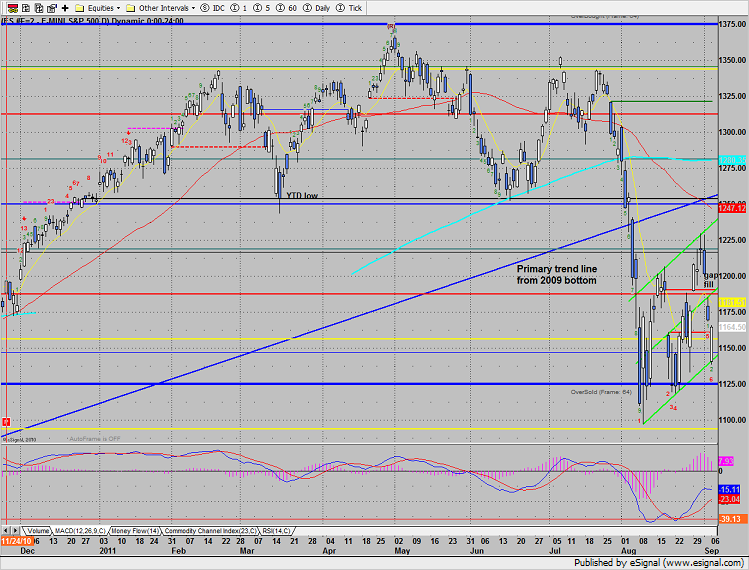

The SP opened at the lower boundary of the trend channel and found willing bidders. The futures lost 4 handles on the day but I would expect that price will return at least to the midpoint of the channel. Keep in mind that even though price was down on the day the pattern qualifies as a camouflage buy signal.

Naz was strong vs. the SP and filled the day’s gap. Note the importance of the 1287.50 level (June low and break down level).

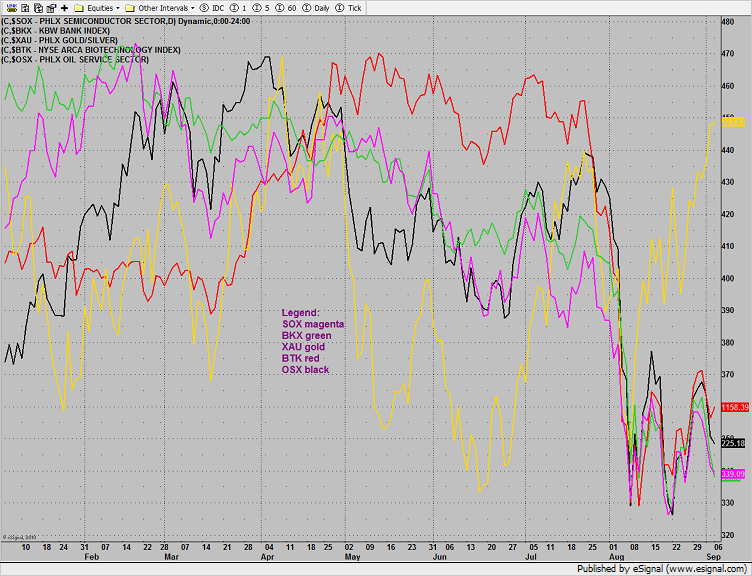

Multi sector daily chart:

The 10-day Trin is neutral and has plenty of oversold energy available for upside action.

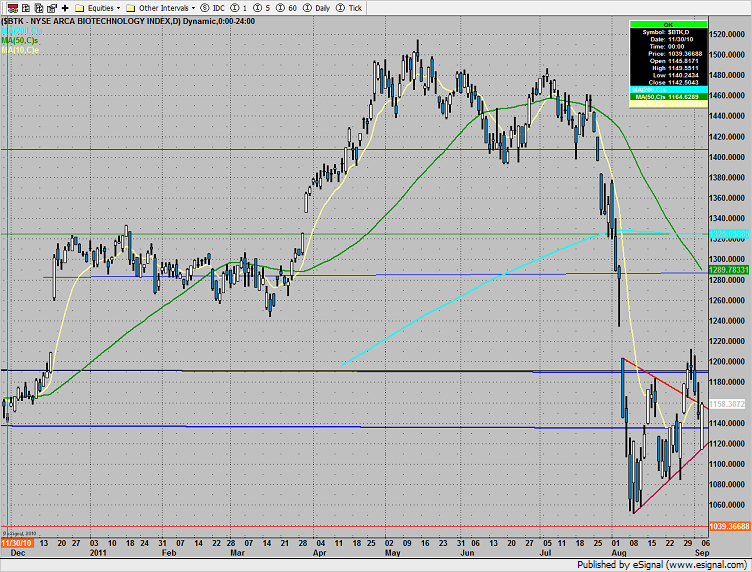

The BTK was top gun, +1%,

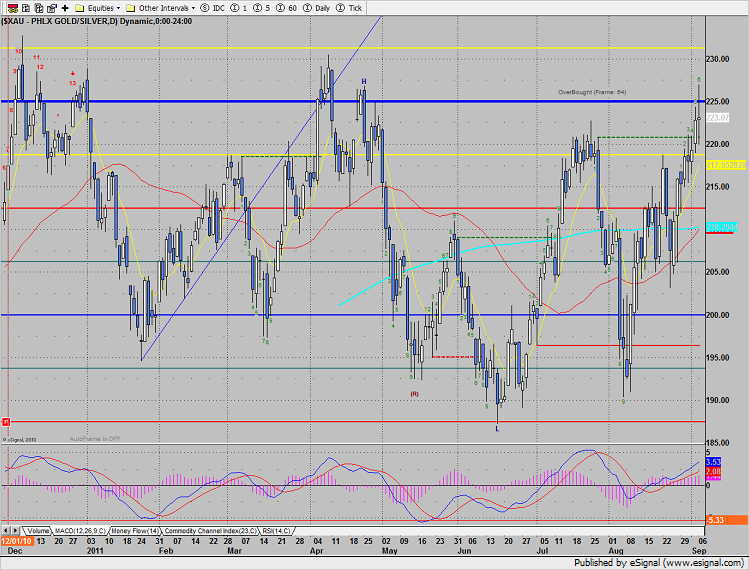

The XAU probed prices above the 8/8 level but was rejected.

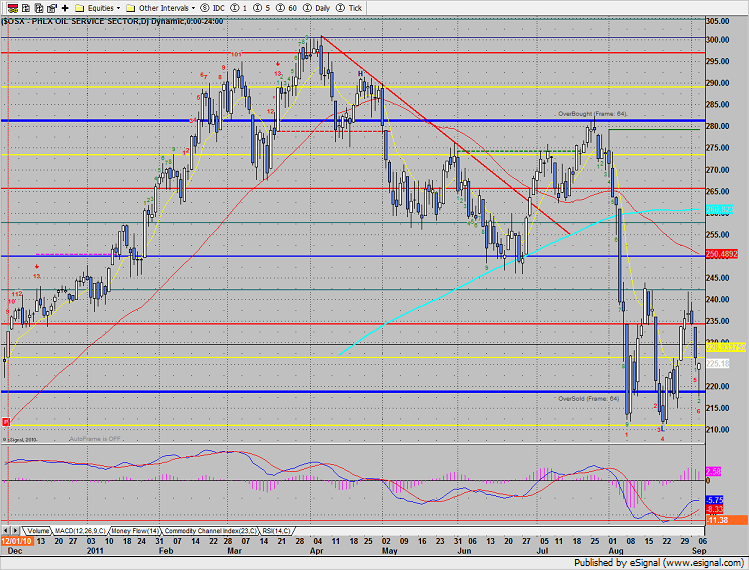

The OSX was slightly stronger than the broad market.

SOX remains trapped in the same trading range.

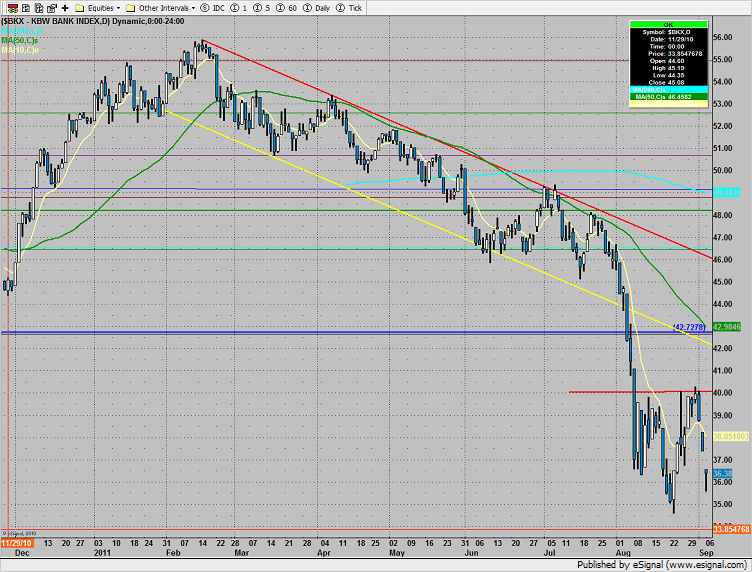

The BKX was weaker than the market and still has to reclaim the 40 level to turn bullish.

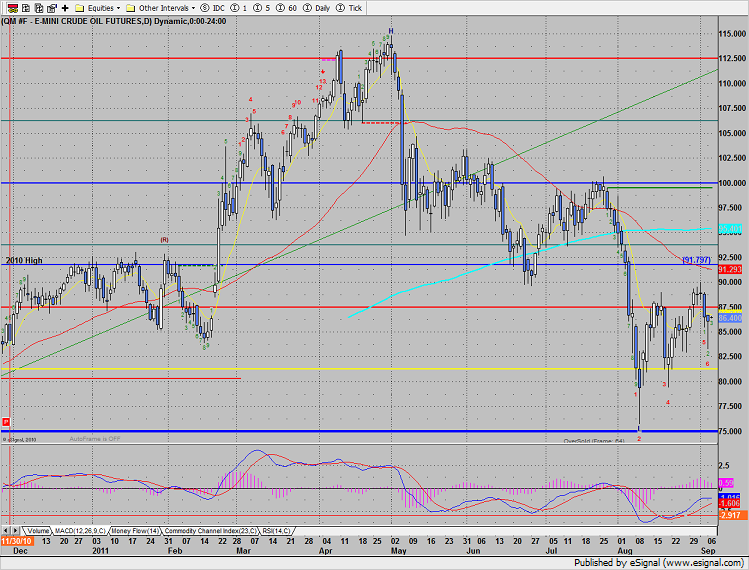

Oil is still in the triangle, 90 remains key resistance.

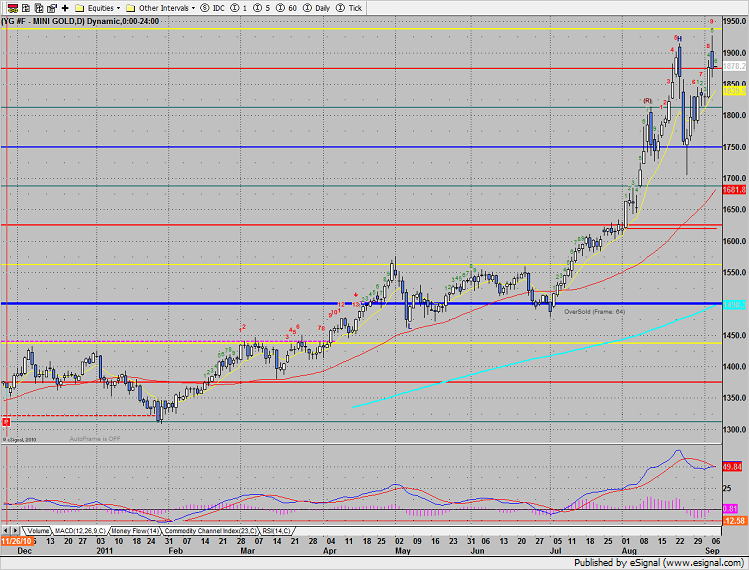

Gold printed new highs on the move and has yet to print 13 days up in the Seeker countdown.