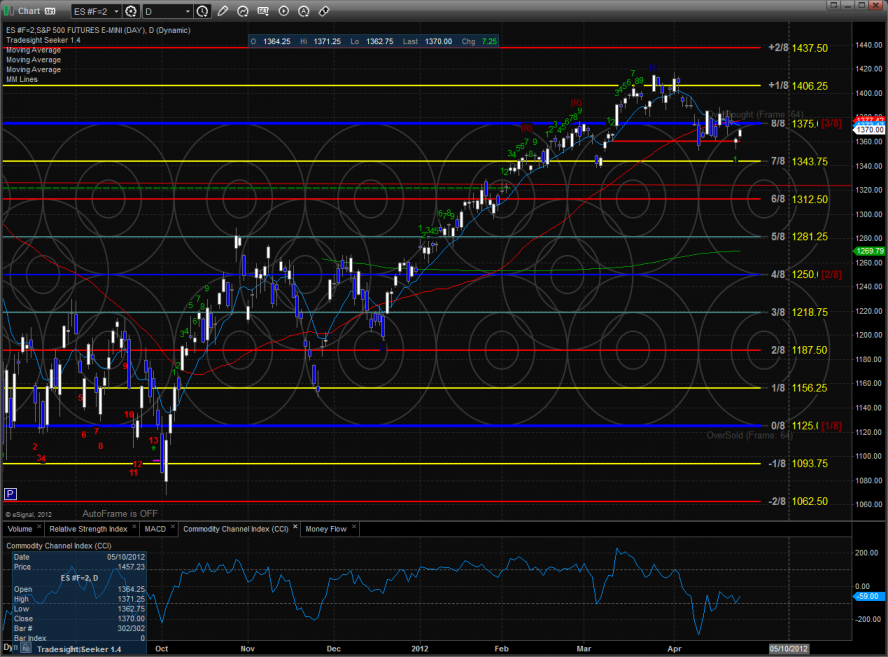

The ES made good on the camouflage buy signal in place from yesterday’s trade to gain 7 on the day. Earnings releases will likely continue to drive price and keep things gappy.

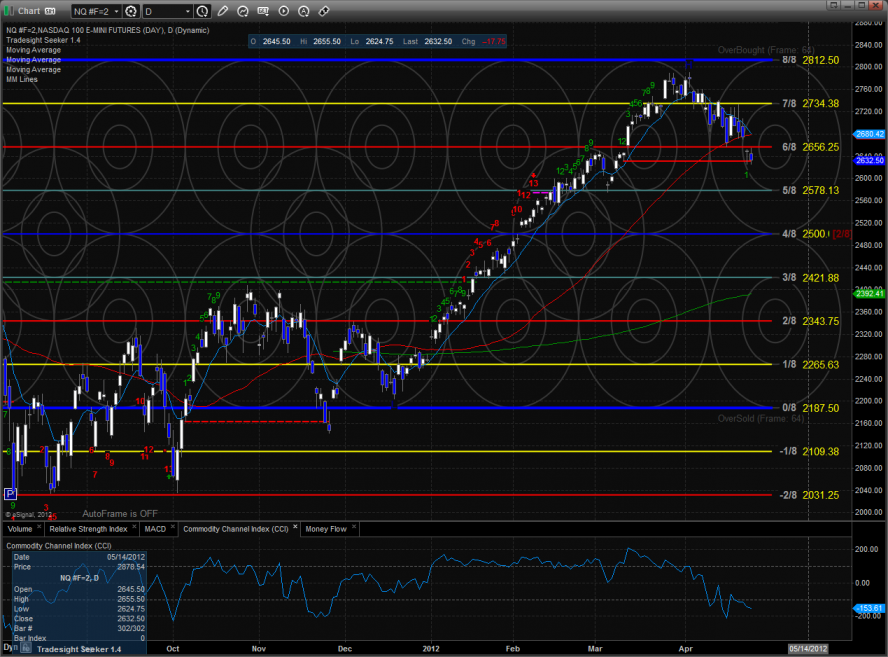

The NQ futures were lower by 17 on the day which continues with the relative weakness theme. Price settled right at the key static trend line. If this level is lost then the downside momentum will really accelerate and the 4/8 Murrey math level will come into play.

10-day Trin is back to the neutral level at 1.00:

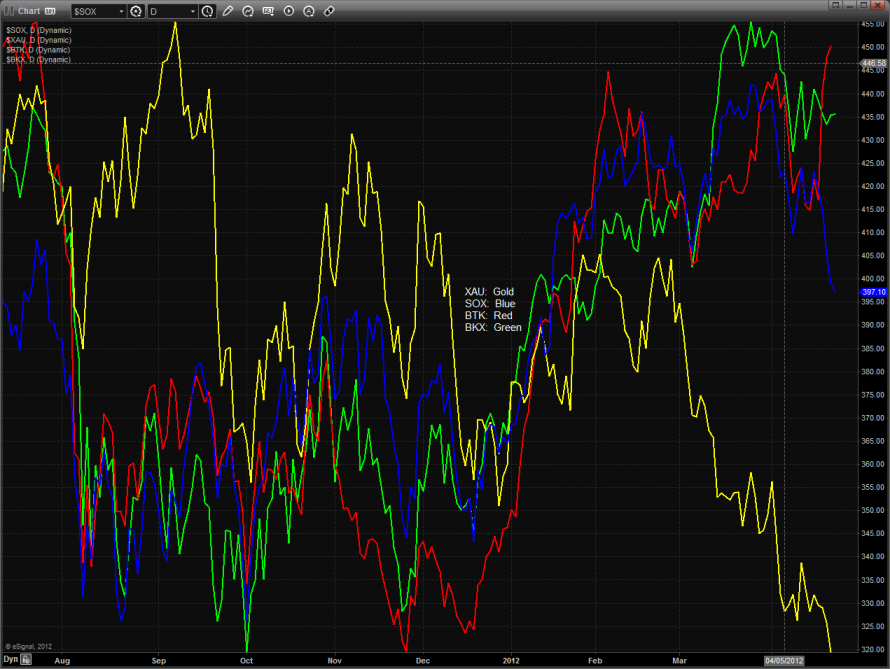

Multi sector daily chart:

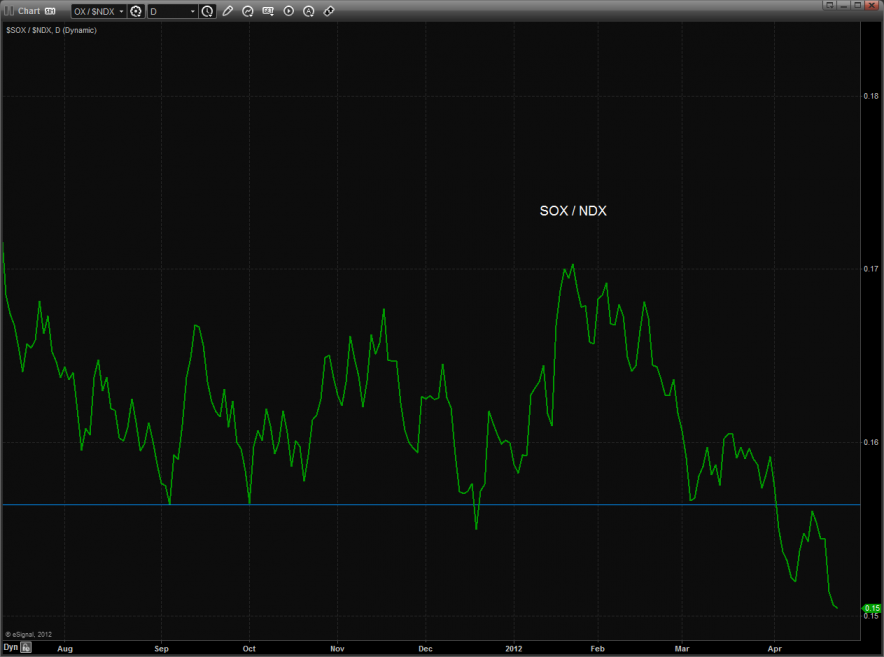

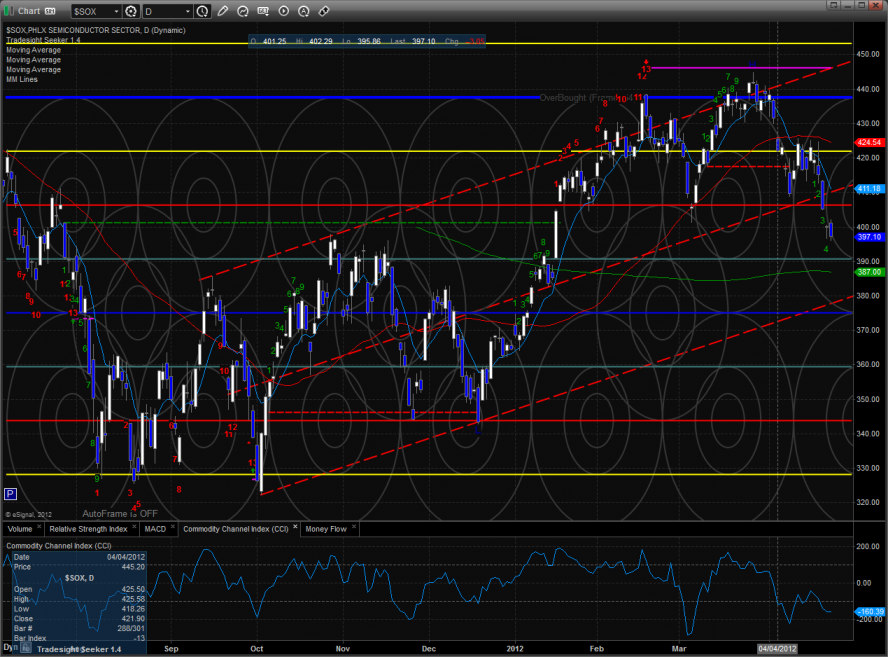

The SOX/NDX cross made a new low on the move. The AAPL earnings will likely have a vote as to the near term direction of this ratio.

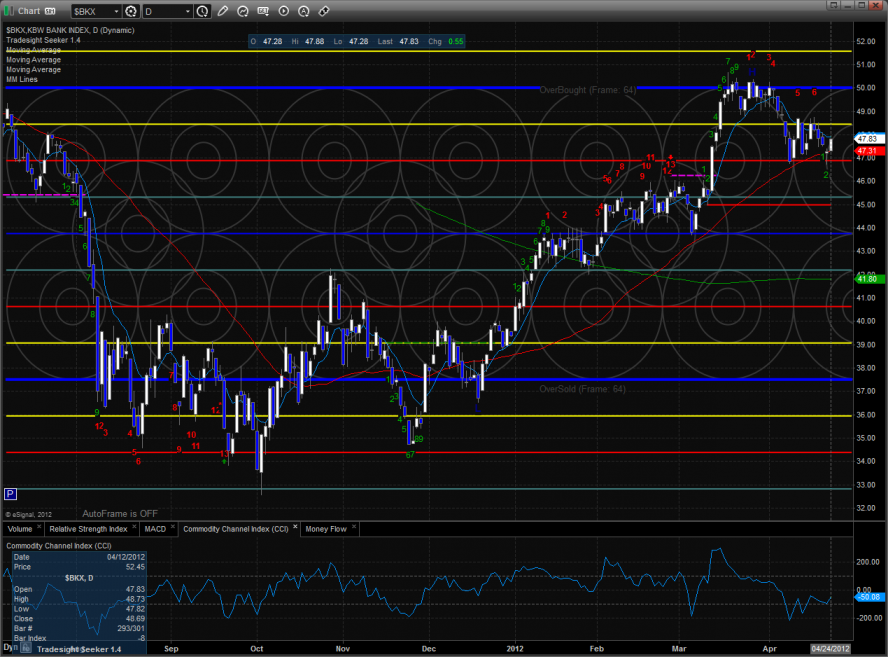

The BKX was the top major sector on the day. A close above the 10ema would turn the chart back to short term positive.

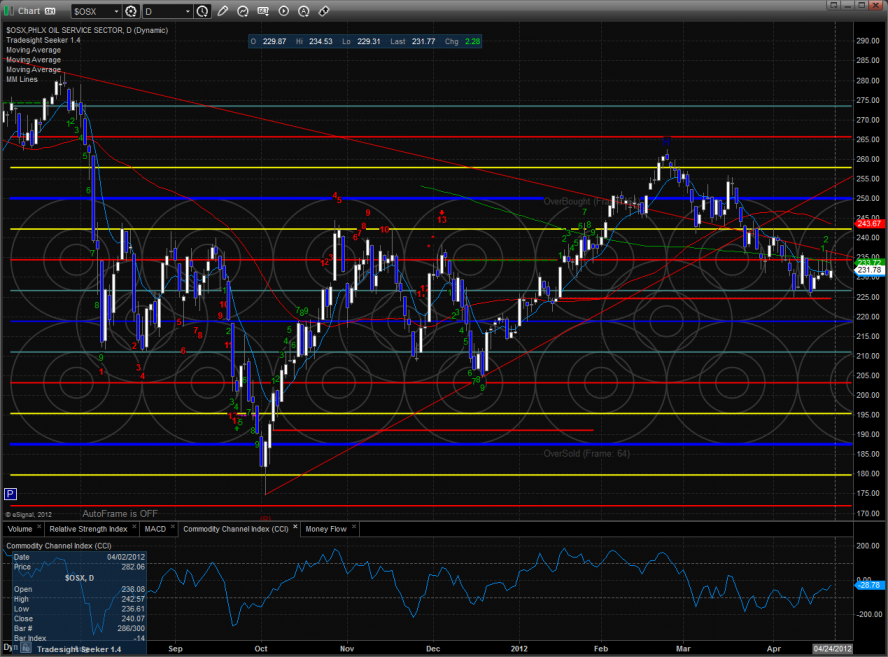

The OSX is trying to make a turn here. Keep an eye on the old DTL.

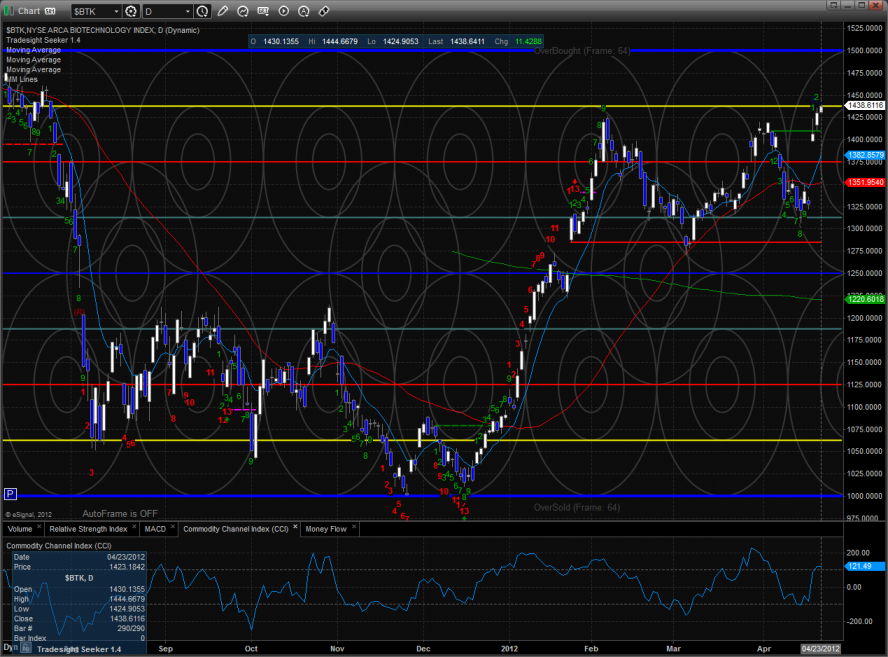

The BTK made a new high on the move settling right at the 7/8 level. Note that the Seeker count is only 3 days up.

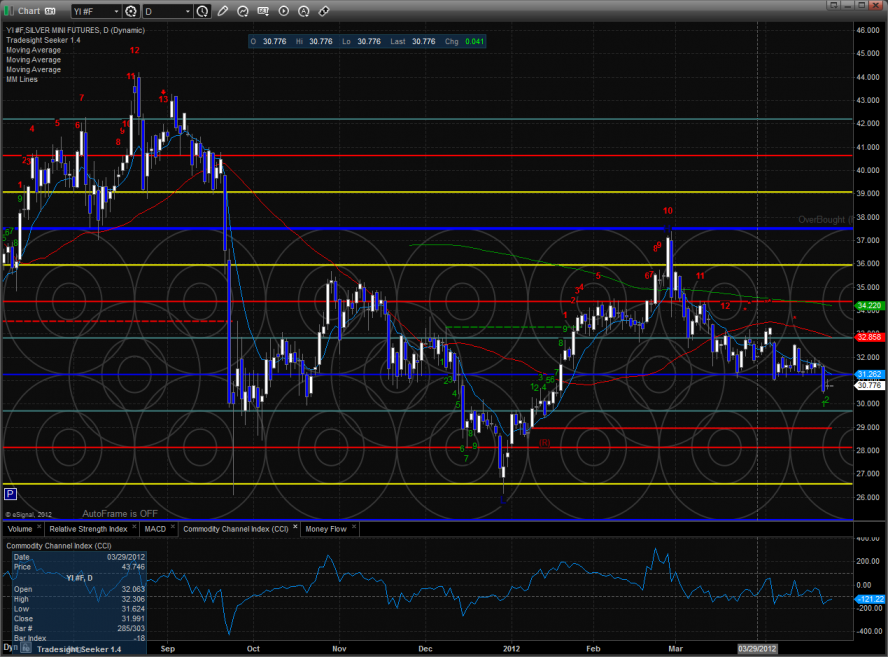

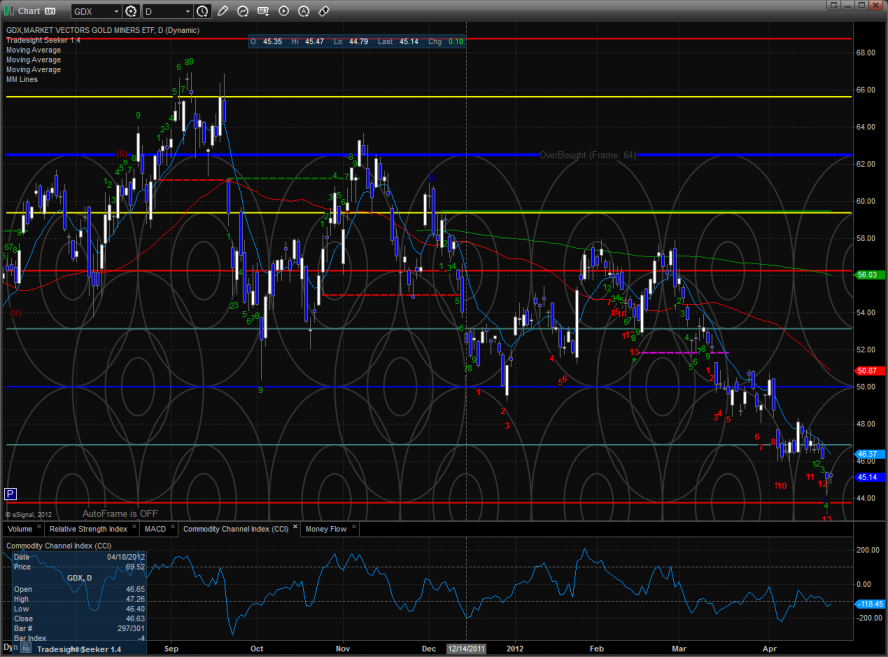

The XAU still has a fresh 13 buy signal. Monday’s action was inside the prior day’s candle so be sure to set an alarm for a break over Friday’s high and have some long ideas ready to go after the FOMC announcement.

The SOX was the last laggard on the day making a new low close on the move. The next important level of support is the 200dma at 387.

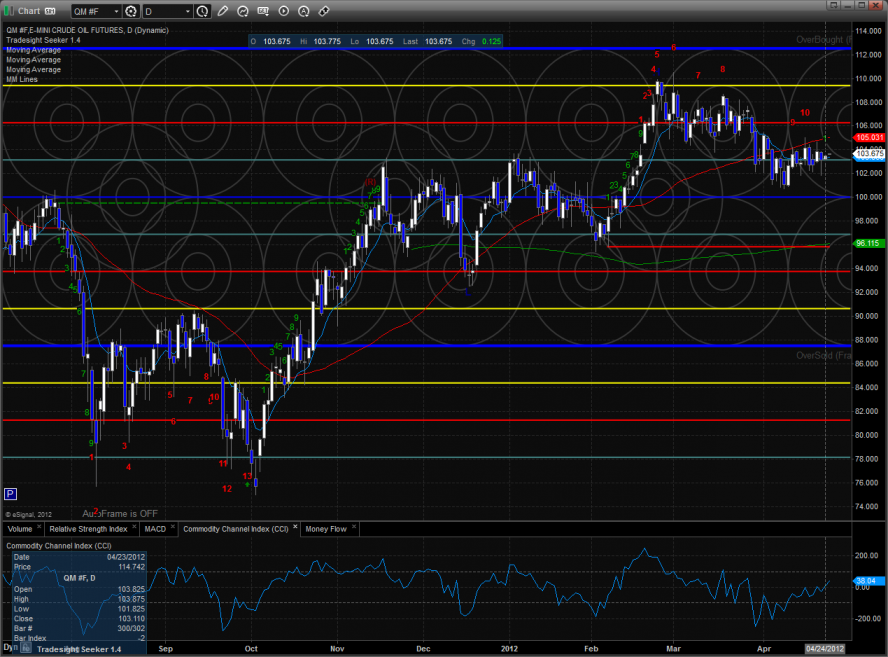

Oil:

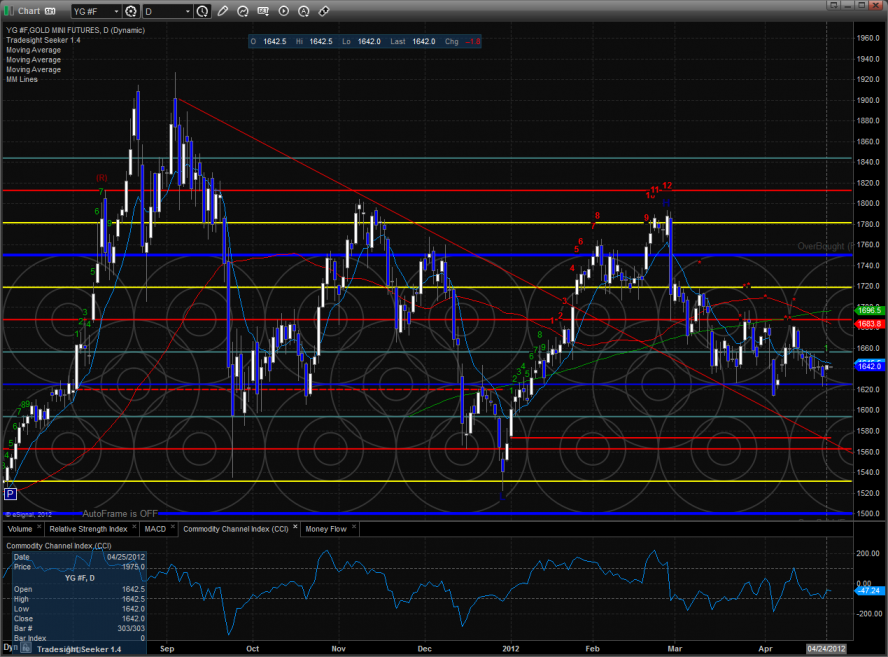

Gold:

Silver: