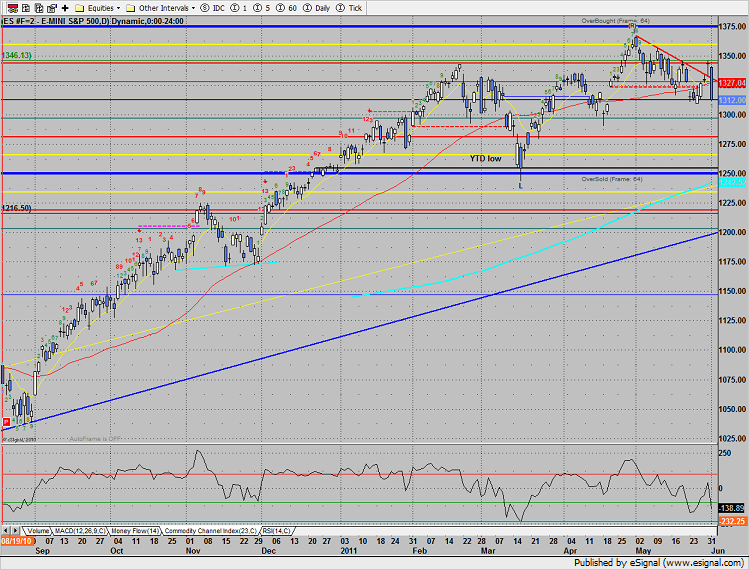

The SP decisively broke to the downside after a very weak ADP employment report premarket. The SP settled right at the 1312.50 4/8 level after losing 32 handles on the day. The Trin closed at 4.25 so odds favor some kid of a relief gap up Thursday.

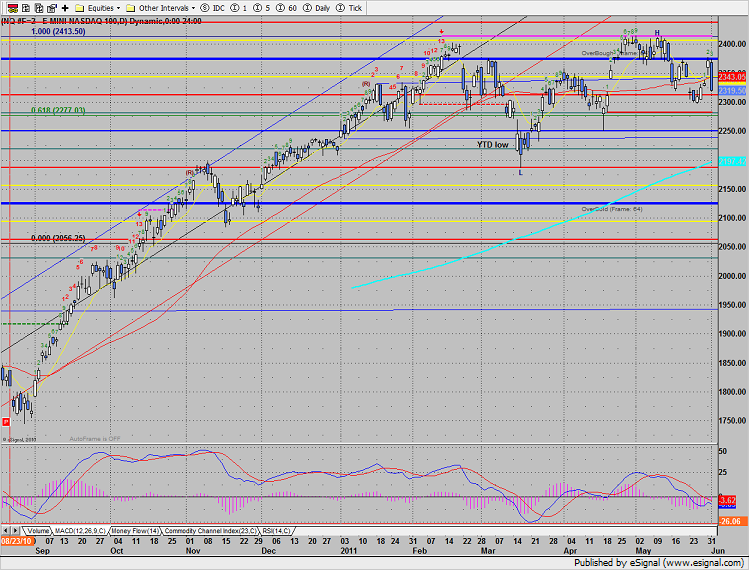

Naz lost a full 52 on the day closing 2 open gaps in the process. If this follows through to the downside, this could be a key rejection of the 8/8 level and resistance just overhead. Price has closed back below the 50dma. Note that the MACD is still in a sell condition.

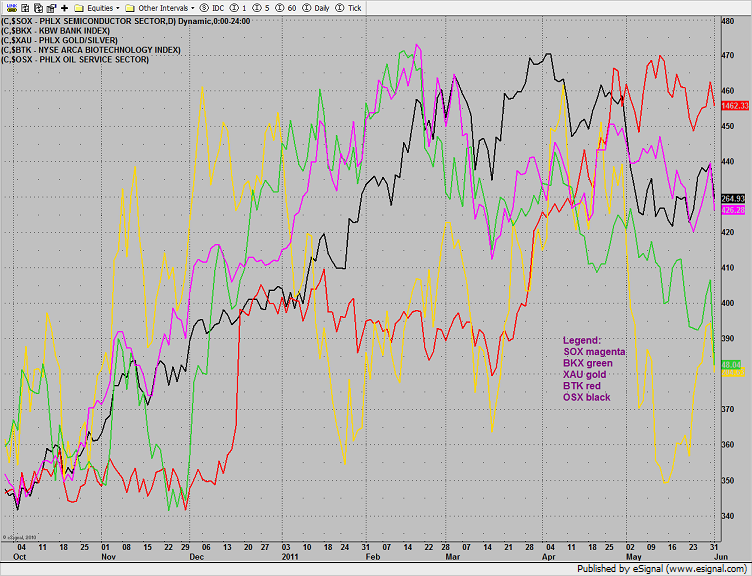

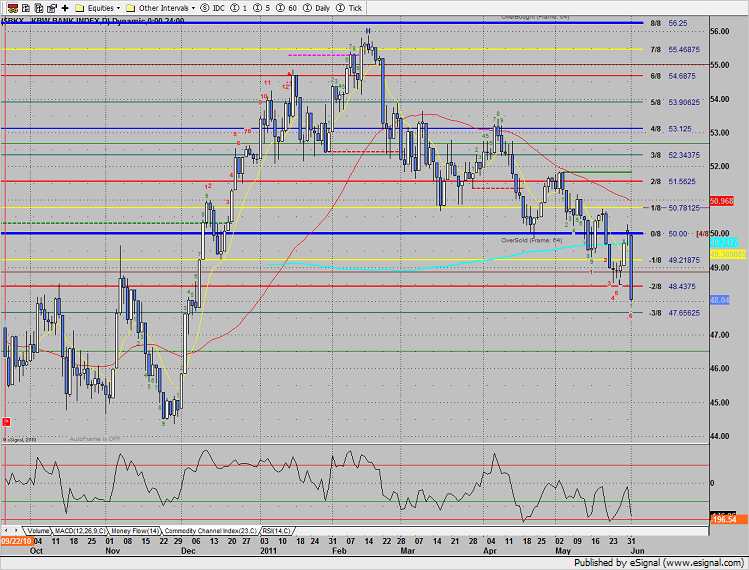

The multi sector daily chart shows the acute weakness in the banks which are close to becoming the weakest of the four on the chart.

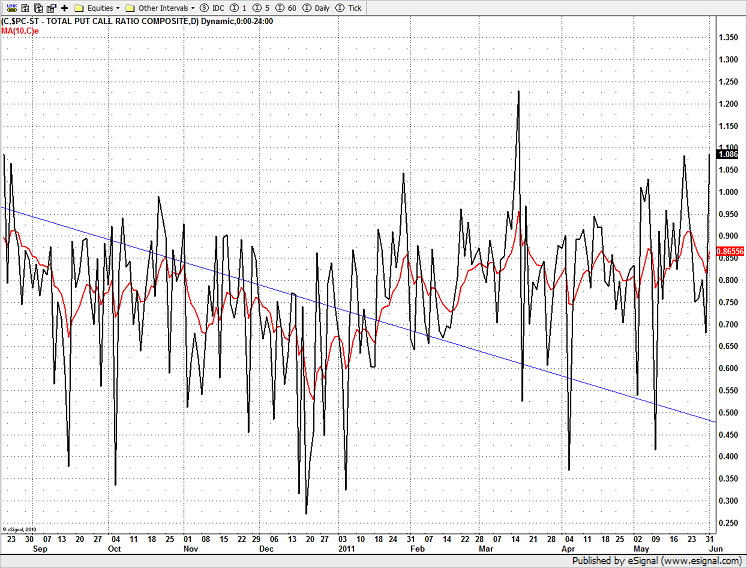

The put/call ratio did record a spike, closing solidly over the 1.00 level.

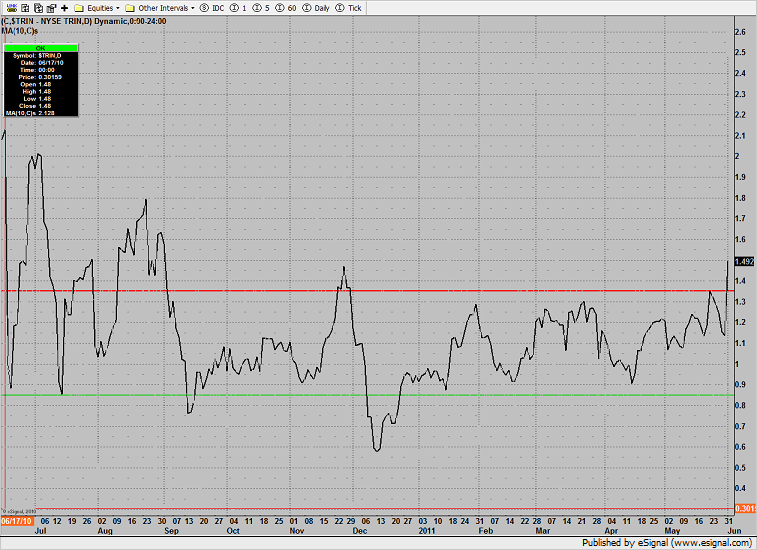

The 10-day Trin is well above the 1.35 oversold threshold. There is plenty of oversold gas in the tank for a bounce if price reverses.

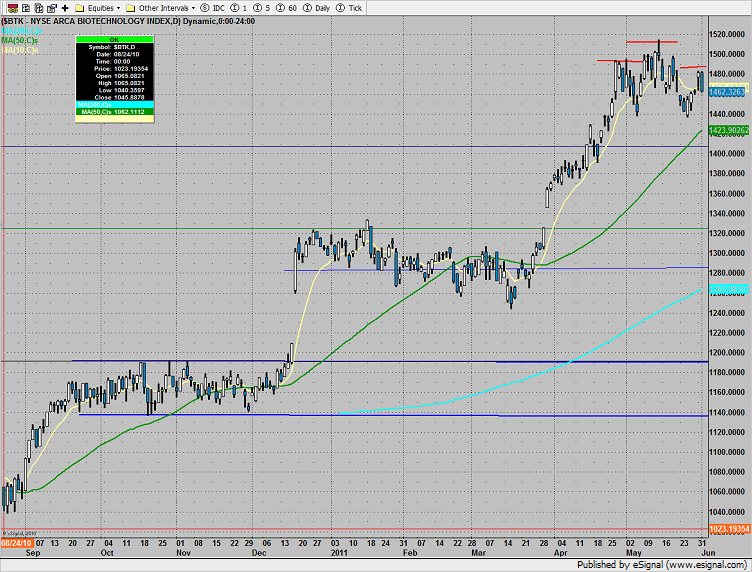

The BTK was the best of the worst. Note that while still range bound, the price action is tracing out a head and shoulders.

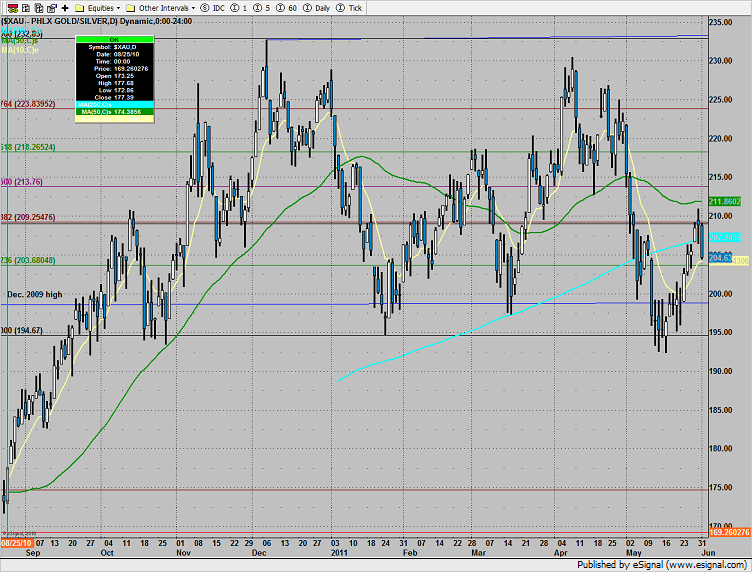

The XAU was slightly stronger than the broad market, down 2% on the day. Price is back below both the 50 and 200dmas.

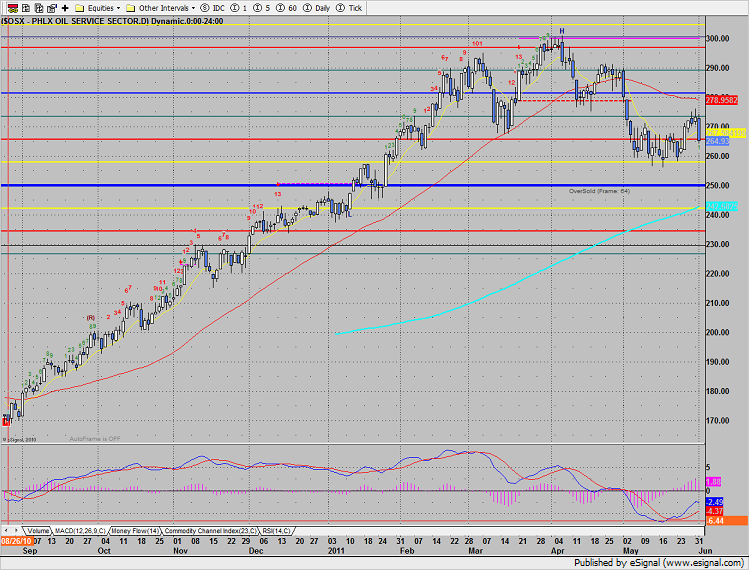

The OSX lost 3% on the day but remains well above the May lows. This is the key level of support at hand.

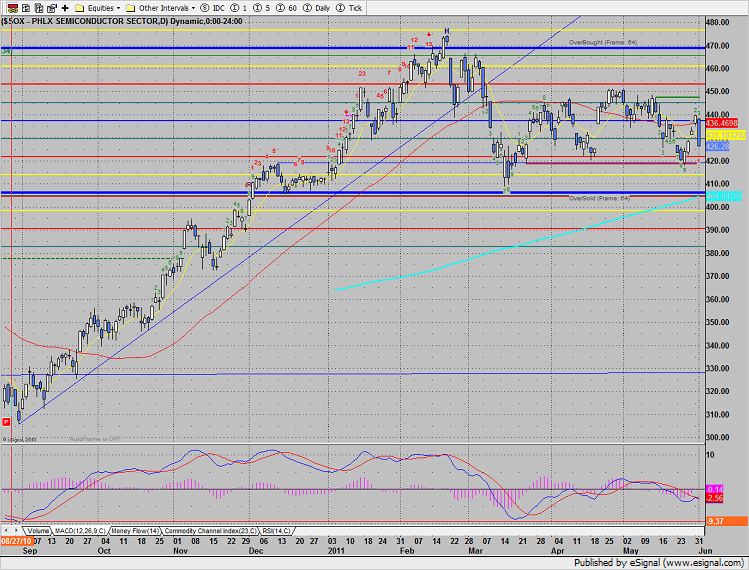

The SOX was weaker than the Naz losing more than 3% on the day.

The BKX was the weakest sector on the day losing more than 4%. This is a new low and low close on the year. Note that the Gann box will frame shift because price closed below the -2/8 level.

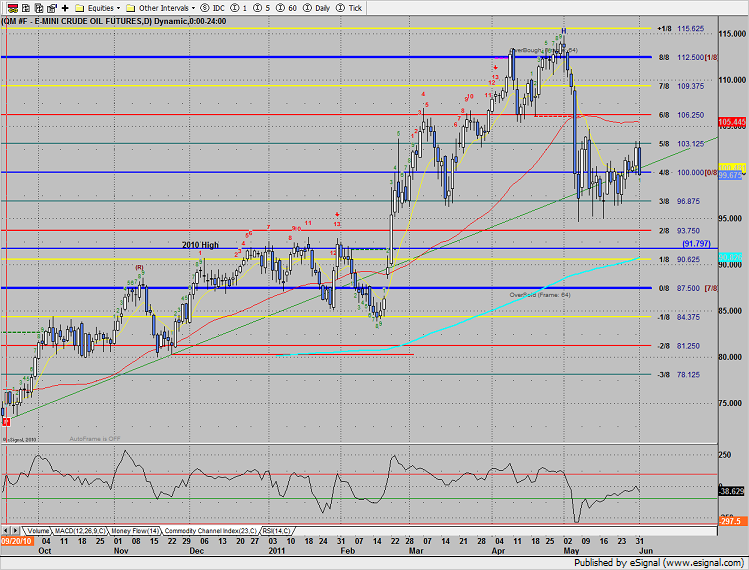

Oil settled near $100 which is the 4/8 level:

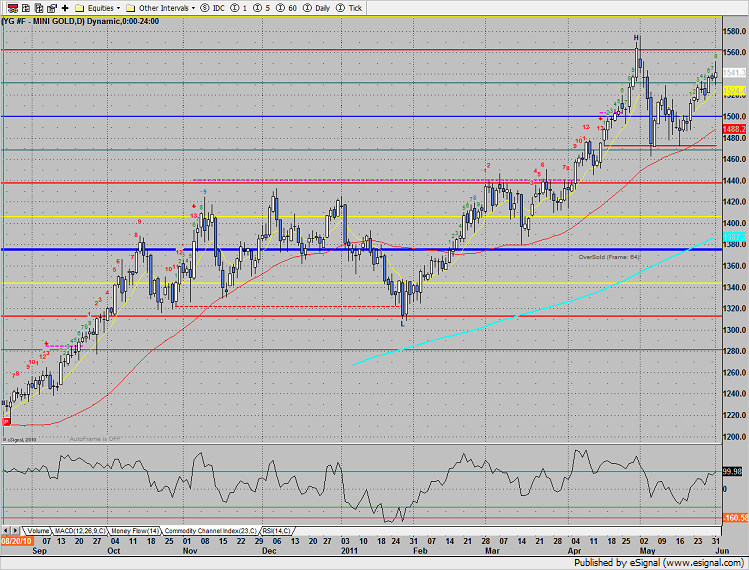

Gold saw some buying but faded. Note that this is a trend termination candle, though it is not at range high and will have less potency.