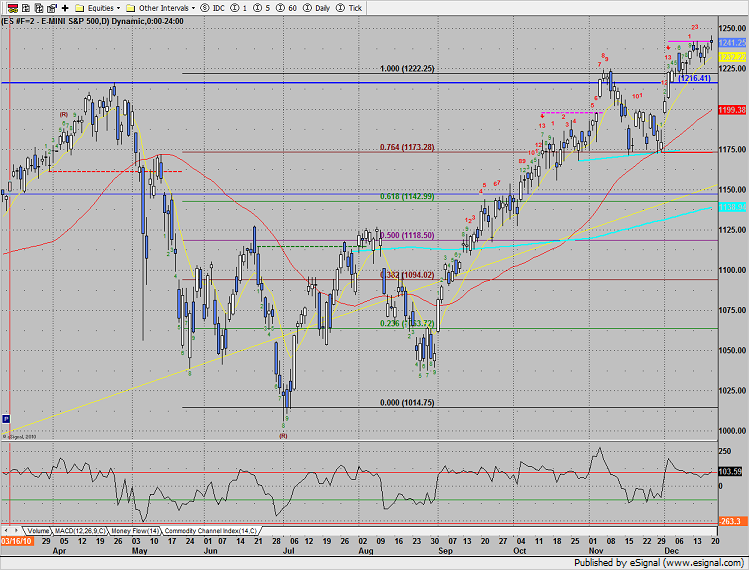

The SP nudged to a new high on the move and violated but did not break the SEEKER exhaustion signal’s risk level. This “uncle” level is the last hope for the bears. But there is hope for the bears because of the internals of today’s candle. Internally, today’s price action is a range high camouflage sell signal. Price settled higher on the day but closed below the opening level. This pastern setup 5 days ago and led to lower short term prices and a test of the 10ema. A similar reaction should be expected.

Naz was higher by 7 on the day but like the SP posted a camouflage sell signal. This can be a very important nuance at range high.

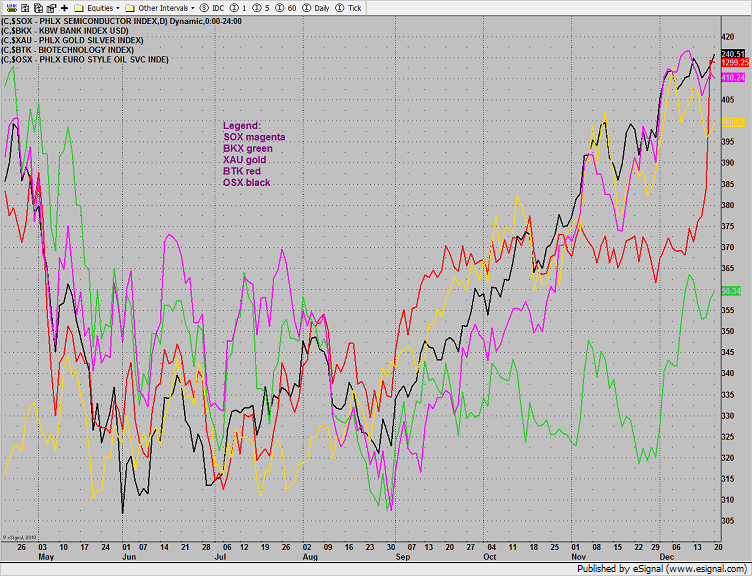

Multi sector daily chart;

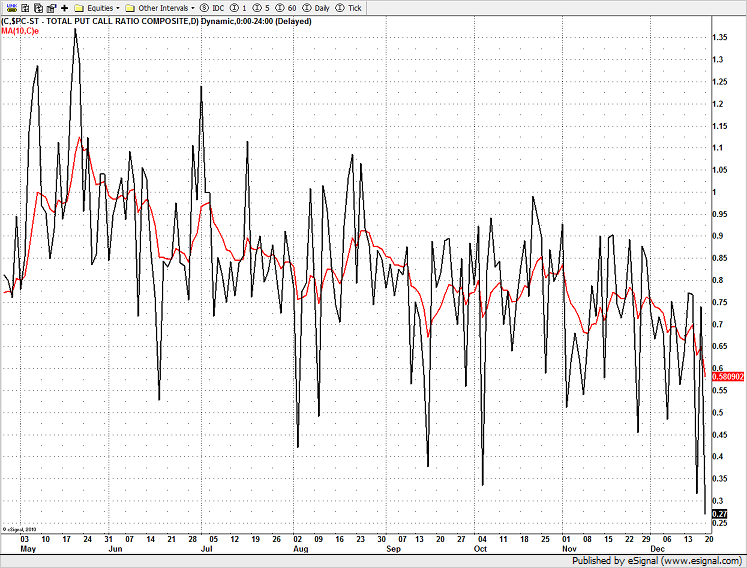

The Put/Call ratio recorded a new low on the year which suggests extreme complacency. This can often be some magnitude of inflection point.

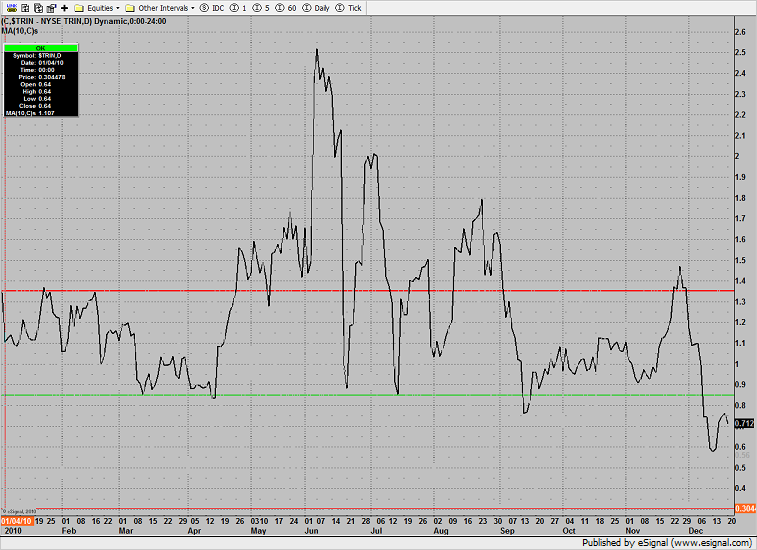

The 10-day Trin still shows that equities are short-term overbought.

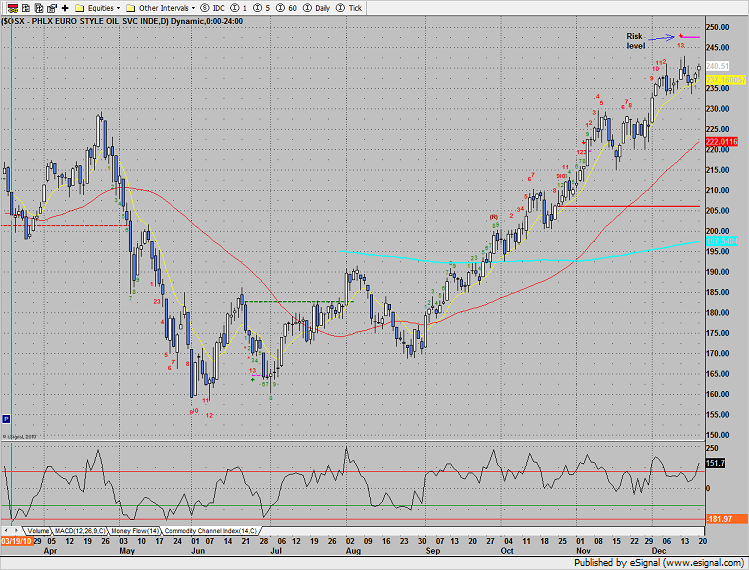

The OSX was top gun, closing at a new high not making a new absolute high on the move. The 13 SEEKER exhaustion signal will remain active until the risk level is violated.

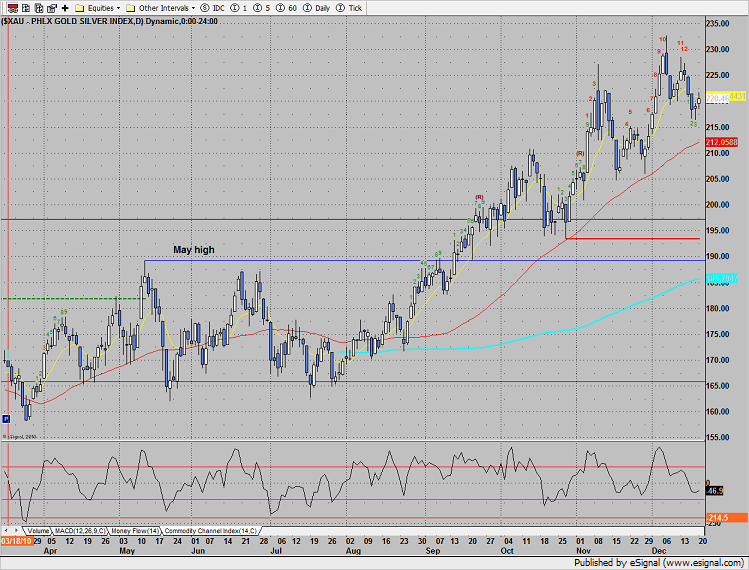

The XAU was stronger than the broad market and is 12 days up in the SEEKER exhaustion count.

The BKX is consolidating the 200dma breakout. The more meaningful breakout will be closing above the 51 level (50% fib).

The BTK saw profit taking;

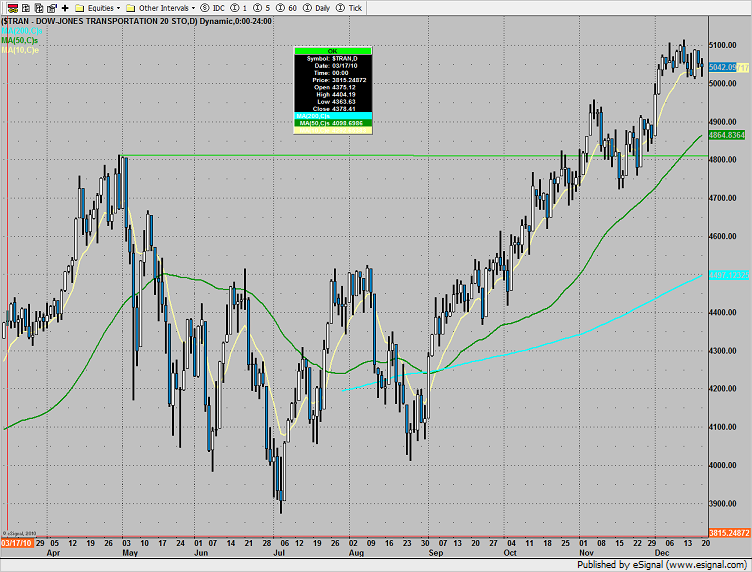

The Dow transports are struggling. Set an alarm for a break under 5000.

The SOX was the last laggard on the day:

Sox

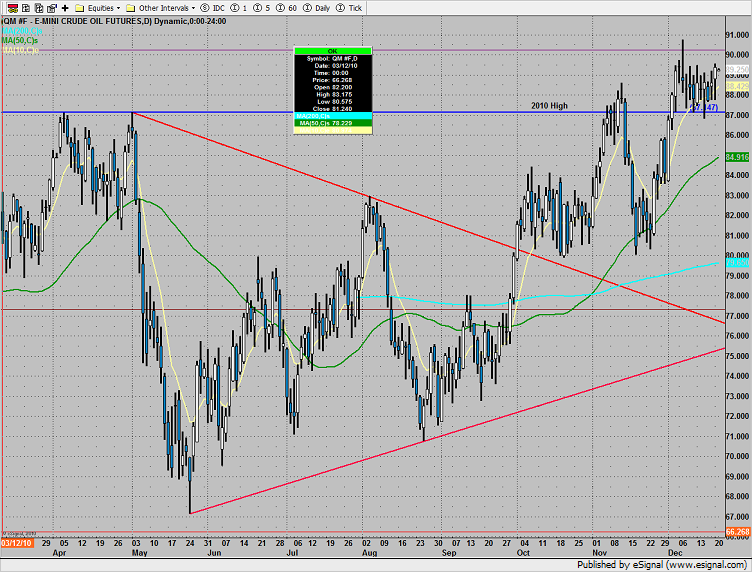

Oil moved towards the high of the range despite the dollar strength:

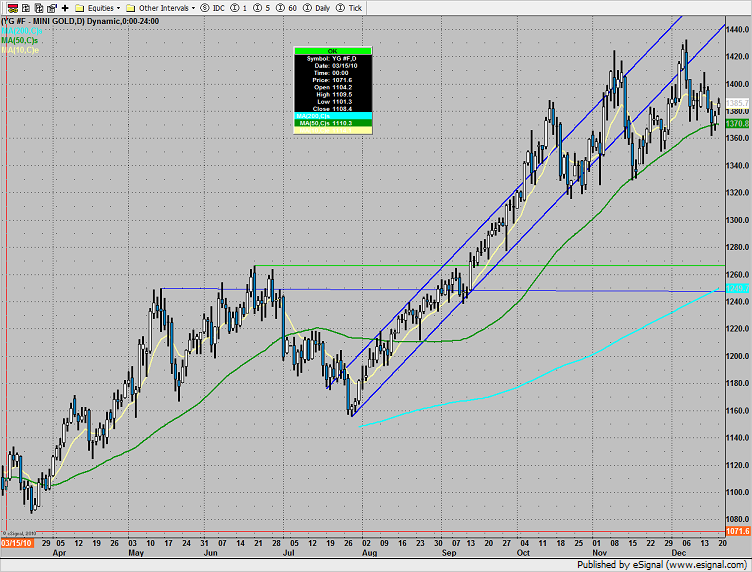

Gold bucked the buck, up on the day: