Tuesday, the SP closed flat to the penny, but the session had some interesting features. Price closed the dirty gap on the intraday decline but failed to fully close the 1253 gap. The Seeker count is now 10 days up and at very little risk of a recycle.

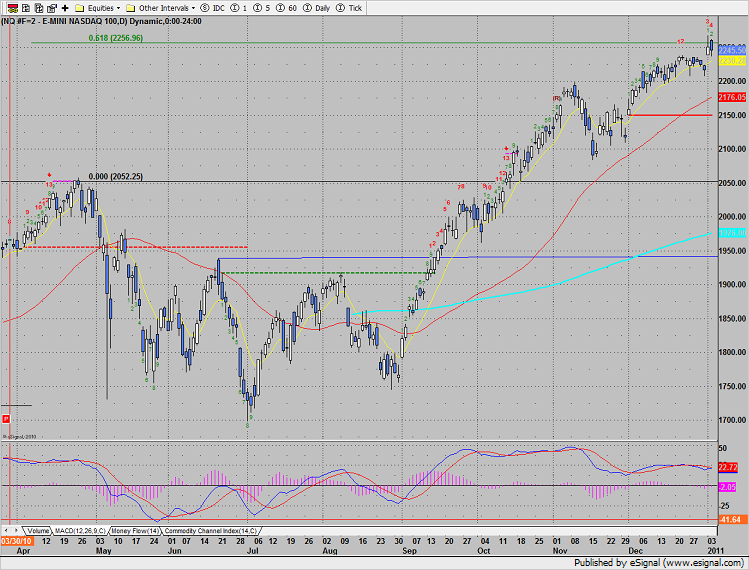

Naz was lower by 5 handles closing in the bottom half of the day’s range. The holiday gap remains open and is an alluring target. Price is still being repelled by the 62% fib extension. A settlement over this level will really trap the bears.

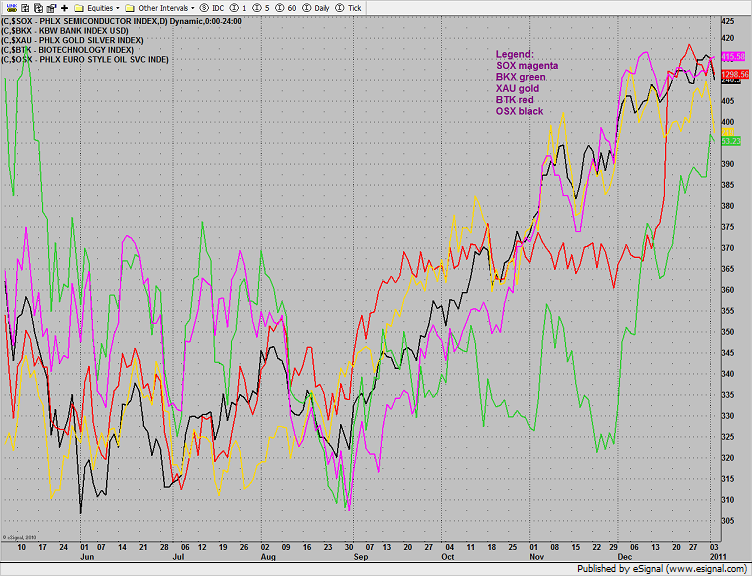

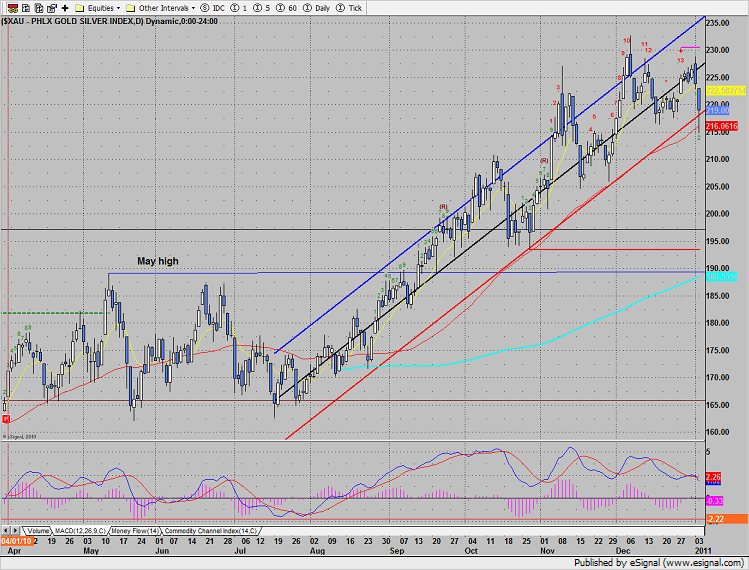

The multi sector daily chart shows that the XAU is very close to a qualified lower high. A lower high becomes qualified when a lower high is recorded and then a lower near term low prints.

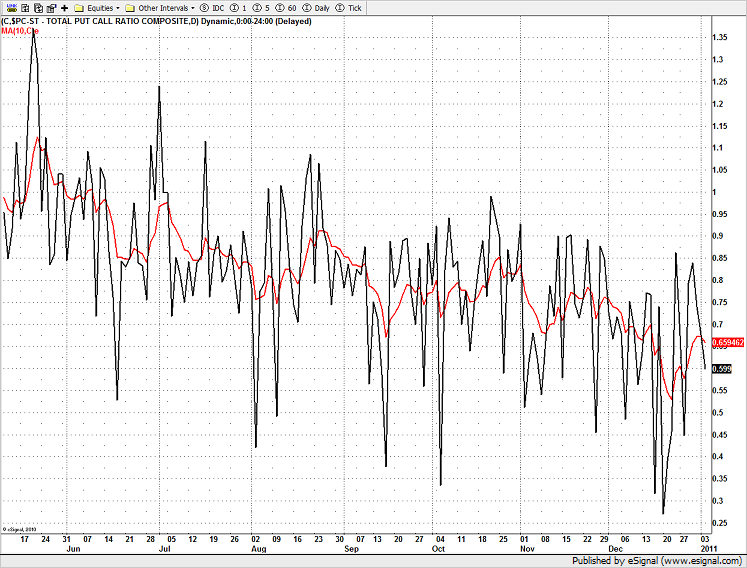

The put/call ratio has yet to show any evidence of protection buying.

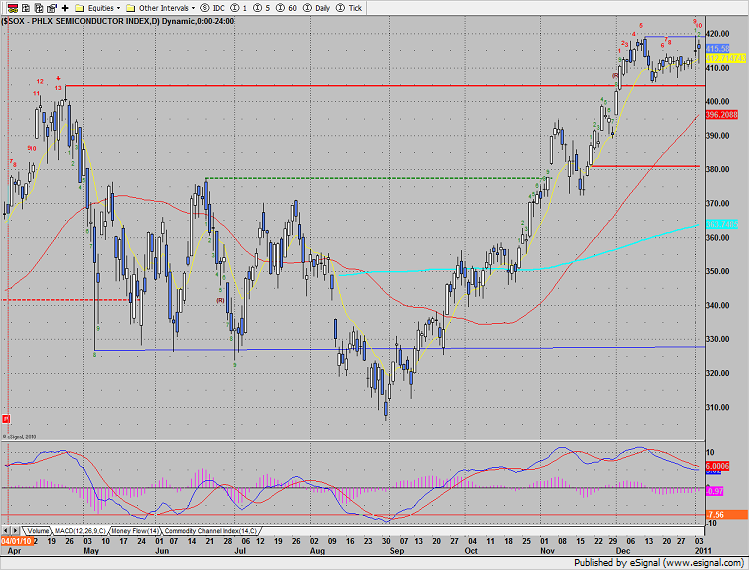

SOX was top gun, closing slightly higher on the day. There was some relative strength but price remains in the current lateral range.

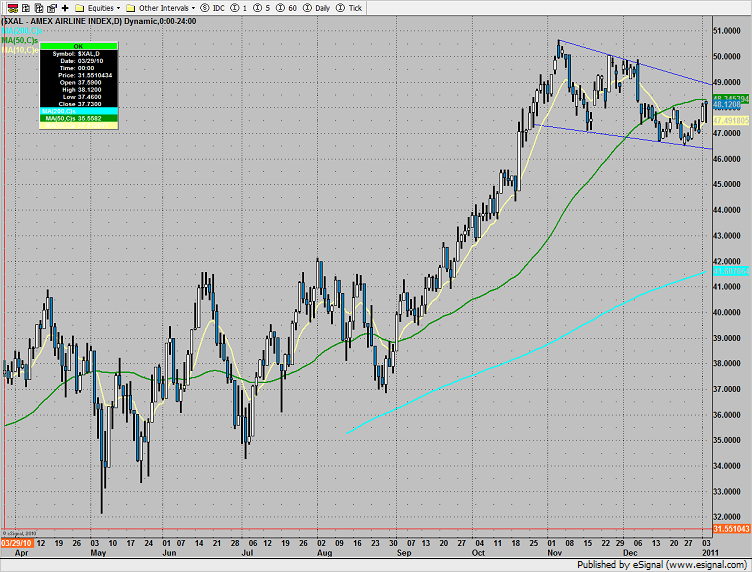

The XAL was higher on the day by a fraction. Be sure to have an alarm set for a break over the falling wedge. Don’t forget that triangle pattern breakouts that happen before the apex is reached in time are usually more potent.

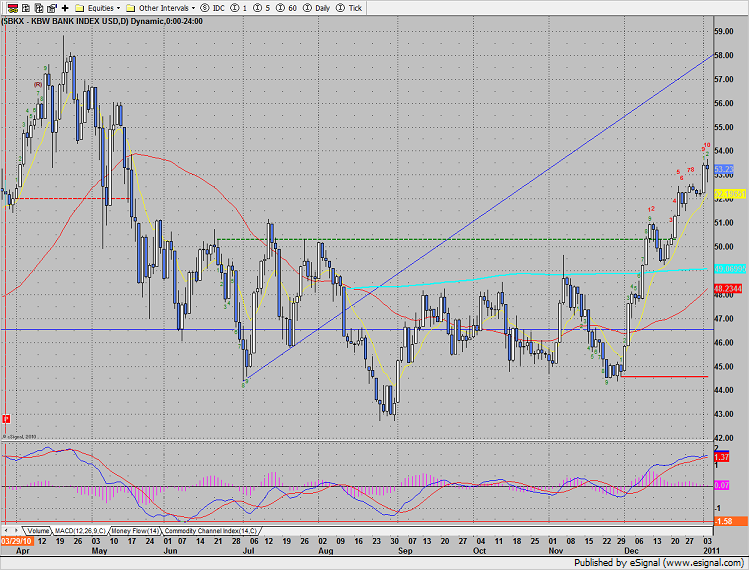

The BKX posted a wide raging candle that went nowhere. A new high was recorded for the move. The Seeker countdown is now 10 days up.

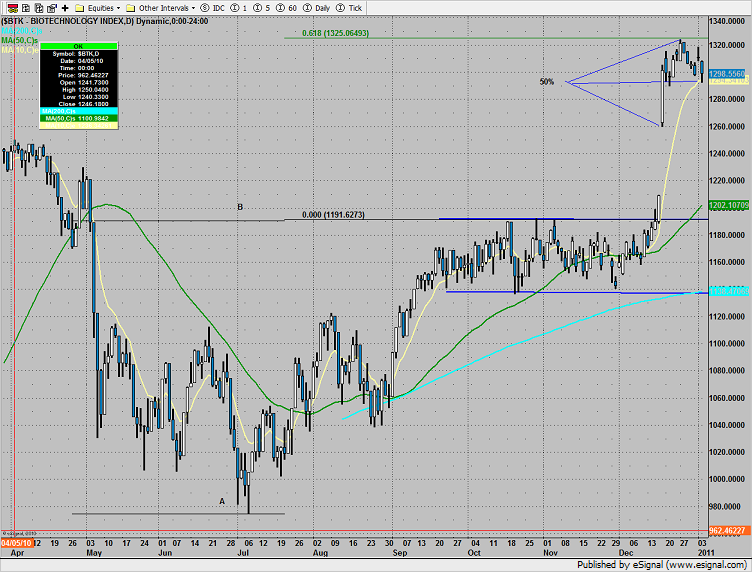

The BTK tested but didn’t close below the 10ema. This was one of the weaker sectors on the day, underperforming the SP and the Naz. Set an alarm for a break under Tuesday’s low 1291.80 which could unleash some selling. This would be a break under the 50% level of the recent range (excluding the gap).

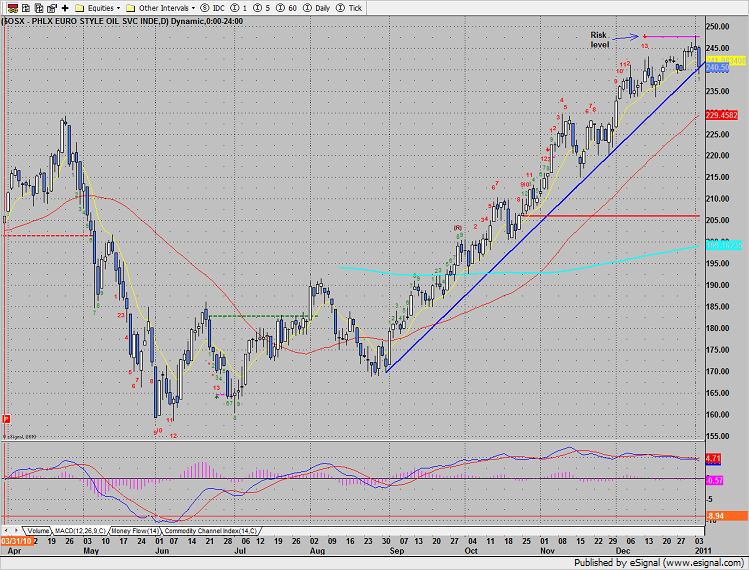

The OSX settled below the 10ema and greatly underperformed the broad market. A trend line has been added to the chart. The Seeker exhaustion signal is still active.

The XAU was the last laggard on the day. A trend channel has been added to the chart. Price has settled below the 10ema and a close below the trend channel should get downside momentum rolling.

Oil broke sharply. When a sharp break occurs evaluate the close vs. both 7 and 11 days ago. Tuesday’s close in gold was below 7 but not 11 days ago which means that immediate follow through is unlikely. Typically when a break happens and it exceeds the close of both 7 and 11 days ago the impulse is strong enough to continue without any measuring or pause.

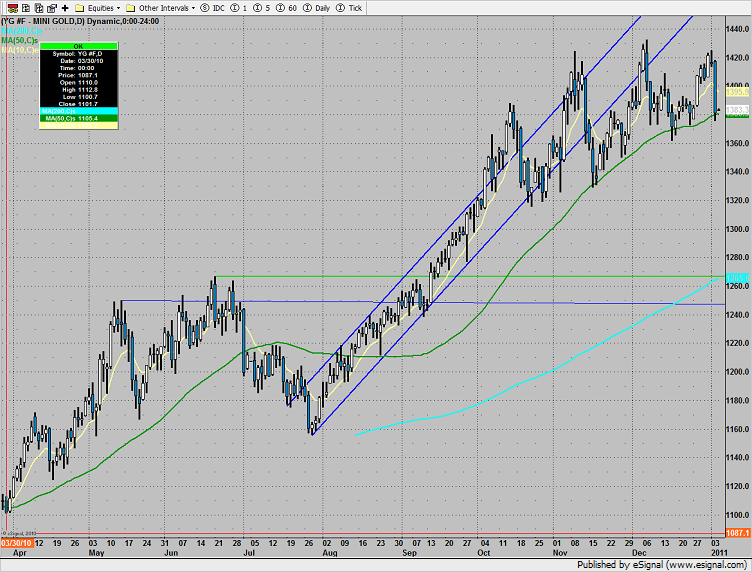

Gold also broke sharply but didn’t meet the 7/11 criteria for an immediate follow though. There hasn’t been a settlement under the 50dma (green) since August so this is a very key metric to monitor.