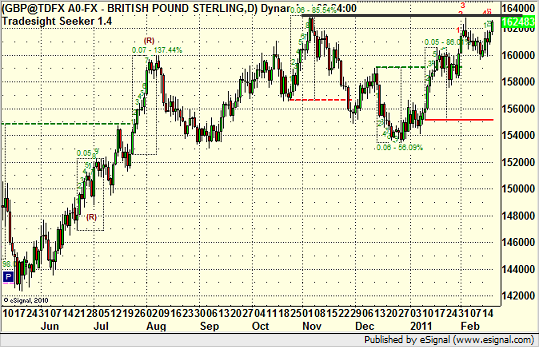

Let’s examine the market and see what the power might be behind the GBPUSD breakout play mentioned in our weekend report.

First, here’s a look at the play, which is a clean breakout of a cup and handle on the daily chart:

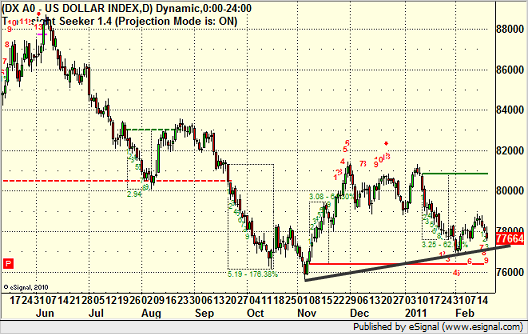

What does that mean? Well, to make it simple, what it means is that if the US Dollar breaks lower, that trigger should hit and go. So the important thing is that we analyze what the prospects are for the US Dollar Index here and add that to the discussion. And what does it look like? Let’s start here, with the daily chart, which now shows an inverted cup and handle formation against this major uptrend line:

If that breaks and then the GBPUSD breaks out, you should be all over it. Note that on that chart, we’re only 3 bars into the 9-bar count, so there is plenty of energy.

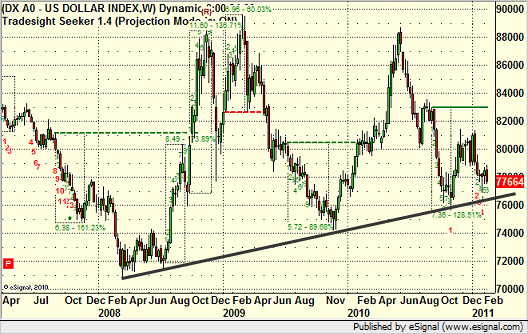

Meanwhile, go to a weekly chart on the US Dollar Index and you get this:

Here we see a significant 2 year trendline. If that breaks, that is the most significant sign that the USD is in trouble. Having said that, we are now, in projection mode, 6 bars down on the weekly chart, which means that we don’t have a ton of energy left to expend breaking that trendline. It will be hard to break lower, so be careful about assumptions here. Have a good weekend.