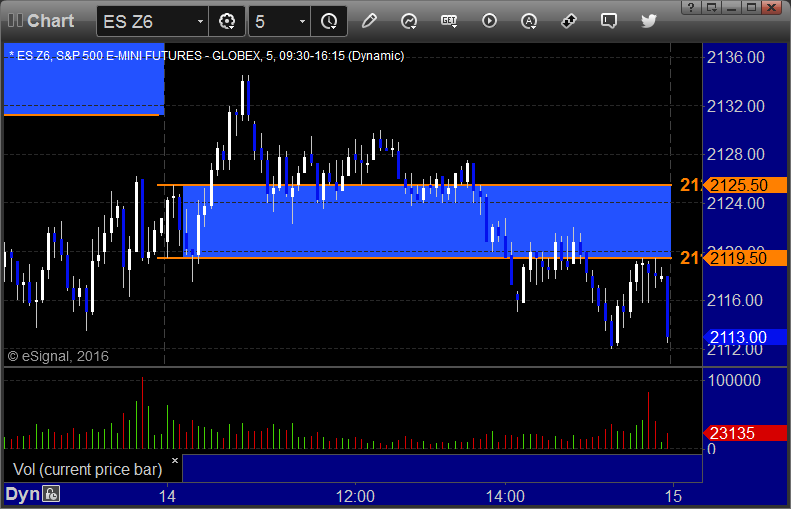

The markets opened fairly flat and wiggled both ways, then pushed higher in the morning, settled down over lunch, and the broad market swept the lows after lunch. Since the top was an hour in and volume held up a bit, it does appear that we got a slight options unravel move, which was to the downside. NASDAQ volume was 1.7 billion shares.

Net ticks: +23 ticks.

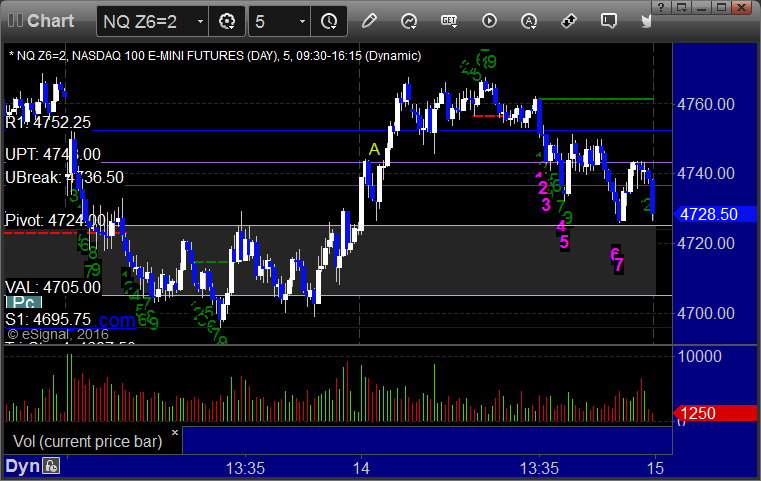

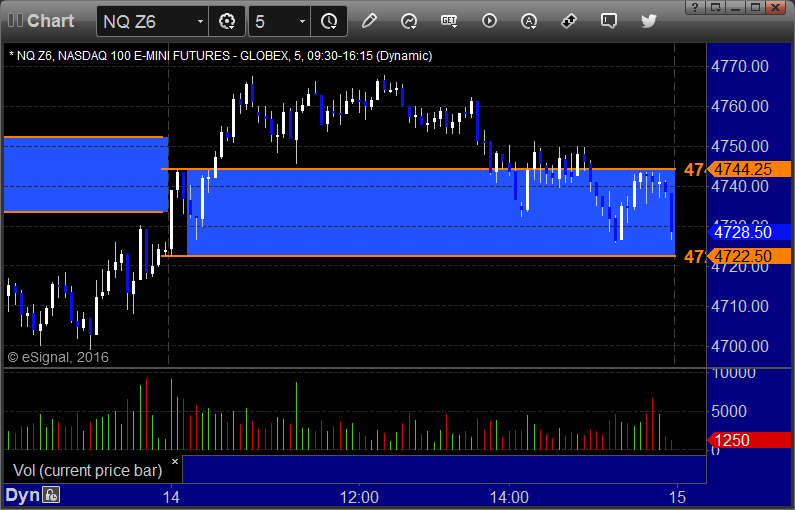

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

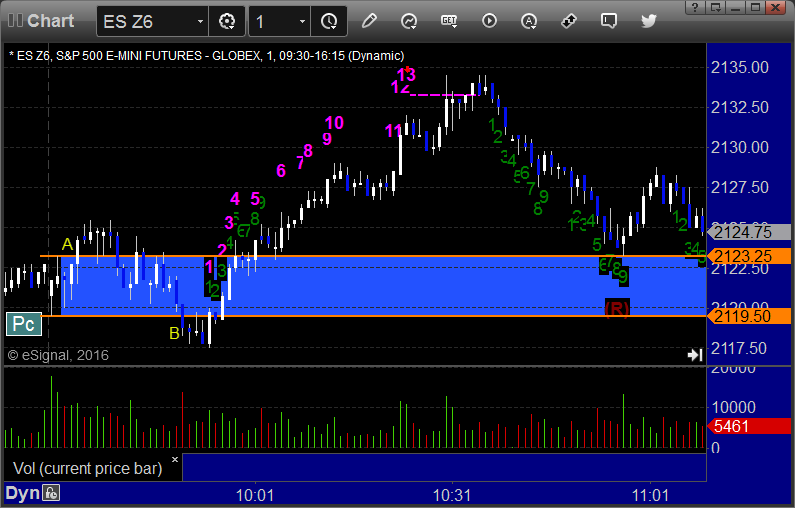

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, we used the midpoint, triggered short at B and stopped, we used the midpoint:

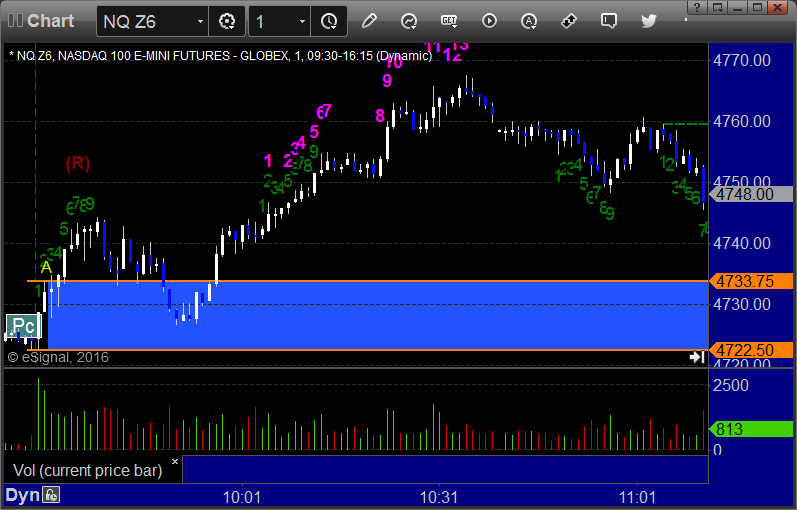

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4744.50, hit first target for 6 ticks, raised the stop several times, and locked in 34 ticks to the final exit: