The markets gapped up and tried to go a little higher, then drifted back down ahead of lunch, then basically went sideways for the rest of the session. Opening Range plays worked both ways, and the Comber caught the high on the 5 minutes ES, but a nice NQ setup never triggered. Watch the YouTube preview for some important info for tomorrow.

Net ticks: +22.5 ticks.

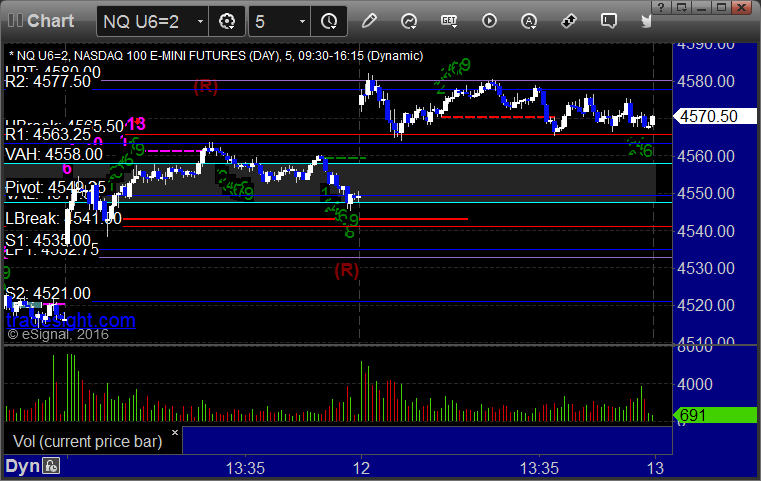

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked. Triggered short at B and worked:

NQ Opening Range Play triggered long at A and worked. Triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.