The markets gapped down and were flat for 20 minutes, then finally pushed lower for a bit, bottomed about 30 minutes in, and rose to fill the gaps over lunch and then flattened out on 1.6 billion NASDAQ shares. The ES Opening Range plays unfortunately stopped both ways, offsetting a nice NQ OR play and a separate nice NQ play. See those sections below.

Net ticks: +2 ticks.

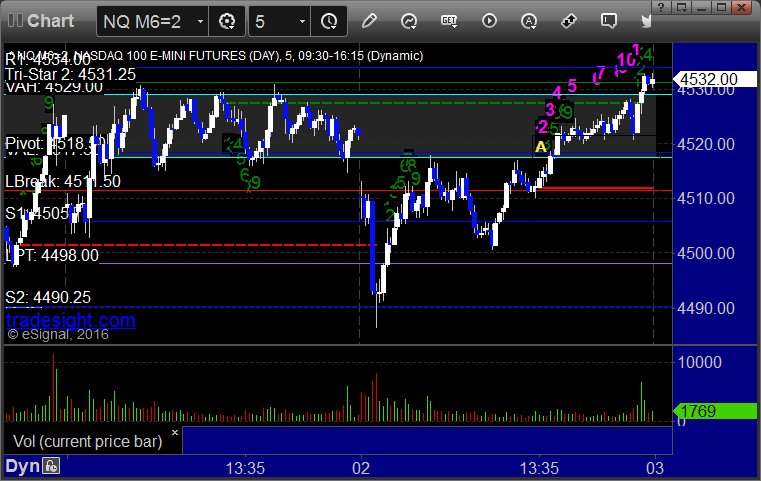

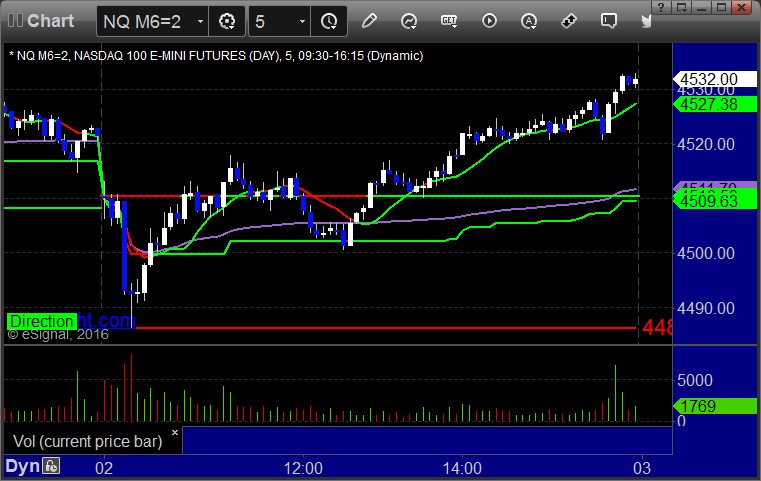

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn’t work, triggered long at B (valid even though we were short NQ because it is into the gap) and didn’t work:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4518.75, hit first target for 6 ticks, and stopped the final piece 28 ticks in the money: