The markets gapped down, then head-faked up for a little, then rolled again, using the LPT on the ES as general support for hours before coming back up to close above some key levels. NASDAQ volume was 1.65 billion shares. Opening Range plays were great, and we had another winner in the TF and a loser on the ES separately. See those sections below.

Net ticks: +54.5 ticks.

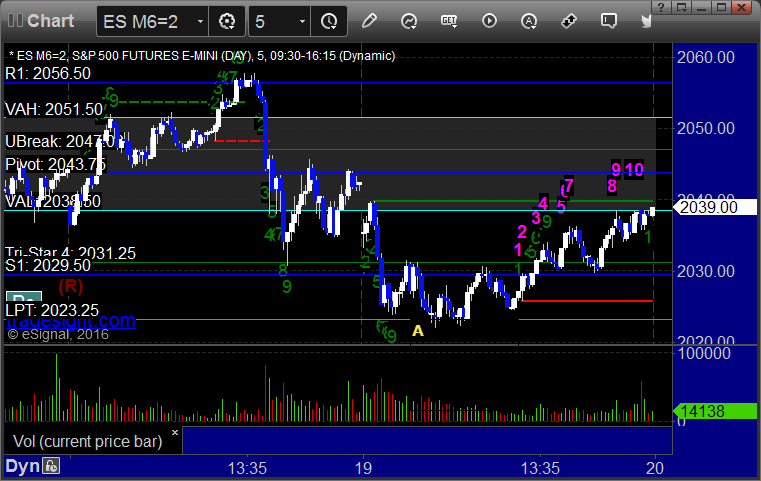

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked:

NQ Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 2023.00 and stopped for 7 ticks:

TF:

Triggered short at A at 1090.40, hit first target for 9 ticks, stopped second half 13 ticks in the money: