Volume (and action) issues continue. The markets gapped up and were dead flat for over an hour, never really doing anything of interest all day on 1.3 billion NASDAQ shares. Opening Range plays never had a chance. Some people think it is good when the Opening Ranges are narrow because you don’t have to risk much, but it also means it is easier to stop out. See those below.

Net ticks: -28 ticks.

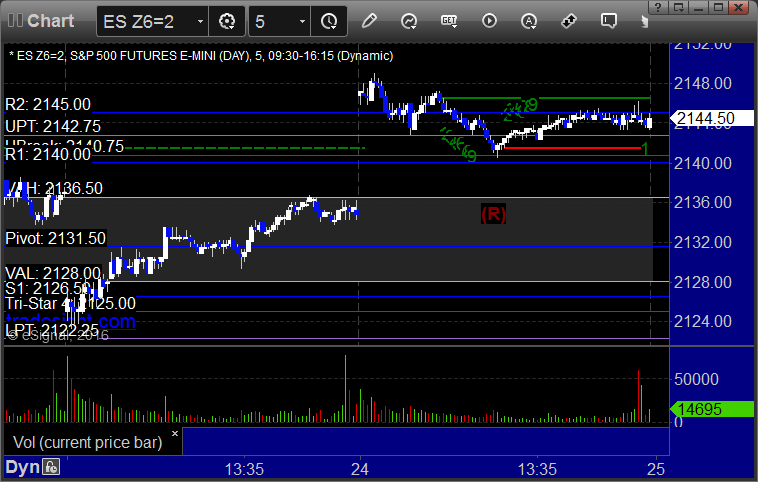

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped (missed the 8 tick partial by 1 tick), triggered short at B and worked eventually for a partial:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and stopped (valid because it was into the gap):

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: