No calls due to volume, and that might be the case for the rest of the week. However, using the Seeker and Comber tools, we can have some educational discussions even in the light volume environment, so take a look at the NQ and YM below for examples of how you can spot general entry points even in dull markets (without the type of specific entry points that we would put in the Messenger).

Net ticks: +0 ticks.

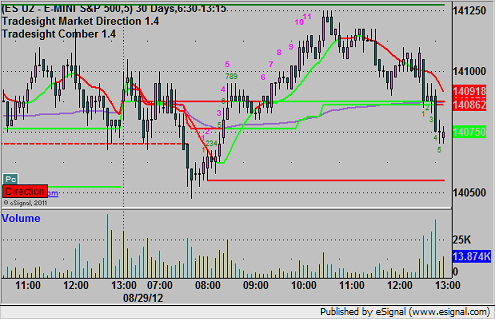

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

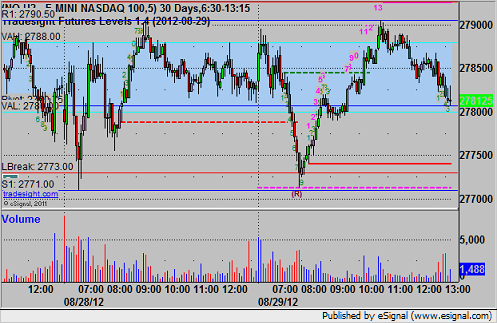

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Note that the NQ hit R1 on exactly a Comber 13 sell signal in light volume activity, which gave us the exact top. The market is often dragged to the VWAP/midpoint without volume, and this signal gave you the entry point for the fade back to the VWAP:

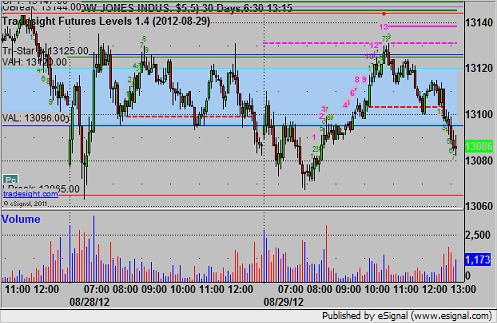

YM:

Note that the YM did the same with the 13 signal calling the top around the same time: