A nice day with just one call due to light volume, but it incorporated everything we teach in our courses: Gaps, Value Areas, Pressure Thresholds, etc. (well, not everything we teach, but several key pieces). See NQ section below. The winner was 25 POINTS to final exit (50 ticks).

Net ticks: +28 ticks.

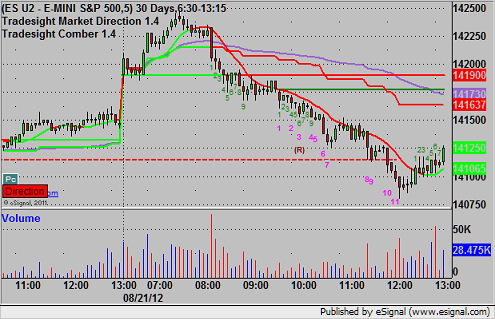

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

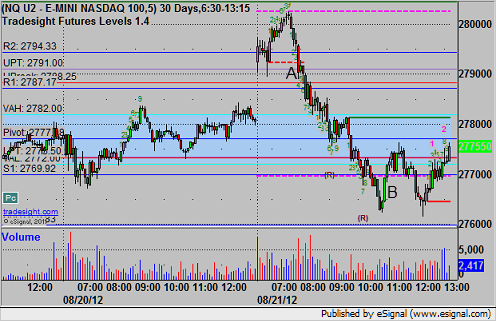

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

After the early hour of trading, I was interested in the NQ bouncing off of the UPT coming back down (it hit it exactly and bounced, then broke it, all inside the trigger bar, but the important point is that it bounced off it first). The trigger short at A was 2790.50. We hit the first target for 6 ticks at 2787.50, then proceeded to lower the stop 6 times as it filled the gap, broke into the Value Area, and went lower. Final exit was at 2765.50 at B: