One stop out, one winner, and one trade that took too long to get going heading into lunch so we killed it.

Net ticks: +1 tick.

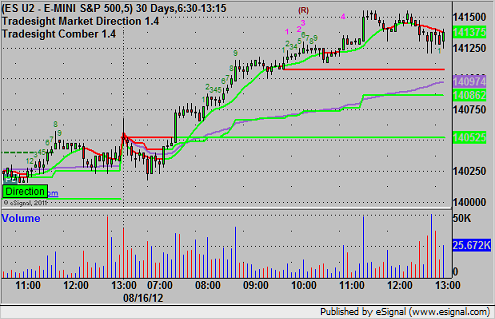

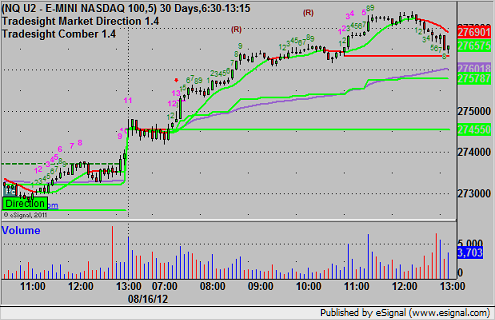

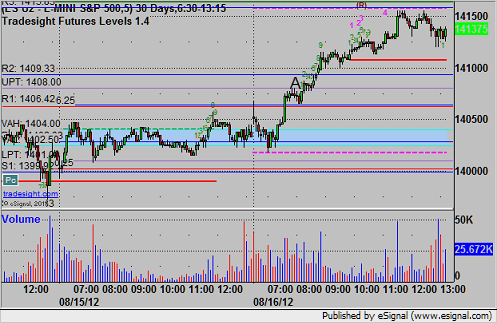

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Triggered ong at 1408.25 at A. After 30 minutes, it hadn’t move more than 2 ticks in either direction, so we closed the trade heading into lunch, although it ended up working just after that:

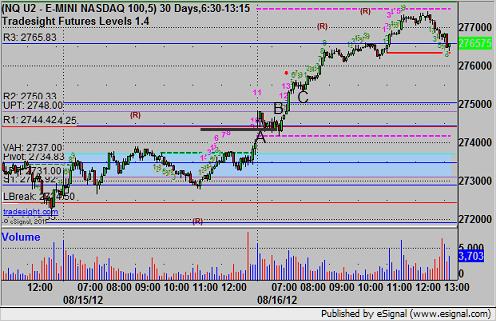

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 2743.50 and stopped. Triggered long at 2748.50 at B, hit first target for six ticks, raised stop and stopped at 2753.50 at C: