Couple of nice setups in the ES and NQ stopped out once and I chose not to re-enter due to extremely light market volume from quarterly options roll. They ended up re-triggering and working for huge gains, of course. See both sections below.

We are on the U3 contracts effective now.

Net ticks: -14 ticks.

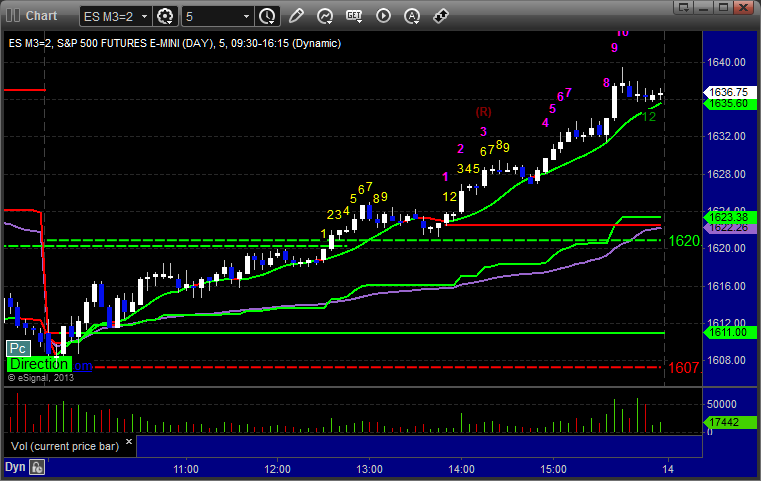

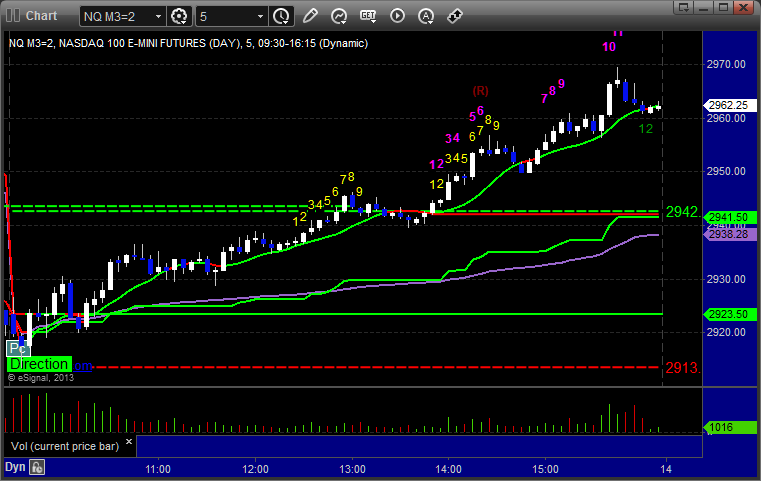

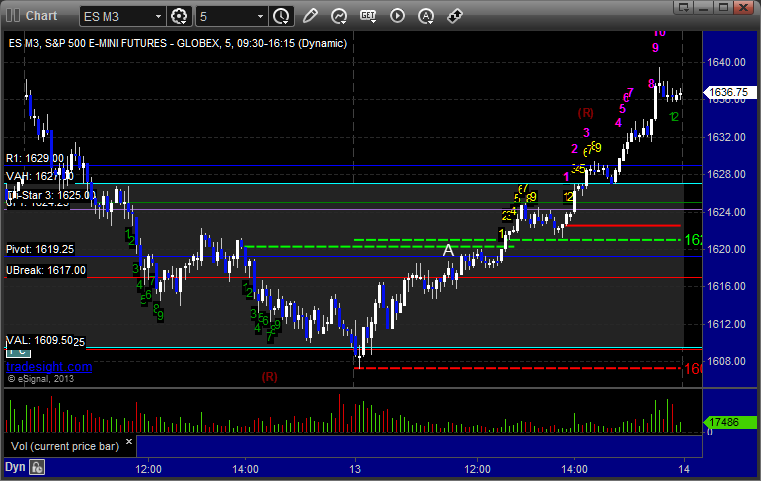

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Triggered long at A at 1617.25 and stopped for 7 ticks:

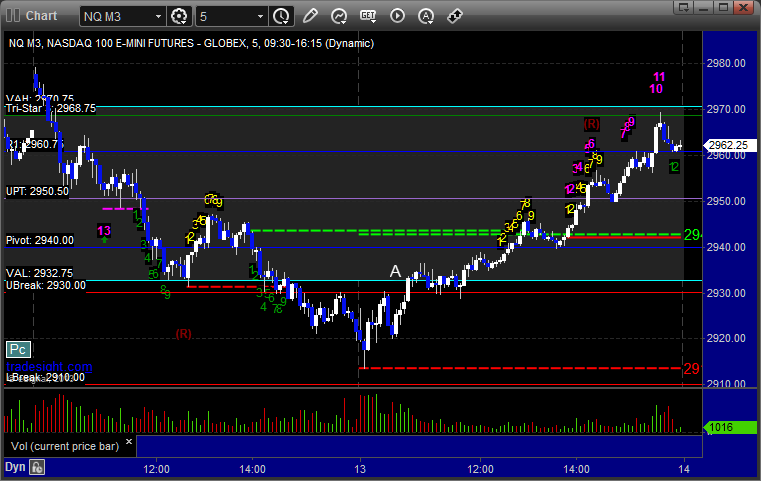

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 2934.00 and stopped for 7 ticks: