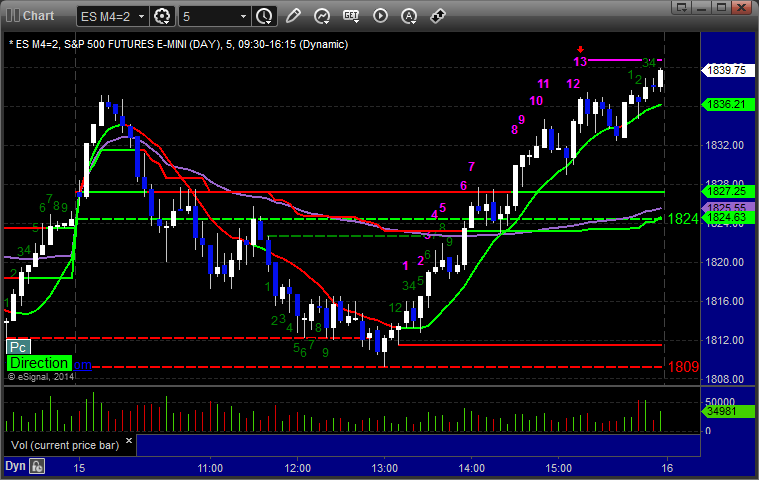

For Tax Day, the markets gapped up, headed higher initially, then rolled. Market volume was extremely poor early but picked up during the day, so the NASDAQ closed at 2 billion shares. We headed much lower and then got a strangely strong rebound in the afternoon. This might have been options unraveling related, but it is still a strange move. See NQ section below for our sample trade winner.

Net ticks: +7.5 ticks.

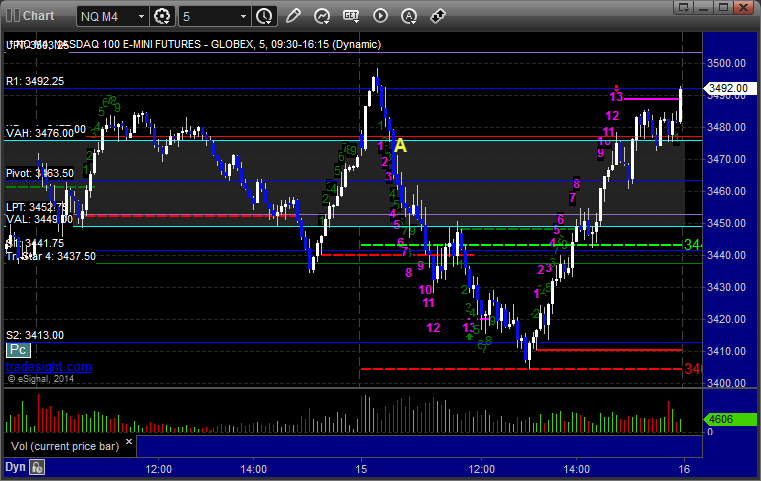

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3475.00, hit first target for 6 ticks, lowered stop twice and stopped second half at 3470.50 for 9 ticks: