What should have been one of the least interesting days of the year waiting for the Fed turned into one of the choppiest days in a while after the Turkish Central Bank took extreme steps to protect their currency. We ended up with a gap down in the market and some extremely wild (though still somewhat narrow) swings back and forth early, then slowed down until the Fed, and then spiked both ways again, settling on a downward direction for a bit, and then rising to close on the VWAP after all of that. NASDAQ volume was 2 billion shares. See ES and NQ sections below for trade recaps.

Net ticks: -8 ticks.

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

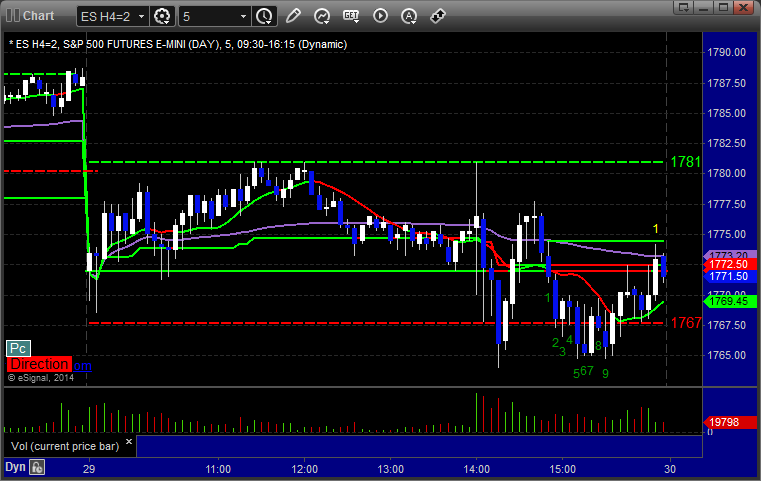

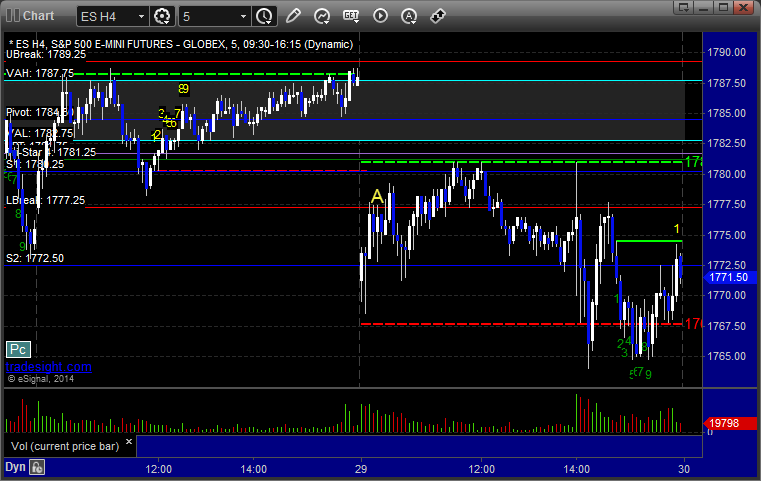

ES:

Triggered long at A at 1778.00 and stopped for 7 ticks. Put it right back in and it triggered again and came within a tick of the first target but then stopped:

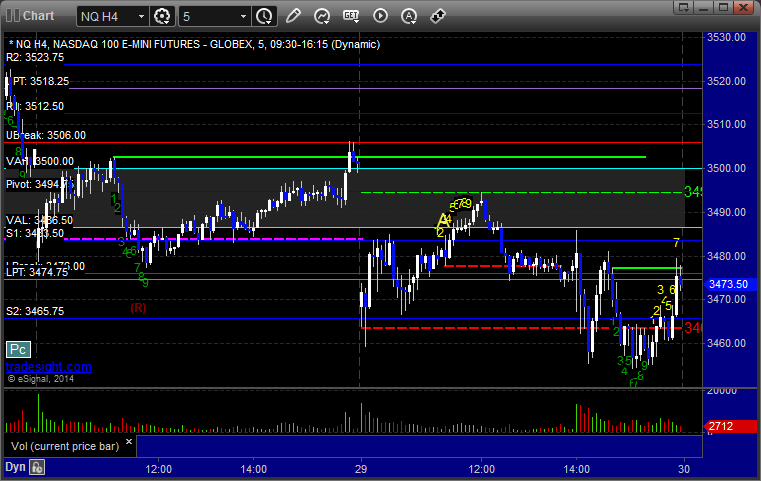

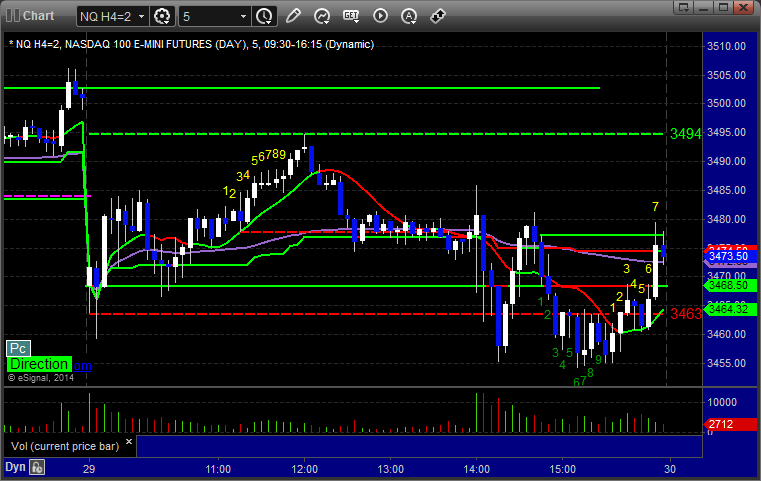

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark’s call triggered long at 3487.00 at A, hit first target for 6 ticks, and stopped second half at the same number, 6 ticks in the money: