One loser that I didn’t re-enter (it worked great the second time). The market gapped down on the “news” that the House failed to pass a second option for the Fiscal Cliff situation. Not that anyone should have been surprised and not that whatever they passed would have gone through the Senate. At any rate, we closed higher than we opened by a bit but left a huge gap above. At the same time, we had options expiration, which caused a lot of volume early, but we still only hit 2 billion NASDAQ shares.

Net ticks: -7 ticks.

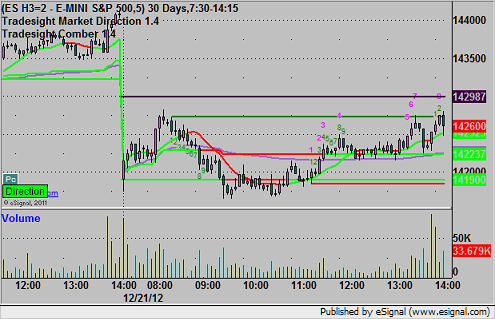

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

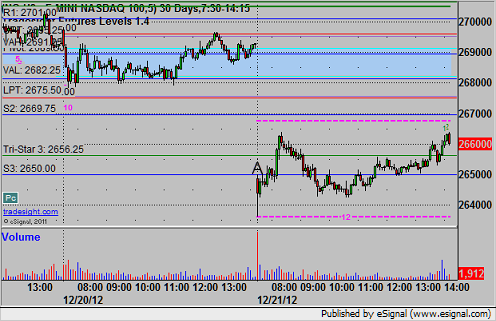

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long on a stop at 2651.00 at A and stopped for 7 ticks but just barely, almost a great play: