Couple of triggers with various results. See ES and NQ sections below. Tomorrow, we start trading the H3 (March 2013) contracts, and the first day of trading a new contract is usually a little sketchy.

Net ticks: -2 ticks.

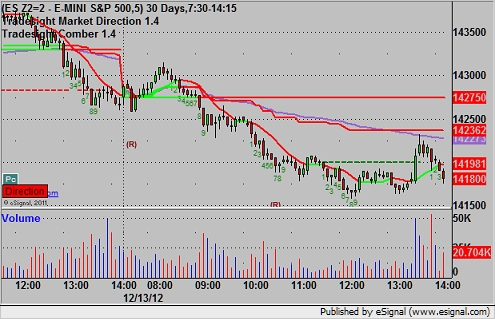

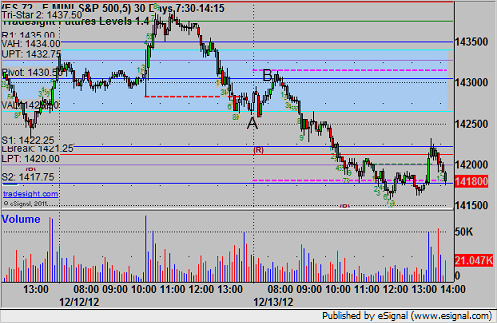

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

My short triggered at A at 1425.75 and stopped for 7 ticks. Mark’s long triggered at B at 1430.75 and stopped for 7 ticks. Both were cancelled in terms of further entries:

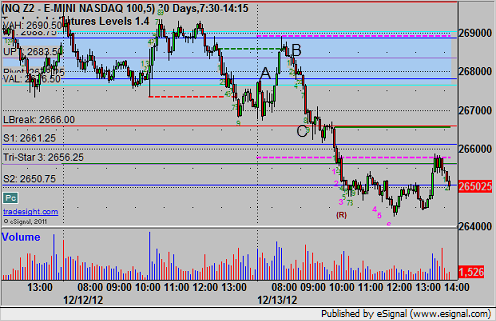

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark’s long triggered at 2679.00 at A and hit the first target and more, closing the final piece on a stop at 2685.50 at B. His short triggered at 2665.50 at C and hit the first target, and the second half stopped over the entry: