The market gapped and I didn’t like the setups that I was seeing, particularly back for weakness in the USD. Fortunately, that wasn’t the direction that we headed anyway. I put in a short idea which triggered and stopped, see EURUSD below with some notes.

Here’s a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight. Back to normal after the gap hopefully.

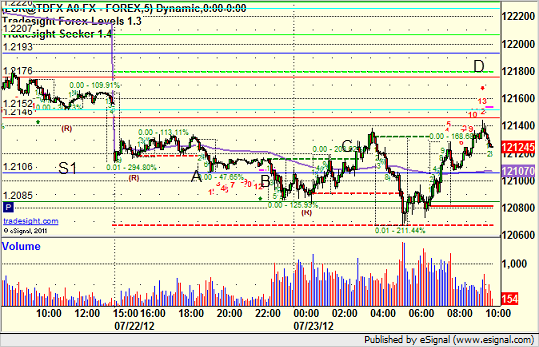

EURUSD:

Set the S1 level exactly at A, triggered short at B, stopped at C. Note that the high of the session was the Seeker 13 sell signal at D: