Some winners and a loser in the GBPUSD to close out the week and month of May. Glad it is over.

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts heading into the new week with the Seeker and Comber counts separately, and then look at the US Dollar Index.

From the perspective of the Seeker and Comber, there is a lot going on for once, all of which suggests a likely reversal to the downside of the USD and to the upside on the EUR. That might not make sense to many given the news, but the technicals are saying so. We shall see.

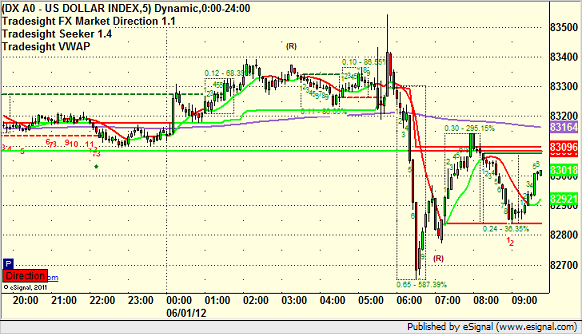

US Dollar Index intraday from Thursday/Friday with our market directional lines:

New calls and Chat Sunday afternoon.

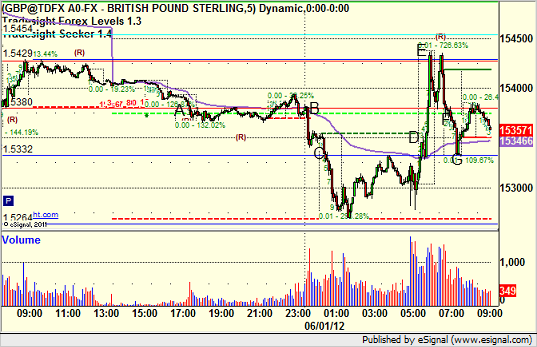

GBPUSD:

Triggered short early at A (half size night ahead of NFP), but gave you hours to enter all the way to B without stopping. Hit first target at C, lowered stop and stopped at D. Triggered the long at E and stopped. Triggered short again at F, hit first target at G, and closed out the final at the end of the chart for the end of the week: