Forex Calls Recap for 1/27/15

Some good ranges, but our GBPUSD stopped before working great later. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The second half of the EURUSD from the prior day stopped (just barely, by 2 pips at the low of the session):

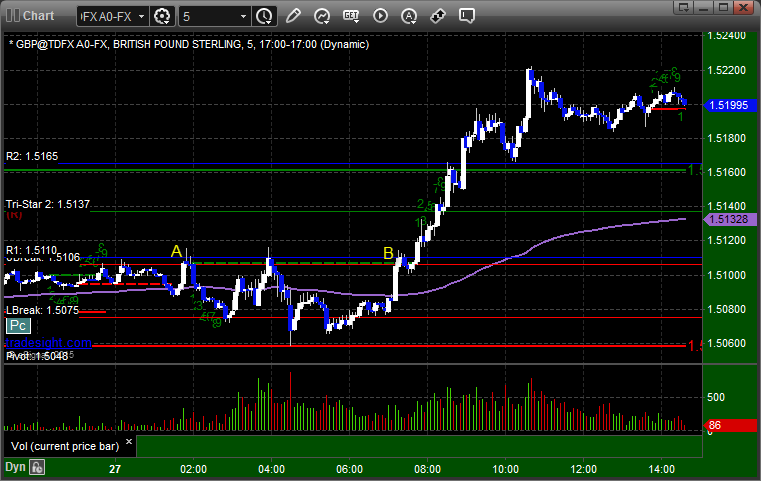

GBPUSD:

Triggered long at A and stopped. Unfortunately, triggered again in the morning at B before I got back up to put it back in and it worked for 100 pips:

Stock Picks Recap for 1/26/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MCHP triggered long (with market support) and didn't go enough in either direction to count:

CREE triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

Rich's YHOO triggered long (with market support) and didn't work:

His AMZN triggered short (without market support) and worked enough for a partial:

His ALXN triggered long (with market support) and worked enough for a partial:

FSLR triggered long (without market support) and worked great:

Rich's GNRC triggered short (without market support) and didn't work:

Mark's ISIS triggered long (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

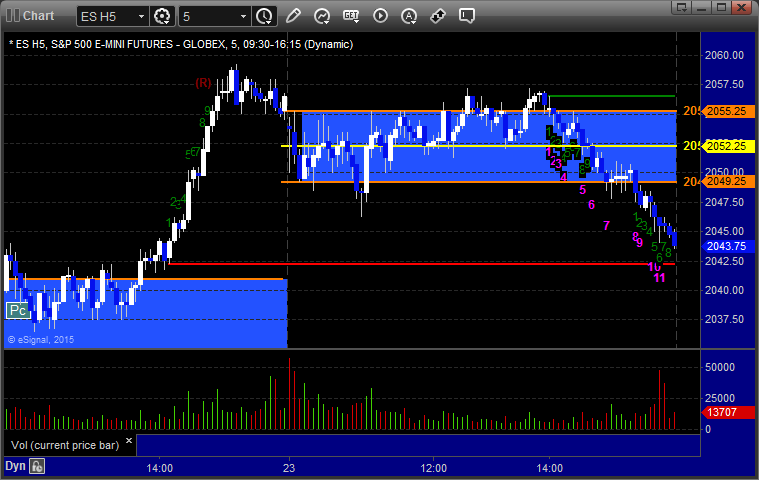

Futures Calls Recap for 1/26/15

The markets moved lower early and then recovered, but we got a horrible volume number after the first hour due to the storm back East. The ES Opening Range play worked a little (see that section below) and then we had small gains on a separate ES call that stopped once and worked a second time. NASDAQ volume was only 1.5 billion shares and should be worse Tuesday with the storm really hitting overnight tonight.

Net ticks: +1.5 ticks.

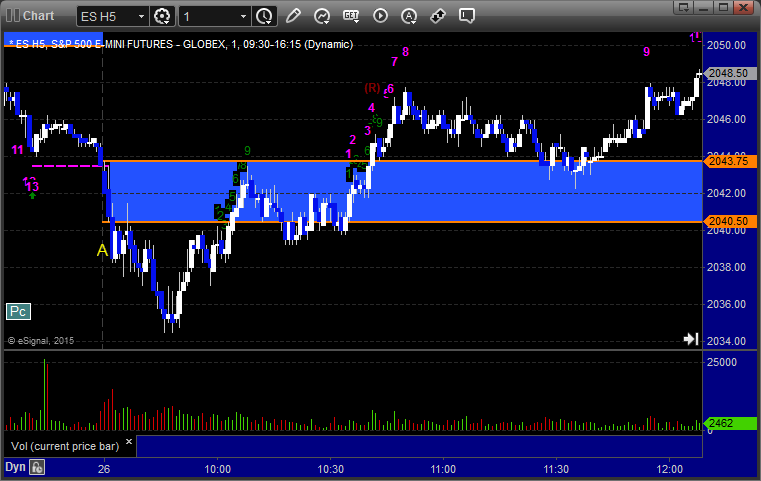

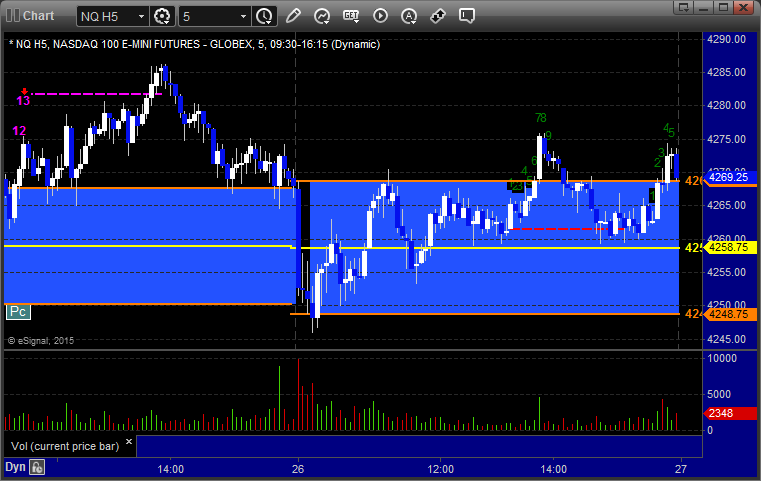

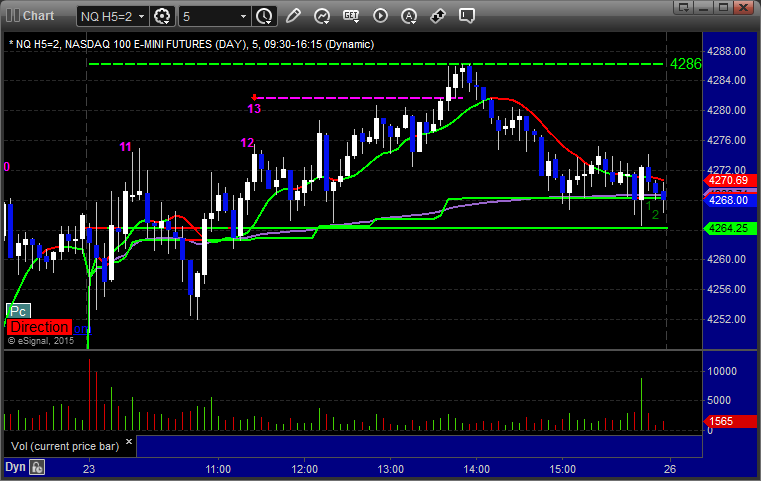

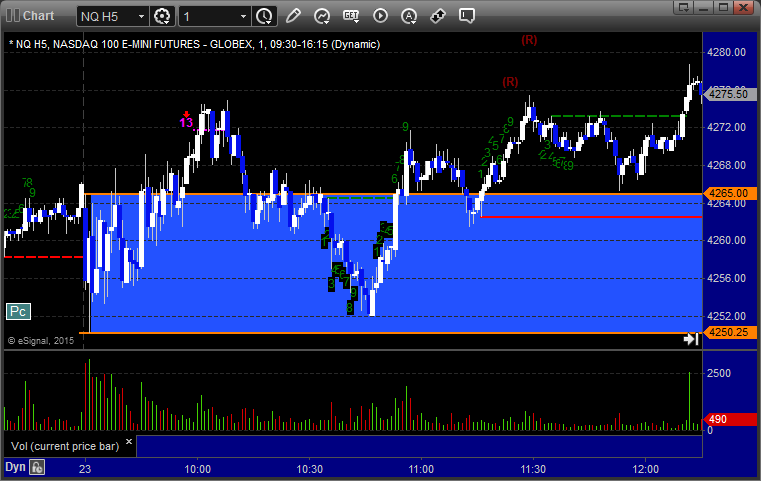

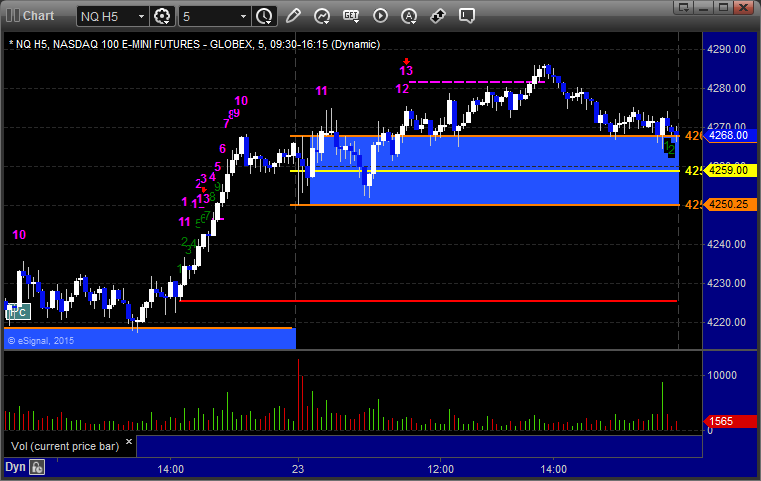

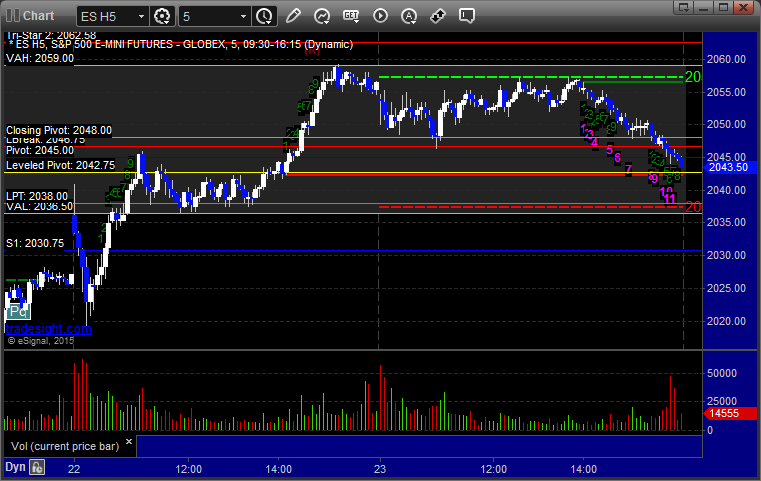

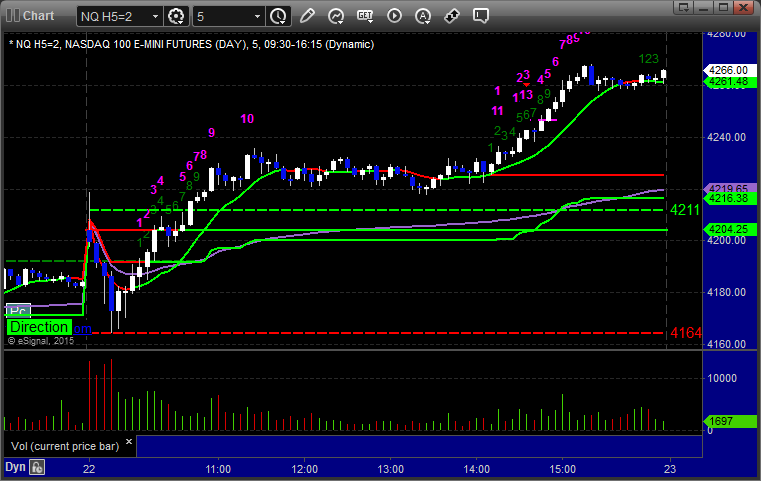

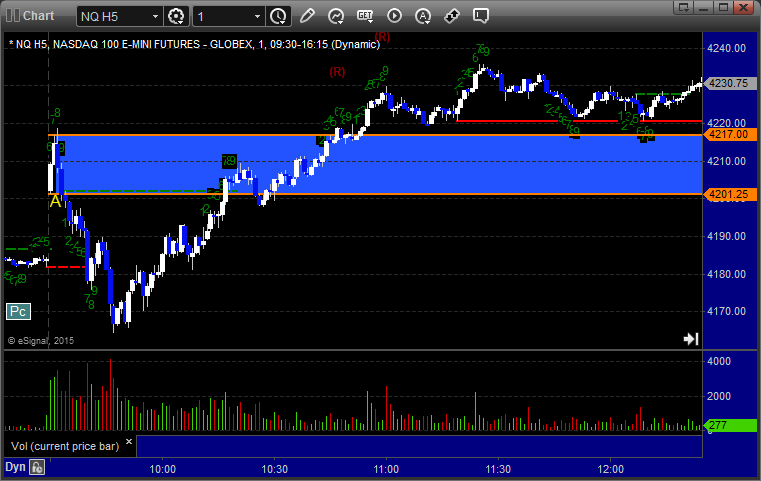

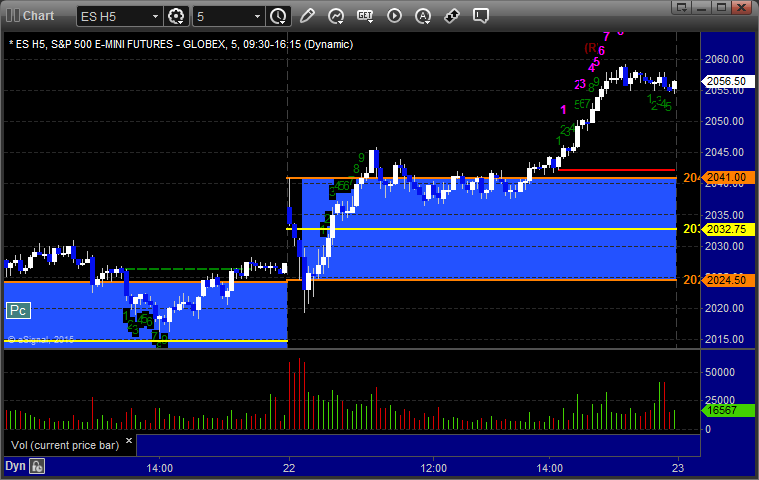

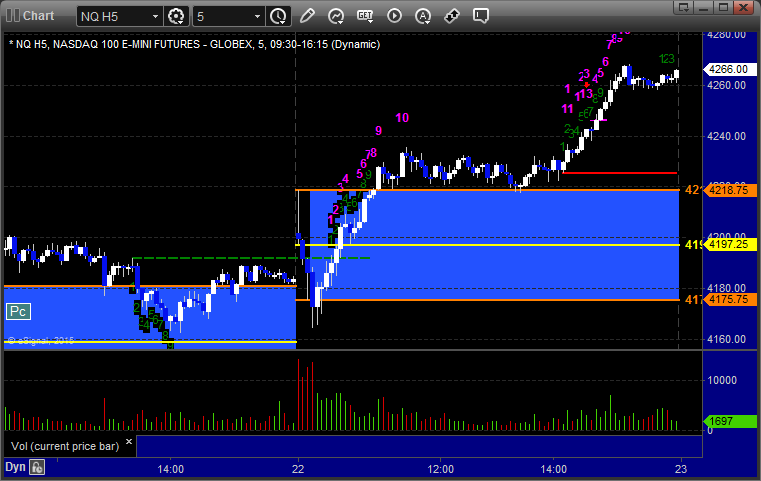

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

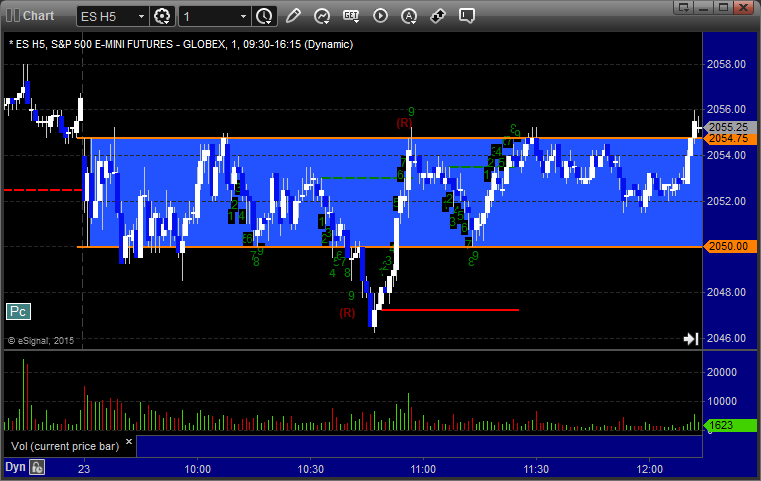

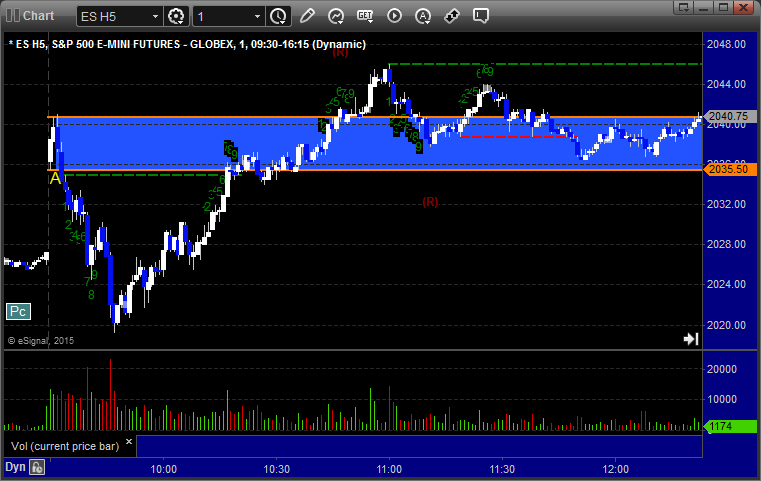

ES and NQ with Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2043.00 and stopped. Put it back in and it triggered again at B, hit first target for 6 ticks, and closed second half for 11 ticks:

Forex Calls Recap for 1/26/15

A winner to start the week after a gap at the Sunday open in the EURUSD. See that section below.

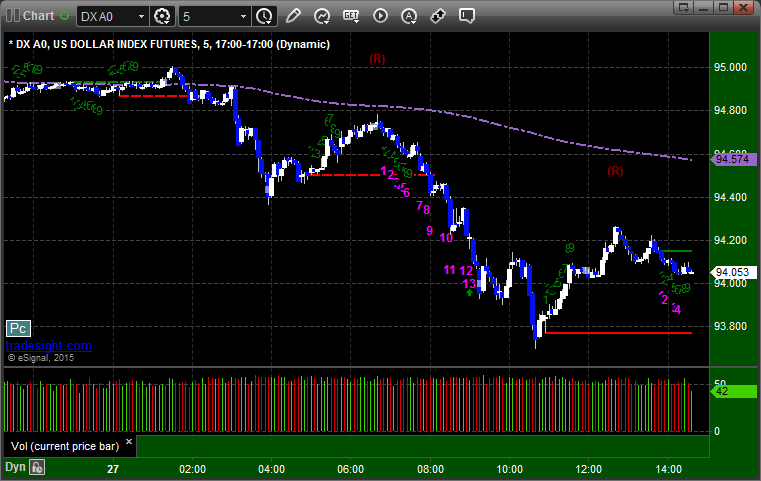

Here's a look at the US Dollar Index intraday with our market directional lines:

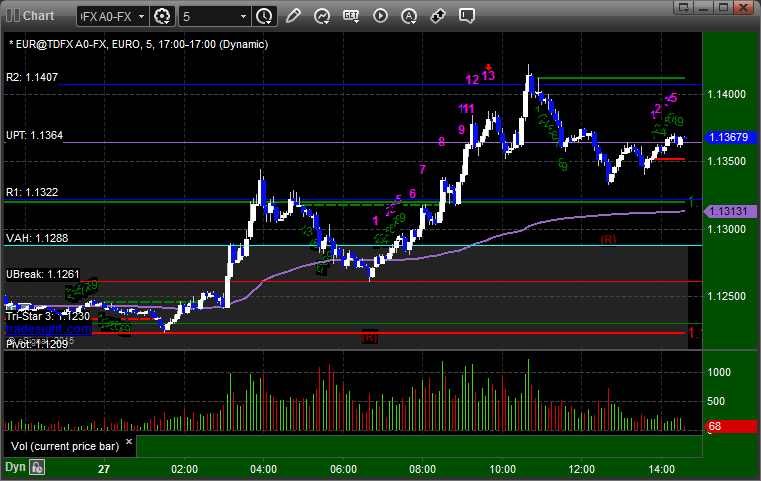

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under the Pivot:

Stock Picks Recap for 1/23/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CRUS and CELG gapped over, no official plays, although CRUS worked after:

From the Messenger/Tradesight_st Twitter Feed, Rich's TBT triggered long (ETF, so no market support needed) by a penny and didn't work:

His SLB triggered short (with market support) and didn't work:

His FAS triggered short (ETF, so no market support needed) and worked:

His NEM triggered short (barely with market support) and didn't work:

In total, that's 4 trades triggering with market support, 1 of them worked, 3 did not.

Futures Calls Recap for 1/23/15

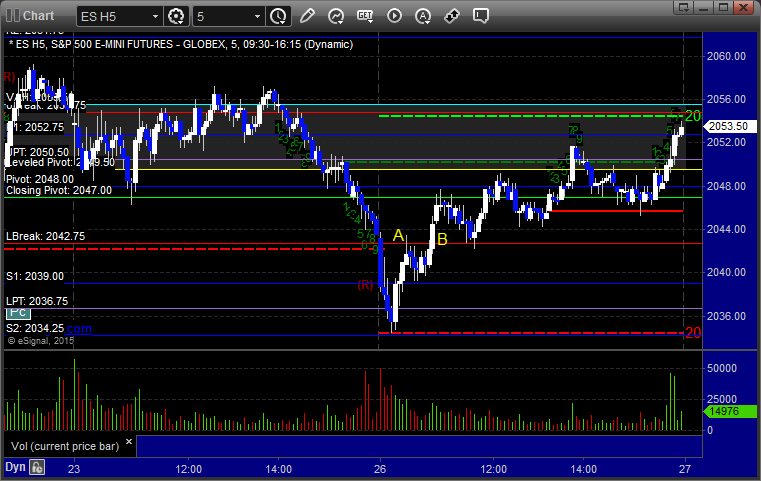

A totally dead session, even moreso than I would have expected for the Friday in the middle of core earnings. The ES basically stuck in a 5-point range for most of the session, and even the Opening Range plays didn't do much. A waste of a trading day. NASDAQ volume closed at 1.5 billion shares. We spent a painfully big piece of the day inside the Opening 2-minute Range.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES with Levels:

Forex Calls Recap for 1/23/15

We wrap up one of the slowest, most disappointing weeks in Forex in a while with no triggers at all. The GBPUSD played exactly with the LBreak short trigger but never broke it by enough. The range was horrible there. The EURUSD was where the play was at.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Make sure you check out the EURUSD, GBPUSD, and US Dollar sections in particular.

EURUSD:

GBPUSD:

Stock Picks Recap for 1/22/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TASR triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered short (with market support) and worked:

Mark's XLNX triggered short (with market support) and worked:

BIDU triggered short (with market support) and worked enough for a partial:

Rich's SNDK triggered long (without market support) and didn't work under our usual rules, although Rich gave different guidance for this play in the Lab:

Rich's TBT triggered long (ETF, so no market support needed) and worked:

AAPL triggered long (with market support) and worked:

Rich's FB triggered long (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

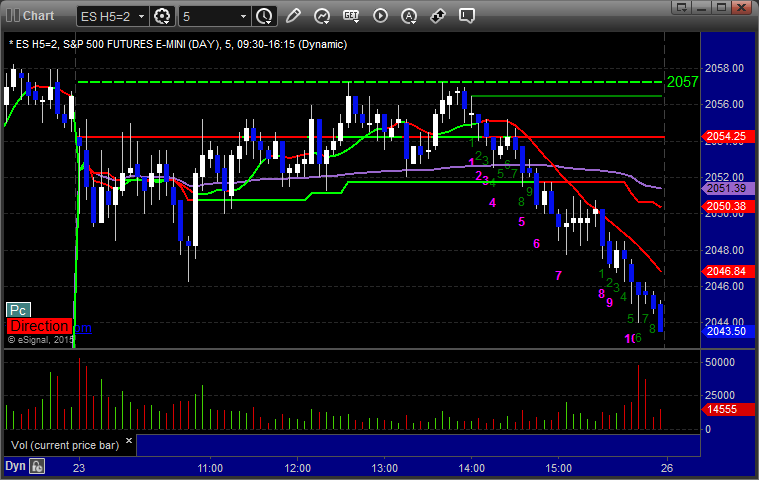

Futures Calls Recap for 1/22/15

The Opening Range plays worked again, the Institutional Ranges were too wide to take, and we had another nice ES call winner (the Value Area play) that worked well. See the ES section below.

Net ticks: +10 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play was a little too wide to trade today:

NQ Tradesight Institutional Range Play, same deal:

ES with Levels:

Triggered short at A at 2029.75 and hit first target for 6 ticks, lowered stop twice and stopped at 2026.25 for 14 ticks:

Forex Calls Recap for 1/22/15

A painfully slow week continues in Forex with two more stop outs in the EURUSD, although it worked later if you were awake to take it again. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

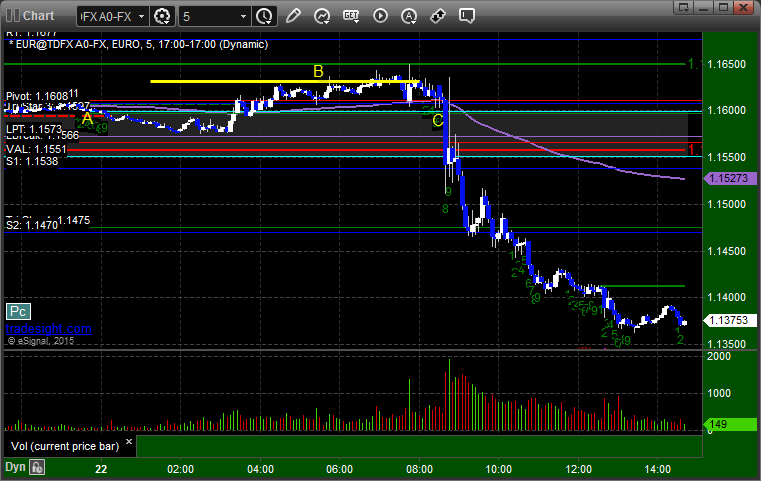

EURUSD:

Triggered short at A and stopped. Triggered long at B and stopped. Too bad, because if you were awake to take it again, the next trigger short at C worked: