Tradesight Recap Report for 4/22/24

Today in the Markets:

The markets gapped up, pulled back to almost fill the gaps, then rallied higher and topped out on a Comber 13 sell signal for the ES, NQ, and RTY all around the same time.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

6B with Levels:

Futures:

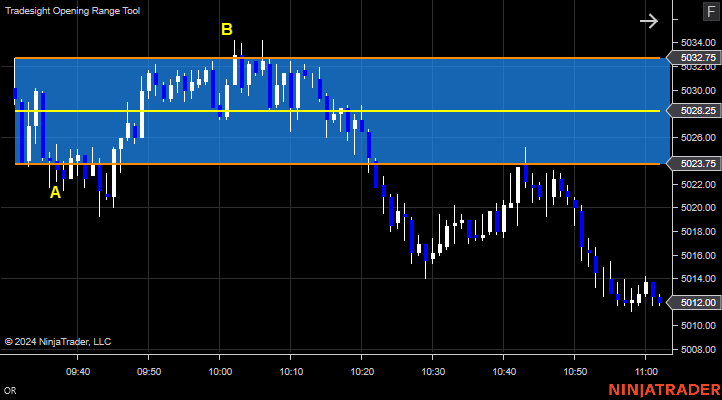

Not a great day for the Opening Range plays.

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B and stopped under the midpoint:

Additional Futures Calls:

None

Results: -16 ticks.

Stocks:

A couple of losers for the session.

These are the Tradesight calls that triggered, Rich's AXP triggered long (no market support due to first 5-minutes) and stopped. Worked if you took it again later in the day:

His AMAT triggered short (with market support) and didn't work:

His ZM triggered short (with market support) and didn't work:

That's 2 triggers with market support, and they both didn't work.

Tradesight Recap Report for 4/15/24

Today in the Markets:

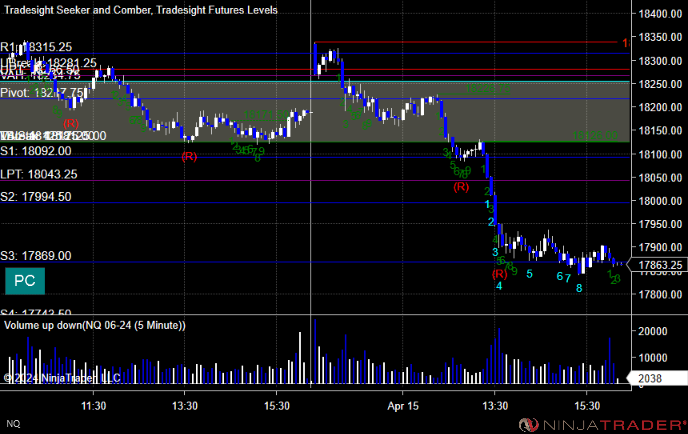

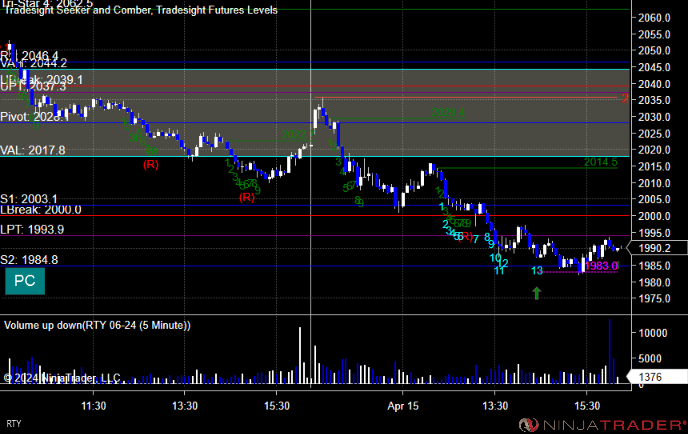

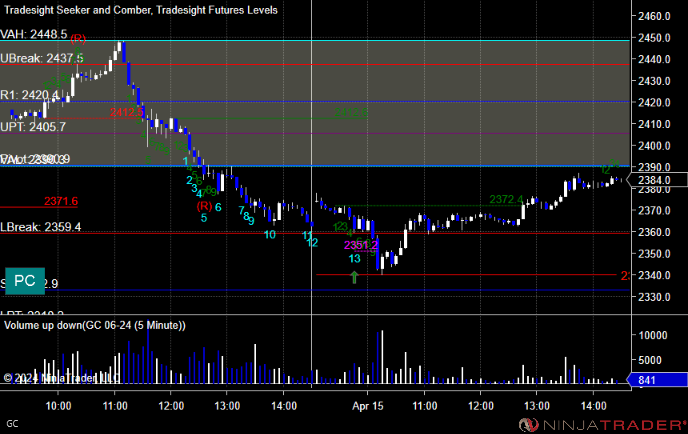

The markets gapped up and sold off a lot on 5.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

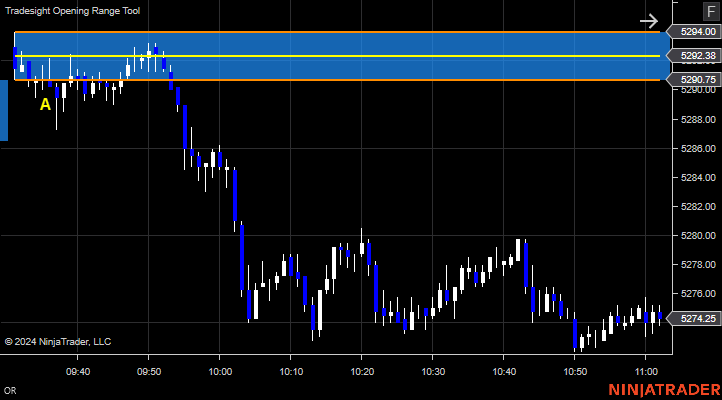

ES Opening Range Play, triggered short at A and worked:

Additional Futures Calls:

None.

Results: +8 ticks

Stocks:

Two calls triggered. Big day.

These are the Tradesight calls that triggered, EL triggered short (with market support) and worked:

Rich's WDAY triggered short (with market support) and worked:

That's 2 triggers with market support, both worked.

Tradesight Recap Report for 4/12/24

Today in the Markets:

The markets gapped down on concerns in the Middle East and went lower and the S&P closed at the low of the week on 5.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing here under the rules.

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take.

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

One loser.

These are the Tradesight calls that triggered, COST PT play triggered short (with market support) and didn't work:

That's 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 4/11/24

Today in the Markets:

We gapped up slightly after a big move premarket, then pulled back, then rallied hard on 5.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

These are the Tradesight calls that triggered, FSLR PT play triggered short (with market support) and worked:

WYNN PT play triggered long (with market support) but didn't go enough to count:

Rich's NVDA triggered long (without market support) and worked big:

That's 2 triggers with market support, 1 worked and 1 didn't do anything.

Tradesight Recap Report for 4/10/24

Today in the Markets:

The markets gapped down, rallied a bit, and then went dead flat all day on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

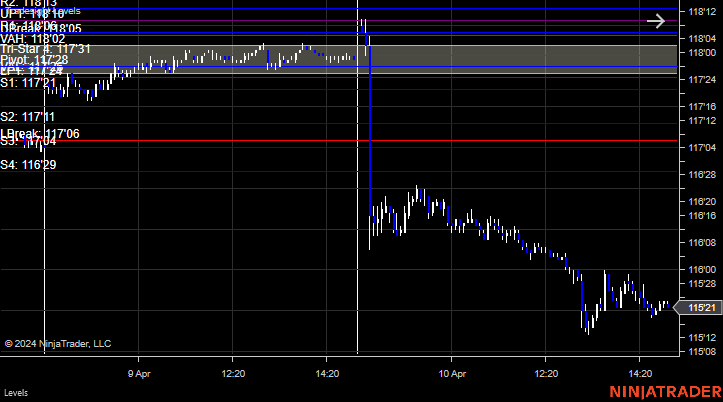

NQ with Levels:

RTY with Levels:

YM with Levels:

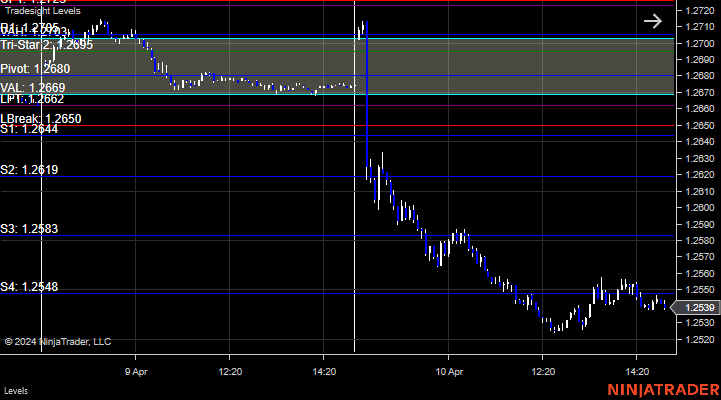

6B with Levels:

ZB with Levels:

Futures:

One loser for the session.

ES Opening Range Play, triggered long at A and stopped:

Additional Futures Calls:

None.

Results: -20 ticks.

Stocks:

Too flat for any of the calls to trigger.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 4/9/24

Today in the Markets:

The markets gapped up and sold off sharply, then recovered to about even on 5.1 billion NASDAQ shares.

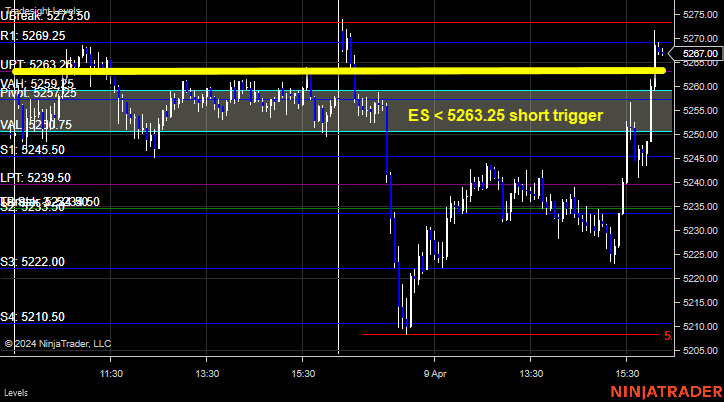

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

6B with Levels:

CL with Levels:

Futures:

Two winners and a loser for the session.

ES Opening Range Play, triggered long at A and stopped, triggered short at B and worked enough for a partial:

Additional Futures Calls, triggered short at 5263 and worked:

Results: +7 ticks.

Stocks:

Three clean winners for the session.

These are the Tradesight calls that triggered, Rich's VLO triggered short (with market support) and worked:

His META triggered short (with market support) and worked:

His XLE triggered short (ETF, so no market support needed) and worked:

That's 3 triggers with market support, and they all worked.

Tradesight Recap Report for 3/28/24

Today in the Markets:

Dead day ahead of the long Easter weekend. See you Monday.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

A small winner again for the session.

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

A winner for the session.

BBWI, which was a call the other day that was good all week due to the length of the pattern, triggered long (with market support) and worked:

These are the Tradesight calls that triggered, BANC triggered long (without market support) and worked:

That's 1 trigger with market support and it worked..

Tradesight Recap Report for 3/27/24

Today in the Markets:

The markets gapped up a little, came back to fill the gaps, then went dead flat for hours before running up in the last 30 minutes on 5.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

ZB with Levels:

Futures:

A small winner for the session.

ES Opening Range Play, triggered short at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

Three winners for the session.

These are the Tradesight calls that triggered, Rich's AMAT triggered short (with market support) and worked:

His LRCX triggered short (with market support) and worked:

His UBER triggered short (with market support) and worked:

That's 3 triggers with market support, and they all worked.

Tradesight Recap Report for 3/26/24

Today in the Markets:

The markets gapped up a little and were dead flat all day until the last 30 minutes, then dropped suddenly on 4.8 billion NASDAQ shares.

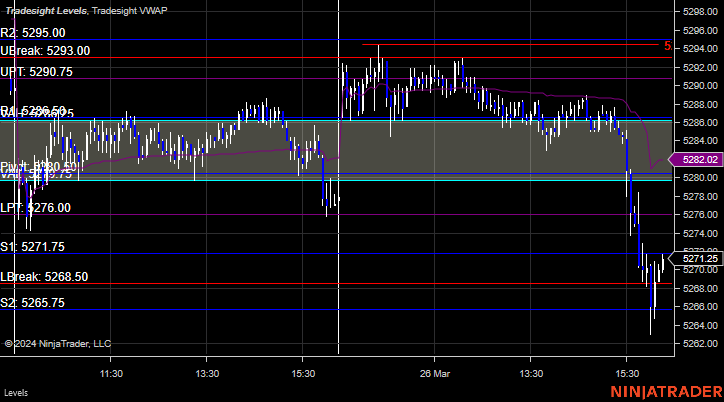

ES with Levels:

ES with Market Directional:

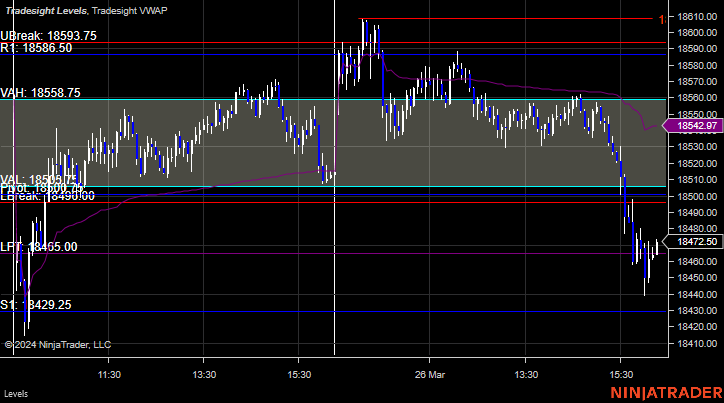

NQ with Levels:

RTY with Levels:

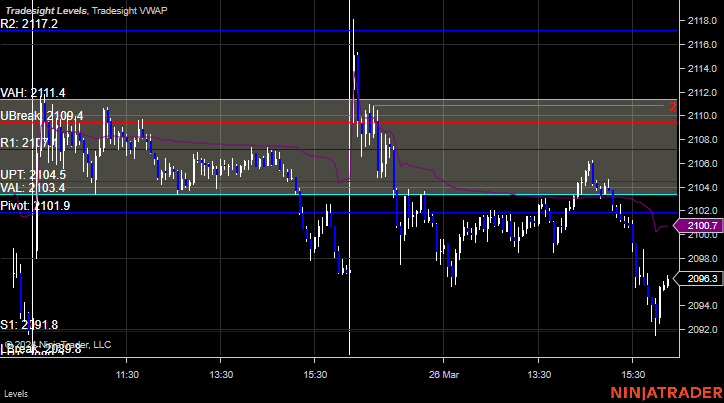

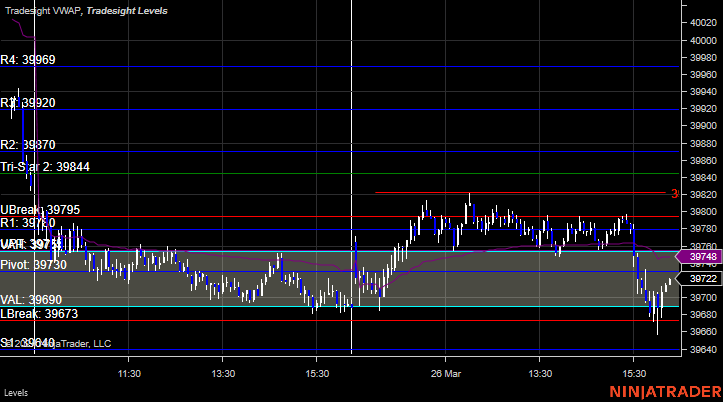

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

A loser for the session, and look how flat the futures were for the first 90 minutes.

ES Opening Range Play, triggered long at A and stopped:

Additional Futures Calls:

None.

Results: -18 ticks.

Stocks:

Two late day small winners for the session.

These are the Tradesight calls that triggered, Rich's AVGO triggered short (with market support) too late in the day and worked a little:

His AMAT triggered short (with market support) and worked a little:

That's 2 triggers with market support, and they both worked a little.

Tradesight Recap Report for 3/25/24

Today in the Markets:

The markets gapped down and closed inside the open candle without filling the gap on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

ZB with Levels:

CL with Levels:

Futures:

A small winner.

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

A nice green day to start the short week.

These are the Tradesight calls that triggered, PYPL PT play triggered long (with market support) but didn't go enough to count:

Rich's HOOD PT play triggered long (with market support) and worked:

That's 3 triggers with market support, and 2 worked and 1 did not do anything.