Tradesight Recap Report for 4/25/25

Today in the Markets:

The markets opened flat and closed barely higher on 7.1 billion NASDAQ shares.

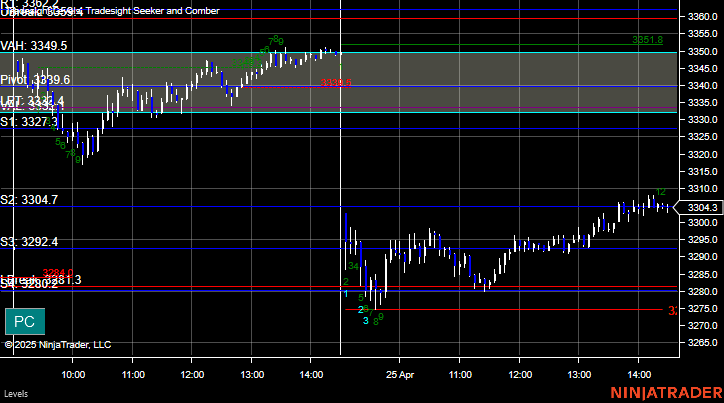

ES with Levels:

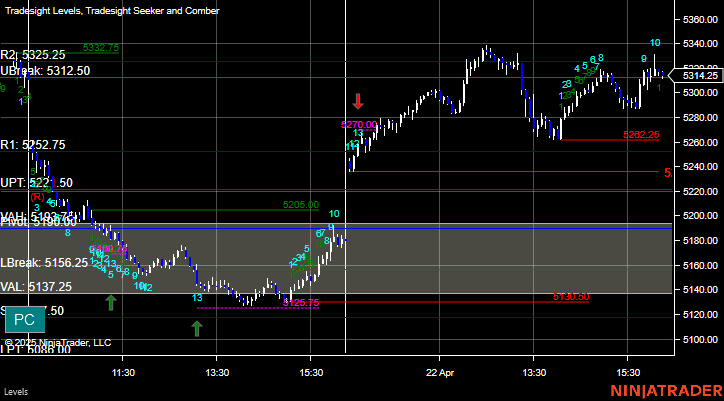

ES with Market Directional:

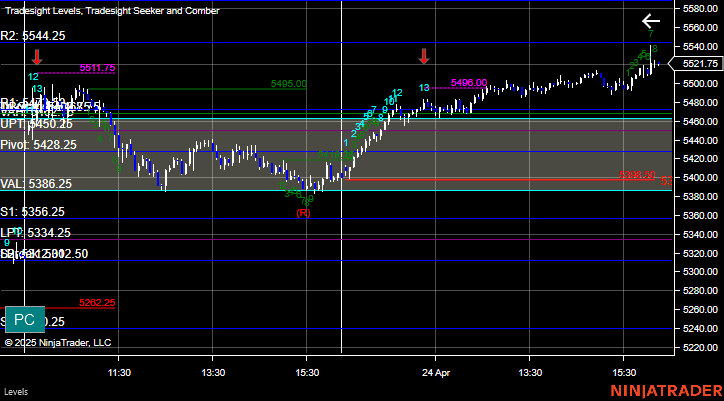

NQ with Levels:

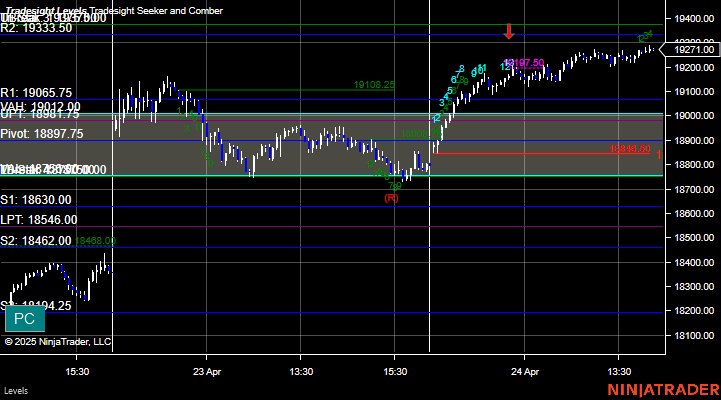

RTY with Levels:

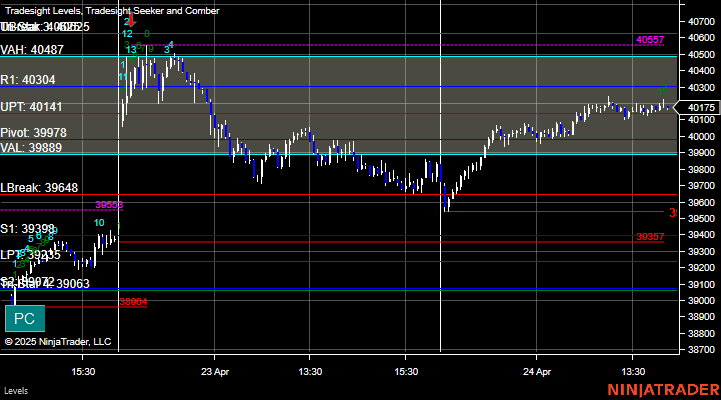

YM with Levels:

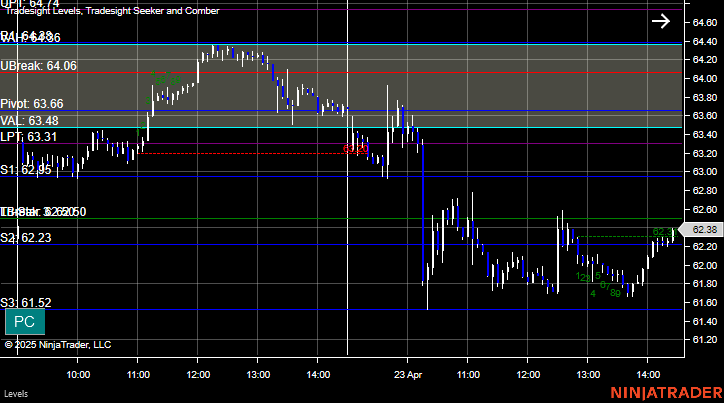

CL with Levels:

GC with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Two winners but without market support.

These are the Tradesight calls that triggered, Rich's ADBE triggered long (without market support) and worked:

His UNH triggered short (without market support) and worked:

His ENPH triggered short (without market support due to first 5-minute) and didn't work:

That's 0 triggered with market support.

Tradesight Recap Report for 4/24/25

Today in the Markets:

A flat opening and then we drifted higher on 6.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

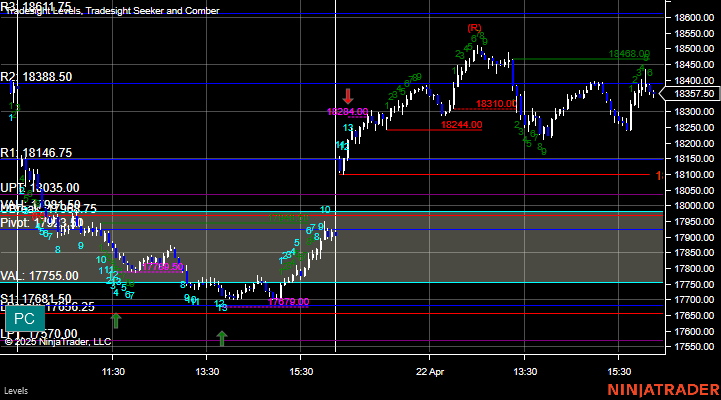

NQ with Levels:

RTY with Levels:

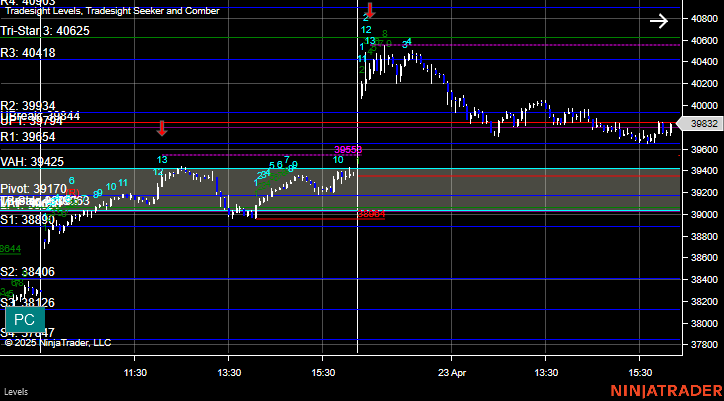

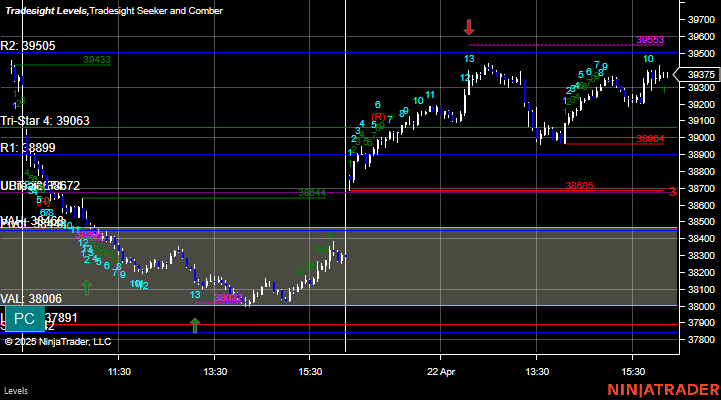

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A winner for the session.

These are the Tradesight calls that triggered, Rich's NFLX triggered long (without market support due to first 5-minute) and worked:

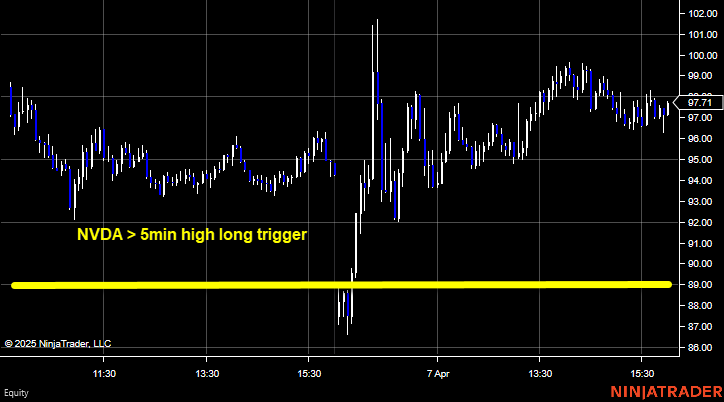

His NVDA triggered long (with market support) and worked:

His ETSY triggered short (without market support due to first 5-minutes) and worked:

That's 1 trigger with market support, and it worked.

Tradesight Recap Report for 4/23/25

Today in the Markets:

The markets gapped up and drifted lower on 6.8 billion NASDAQ shares.

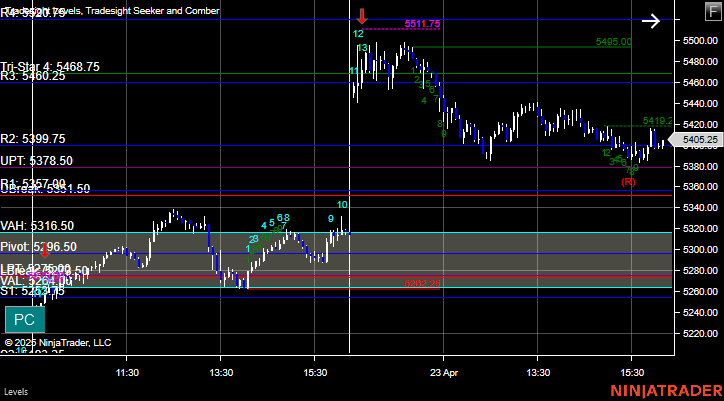

ES with Levels:

ES with Market Directional:

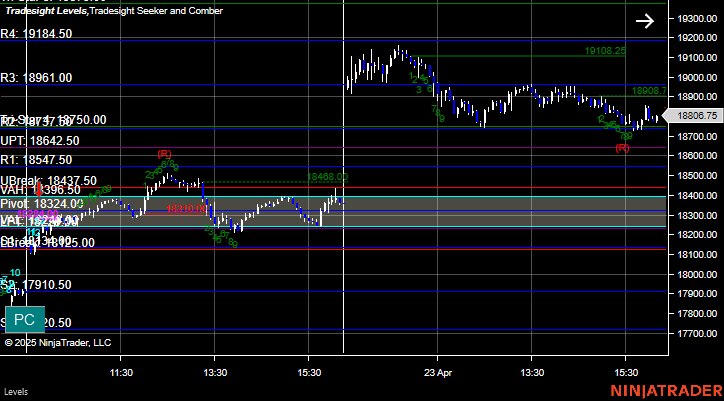

NQ with Levels:

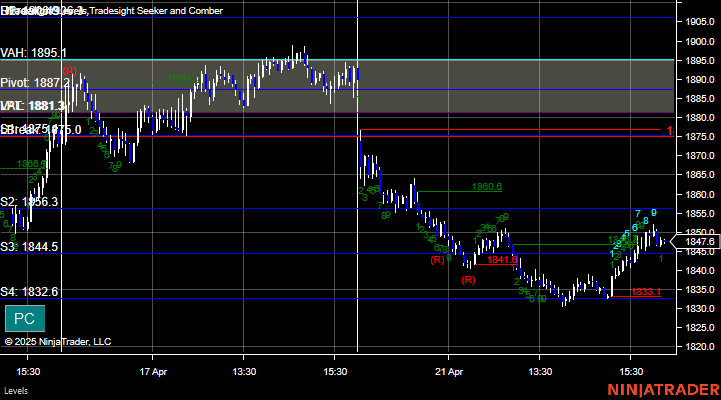

RTY with Levels:

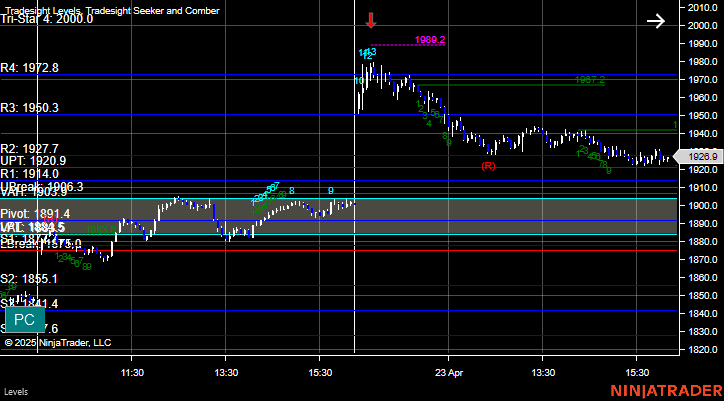

YM with Levels:

ZB with Levels:

CL with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No valid triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 4/22/25

Today in the Markets:

The markets gapped up and went higher on 7.2 billion NASDAQ shares.

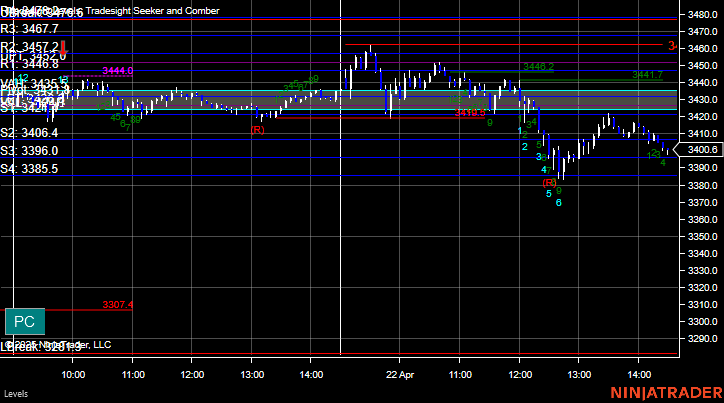

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

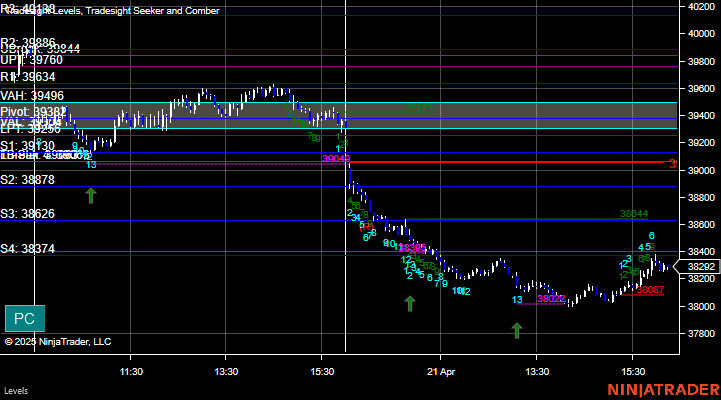

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Nothing.

These are the Tradesight calls that triggered, Rich's INTC triggered long (without market support due to first 5-minutes) and worked:

That's 0 triggers with market support.

Tradesight Recap Report for 4/11/25

Today in the Markets:

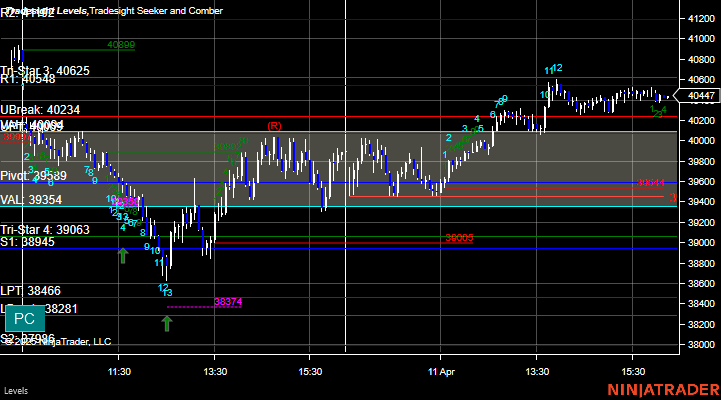

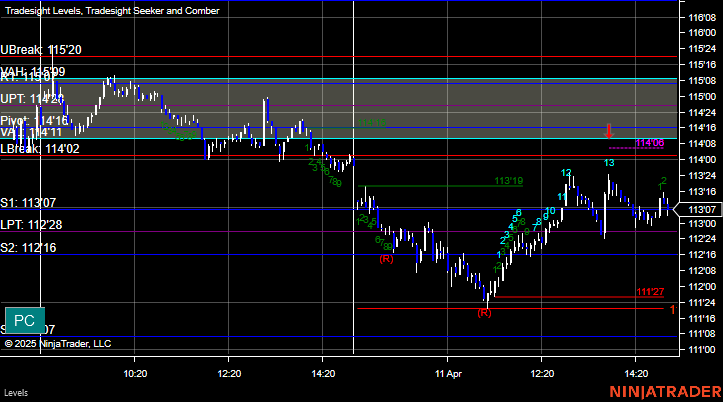

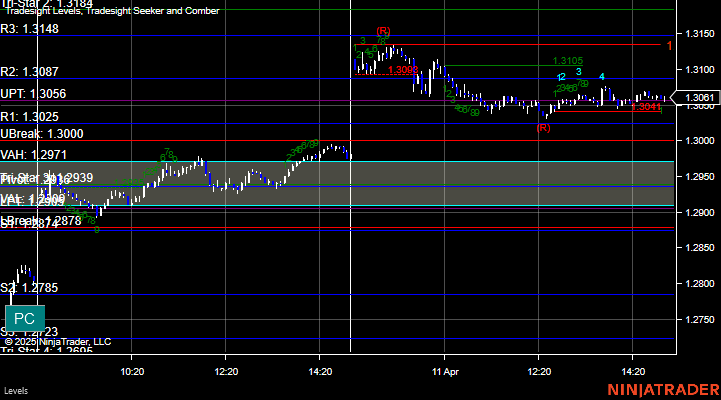

Dead flat open, mostly flat day on 6.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

ZB with Levels:

6B with Levels:

Futures:

No triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 4/21/25

Today in the Markets:

The markets gapped down and went lower on 8.8 billion NASDAQ shares.

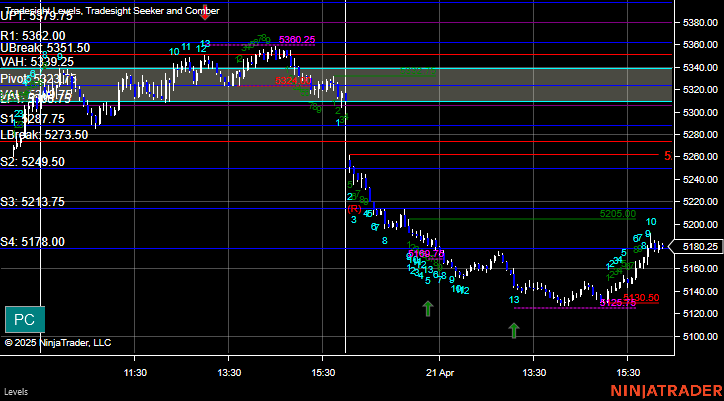

ES with Levels:

ES with Market Directional:

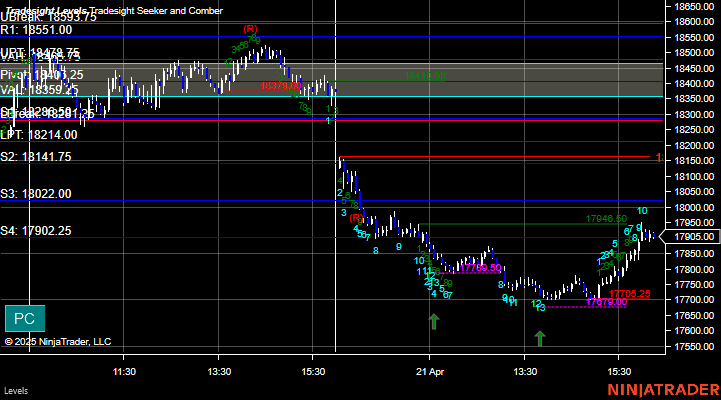

NQ with Levels:

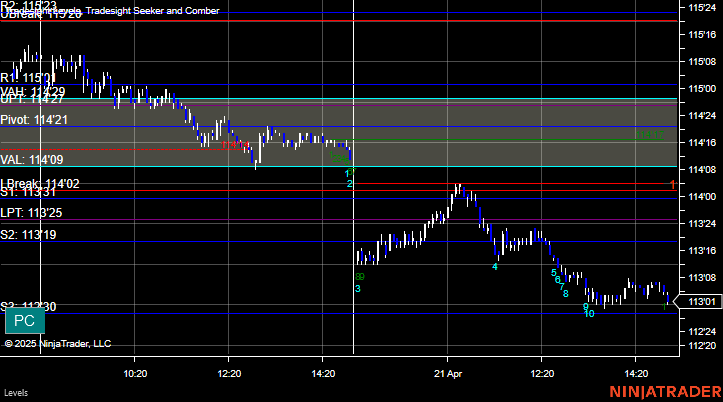

RTY with Levels:

YM with Levels:

ZB with Levels:

Futures:

No triggers.

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Winners all around.

These are the Tradesight calls that triggered, Rich's AAPL triggered short (with market support) and worked:

His UNH triggered short (with market support) and worked:

His DE triggered short (without market support due to first 5-minute) and worked:

That's 2 triggered with market support, and both worked.

Tradesight Recap Report for 4/10/25

Today in the Markets:

The markets gapped down a little and went flat on 8.1 billion NASDAQ shares.

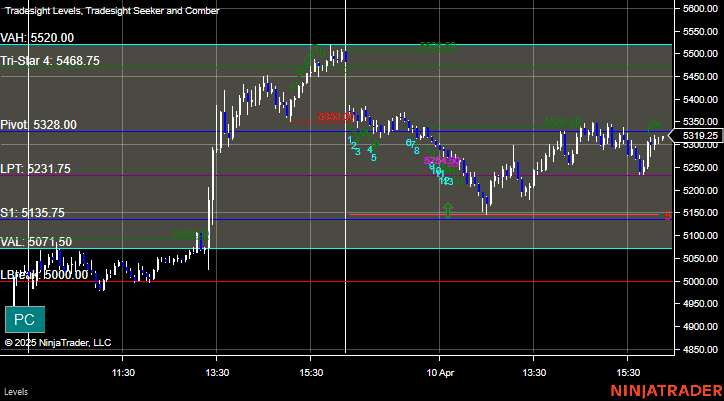

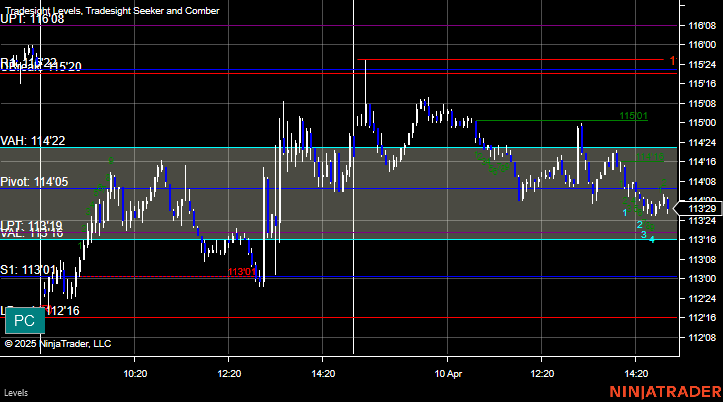

ES with Levels:

ES with Market Directional:

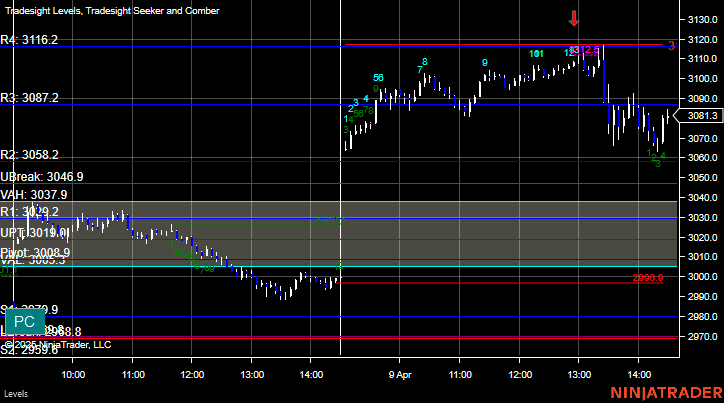

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

ZB with Levels:

Futures:

No valid triggers in futures.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take.:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Nothing triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 4/9/25

Today in the Markets:

The markets opened flat and stayed flat until they spiked on the Fed announcement.

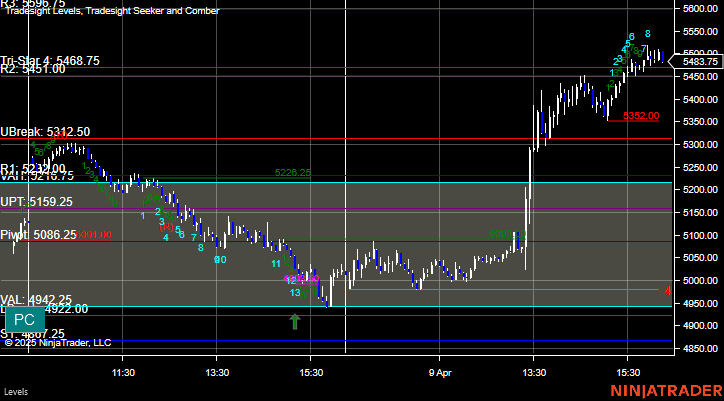

ES with Levels:

ES with Market Directional:

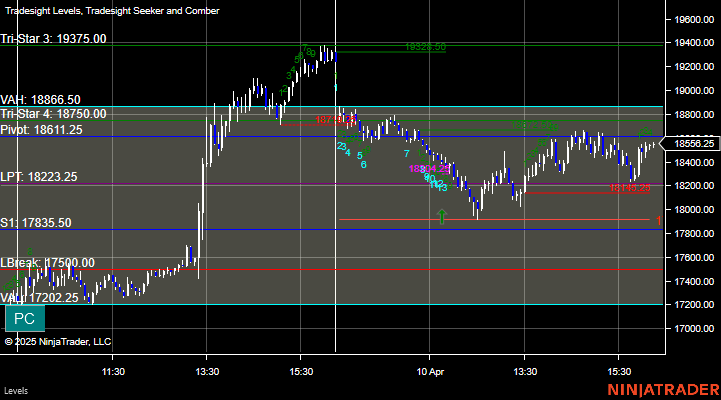

NQ with Levels:

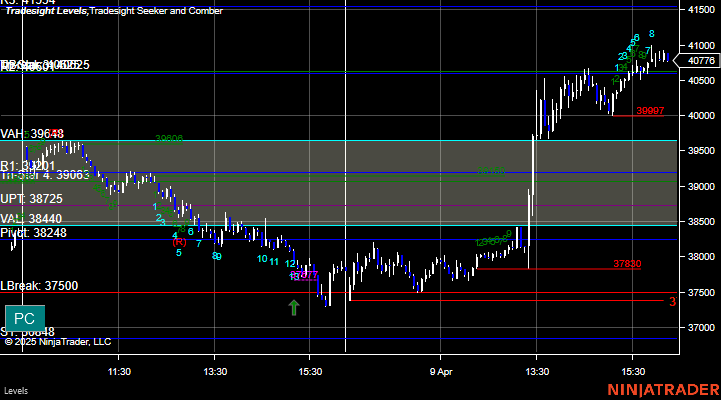

RTY with Levels:

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A super nice winner for the session again.

These are the Tradesight calls that triggered, Rich's AVGO triggered long (with market support) and worked:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 4/8/25

Today in the Markets:

The markets gapped up and sold off on 9.8 billion NASDAQ shares.

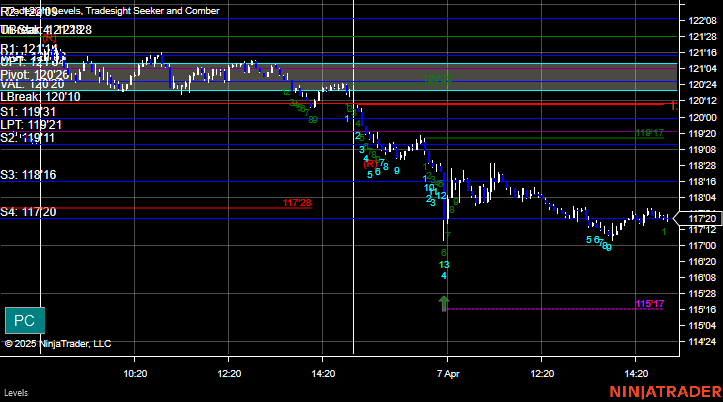

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

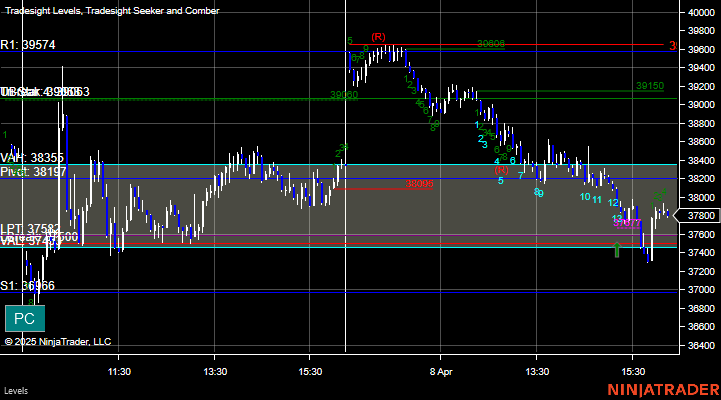

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Two winners.

These are the Tradesight calls that triggered, Rich's HOOD triggered long (without market support) and worked enough for a partial:

His BIIB triggered short (with market support) and worked:

His UPS triggered short (with market support) and worked:

That's 2 triggered with market support, both worked.

Tradesight Recap Report for 4/7/25

Today in the Markets:

The markets gapped down and spiked to fill quickly and then went flat on 8.9 billion NASDAQ shares.

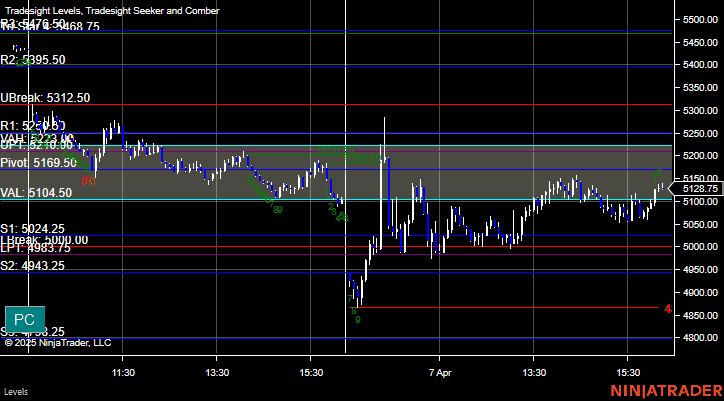

ES with Levels:

ES with Market Directional:

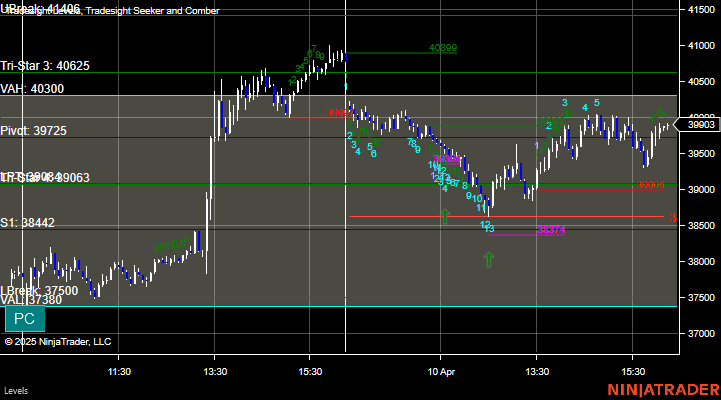

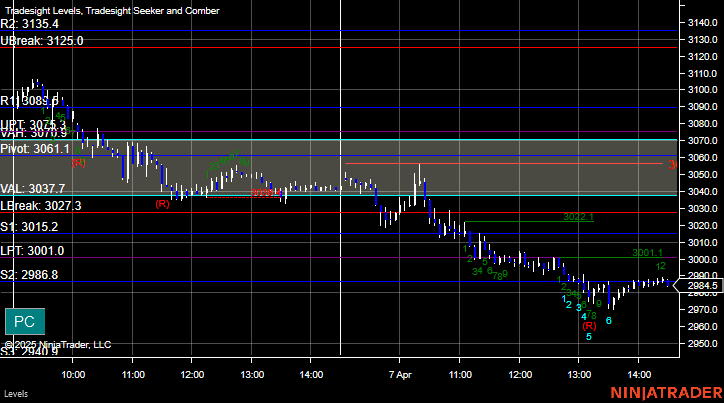

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

ZB with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A small winner for the session.

These are the Tradesight calls that triggered, Rich's NVDA triggered long (with market support) and worked:

That's x triggered with market support, y worked and z did not.