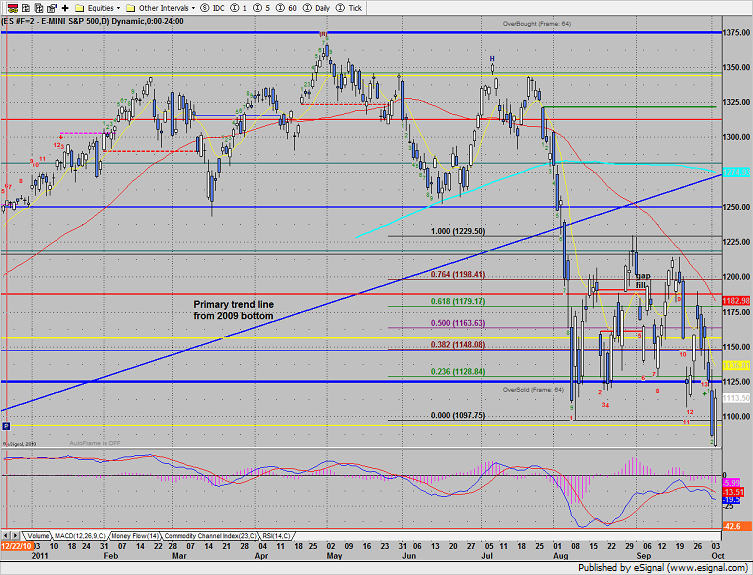

Reversal day? The ES was higher by 27 on the after recovering a gap down, the powering higher very late in the session. By definition, this was not at key reversal day because the prior day’s range was not engulfed but it was a very notable session none the less. Reclemation of the 1125 level would be the next positive for the bulls to build on. Wednesday, before the open, the ADP employment number will be released and should be very important for price action leading up to Friday’s NFP number.

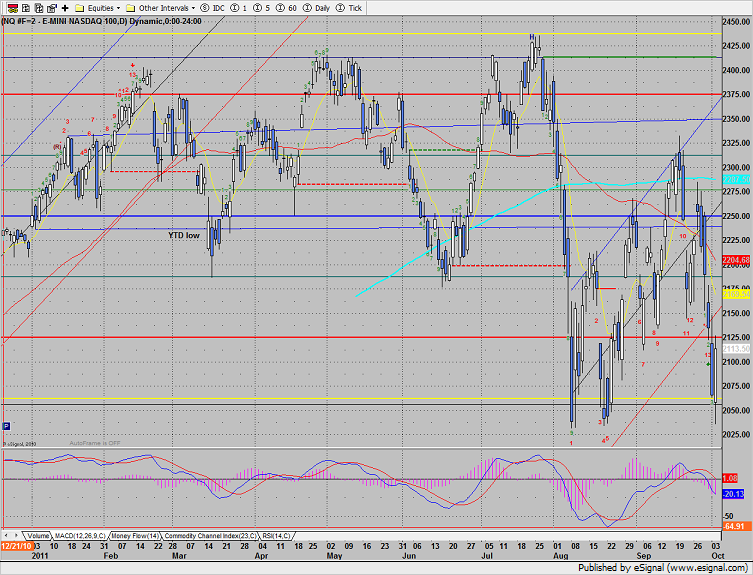

The NQ futures tested but did not break the August low which keeps the chart technically stronger than the broad market futures. This could be a very important foundation of a reversal but keep in mind that a reversal isn’t a reversal until the follows through.

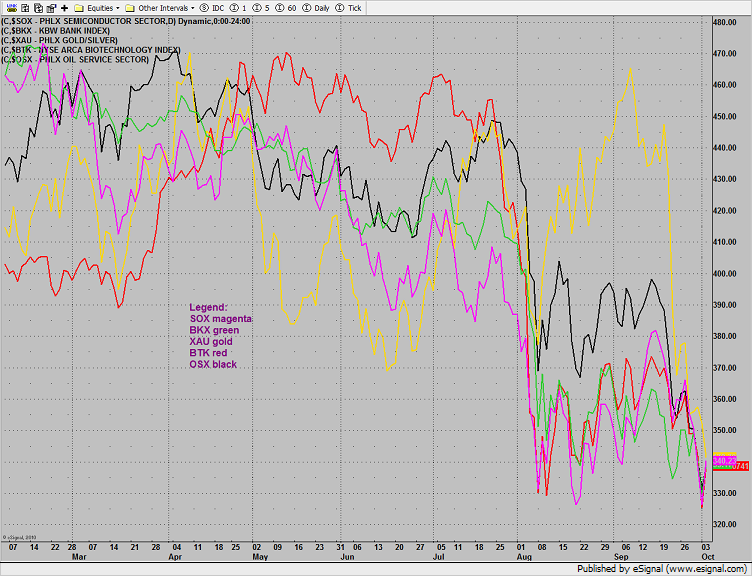

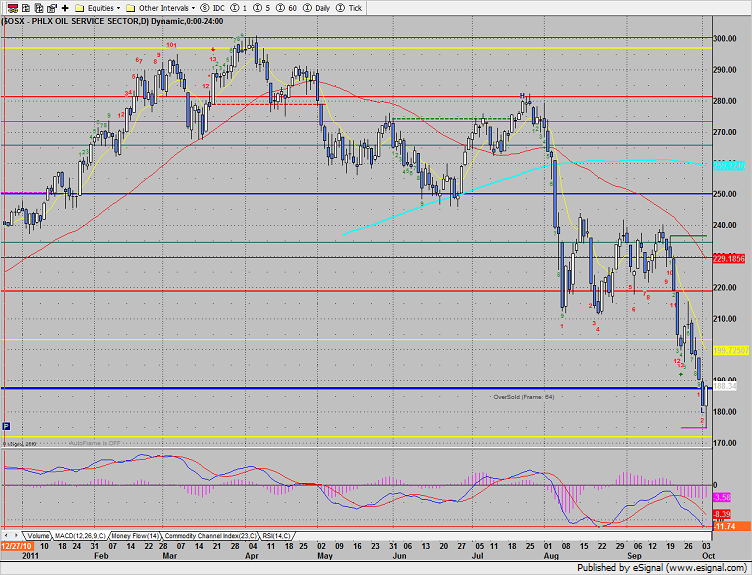

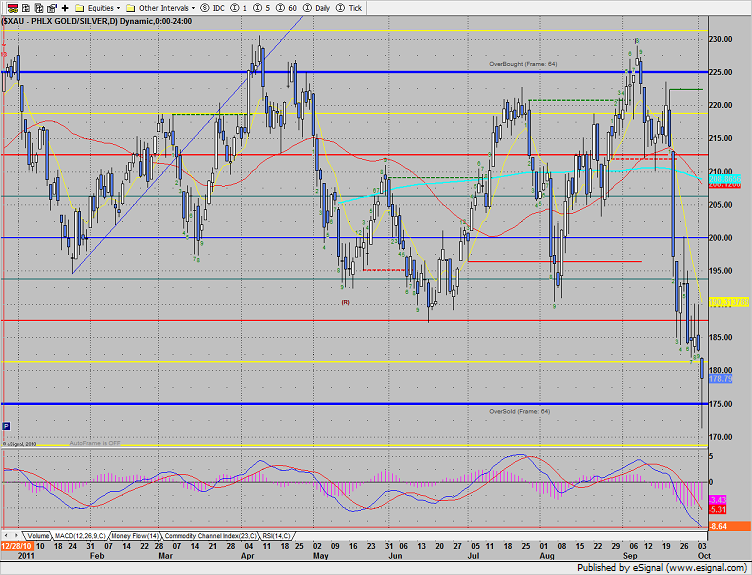

Multi sector daily chart:

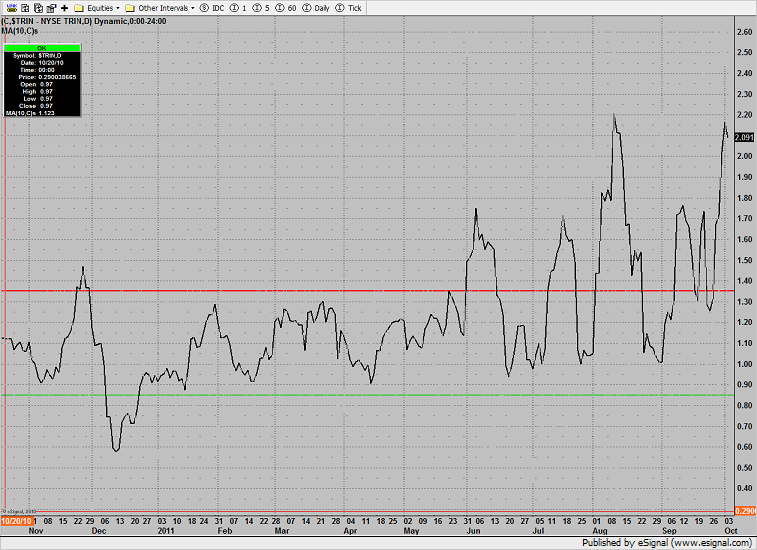

Like we noted in the prior report the 10-day Trin has a TON of oversold energy loaded into it. This means that the tank is full up energy. Even if this is only a bounce rather than a reversal it could be very, very sharp.

The Dow/gold ratio has been moving in favor of stocks for the last couple of weeks. This could be an important source of funds where money rotates out of hard assets into equities.

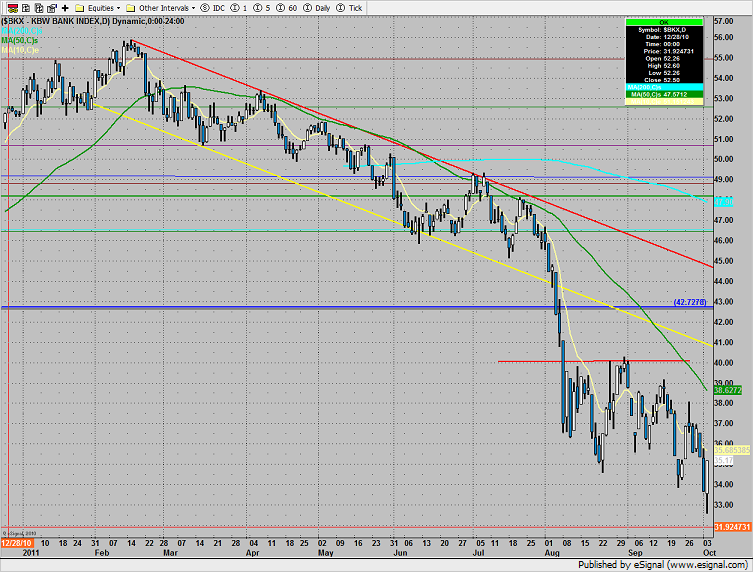

The BKX was top gun up 4.5% on the day. This was a very strong session but not a key reversal day.

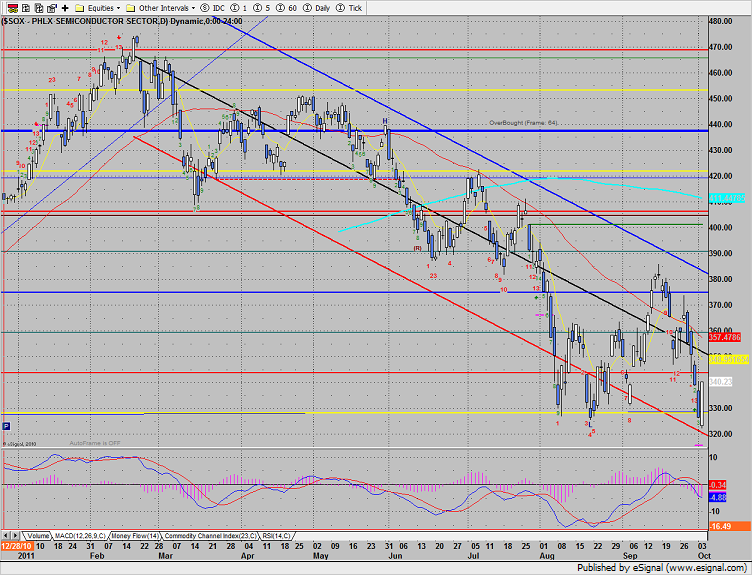

The SOX is still hanging onto the trend channel. Note the active Seeker buy signal.

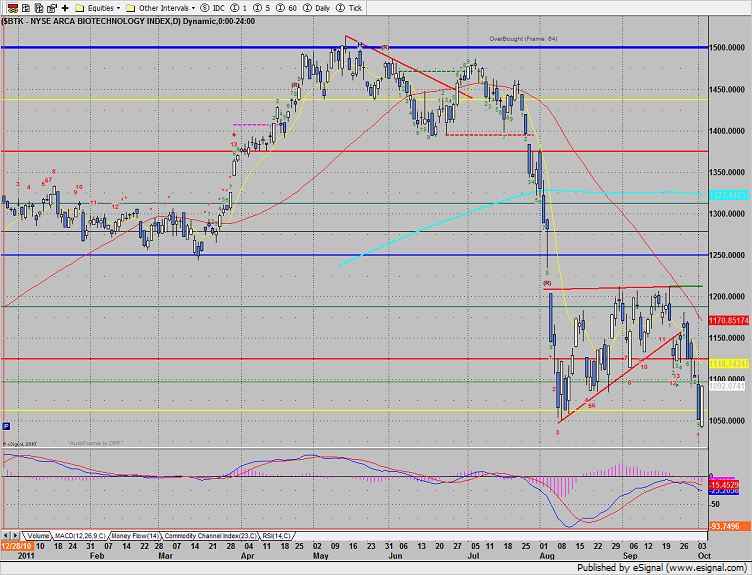

The BTK violated but settled well above the August lows.

The OSX was stronger than the broad market, closing up 6 points on the day. Note that the risk level from the Seeker buy signal was the exact low of the day. This will be a very key level going forward.

The XAU was the last laggard and the only major sector closing down on the day. The 0/8 Gann level at 175 is key support.

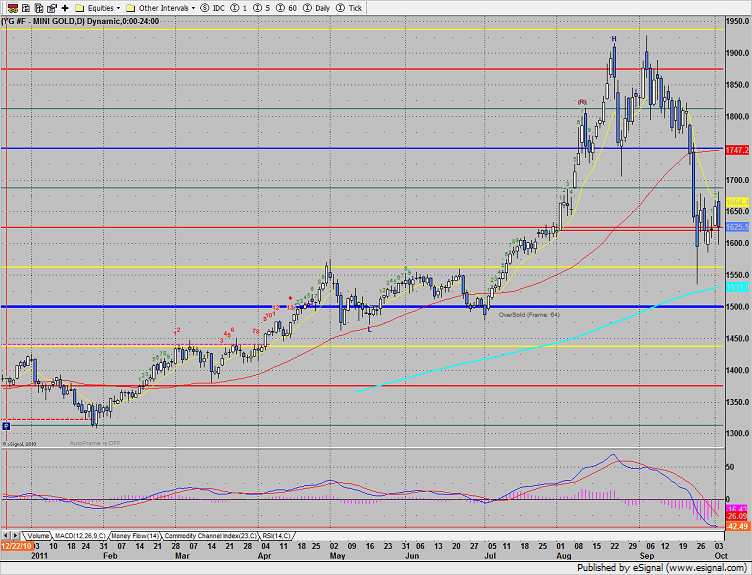

Gold:

Gold

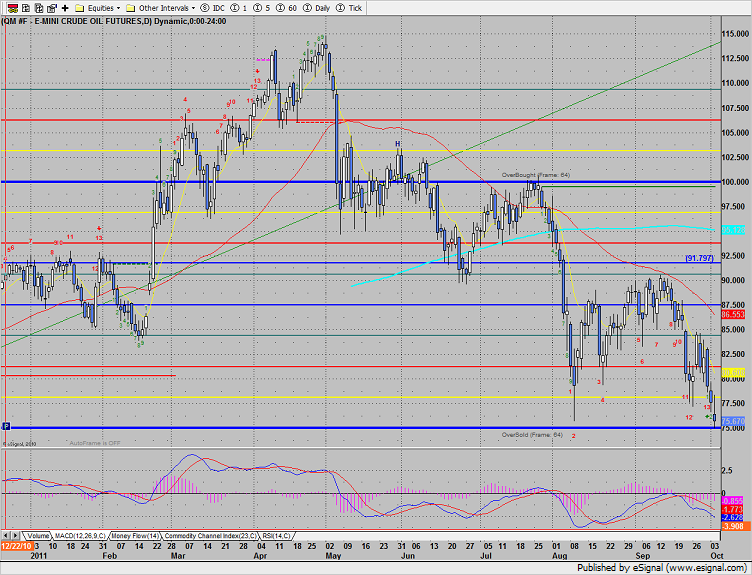

Oil: