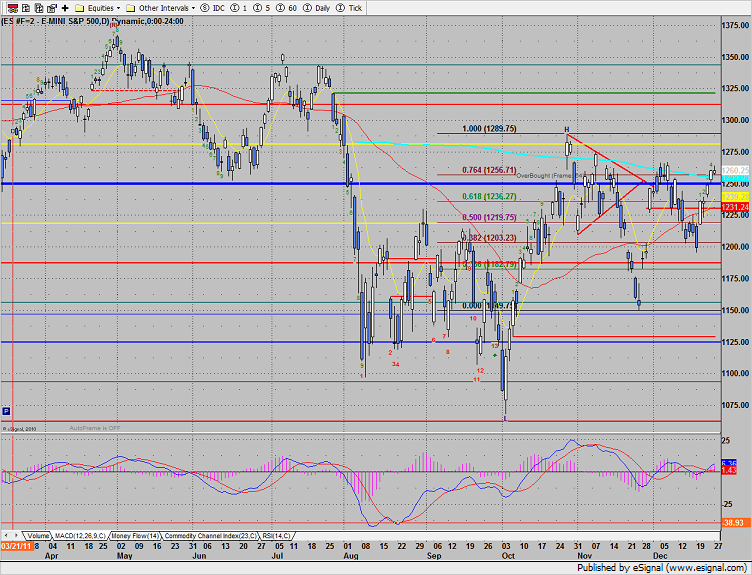

The ES closed unchanged after expanding the upside range of the current run. Expect that the 200dma might be a near-term draw.

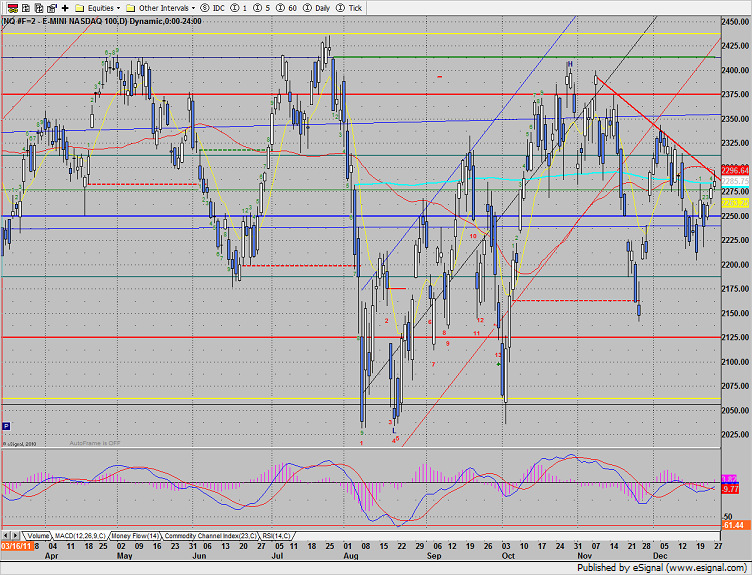

NQ futures were higher by 7 on the day but couldn’t break above the active DTL. Note the proximity of the 200dma which could be a draw in a light volume environment.

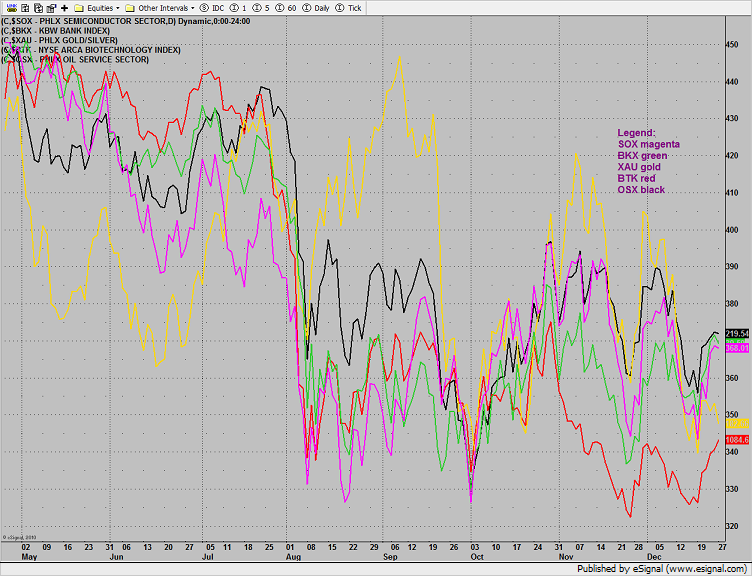

Multi sector daily chart:

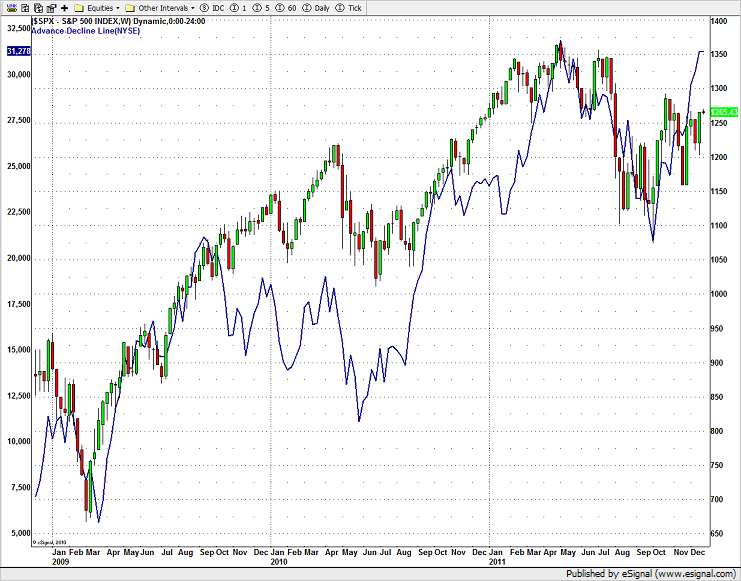

Note how in the chart below the NYSE cumulative A/D line is bullishly leading the broad market, represented by the SPX.

The BTK was the top gun on the day closing above the 50dma for the first time since October. Keep in mind that there is still an active Seeker buy signal active.

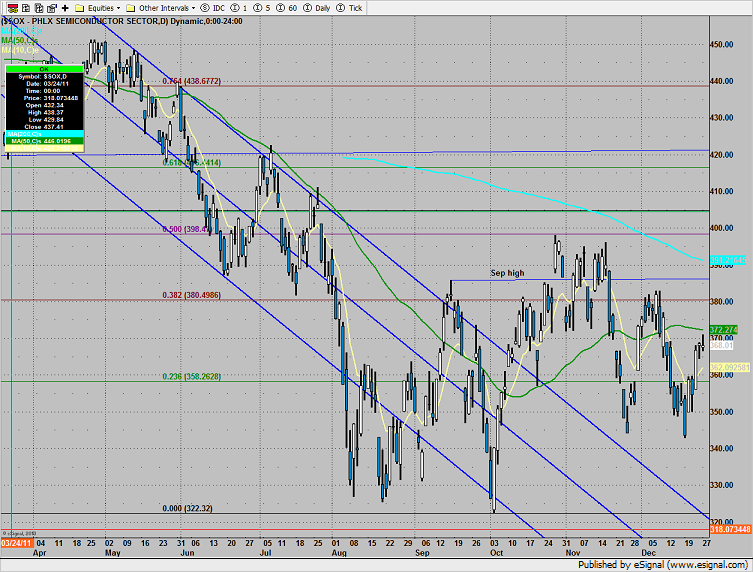

The SOX remains below the major moving averages.

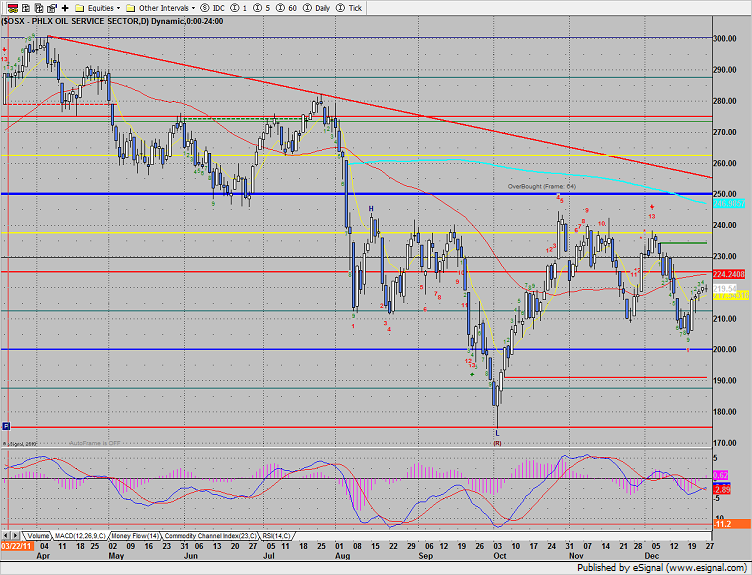

The OSX was almost unchanged on the day with an active Seeker sell signal in play.

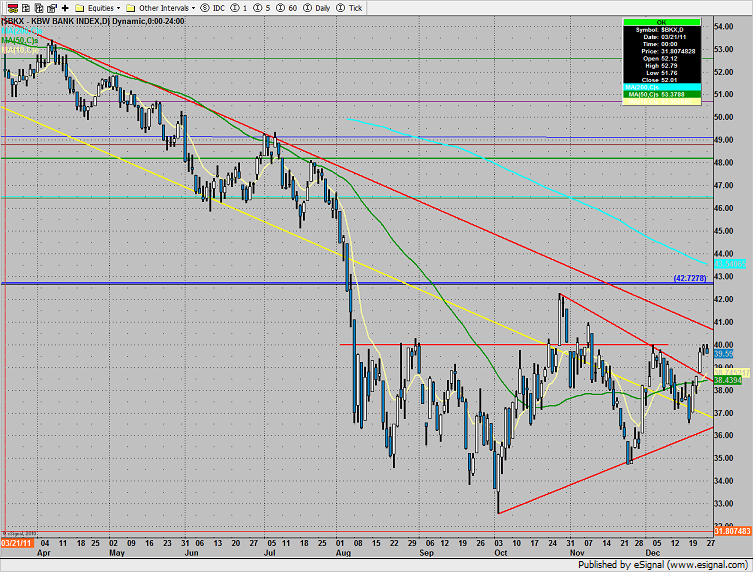

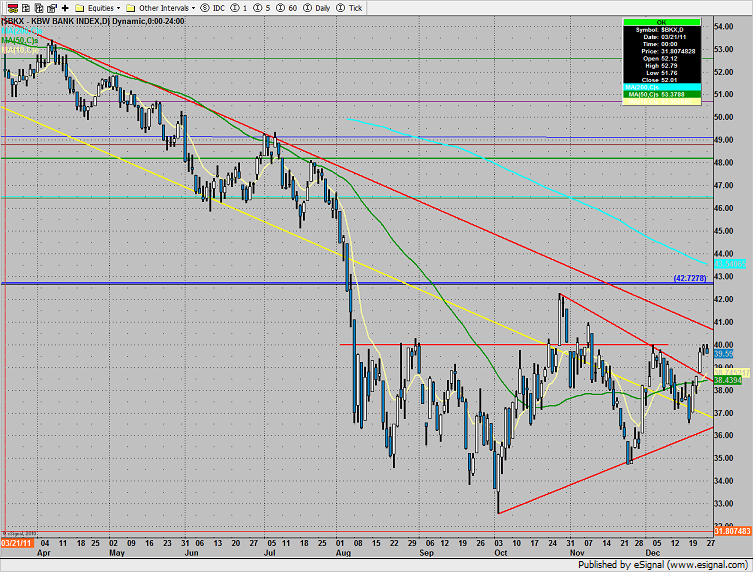

The BKX is having trouble at the key 40 level:

The XBD broker-dealer index posted a potential reversal day which would be bad news for the broader financials.

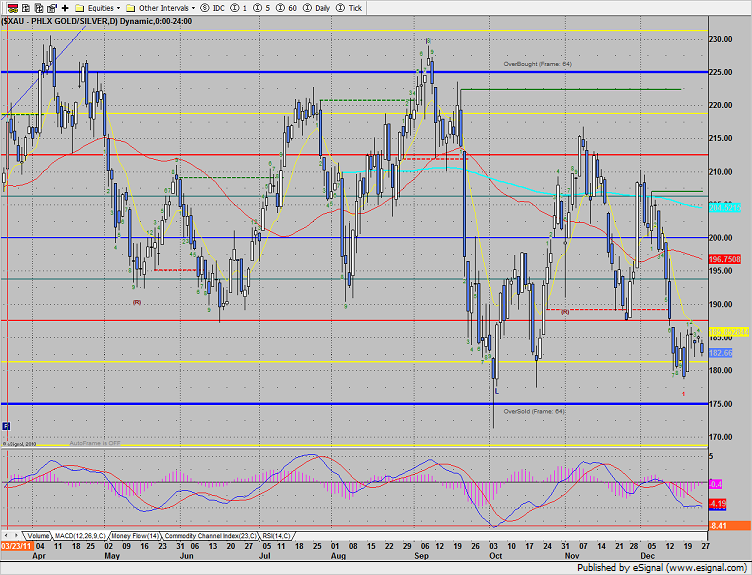

The XAU could be forming a bearish lower reverse cup so set an alarm for a break under 178.

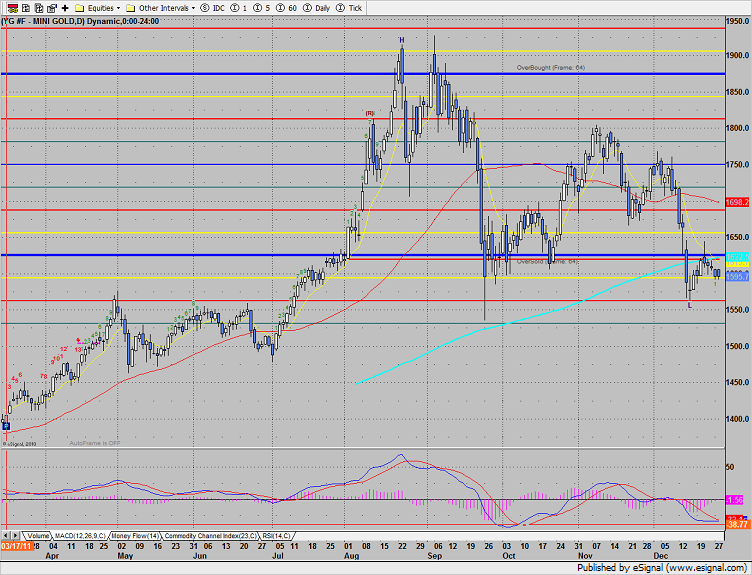

Gold was slightly lower on the day :

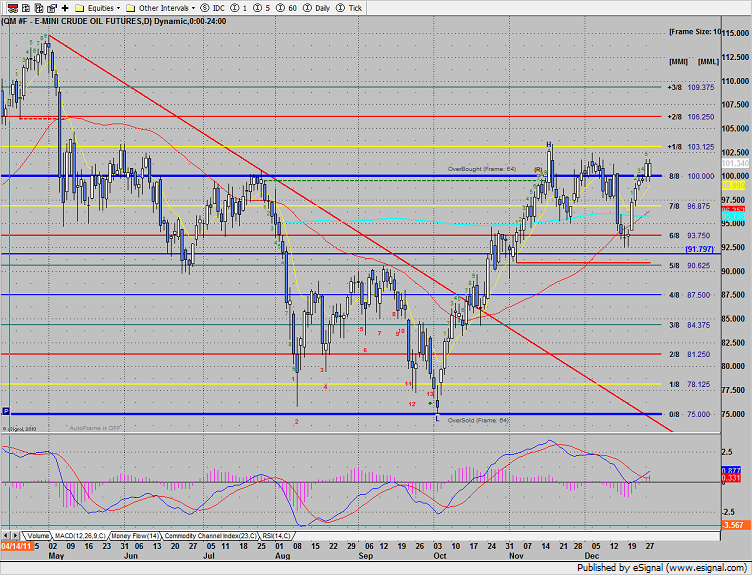

Oil broke nicely above the 100 level and is closing in on the recent highs at 102.75.