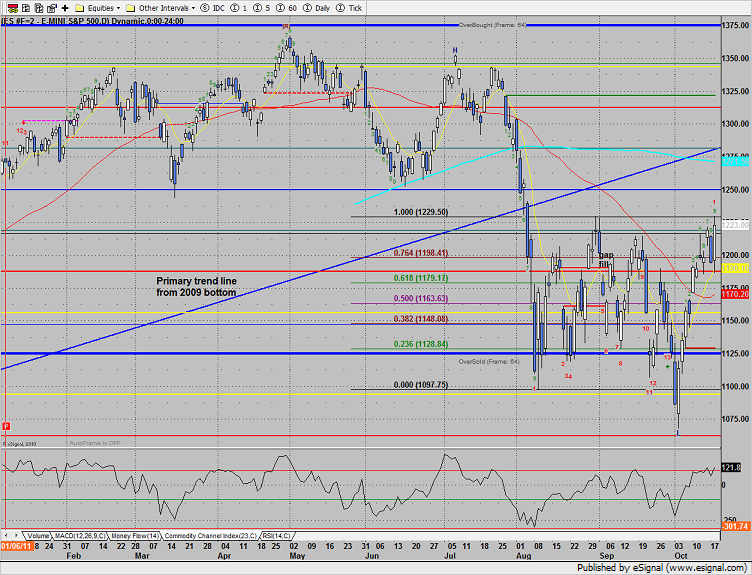

The ES closed at a new high on the move gaining 29 on the day. Price exactly touched the prior intraday high on the move. Also, the Seeker recorded the first completed 9 bar run since early August. Not only was the ES 9 bars up but there were 1200 individual stocks 9 days up. This is a cue for either price to pause or retrace.

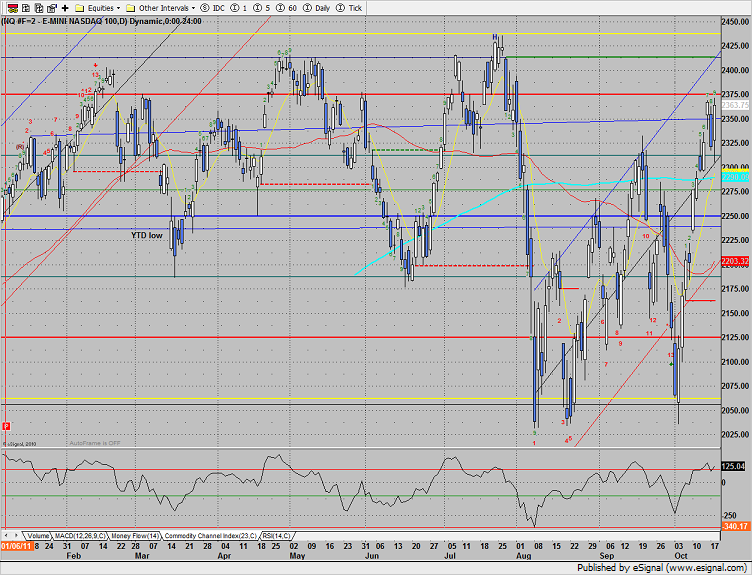

NQ futures were higher by 42 on the day and recorded 9 bars up on the Seeker. On the Naz side note that neither day 8 nor 9 were higher than both days 6 and 7 which disqualifies the 9 bar stop.

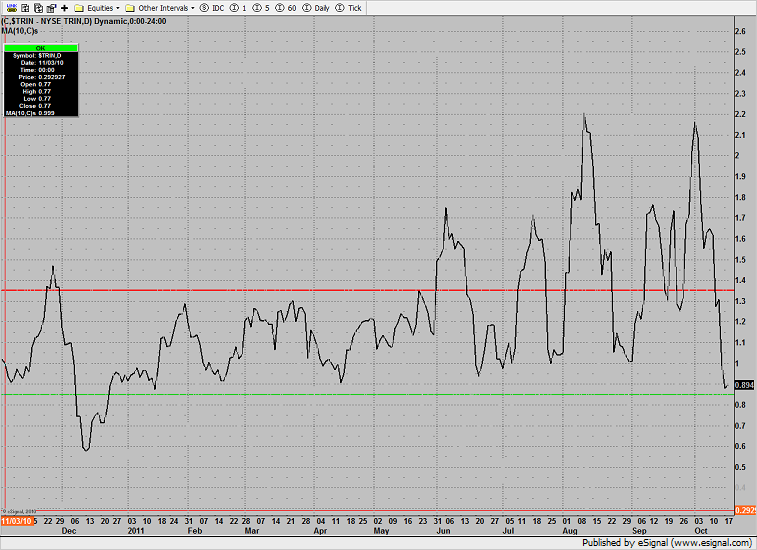

The 10-day NYSE Trin is still hovering just above the 0.85 overbought threshold.

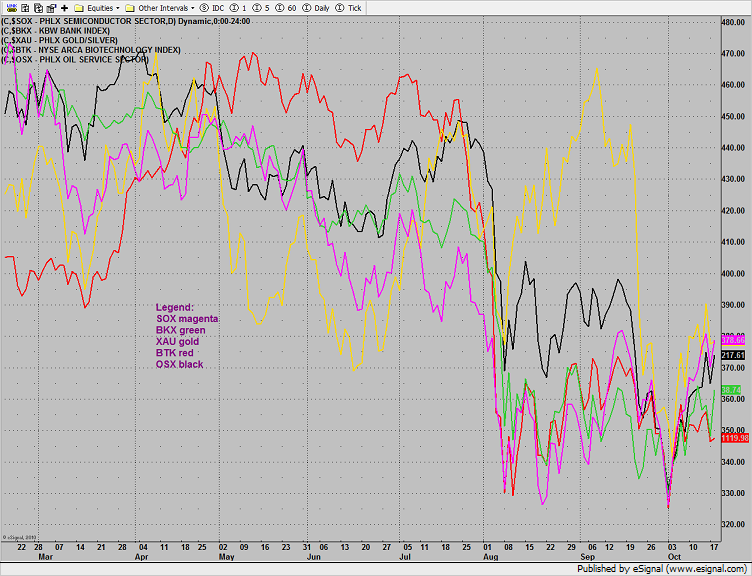

Multi sector daily chart:

The BKX was the top gun on the day but still remains below the key 40 breakout level.

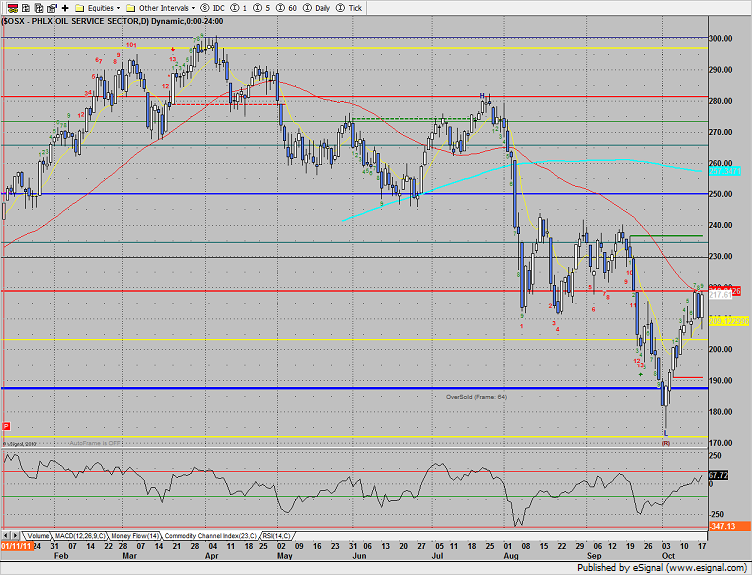

The OSX is still contained below the key 220 level. Note the formation of the recent candles.

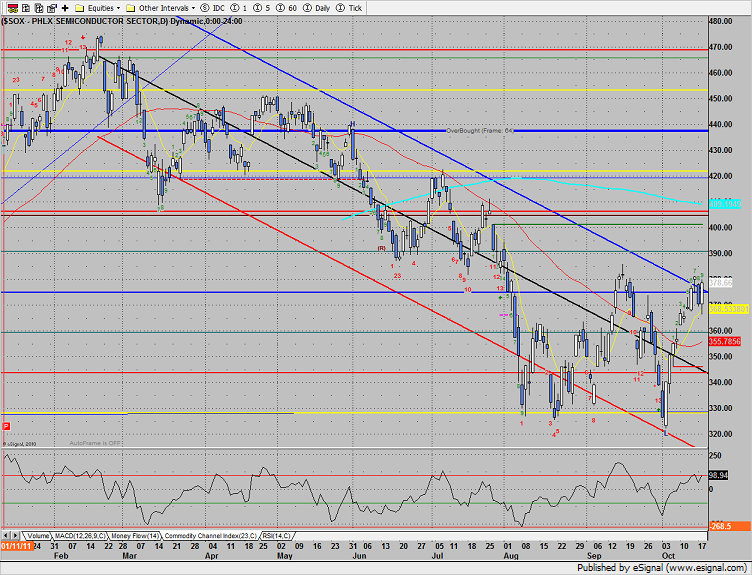

The SOX is 9 days up but below the close of day 7 which disqualifies the 9 bar stop.

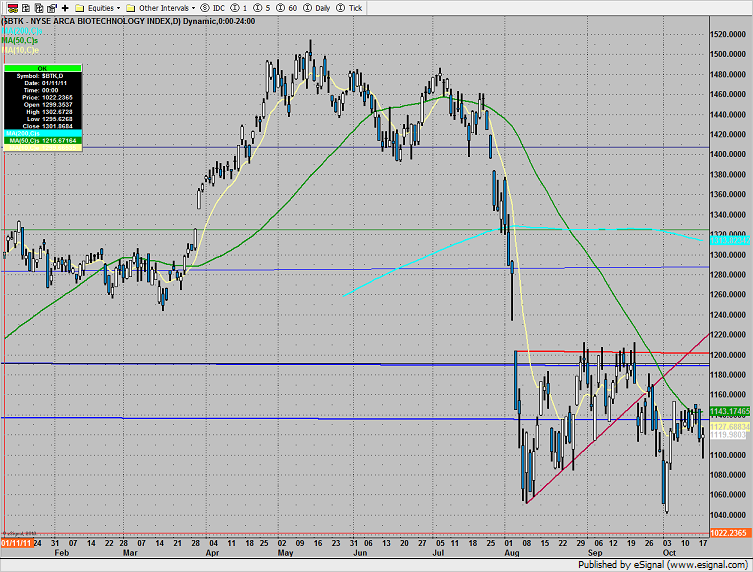

The BTK did little on the day and is contained below the 50dma.

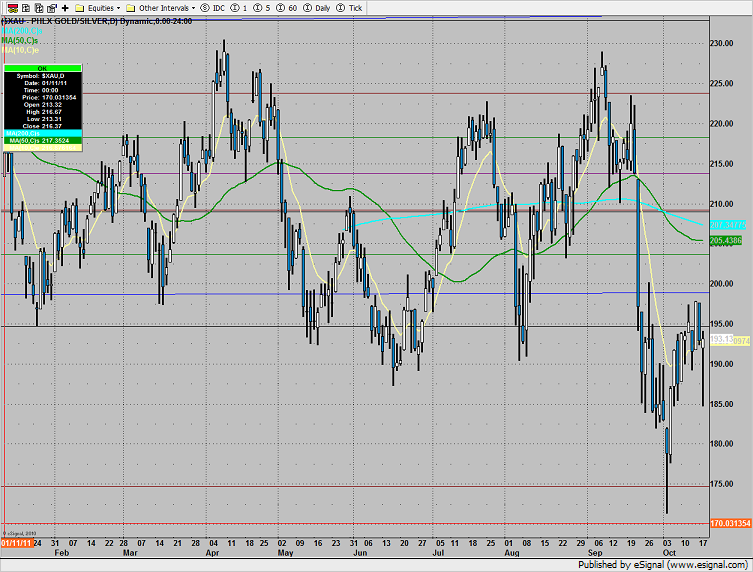

The XAU was the last laggard on the day but did recoup a nasty intraday drop.

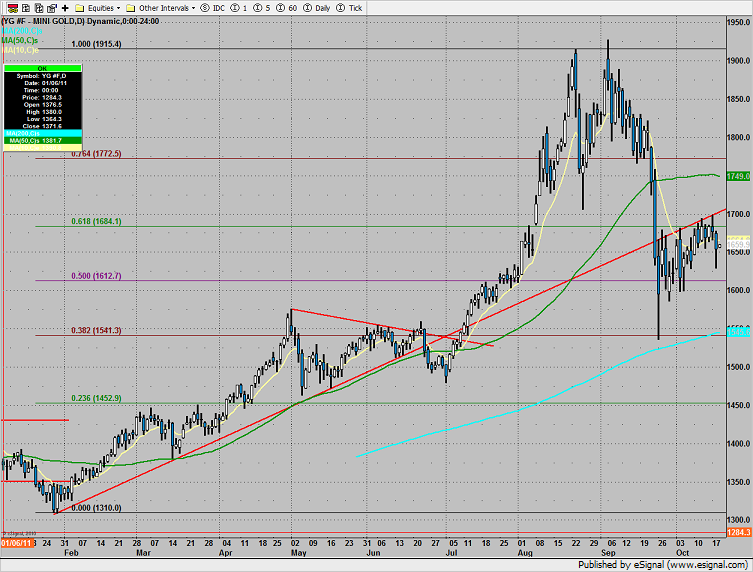

Gold broke below the recent lows and is getting some distance away from the DTL.

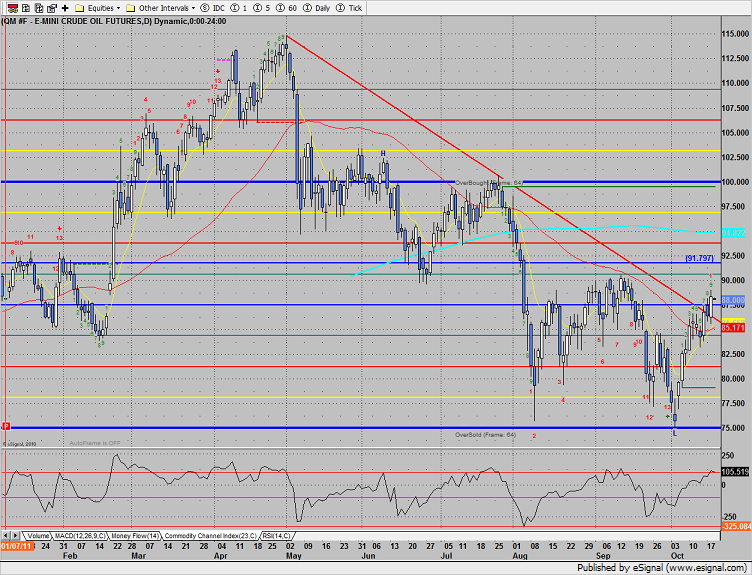

Oil broke out above the DTL but also recorded 9 days up.