A winner, a 1-minute sweep loss, and a winner on the second try of that trade, adds up to some gains. Also, amazing how the high of the session on the ES was the UPT/VAH exactly. See ES and NQ sections below. The market was back and forth today in a much narrower range than the last few sessions on 2 billion NASDAQ shares.

Net ticks: +4.5 ticks.

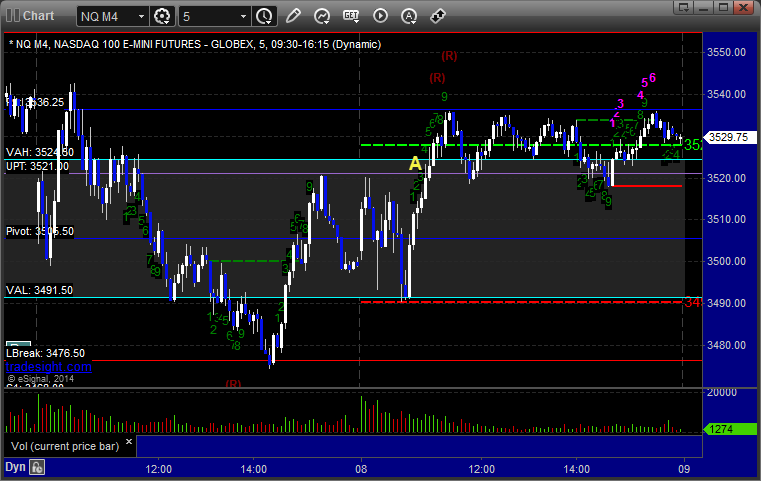

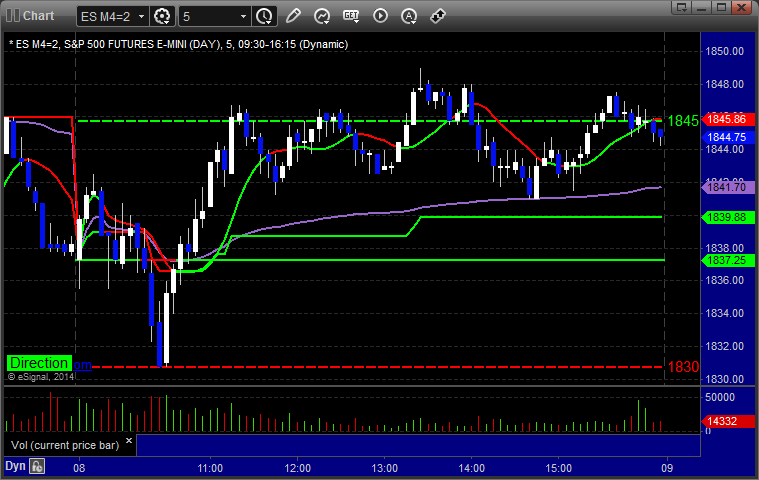

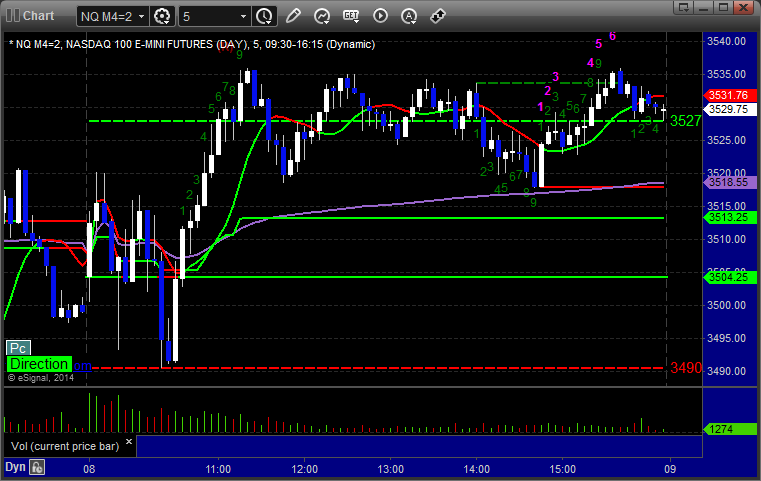

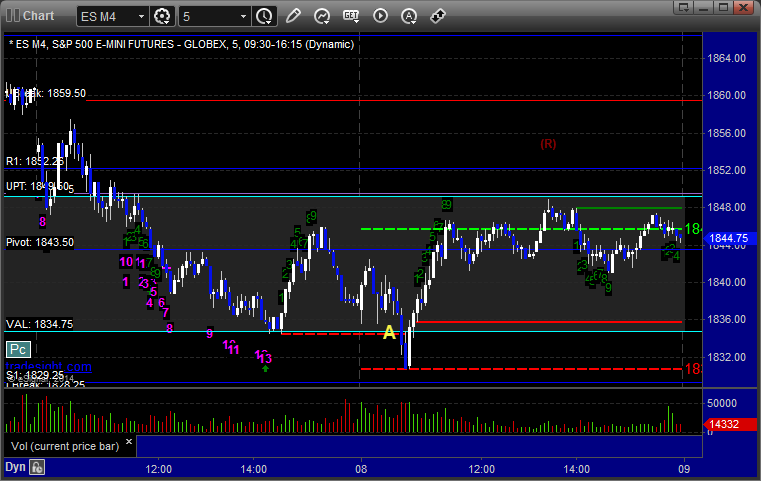

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:Triggered short at A at 1834.25, hit first target for 6 ticks, and stopped second half over the entry:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3521.50 and swept immediately, didn’t even close a 1-minute bar over the trigger, so we go right back in. Triggered just after that, hit first target for 6 ticks, raised stop twice and stopped 12 ticks in the money: