Well, with volatility comes the bigger chance of getting stopped with a tight stop. Unfortunately, the initial setup that I wanted, which was the NQ short under the opening 5 minute bar into the gap, went too fast to call. Everything else was a problem. See ES and NQ below.

Net ticks: -21 ticks.

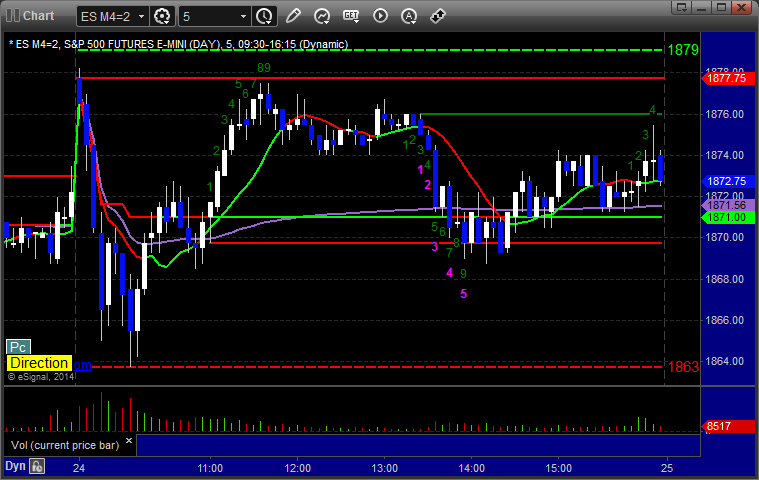

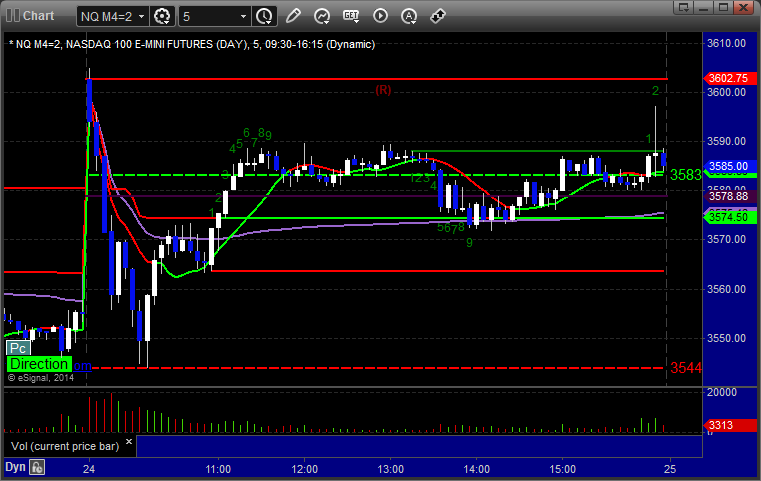

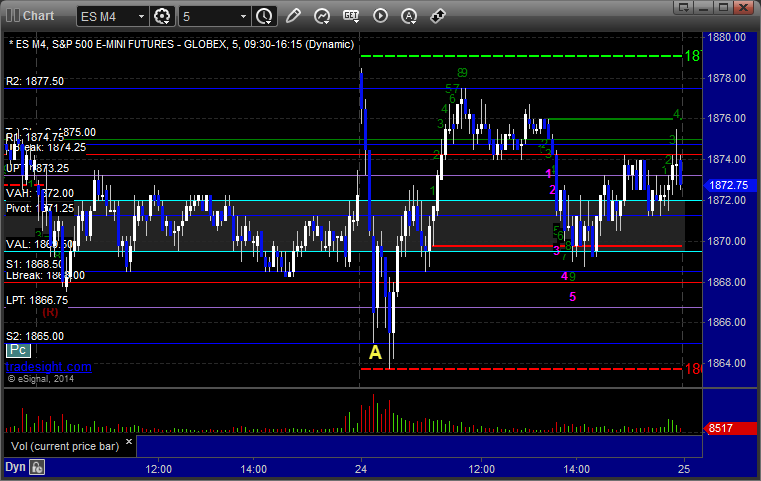

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Triggered short at A at 1864.75 and stopped. Triggered again 5 minutes later and stopped:

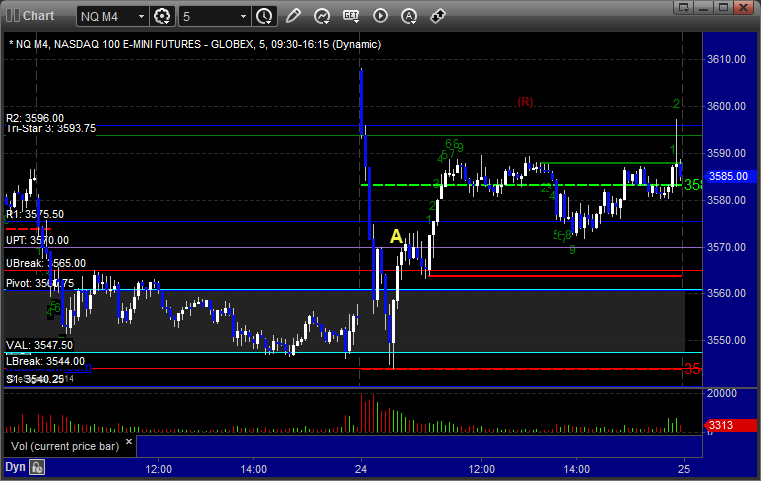

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long over UPT at A at 3570.50 and stopped. Did not reenter: