Three losers and a winner on a choppy session that was flatter on the ES than the NQ due to the AAPL news. Volume was 1.75 billion NASDAQ share.

Net ticks: -15 ticks.

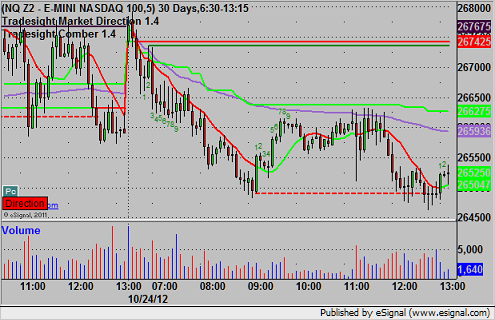

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

A nice afternoon setup triggered long at A at 1413.50 and stopped for 7 ticks. I put it in again as it set up a bull flag and it stopped again:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark’s call triggered short at A at 2654.00 and stopped. His long triggered at B at 2672.50, hit first target for 6 ticks, and should have stopped at the same price level. Note that it exactly moved across the Value Area to C: