A Value Area play is a trade based on the “market memory” of the prior day’s trading activity. It is a specific range from the prior day’s action that the market uses in a certain method with a high percentage of success. One of the main ways that we use the Value Area is to look for wide open Value Areas where a pair starts outside the Value Area, then enters the Value Area or breaks through a key support/resistance point just inside the Value Area, and then targets moving across the Value Area without breaking back outside of it.

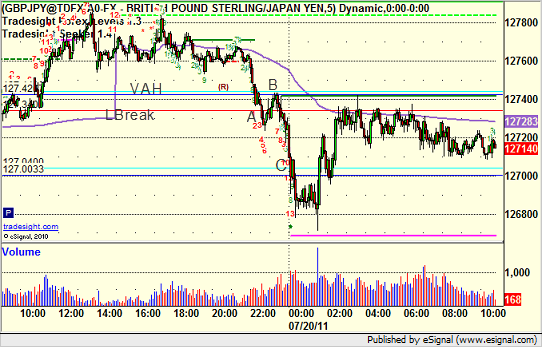

On Wednesday, we had a Classic Value Area play on the GBPJPY. We focused in the Trading Lab on the break under the LBreak, which was just under the line blue (cyan) Value Area High line. The dark blue Pivot was also right there. So the goal was to go short under LBreak with a stop over VAH (in case it came back outside the Value Area) and a target of the cyan VAL. It triggered short at A, retested EXACTLY the VAH at B and didn’t stop out above it, and hit VAL target at C for a perfect Value Area trade: