Weird looking day. The markets gapped down and pushed lower, then reversed sharply to fill the gaps, then dipped sharply back to lows (still in narrow range), then bounced back up to even, then flat-lined on the midpoint. Still, we traded a very slightly-better-than-last-week 1.4 billion NASDAQ shares and went nowhere on half of average daily range. Opening Range plays were net winners, see that section below.

Net ticks: +6 ticks.

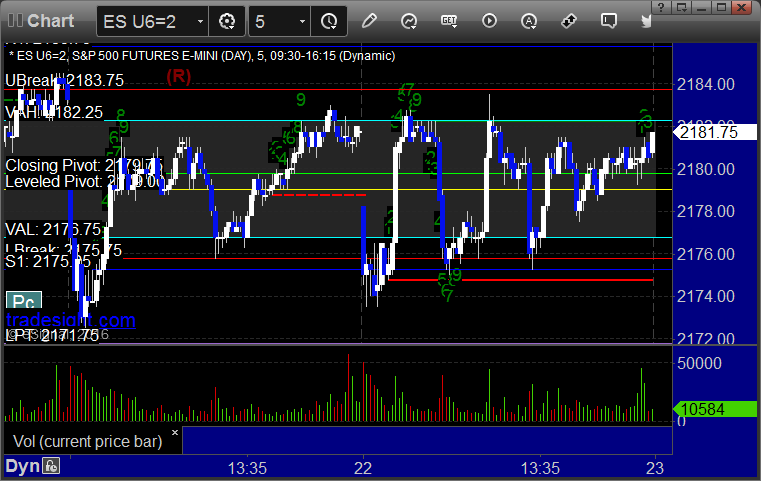

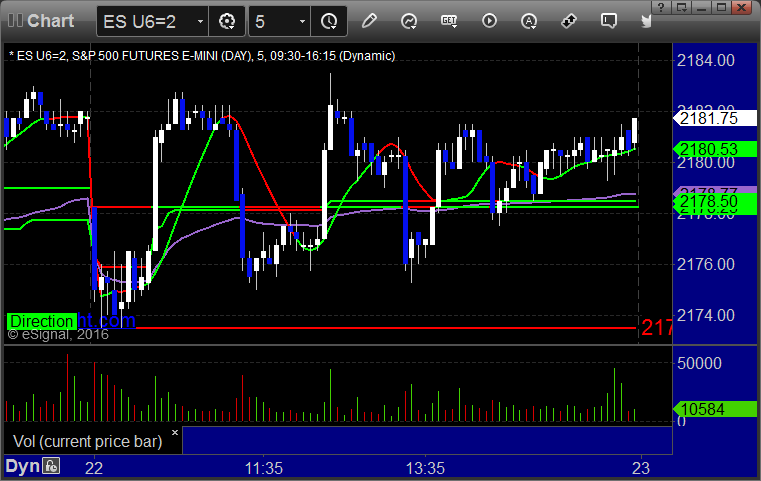

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and I used the midpoint on the short entries because they were away from the gaps and the ORs were a little wider than we had seen in a while, triggered long at B and worked:

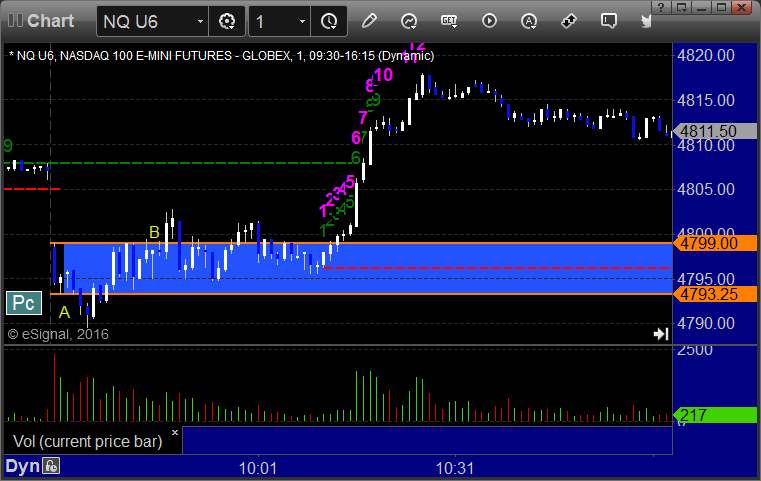

NQ Opening Range Play triggered short at A and I used the midpoint on the short entries because they were away from the gaps and the ORs were a little wider than we had seen in a while, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: