The markets opened flat, spent the first hour flat, went up over lunch, and then broke the lows coming out of lunch to take us back to the ES 1937.50 key level on a weak 1.5 billion NASDAQ shares for end of month. The Opening Range plays didn’t work in the flat chop, and we had two additional calls. A losing day to close a very nice month.

Net ticks: -27 ticks.

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

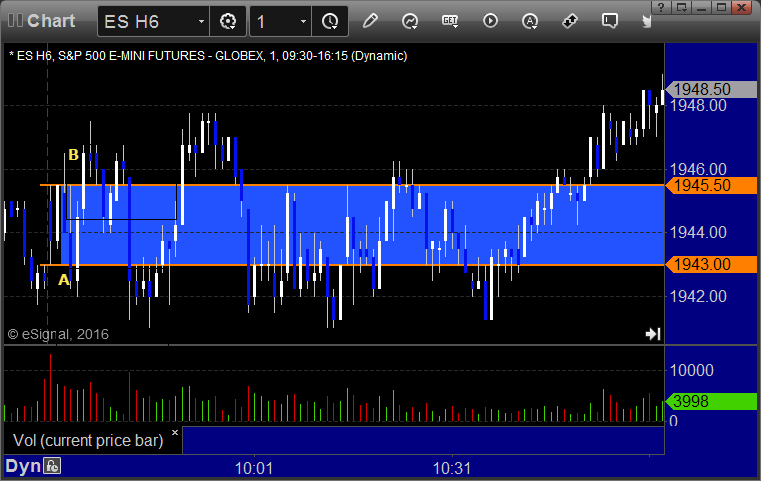

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered long at A and worked enough for a partial but also triggered pretty far above the Opening Range:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 1941.00 and stopped, put it back in, triggered again at B, hit first target, stopped second half over the entry: