A very dead session to start the month of February. Mondays don’t have to be exciting but this was a little ridiculous. The S&P 500 literally closed down less than a point and spent the first several hours in a tiny range after gapping down. With that, of course, the futures were choppy, so we’re off to a slow start for the month. See the ES section for Mark’s call and the Opening Range plays.

Net ticks: -41 ticks.

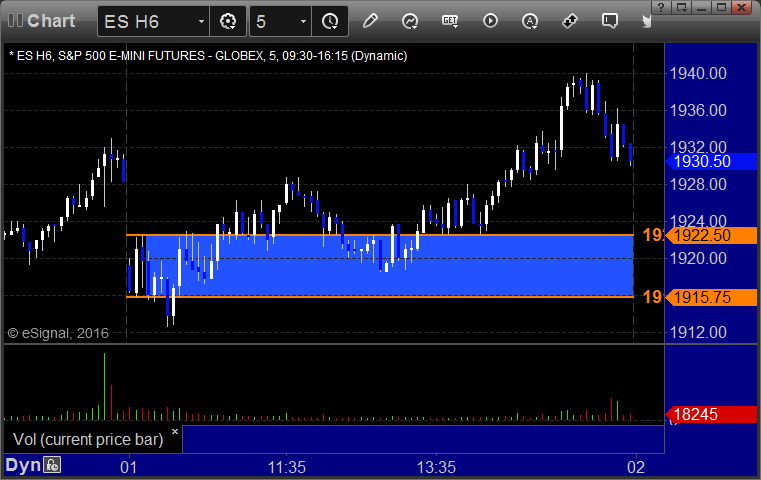

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn’t work. Triggered long at B and didn’t work:

NQ Opening Range Play triggered short at A and worked enough for a partial. The long entry trigger was too far outside of the range to take under our rules:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark’s call triggered long at A at 1922.75 and stopped. He did not re-enter: