The markets gapped down on lower oil, a potential nuclear test out of North Korea, and reports of reduced production by Apple. It was a big gap. Initially, we pushed higher (Opening Range plays were a wash as the ES got stopped but NQ worked). Then we pulled back over lunch and sat in neutral territory, and then we sold off in the last hour. The gaps didn’t fill (in fact, the 50% gap fill was exactly the high on the ES), and we closed on 1.9 billion NASDAQ shares. Two ES calls worked, see that section below.

Net ticks: +21.5 ticks.

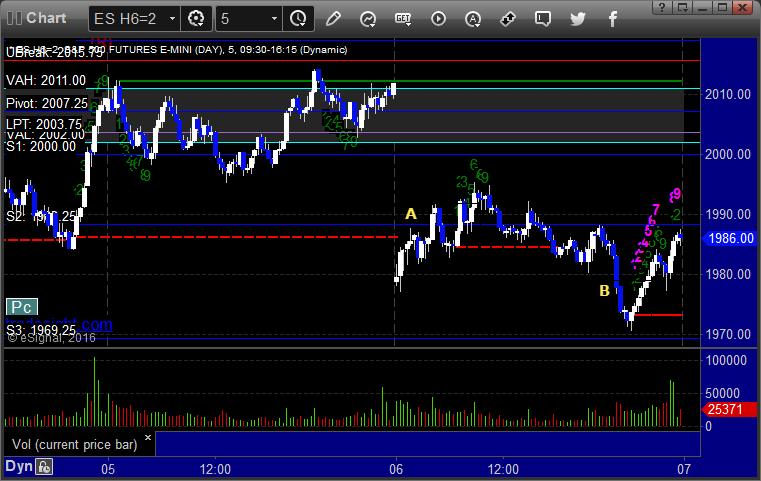

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and barely stopped:

NQ Opening Range Play triggered long at A and worked, washing out the ES loss:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 1988.50, hit first target for 6 ticks, and stopped second half under the entry. Mark’s call triggered short at B at 1977.25, hit first target for 6 ticks, and stopped second half over the entry (the stop should have been adjusted down one more time but wasn’t posted):