The markets opened fairly flat and did some back and forth early, but mostly waited for the Fed at 2 pm EST. Then things started to head lower, but we didn’t just get a big move down, we got some whiplast. Opening Range plays worked although I closed out the ES early and we had a nice winner on the NQ after the Fed. NASDAQ volume was 1.75 billion shares.

Net ticks: +22 ticks.

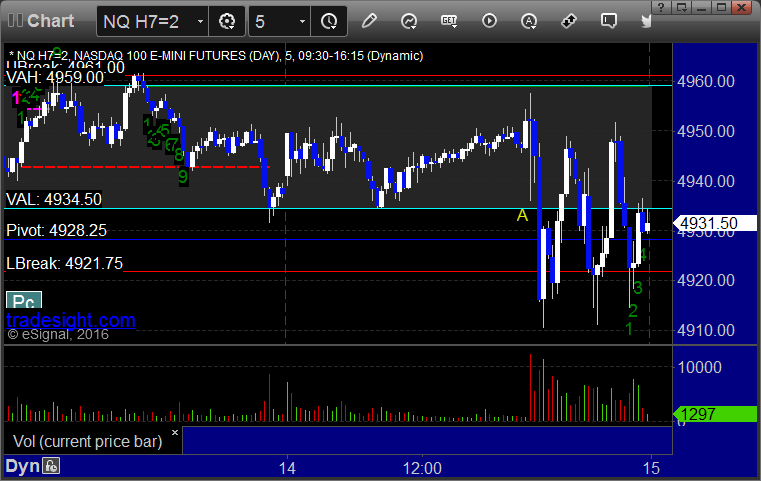

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

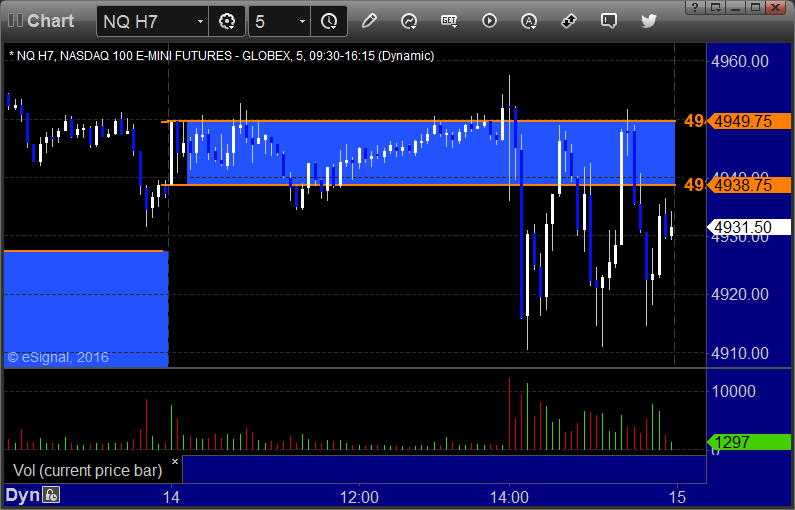

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and I closed it for a 4 tick gain after filling the gap:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at A at 4934.00, hit first target for 6 ticks, and closed second half 22 ticks in the money: